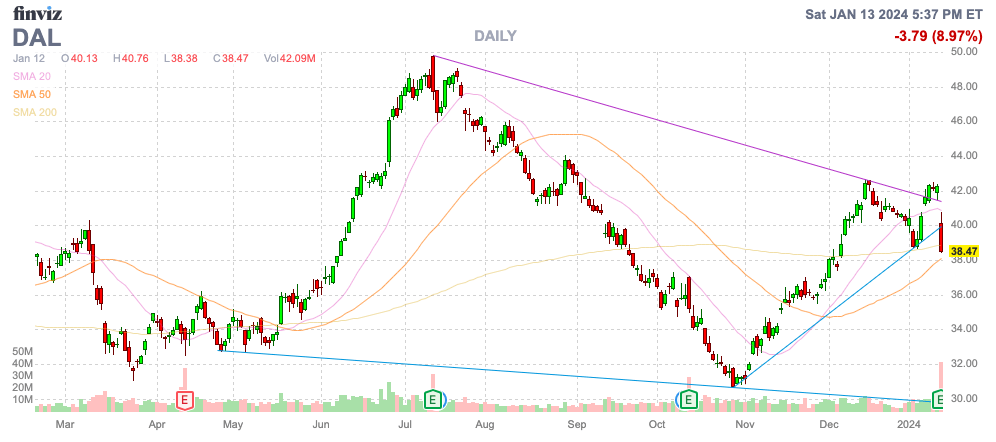

The airline stocks are struggling to regain pre-Covid levels despite the businesses already surpassing those levels. Delta Air Lines (NYSE:DAL) just got crushed after forecasting massive profits and cash flows in 2024 due to the market apparently being upset the amounts might not reach a prior projection. My investment thesis remains ultra Bullish on the airline stock trading at a level not suggesting the market was even valuing the stock off those prior targets anyway.

Source: Finviz

Great End To 2023

Delta faced a tough Q4’23 with fuel prices spiking. The airline still reported a big EPS for the quarter as follows:

Source: Seeking Alpha

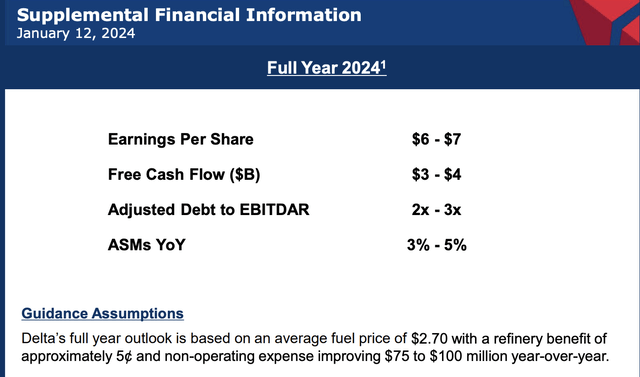

The stock got crushed due to the updated guidance for 2024 with the airline predicting a 2024 EPS of $6 to $7 after earning $6.25 per share last year. Normally, this number would be received well by the stock market for a stock trading at only $40.

Source: Delta Air Lines Q3’23

The airline had previously guided to an EPS target of $7 for 2024 while actually maintaining a 2023 target for an EPS of $6 to $7. Delta ended up earning at the low end of the target due to the fuel spike.

The big issue here is that Delta is basing the outlook on average fuel prices of $2.70 per gallon. The airline has a Q1’24 fuel price target of $2.50 to $2.70 per gallon, though jet fuel prices are only currently $2.47 and the airline will see a refinery benefit of up to $0.10.

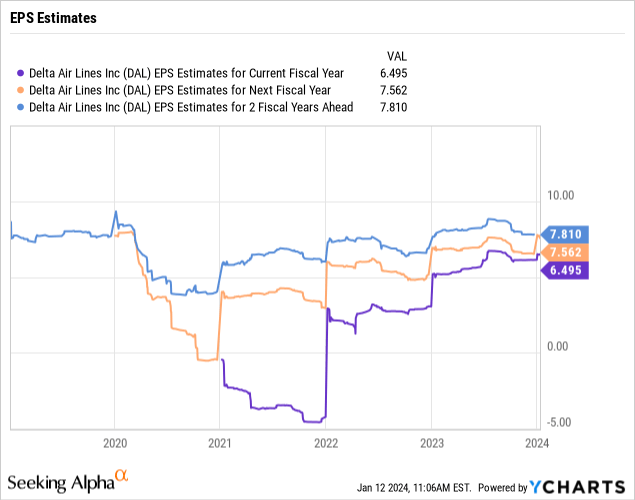

Delta is still projecting the potential for the airline to achieve the $7 EPS target, but the macro, geopolitical and supply chain issues make the management team provide the potential for the target to slip. The key to the investment story is that Delta doesn’t see any peak EPS level here with targets rising above $7.50 in 2025 and growing in 2026.

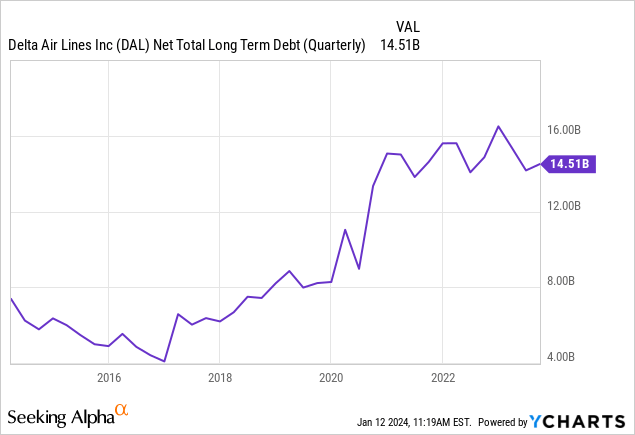

Overflowing Cash

While the market is obsessing over the correct EPS targets for 2024, Delta forecast free cash flow to surge to $3 to $4 billion for the year. The airline generated $2 billion in FCF in 2023 and Delta will now start producing massive FCF to repay substantial debt amounts leading to the airline having excess capital to return to shareholders.

Delta announced a small dividend back in 2023. The current dividend payout is only $0.05 per quarter amounting to a yield of 0.5%, but the payout is only $32 million per quarter. The company can easily hike these payouts after spending the next year repaying debt.

With lower fuel prices, Delta could hit the $4 billion FCF target for the year and will quickly pay down the debt outstanding. The company had already reduced net debt to $14.5 billion and the airline only needs a couple of years now to push debt back to the pre-Covid levels of ~$8 billion.

At the end of the day, an investor gets a stock producing $6+ in EPS and massive cash flows for sub-$40 now. With the strong margins and returns on invested capital, Delta shouldn’t trade anywhere close to 5x EPS targets for 2025.

Takeaway

The key investor takeaway is that investors should continue to use the weakness in the sector stocks to load up on the leader. Delta shouldn’t trade below 10x EPS targets, yet the stock is heading towards half an acceptable forward P/E multiple.

With the 9% dip on Friday following earnings, Delta could head lower next week. The stock traded down to the low $30s in late October and another such dip would be a sweet gift.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.

Read the full article here