Investment action

I recommended a buy rating for Dexcom (NASDAQ:DXCM) when I wrote about it during October last year, as the 3Q23 results gave me further confidence in the business’s positive outlook. The share price has rallied strongly post-my update, back to as high as DXCM’s 1-year all-time high of $142 (~10% below my target price). Based on my current outlook and analysis, I recommend a buy rating. My key update to my thesis is that DXCM should continue to exhibit >20% growth for the foreseeable future, and despite the sequential slowdown in US sales, I believe the launch of Stelo in the coming Summer will continue to support growth. Also noteworthy is that ex-US growth remains very strong, at 26% organically.

Review

DXCM reported 1Q24 earnings on 25th April, where sales came in 1% above consensus at $921 million, driven by organic growth of 25%. US sales saw $653 million, up 24% vs. 1Q24, but were down sequentially by 260bps, while ex-US organic growth was stronger at 25.8%. However, gross margin came in softer than 1Q23 and 4Q23 at 61.8%, mainly due to the higher mix of lower margin G7. That said, adj EBIT margin came in at 15%, which was a ~500bps improvement vs. 1Q23. If I were to simply look at the results and compare them to my model in October last year, DXCM is definitely tracking well against my expectations (I expected FY24 revenue growth of 23% and 1Q24 reported organic growth of 25%). Despite that, DXCM’s share price fell by ~10% post 1Q24 results, and I believe it is mainly due to the slowdown in US sales sequentially that has spooked investors, as it implies potentially more sequential slowdown ahead as the comp base gets tougher (2-4Q23 saw 20+% growth vs. 1Q23’s 16.6% growth).

DXCM

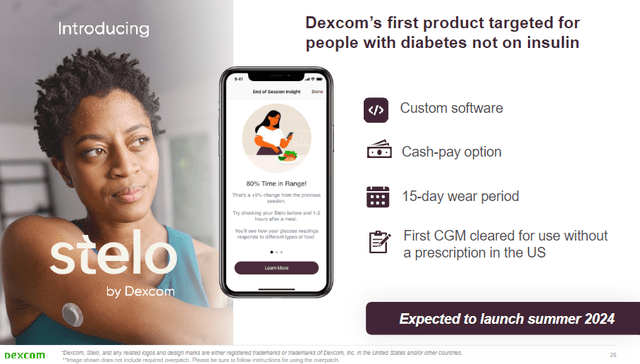

In my opinion, the market is overly worried about this sequential decline and is missing out on the key positive catalyst ahead: Launch of Stelo (DXCM’s new cash-pay continuous glucose monitor [CGM] indicated for non-insulin users). Management is planning to launch Stelo this summer after receiving an unexpectedly early March approval from the FDA. I believe this is going to continue supporting >20+% growth rate. It was called out that there was pent-up demand among primary care physicians and prospective customers, and management cited this dynamic as the most interest they’ve seen in an upcoming launch. Considering that the TAM is huge—there are around 25 million US type 2 non-insulin patients, according to management—this paints a very positive outlook for the medium-term growth strength of DXCM. Apart from the core customers, I think the figures improve when non-diabetic patients are included as well. Management has commented on this, stating that they expect a broader range of use patterns with Stelo due to the variability in the target population. They hope that favorable coverage decisions will be made based on real-world data collected after the launch. All in all, the way I see it, the market is not pricing this positive aspect at the moment but will do so eventually as DXCM starts to report the adoption rate and sales contribution.

Well, we haven’t anybody reached out to buy it, because we haven’t offered it for sale, but we certainly had a lot of inquiries. And again, as you go to media impressions, articles, interviews, unsolicited stuff, things like that, Stelo has been the biggest offering that we’ve had as far as news. And as our reps walk into primary care doctor offices, I just spent a bunch of time with several of our field team members, that’s the question the minute they walk in the door, when am I going to see Stelo, and how? And when I was in — at ATTD, it was interesting. Many of the physicians came up to me and said, how does the Stelo affect me in my practice? 1Q24 call

Some investors might also be worried about the Hardware revenue decline of 26% to $66.7 million vs. $89.6 million last year, which could imply that underlying adoption is weak. However, my view is that this is not a big issue either. Firstly, there is an indirect mix impact from the ramp-up in G7 volume, which has a built-in transmitter, vs. G6, which does not. Hence, there is no recognition of transmitter revenue for G7. Secondly, G7 saw another record overall new patient quarter, which makes the mix skewed more towards G7. I believe this revenue line is going to be less important moving forward, and investors should pay less attention to it since the mix is going to skew further towards the G7 as it benefits from the rollout of direct-to-Apple Watch connectivity.

Management’s updated guidance is also a very positive sign that growth momentum is not showing any signs of slowdown. The new guidance includes a sales range of $4.2 billion to $4.35 billion, implying 17% to 21% organic growth. Notably, the bottom end of the guide was raised by $50 million. I believe management is being conservative on their guide, as this implies a slowdown in growth despite the launch of Stelo, continuous strength in ex-US growth, suggesting that expansion into new geographies is working well, and completion of the transition in sales model in Japan (growth stalled previously because of the transition). I also note that, historically, DXCM has always beaten the midpoint of its annual revenue guidance by an average of 1.2% since FY15.

Valuation

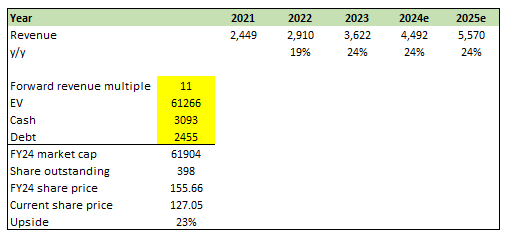

Author’s work

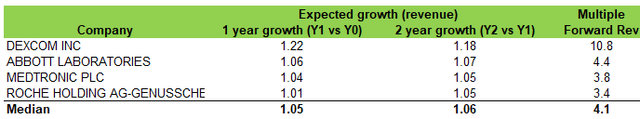

I believe DXCM can continue to grow at >20% because of the positive catalysts that I have reviewed above. In my current model, I have increased my growth expectations by 100bps from 23% to 24% for the next 2 years to reflect the impacts of these catalysts. I used 24% because it is the strength seen for FY23 and 1Q24. I would note again that ex-US is still growing organically at 26%, which is 200bps above my forecast. From a valuation standpoint, DXCM deserves to continue trading at a premium (at 11x forward revenue) to its peers because of the big difference in expected growth ahead. I have said this before, and I reiterate again, that 11x is DXCM’s historical revenue multiple; as such, there are no outsized expectations embedded in the current valuation.

Author’s work

Risk

The adoption of Stelo might not be as good as I expected, despite the indication of pent-up demand. This would be a major disappointment that will impact the future growth outlook. In addition, the expected results from the completion of the transition in the sales model in Japan might not play out as well as they should since Japan is a new country for DXCM.

Final thoughts

My recommendation is a buy rating for DXCM. The upcoming launch of Stelo, a continuous glucose monitor for non-insulin users, is a major positive catalyst with a large target market. Strong ex-US growth and conservative management guidance also make me more confident about DXCM’s outlook. While the adoption of Stelo and the sales model transition in Japan present some risks, I believe the upside is appealing enough.

Read the full article here