Foolishness sleeps soundly, while knowledge turns with each thinking hour, longing for the dawn of answers.”― Anthony Liccione

Today, we take an in-depth look at a clinical stage oncology focus firm that has some intriguing prospects, a large slug of cash on its balance sheet and some recent buying from a beneficial owner. An analysis follows below.

Seeking Alpha

Company Overview:

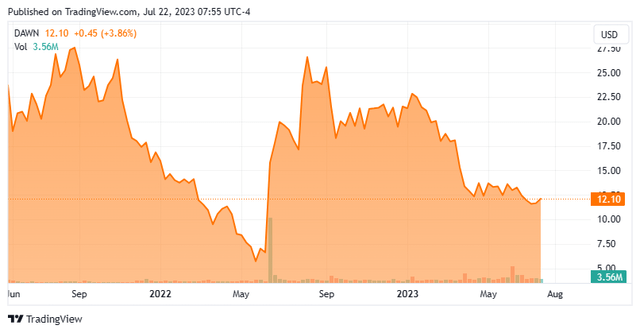

Day One Biopharmaceuticals, Inc. (NASDAQ:DAWN) is a Brisbane, CA based late clinical-stage biopharma concern focused on the development of targeted oncology therapeutics with an initial focus on pediatric cancers. It has two assets in the clinic, including lead candidate DAY101 (tovorafenib), which is undergoing investigation for BRAF-altered tumor indications. Day One commenced operations in 2018 and went public in 2021, raising net proceeds of $167.0 million at $16 per share. Its stock trades near $12.50 a share, translating to an approximate market cap of $1.05 billion.

Approach

The company endeavors to exploit an opportunity in pediatric oncology, citing a 21-year period (1997-2017) where 126 oncology drugs were approved by the FDA. During that period, the median time between first-in-adult trial and first-in-child was 6.5 years. Furthermore, of the 117 non-hormonal oncology meds approved over that same period, only six had an initial approval that included children. In many instances, standard-of-care therapeutics don’t exist for many pediatric oncology indications. Management believes that this current regulatory landscape provides (in some instances) a quicker path to approval for its assets. To further expedite the process, the team at Day One in-licenses its drug candidates after they demonstrate promise and leverages its expertise in designing clinical development programs similar to an ultra-rare disease model – i.e., fewer patients and no placebo controls in its pivotal trials.

Pipeline

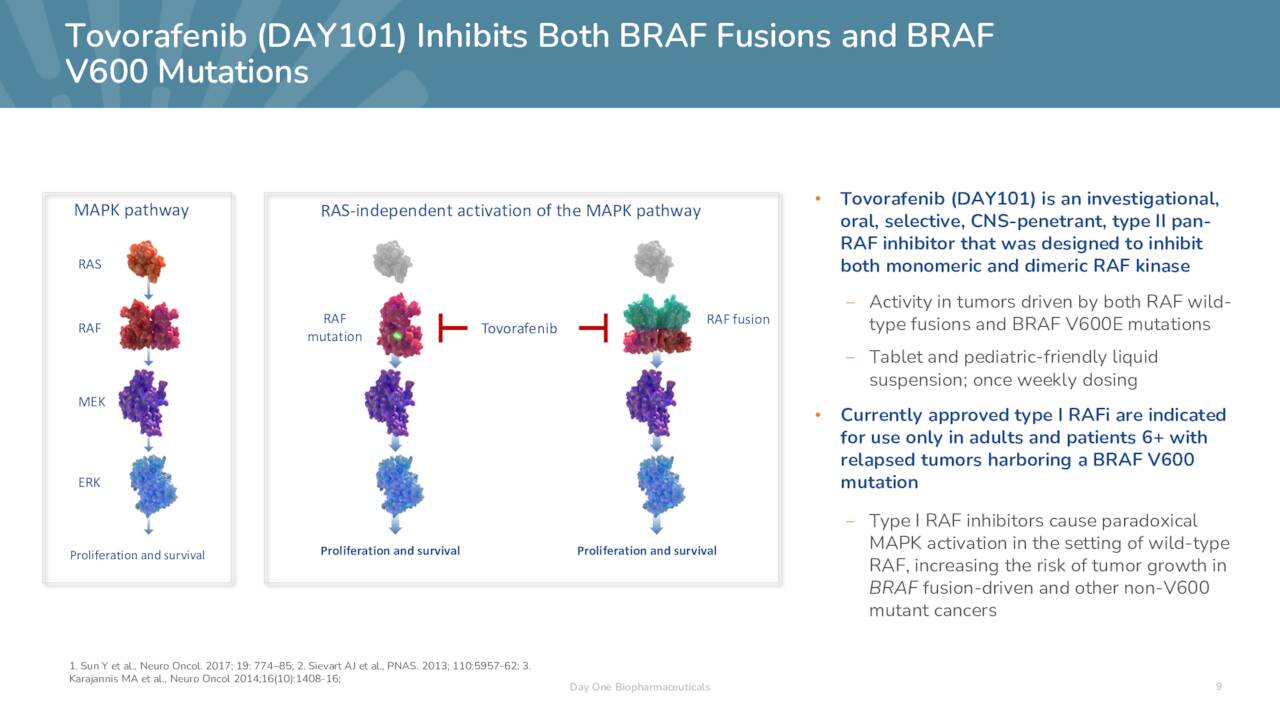

Tovorafenib. Its lead candidate, tovorafenib (heretofore, ‘tovo’), embodies Day One’s approach. In-licensed from Sunesis, it is an oral, brain-penetrant, Type II pan-RAF kinase inhibitor that antagonizes both monomeric and dimeric RAF kinases. Without trying to get too deep into the weeds, RAF (rapidly accelerated fibrosarcoma) kinases (ARAF, BRAF, and CRAF) are enzymes (and key intermediaries) in the RAS oncogene/mitogen activated protein kinase (RAS/MAPK) pathway, transmitting signals that regulate systemic body fluid circulation, as well as cell proliferation, differentiation, and survival. However, RAS is also present in many tumor microenvironments and is the most regularly mutated oncogene, while MAPK is the most frequently altered signaling corridor in cancer. Dysfunction of the RAS/MAPK pathway is responsible for unregulated cell growth and 5.5 million new cancer diagnoses every year worldwide.

November Company Presentation

Inhibition of RAF kinases has yielded significant responses in malignant melanomas containing BRAF mutations. Type I RAF inhibitors (Roche’s (OTCQX:RHHBY) Zelboraf (vemurafenib), Pfizer’s (PFE) Braftovi (encorafenib) and Novartis’ (NVS) Tafinlar (dabrafenib)) are approved but their utility is limited by drug resistance, a function of RAF kinases linking together (dimerizing). Type I inhibitors only antagonize monomers and are therefore limited to use in one category of malignancy (BRAF V600-mutated tumors).

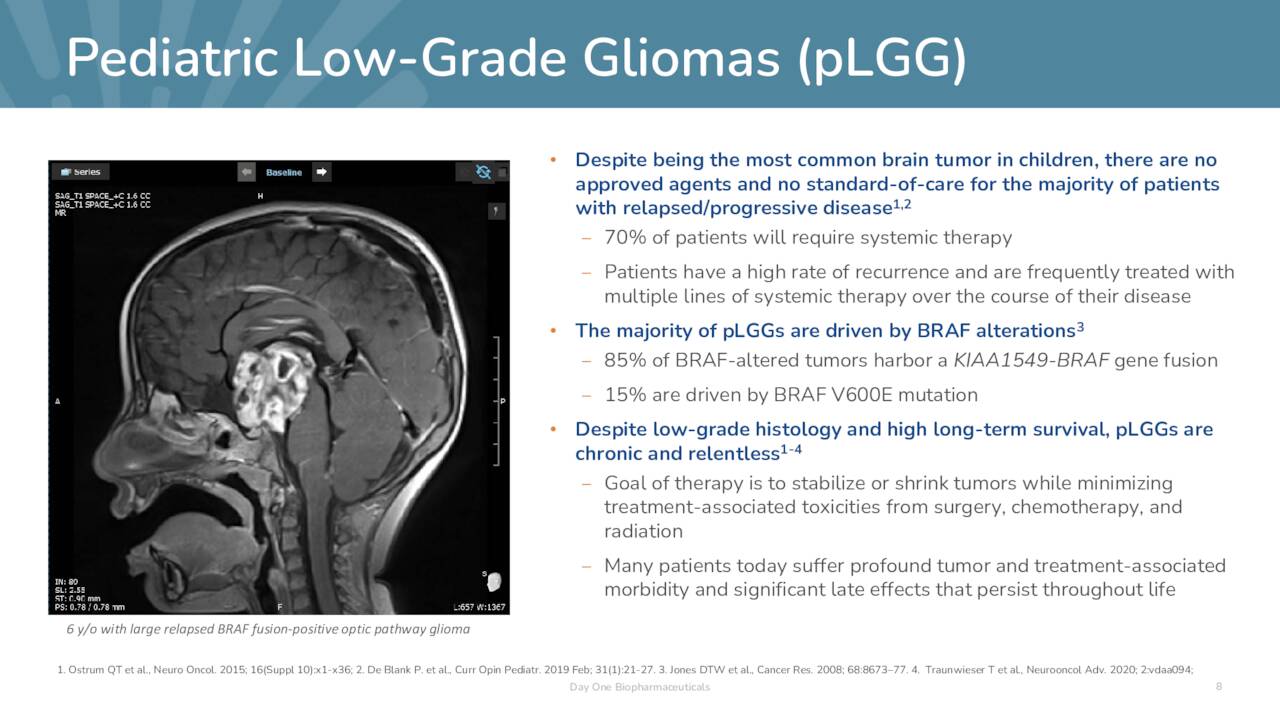

By inhibiting dimeric RAF kinases, Day One believes tovo to be a more advanced and effective version of the Type I RAF inhibitors. In addition to its broader therapeutic capacity, the company’s Type II inhibitor has demonstrated higher brain penetration and has not triggered paradoxical activation in RAF wild-type cells – which can provoke renewed tumor growth – like its Type I predecessors. Owing to its ability to cross the blood-brain barrier, tovo is undergoing evaluation in the treatment of progressive low-grade glioma (pLGG), the most common brain tumor diagnosed in children, where over half the malignancies are a function of abnormal MAPK signaling due to RAF alterations. Until March 2023, there were no approved therapies for this indication.

November Company Presentation

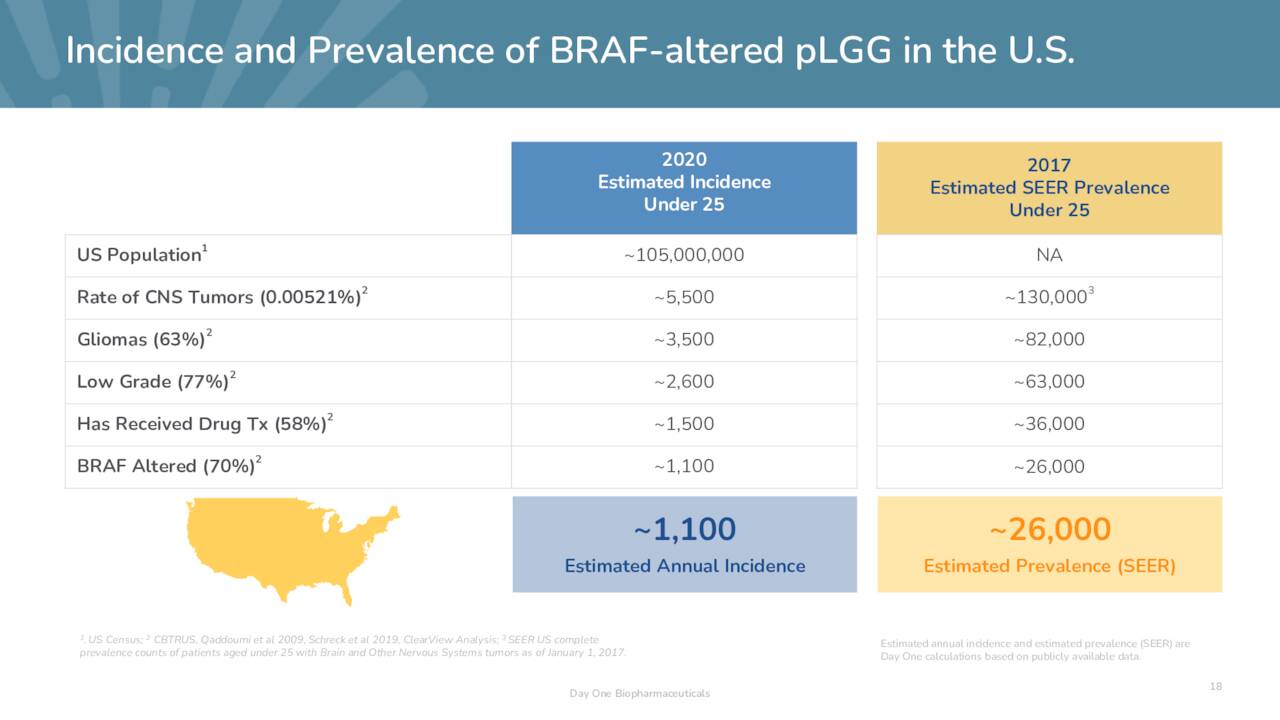

pLGG afflicts ~26,000 Americans under the age of 25 with ~1,100 new cases occurring annually. Symptoms are tumor size and location dependent but include loss of motor functions, nausea, vomiting, vision problems, severe headaches, seizures, mood disorders, and unexplained weight gain or loss. As previously stated, there is no standard of care, but surgery, chemotherapy, and radiation are employed. If complete resection is accomplished, the ten-year survival rate is ~90%; if only partial resection can be performed, that rate drops to 55%. Either way, those afflicted have very low-quality lives and represent a high unmet need. Some hope was offered when Novartis received approval for Tafinlar in combination with its MEK inhibitor Mekinist (trametinib) for the treatment of pLGG patients one year of age and older with LGG from a BRAF V600E mutation, who require initial systemic therapy. That said, BRAF V600E mutations represent only 10%-20% of all BRAF-altered pLGGs.

November Company Presentation

Tovo aspires to be the answer for all BRAF-mutated pLGGs. It is under clinical assessment as a monotherapy in the treatment of both relapsed and frontline pLGG. In the 77-patient arm (Arm 1) of an open-label, pivotal Phase 2 trial (FIREFLY-1) for individuals aged six months to 25 years with relapsed or pLGG harboring an activating BRAF mutation, once-weekly tovo demonstrated an overall response rate (ORR) of 67% (including four complete responses) and a clinical benefit rate of 93% in 69 heavily pretreated patients employing the RANO-HGG (Response Assessment for Neuro-Oncology High-Grade Glioma) criteria. For all 77 treated patients, median duration of response was 10.8 months. Furthermore, only 17% of the 77 patients in Arm 1 harbored the BRAF V600E alteration, with the other 83% harboring a KIAA1549-BRAF gene fusion (dimeric), reflecting broader efficacy than the Tafinlar-Mekinist combo. As for safety and tolerability, across all Day One-sponsored studies with tovo to date, only 4 of 136 patients discontinued due to treatment-related adverse events.

According to management, completion of the other two arms of FIREFLY-1 (expanded access and extracranial RAF fusion tumors) is not a precondition for approval, with data from Arm 1 sufficient.

This latest update of the two-year study was announced on June 4, 2023, but based on its first topline readout in January 2023, Day One initiated a rolling NDA submission in May 2023. The submission is expected to be completed by October 2023.

Day One also dosed its first patient in March 2023 for a pivotal Phase 3 trial (FIREFLY-2/LOGGIC) investigating tovo in a frontline setting. Approximately 400 patients aged 6 months to < 25 years with LGG harboring a RAF alteration will be randomized 1:1 to receive either once-weekly tovo (tablet or liquid suspension) or chemotherapy. The primary endpoint is ORR based on RANO-LGG criteria at 12 months.

Also, tovo is being assessed in the treatment of ~40 patients (ages 12 and up) with solid tumors expressing an activating BRAF fusion, CRAF/RAF1 fusion, or CRAF/RAF1 amplification through a Phase 1b/2a trial (FIRELIGHT-1). The study will include melanoma and tissue agnostic cohorts. The first patient was dosed in November 2021 and the trial is ongoing. In this same study, tovo is being assessed in combination with its other therapy pimasertib – more on that shortly.

Tovo has received Breakthrough Therapy, Rare Pediatric Disease, and Orphan Drug designations from the FDA and the latter from the EU.

Day One’s in-licensing deal for tovo essentially took it off of Takeda’s (TAK) hands from the latter’s in-licensing deal with Sunesis (now merged with Viracta (VIRX)) after Takeda conducted two Phase 1 studies. There are a few moving parts, but to date Day One has spent $6.0 million in upfront and milestones cash payments and issued 6.47 million shares of DAWN for the exclusive rights to tovo. It is potentially on the hook for $54 million in regulatory and development milestones as well as mid-single digit royalties and a mid-teens ‘commission’ on the proceeds from the sale of a priority review voucher from tovo’s Breakthrough Therapy Designation, if approved.

Pimasertib. As stated previously, tovo is being assessed in combination with the company’s other clinical asset, pimasertib. It is an oral inhibitor of mitogen-activated protein kinases 1 and 2 (MEK), which are also key signaling nodes in the MAPK pathway. It was in-licensed from Merck KGaA (OTCPK:MKGAF) after being studied as a monotherapy and in combination with standard-of-care therapies in ten plus Phase 1/2 trials encompassing more than 850 patients. Sub-study 2 of FIRELIGHT-1 is assessing tovo and pimasertib in patients 12 years and older with various MAPK-altered solid tumors, with the first patient dosed in May 2022.

The in-licensing deal cost Day One $8.0 million upfront, $2.5 million in milestones to date, with another $364.5 million in potential milestone payments and high single-digit royalties.

Balance Sheet & Analyst Commentary:

The company used its June 2023 update on tovo as a liquidity event, raising net proceeds of $161.7 million at $13 per share. It had done the same in June 2022, when it released interim data from FIREFLY-1 – then raising $161.6 million at $15 per share. Including its most recent round of funding, Day One holds cash and investments of ~$450 million, providing it a cash runway into FY26.

The Street leans bullish on the company, featuring three buy and two outperform ratings against one hold and one underperform. The underperform rating came via Alec Stranahan at Bank of America when he downgraded Day One (from a buy) in April 2023, citing concerns regarding the strength of the FIREFLY-1 data for FDA approval. Despite his pessimism, analysts’ median twelve-month price objective is $40.

Also optimistic is beneficial owner Access Industries Management, who used the recent secondary to add 769,230 shares to its position at $13, upping its investment to 11.45 million shares, for a 13.2% ownership interest.

Verdict:

Shares of DAWN are down over 50% since their 2023 intraday high of $25.77, set back on January 9, 2023. Novartis winning first approved pLGG therapy and the Bank of America downgrade have hurt. And with Day One never obtaining approval for any therapy to date with its (essentially) ultra-rare disease clinical development strategy, there is a higher likelihood for potential land mines during the regulatory process. That said, the data are supportive of tovo’s approval.

Pricing for the once-weekly therapy have not been discussed publicly, but a quick check suggests that the recently approved Tafinlar-Mekinist combo (each close to $14,000 a month according to goodrx.com) generates annual revenue of $340,000 per patient. If tovo is approved, garners 20% share of the non-BRAF V600E mutations market (~21,000 x 0.20 = 4,200) and receives $150,000 annually per patient, tovo would generate revenue in excess of $600 million. With a market cap net of cash essentially in excess of $600 million and a solid chance of approval in 1H24, the risk-reward suggests a small ‘watch item‘ investment, within a well-diversified biotech portfolio, in this busted IPO is merited.

The nearer the dawn, the darker the night.”― Henry Wadsworth Longfellow

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here