By Jennifer Nash

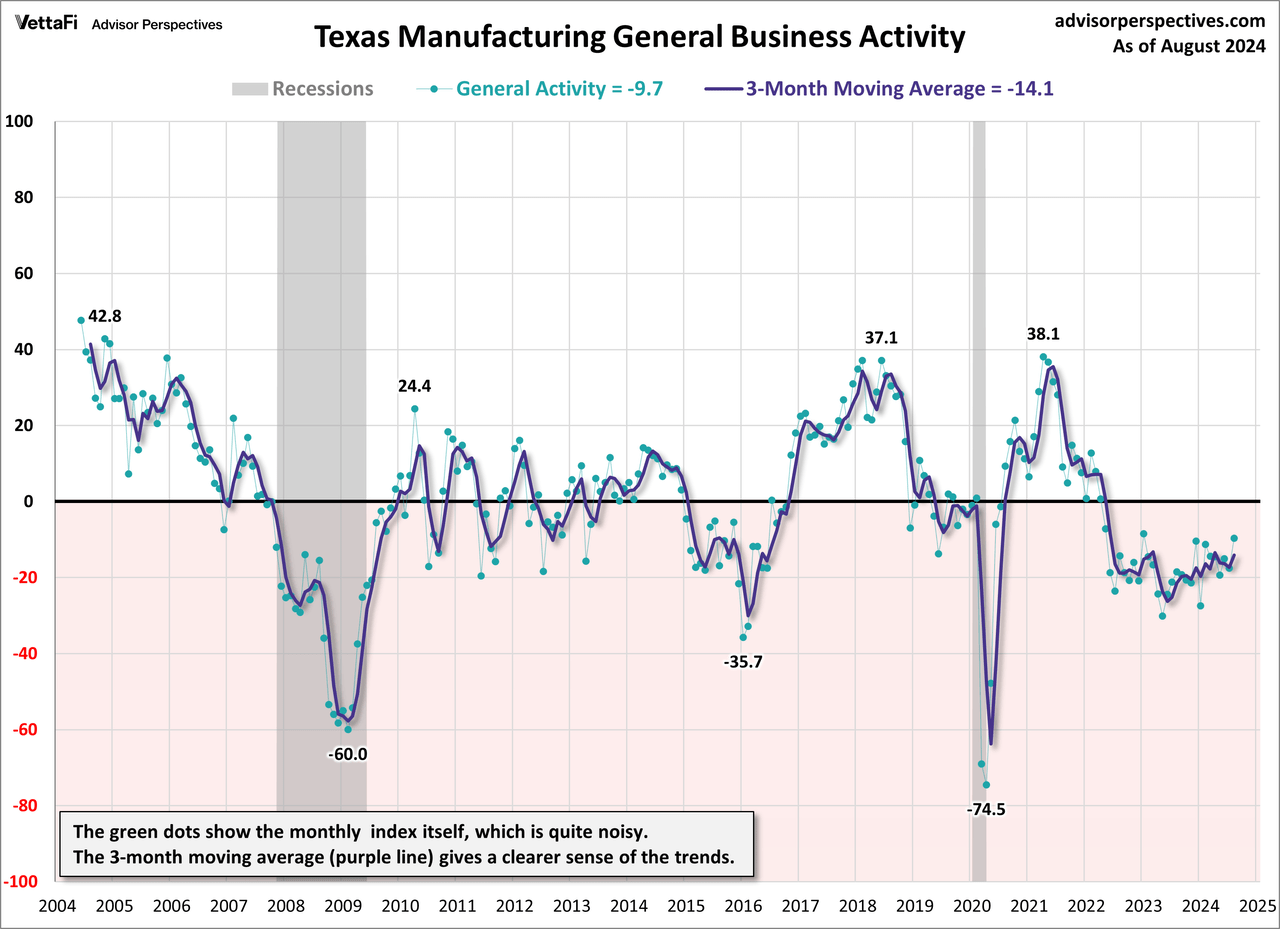

The Dallas Fed released its Texas Manufacturing Outlook Survey (TMOS) for August. The latest general business activity index came in at -9.7, up from -17.5 last month. This marks the highest level for the index since January 2023, but is the 28th consecutive month the index has been in contraction territory.

Background on the Texas Manufacturing Outlook Survey (TMOS)

Monthly data for this indicator only dates back to 2004, so it is difficult to see the full potential of this indicator without several business cycles of data. Nevertheless, it is an interesting and important regional manufacturing indicator.

The TMOS is a monthly survey of 100 Texas manufacturers that provides an assessment on the state’s factory activity. The survey asks firms to whether output, employment, orders, prices, and other indicators have increased, decreased, or remained unchanged over the previous month. Results are aggregated into balance indexes, where negative readings indicator contractions while positive ones indicate expansion.

The Dallas Fed on the TMOS importance:

Texas is important to the nation’s manufacturing output. The state produced $159 billion in manufactured goods in 2008, roughly 9.5 percent of the country’s manufacturing output. Texas ranks second behind California in factory production and first as an exporter of manufactured goods.

Texas turns out a large share of the country’s production of petroleum and coal products, reflecting the significance of the region’s refining industry. Texas also produces over 10 percent of the nation’s computer and electronics products and nonmetallic mineral products, such as brick, glass and cement.

Here is a snapshot of the complete TMOS.

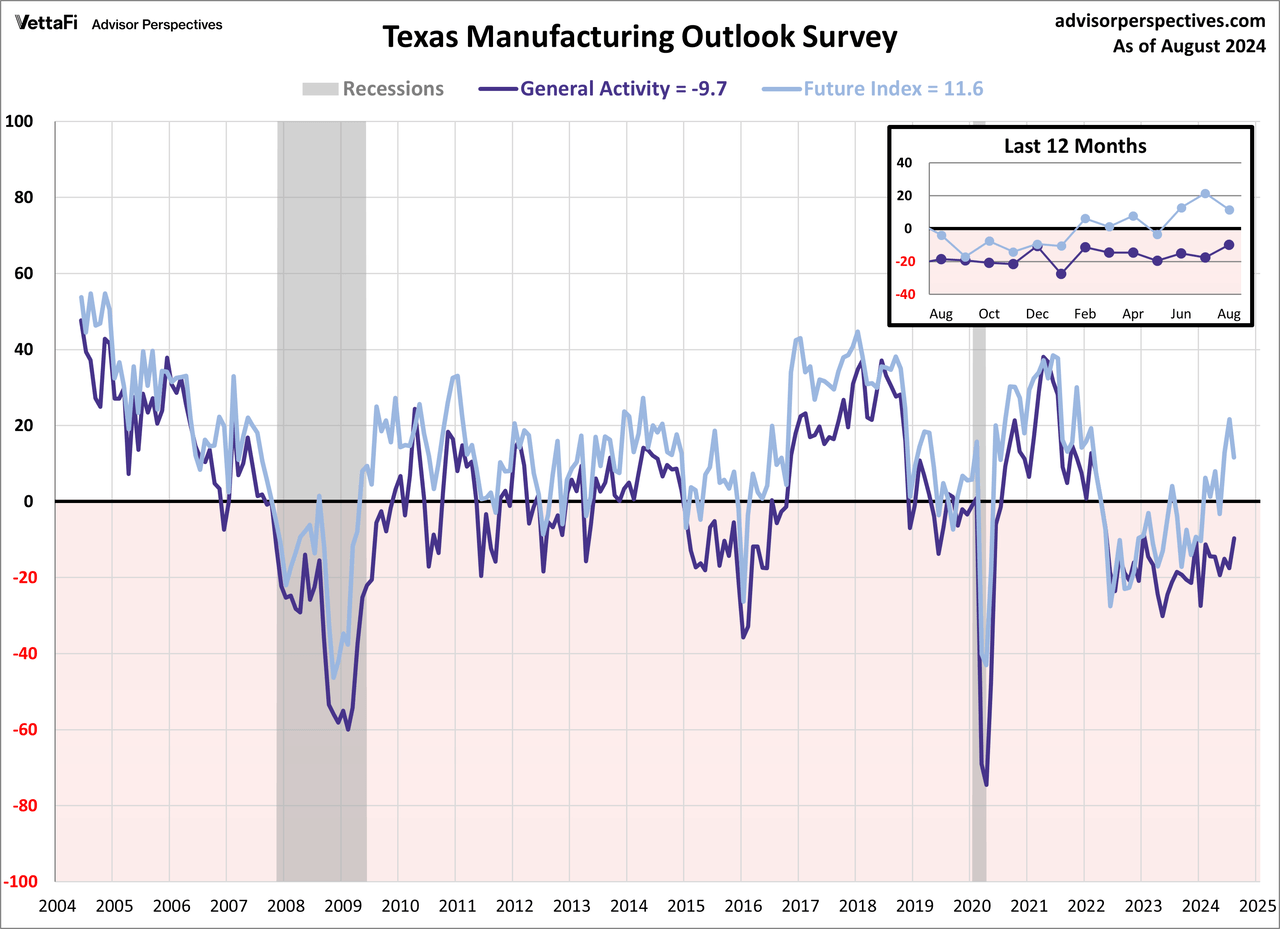

Texas Manufacturing Survey Future Outlook

The next chart is an overlay of the general business activity index and the future outlook index — the outlook six months ahead. Future general business activity dropped to 11.6 in August.

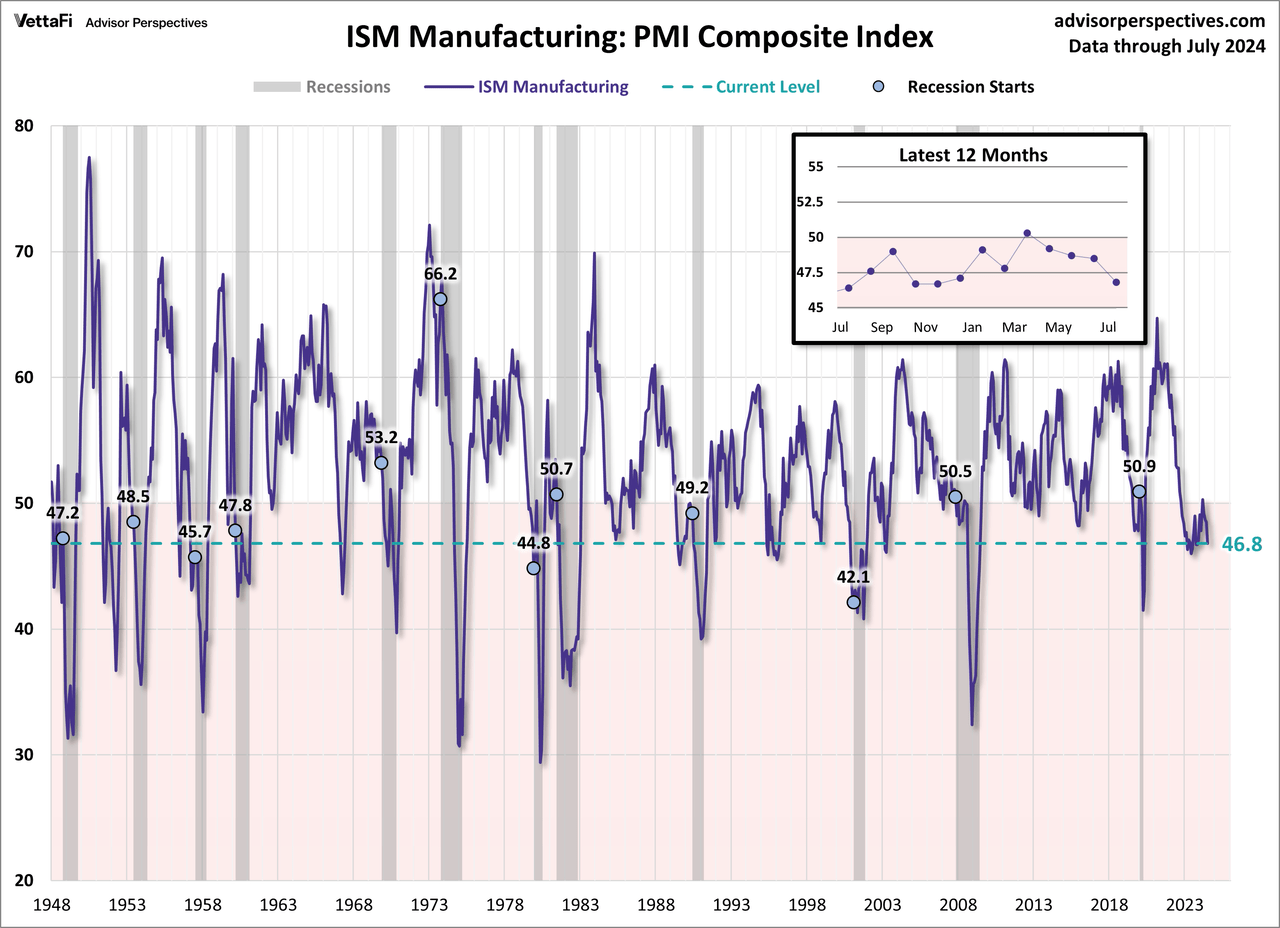

For comparison, here is the latest ISM Manufacturing survey.

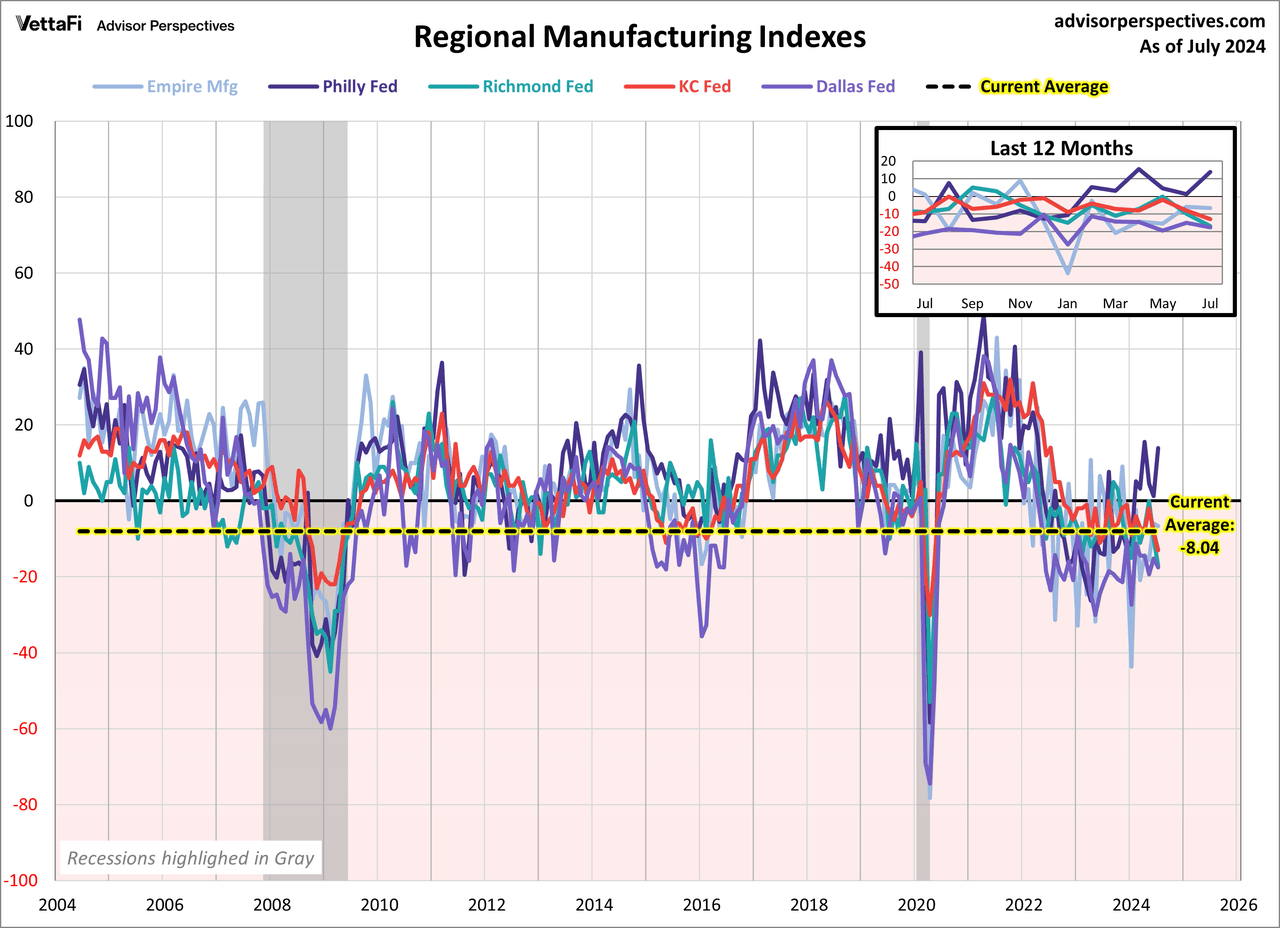

Let’s compare all five regional manufacturing indicators. Here is a three-month moving average overlay of each since 2004 (for those with data).

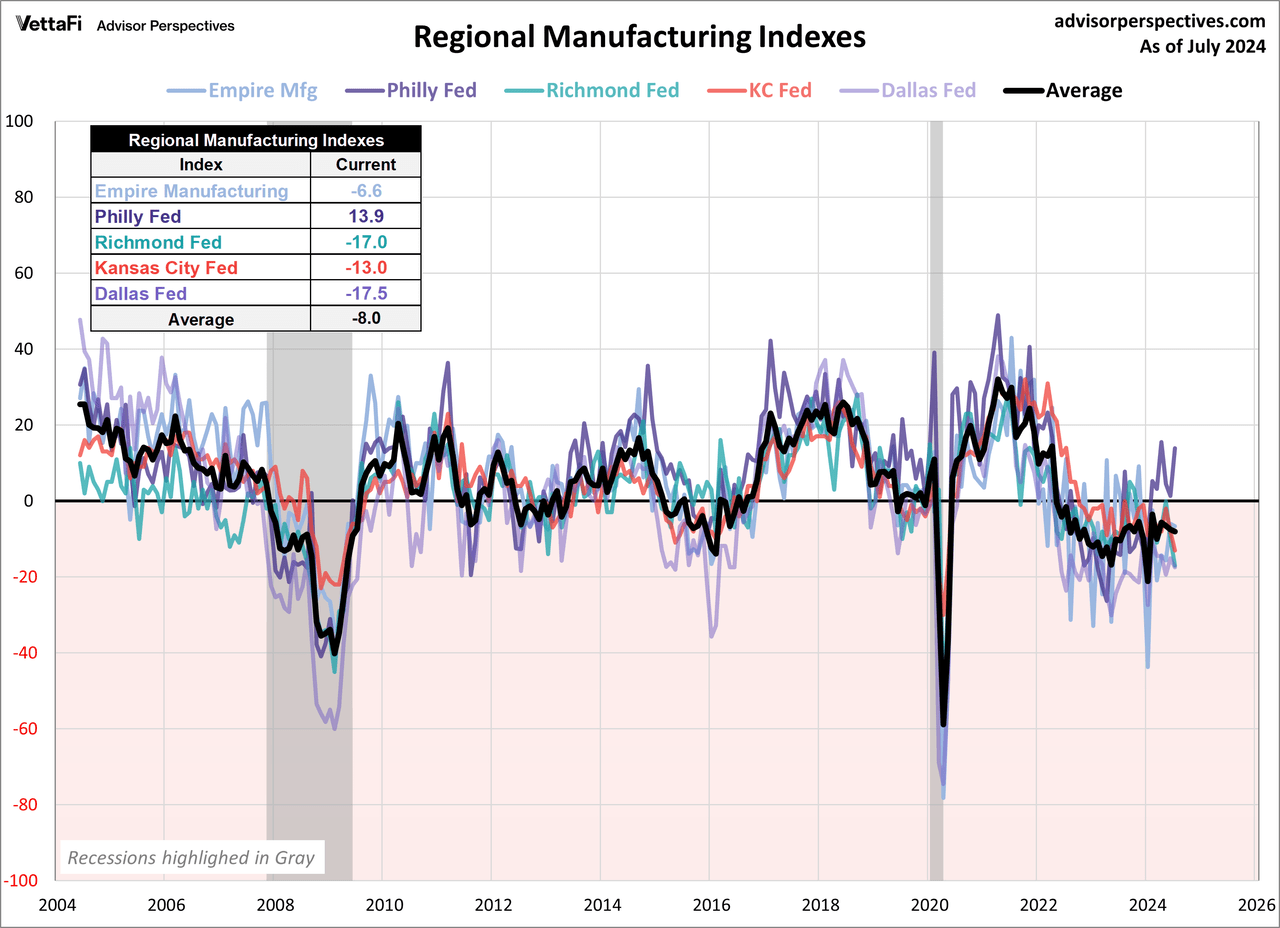

Here is the same chart including the average of the five for the latest month with complete data.

ETFs associated with industrials and manufacturing include: First Trust Industrials/Producer Durables AlphaDEX Fund (FXR), Industrial Select Sector SPDR Fund (XLI), Vanguard Industrials ETF (VIS), and iShares U.S. Industrials ETF (IYJ).

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here