Investment Summary

Looking at just the P/E of Diamond Offshore Drilling Inc (NYSE:DO) I think most investors would quite quickly just turn away as it’s sitting at 281. But this is doing an injustice to the company as the earnings going forward are extremely promising. In 2024 the EPS is to jump to $1.39 and put DO at a P/E of just 11. Seeing as DO is an offshore oil drilling company, they are in a ripe spot to maintain strong profitability as oil prices remain elevated on the back of strong demand still.

If oil prices remain above $60 then 80% of offshore drilling projects are profitable and with expectations of it being around $84 in 2024, I think DO will be posting some incredibly strong earnings going forward. The company is seeing demand on many fronts but also ensuring they capture and secure this too with contracts. Recently awarded $212 million in contracts is making sure that DO has substantial revenues going forward. I think the time to get in on DO is now and will be rating it a buy as a result.

Oil Remains Vital And Demand Showcases This

The outlook for the oil and gas industry has indeed faced significant scrutiny in recent times due to the increasing prominence of renewable energy sources. The rise of renewables, such as solar, wind, and hydroelectric power, has been driven by the global commitment to combat climate change and reduce greenhouse gas emissions. As a result, some analysts have raised concerns that traditional energy sources, like oil and natural gas, may take a back seat in the energy transition.

While the push towards renewables is undeniable and essential for a sustainable future, it is essential to acknowledge the current and projected energy landscape. Oil and natural gas have long been vital contributors to our energy generation, and despite the growing share of renewables, they are expected to remain significant players in the global energy mix for the foreseeable future.

Moreover, oil and natural gas continue to play a crucial role in meeting the energy demands of emerging economies and developing nations. As these countries experience rapid industrialization and urbanization, their energy needs are expected to grow significantly. While they may also embrace renewable energy solutions, the demand for oil and gas is likely to persist in tandem with their economic growth.

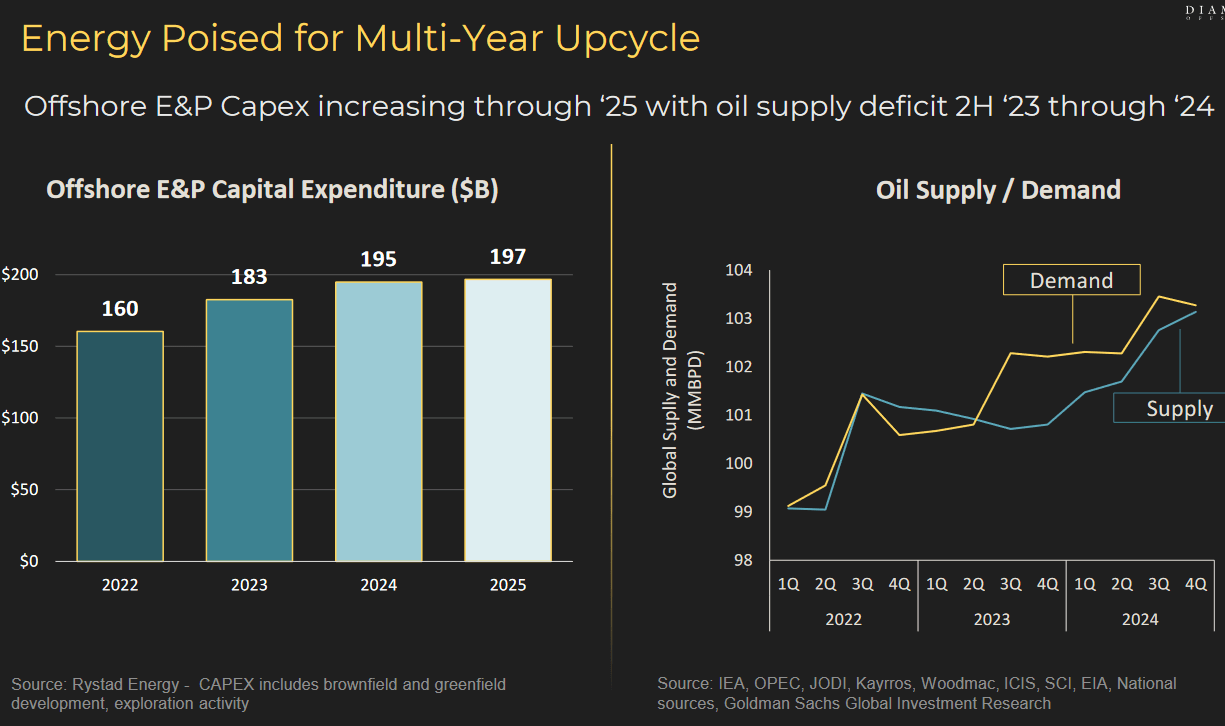

Market Outlook (Investor Presentation)

When I look at the market and its variable external impacts it has, I think oil is ripe for a long-term uptrend from here. The chart above here showcases that demand remains largely higher than supply. Countries like India are some of the major buyers of oil as the growing population in the country and its emerging manufacturing sector is placing extreme demand on oil to fuel production. But for the US oil remains a high priority too and a substantial amount of energy is still being generated from it. That won’t change overnight and likely not that much in 10 years either. This presents a market that is still going to have a lot of demand and generate significant profits. The threshold for profitability for DO seems to be around $60 and oil prices and not very likely to see that level anytime soon I think. That means DO will be able to continue growing earnings and distribute capital through strong buybacks.

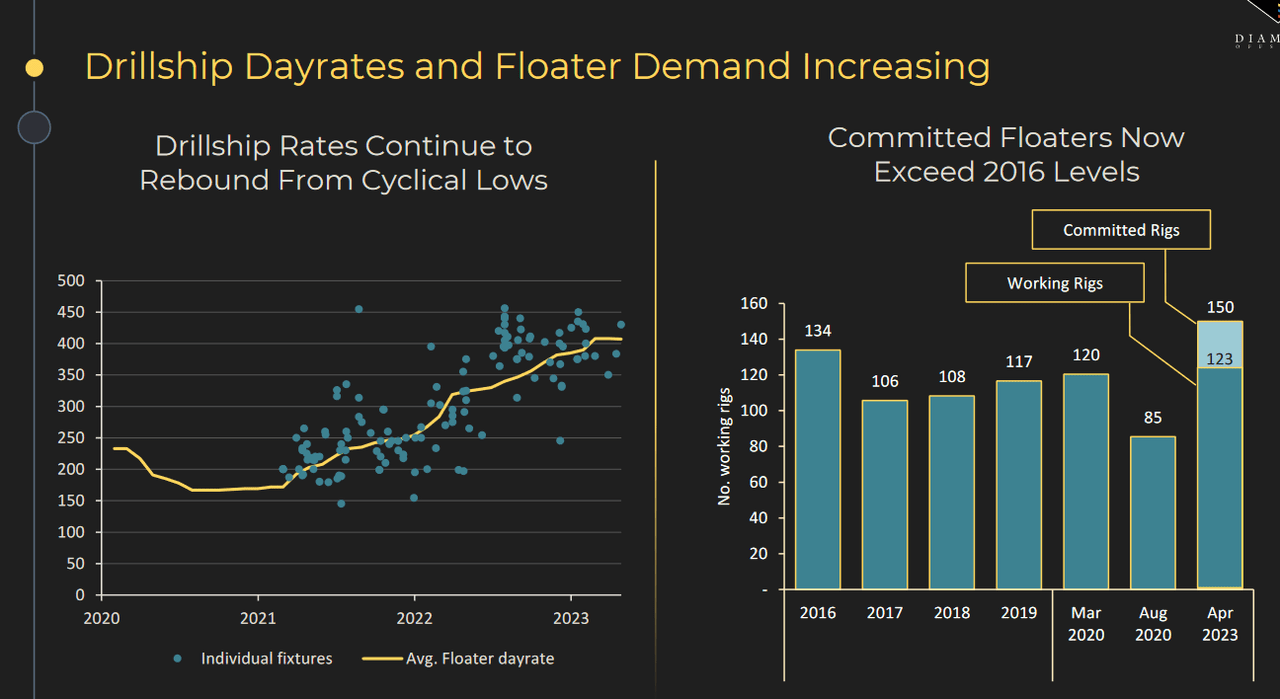

Dayrates (Investor Presentation)

Continuing to benefit DO is the fact that drillship rates are rebounding at a decent rate right now. With strong floater demand still the likelihood of DO posting strong earnings going forward is significantly increased too. One of the highlights of DO certainly is the high-quality fleet that they boast. The rig portfolio consists of high spec 7G UDW drillships and semis have levered the best markets and demand dynamics.

Risks

DO has faced a challenging financial trajectory, suffering significant losses for eight consecutive years, except for a modest profit in 2017. Unfortunately, in 2020, the company’s financial difficulties reached a breaking point, leading to bankruptcy. Although DO has undergone restructuring efforts, it still grapples with vulnerability to the unpredictable ups and downs of the global energy market.

The boom-and-bust cycles in the energy sector pose a persistent risk to DO’s financial stability. Fluctuating oil prices, geopolitical tensions, and shifts in global demand can exert immense pressure on the company’s operations and profitability. Additionally, the emergence of renewable energy sources and the growing focus on sustainability further challenge the traditional oil and gas industry’s long-term prospects.

Furthermore, the company’s reliance on offshore drilling operations adds complexity and cost to its operations. Offshore drilling is a capital-intensive endeavor, requiring substantial investments in specialized equipment and technology. Any delays, accidents, or unexpected operational challenges can severely impact DO’s bottom line.

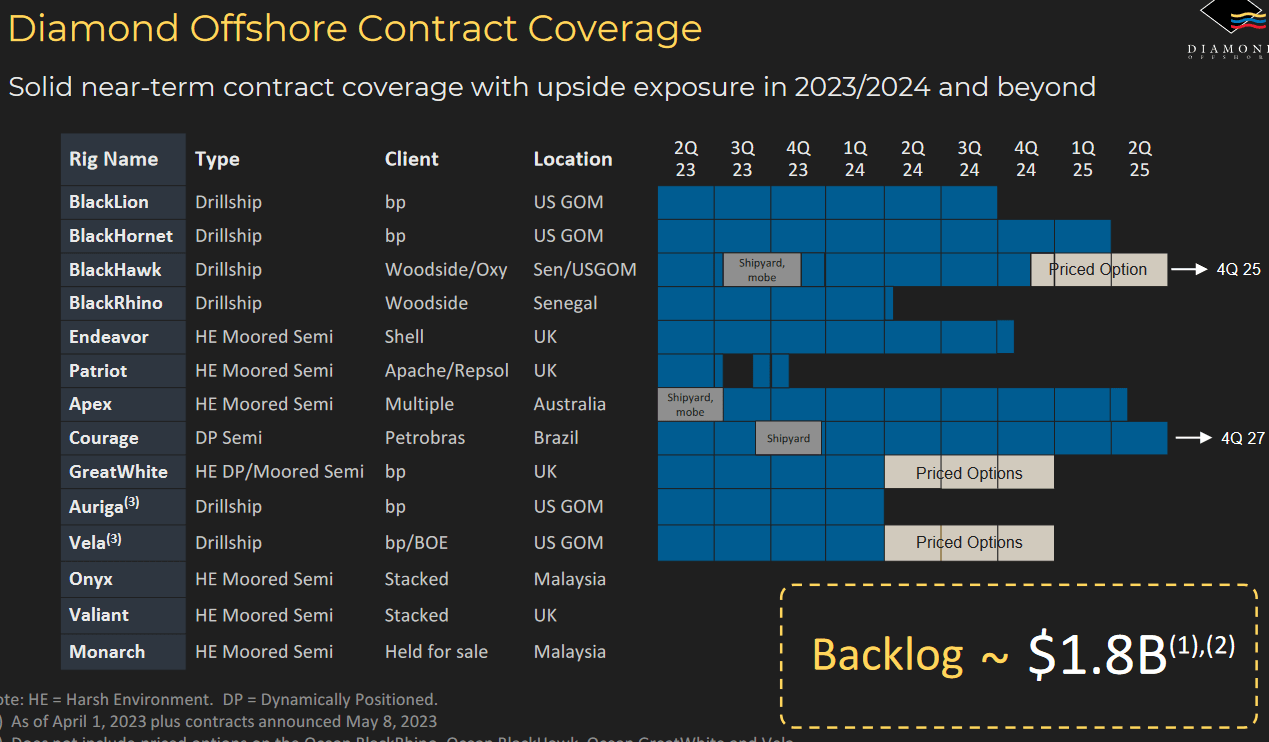

Contract Coverage (Investor Presentation)

The flexible contract coverage of the company is helping offset some of these risks though. With a decent amount not tied up in long-term contracts, there is a bigger possibility of them being able to enter into rising rate markets and produce consistently growing earnings too.

Financials

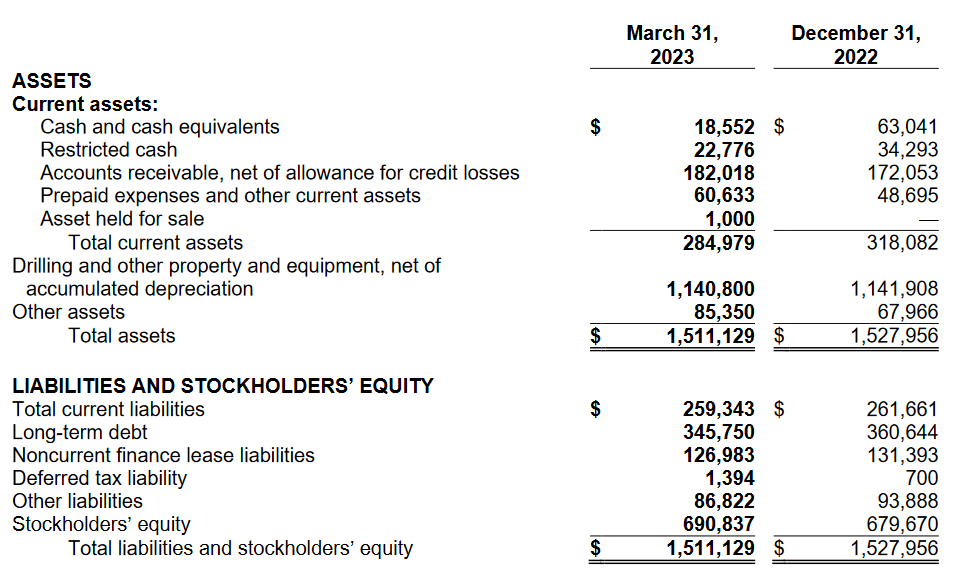

The financials of the company have been fluctuating somewhat on a QoQ basis. The cash position has been decreasing to $18 million as of the last report. Going into Q2 I don’t think we will see a significant increase here. The priority seems to be more on paying down debt instead.

Balance Sheet (Earnings Report)

The long-term debts sit at just $345 million, down $15 million QoQ. In terms of sustaining operations, I think that DO remains in a very good position to continue. The favorable oil prices going forward will make DO very much able to improve its financial position which should justify a slightly higher valuation too.

Valuation & Wrap Up

As we have discussed in the beginning part of the article, the valuation of DO is quite absurd when looking at the TTM P/E. But seeing as oil prices are rebounding and DO has over $1.8 billion in backlog with contracts that aren’t all tied into long-term is creating a solid investment opportunity here. In 2025 the p/e is to be under 6 and with an EPS of $2.74. If we apply a sector-wide multiple of around 9 the price target lands on $24 or an upside of 55%. This is presenting a very good risk/reward ratio for today I think.

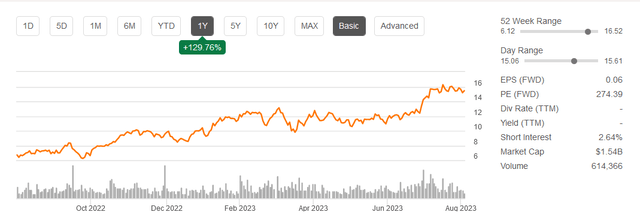

Stock Price (Seeking Alpha)

Given that DO has also been very efficient in buying back shares, there are further benefits that shareholders can have here. To reiterate my stance on the company, I am rating DO a buy today.

Read the full article here