I did a quick ratings search from contributors on Seeking Alpha on the Eaton Vance Tax-Managed Diversified Equity Income Fund (NYSE:ETY), $12.85 closing market price, and just about everyone over the last year has the fund as a Hold rating.

I guess that’s better than a Sell rating, but I’m pretty sure those Hold ratings are based more on market price performance and not NAV performance, which is the true apples-to-apples performance comparison.

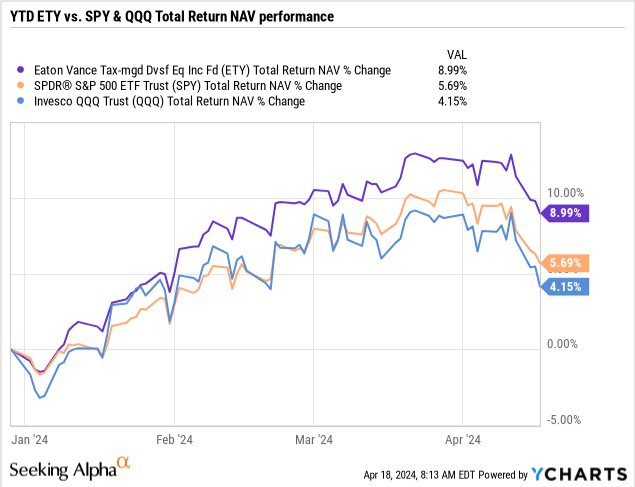

Because if they did perform an NAV performance comparison, this is what would have come up in their results. On a total return NAV comparison with ETY’s benchmark, the S&P 500 (SPY), $500.55 closing market price, and for good measure, I’m going to include the Invesco QQQ Trust ETF (QQQ), $425.84 closing market price, here’s how ETY stacks up, first on a year-to-date basis:

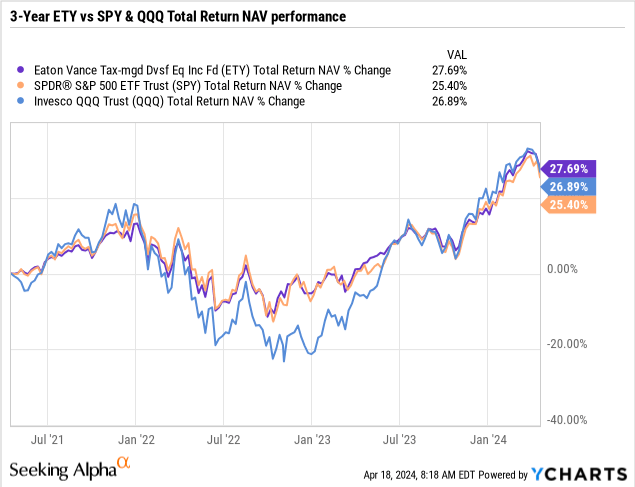

And next on a three-year total return NAV comparison:

So why did I pick these periods and not on a one-year or five-year basis? ETY’s NAV actually keeps up with the indexes over the more bullish one-year and five-year periods as well and actually beats SPY on a one-year look back. But what I wanted to show was comparisons over periods that included more up-and-down market environments since that’s when an option-income CEF can outperform its benchmarks at NAV.

And no option-income CEF has been doing that better than ETY. Here’s why. ETY writes index options on the S&P 500 against roughly 50% of the notional value of its all-US stock portfolio. That allows some defensiveness when the markets are flat or pulling back while allowing more upside capture when the markets are rallying. Sort of a Goldilocks – not too hot and not too cold.

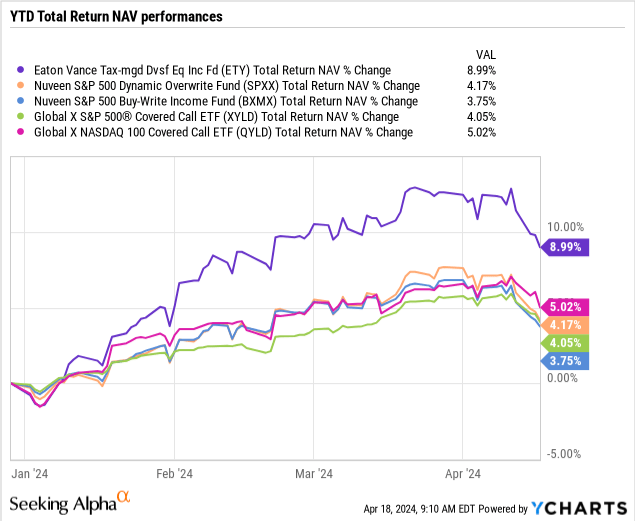

Now you may say that there are lots of equity CEFs and ETFs that an investor can choose from that use the same option-income strategy and also only invest in US large-cap stocks too. That’s true, but none of them are beating ETY.

So why is ETY performing so much better at NAV than other funds in its class? A lot of it has to do with how Eaton Vance has set up their option writing with their equity CEFs that write index options. ETY just happens to be the only Eaton Vance option CEF that focuses entirely on US stocks and writes index options on only 50% of its portfolio value. All the other Eaton Vance option funds are either global or write options on a much higher 96% of the portfolio value or write individual stock options.

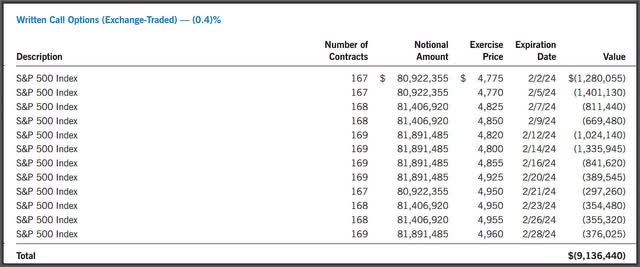

So here’s why ETY has been so successful with this strategy. ETY writes S&P 500 index options on a rotating schedule every few days instead of every month. And when one option expires a month out, another is put on. This is what that looks like for a typical monthly option sleeve for ETY as of 1/31/2024:

Eaton Vance

What happens is that when the earliest 2/2/24 options drop off, a new tranche will be added on or around 3/1/24 (not shown). So even if the 2/2/24 tranche will need to be bought back at a loss, since the markets were rallying at the time, the new ones out a month may expire worthless if the markets are flat or are falling back over the next month.

Why is that an advantage? Because most option-income funds, both CEFs and ETFs, write monthly options, not every few day options like ETY. What that means is that you don’t have to worry about the timing of when the options are placed or when they expire. That can be a huge advantage over monthly writing CEFs or ETFs who may be writing their options at the wrong time (typically the third Friday of a month).

But because of the number of Eaton Vance option funds and their large market caps, Eaton Vance has been able to negotiate with counterparties to place these options every few days for their index option funds.

This is something most shareholders in option-write funds don’t consider when they look at monthly option-write funds from say, Nuveen or Global X, and ask themselves, why aren’t they performing better?

Because frankly, ETY’s portfolio of large-cap US stocks is probably not going to look that much different than the option-write funds from Nuveen and Global X. Yes, ETY is top-heavy in the mega-cap technology stocks, but then, what S&P 500 and Nasdaq-100 following fund isn’t?

Here are ETY’s top 15 holdings as of 2/29/24 (latest given):

Eaton Vance

Now, maybe it helps that ETY only has 57 stock holdings, and the top 15 positions shown above account for 53% of the fund’s total portfolio value, thus giving the portfolio added appreciation if the top picks are performing better than the S&P 500 index ETY writes options against.

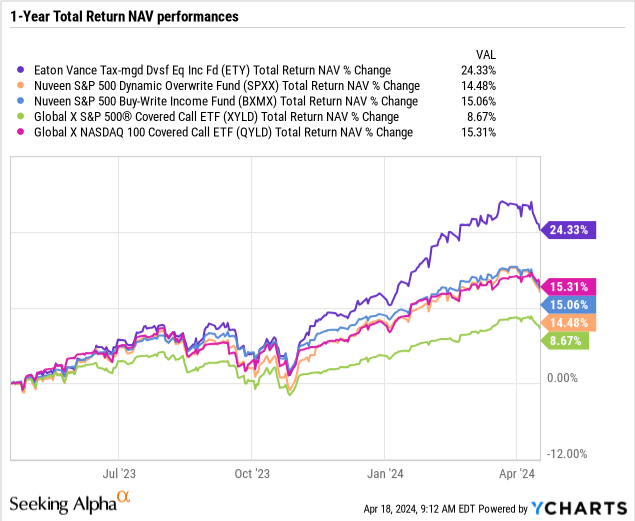

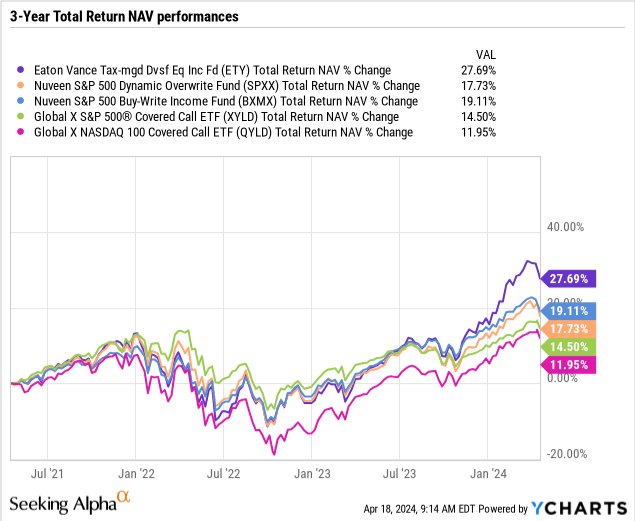

Whatever the reason, ETY’s NAV is soundly beating the Nuveen S&P 500 Dynamic Overwrite Fund (SPXX), the Nuveen S&P 500 Buy-Write Income fund (BXMX) as well as the Global X S&P 500 Covered Call ETF (XYLD) and the Global X NASDAQ 100 Covered Call ETF (QYLD) over multiple periods.

Here is a YTD comparison:

Here is a one-year comparison:

And finally, here’s a three-year NAV total return comparison:

In each period, it’s not even close. You could perform these comparisons with other option-income funds too. ETY has been that dominant. So can we agree that on an NAV total return performance, ETY is the cream of the option-income fund crop?

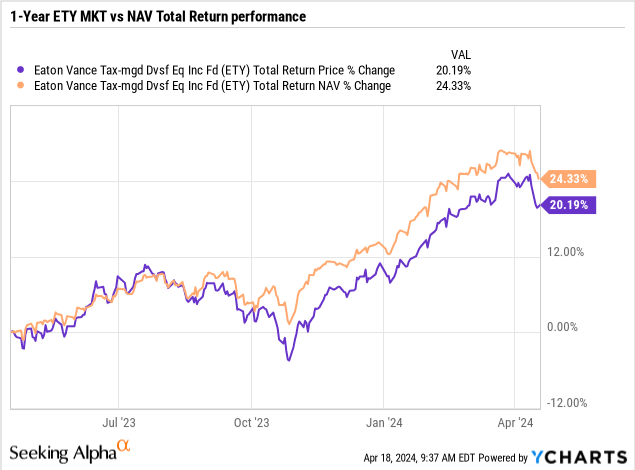

Yeah, But What About MKT Price Performance?

There’s a saying that in the short run the market is a voting machine but in the long run it’s a weighing machine. You also could apply that to CEFs too, only think of a CEF’s market price as the voting machine and a CEF’s NAV as the weighing machine.

A CEF’s NAV is the true value of the fund taking into account all assets and liabilities whereas a CEF’s market price is subject to shareholder demand and supply of the shares, which can be at a premium or discount to its NAV and can be based more on emotions and yield than anything else.

And maybe this explains why if you only looked at ETY’s market price performance, you might rate it as a Hold as well.

It’s not that ETY’s market price performance has lagged so much behind its NAV. It just seems like it needs a catalyst to convince shareholders (and Seeking Alpha contributors), that the fund should be trading higher.

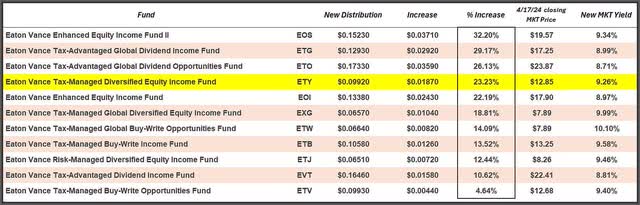

Well, guess what? That catalyst arrived on April 1 when Eaton Vance raised the distributions for all of their equity CEFs, and ETY’s was one of the largest at +23.2%.

Capital Income Management, LLC

More importantly, this puts ETY’s current market yield at a very generous +9.3% paid monthly. That’s a windfall market yield over its +8.8% NAV yield due to ETY’s -5.2% current market price discount.

And if you compare ETY’s +9.0% year-to-date NAV return with its +8.8% NAV yield, ETY is one of the few high-yielding CEFs that has already covered this year’s distribution. And that’s even after the recent pullback in the markets.

Trust me, there are a lot of equity CEFs that will not cover their NAV yields this year, but so far, ETY is one of the few that is.

I’m officially raising ETY to a Buy after this -5% market pullback because ETY has already proven it’s the cream of the crop in an up or down market environment.

All the Eaton Vance CEFs will go ex-dividend with their first higher distribution next Monday, April 22. That means you would have to own ETY by Friday’s close to lock in the distribution.

Read the full article here