Introduction

As a dividend growth investor, I seek new investment opportunities in income-producing assets. I often add to my existing positions when I find them attractive. I also use market volatility to my advantage by starting new positions to diversify my holdings and increase my dividend income for less capital.

The consumer staples sector is attractive whenever there is a recession or slowdown risk. Investors seek havens with lower volatility stocks representing companies with constant product demand. As consumers keep consuming essential products, the sector tends to be more resilient when the stock market is down or when private spending is lower. One company in the industry is The Estée Lauder Companies (NYSE:EL).

I will analyze The Estée Lauder Companies using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

The Estée Lauder Companies manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide. It offers a range of skincare products, including moisturizers, serums, cleansers, toners, body care, exfoliators, acne care and oil correctors, facial masks, cleansing devices, sun care products, and makeup products, such as lipsticks, lip glosses, mascaras, foundations, eyeshadows, nail polishes, and powders, as well as compacts, brushes, and other makeup tools. The company also provides fragrance products in various forms comprising eau de parfum sprays and colognes, as well as lotions, powders, creams, candles, soaps, and hair care products that include shampoos, conditioners, styling products, treatment, finishing sprays, and hair color products, as well as sells ancillary products and services.

Fundamentals

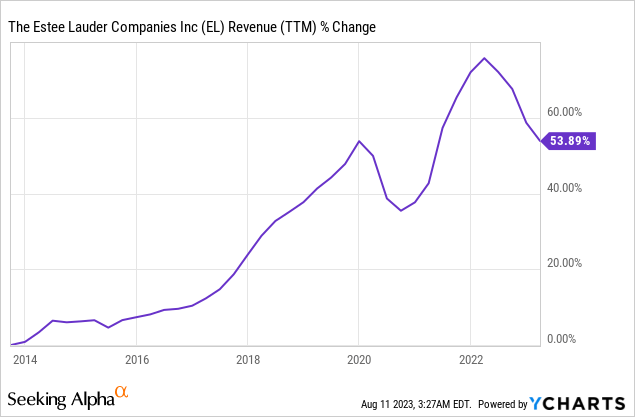

The revenues of The Estée Lauder Companies have increased by 54% over the last decade. Sales of the company are growing by an increase in organic sales as the company sells more products and by acquisitions as the company acquires more brands under its umbrella. The pandemic has caused some weakness in the company’s growth as people were at home and gave less emphasis on personal care. In the future, as seen on Seeking Alpha, the analyst consensus expects The Estée Lauder Companies to keep growing sales at an annual rate of ~9% in the medium term.

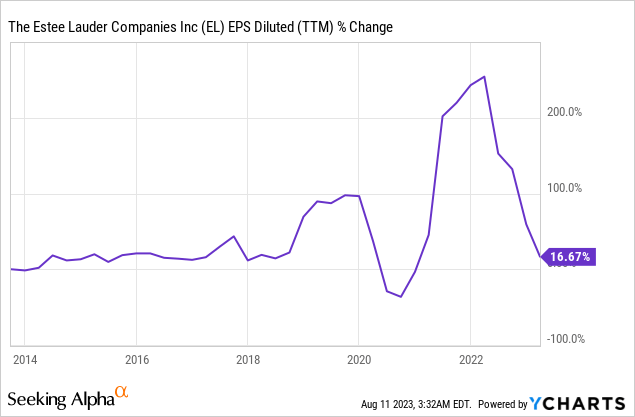

The company’s EPS (earnings per share) has increased by 17%, much lower than the sales. The FY of 2023 ended in June, and the company suffered a significant decline in EPS during that year. With the forecast of Q4, analysts expect to see a ~50% EPS decline, which will recover in the coming two years. The EPS declined despite the lower number of shares and due to the slow recovery in Asia and the inflation. In the future, as seen on Seeking Alpha, the analyst consensus expects The Estée Lauder Companies to keep growing EPS at an annual rate of ~30% in the medium term.

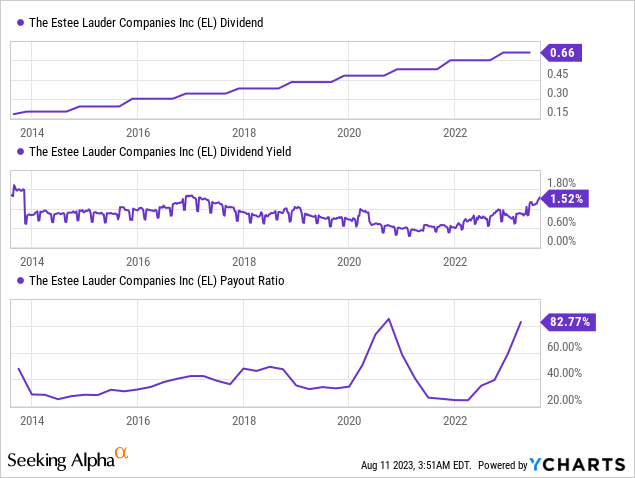

Estee Lauder Companies pays a very reliable dividend. The company has been paying a dividend for over 25 years and hasn’t decreased it during that time. The dividend has been left unchanged for more than a year during the financial crisis of 2008 and several more times in the past but was never reduced. While the payout ratio looks very high at 83%, this is a GAAP payout ratio. The non-GAAP payout ratio is around 60% and is manageable and thus relatively safe. The current dividend yield is not extremely attractive at 1.5%, yet as the company grows its EPS, there will be room for a higher yield on cost.

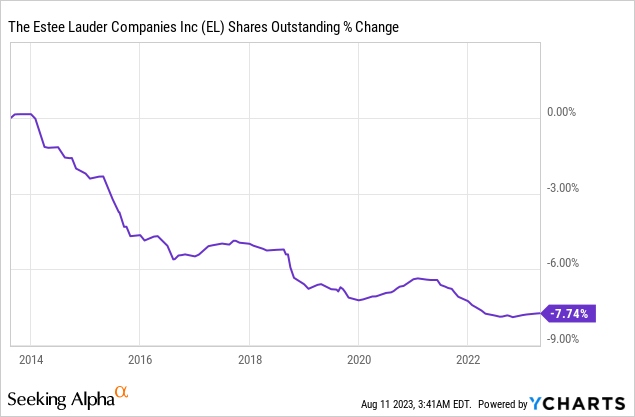

In addition to dividends, companies, including The Estee Lauder Companies, return capital to shareholders via buybacks. Buybacks support EPS growth as they lower the number of outstanding shares. Over the last decade, the management of EL has managed to decrease the number of shares by 8%, contributing significantly to the company’s EPS growth. Buybacks are discretionary spending for firms and are highly effective when the valuation is low.

Valuation

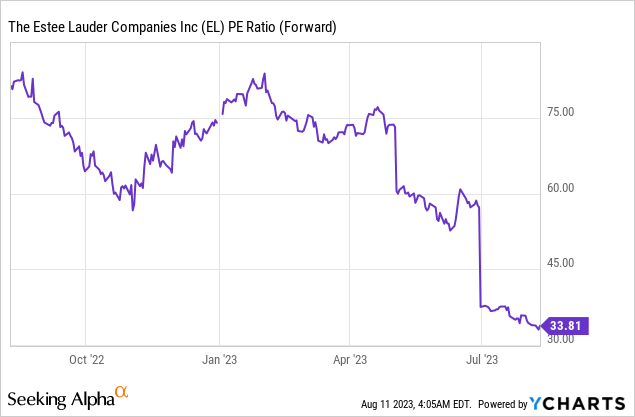

The Estee Lauder Companies’ P/E (price to earnings) ratio stands at 34 when using the EPS estimates for the next fiscal year ending in June 2024. The current valuation is exceptionally high for a consumer staples company. However, the company is expected to snowball as it recovers from a harsh 2023. If the analysts are correct, the company will be trading for 25 times the EPS of FY 2025, ending in June 2025. This is a more reasonable figure, yet it is still far from being an attractive valuation.

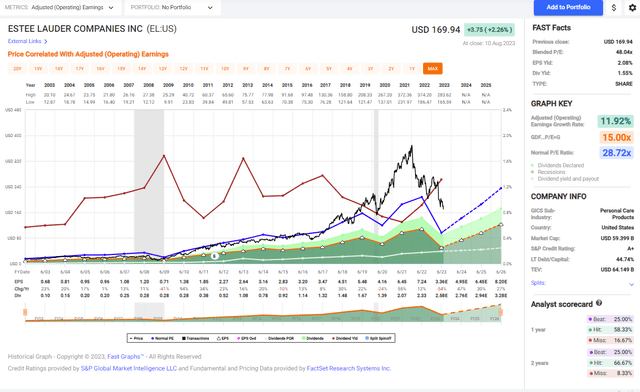

The graph below from Fast Graphs shows a similar picture. The company is overvalued when compared to its average valuation. The average P/E ratio of the company is 29 over the last two decades. During that time, the company grew its EPS by 12% annually. Those shares are significantly more expensive, yet the growth rate is also much higher. While it makes some sense, I am still uncomfortable with the valuation. The reason is that the high valuation is a fact, while the higher growth rate is an expectation.

Fast Graphs

Opportunities

Estee Lauder Companies is a house of brands. It operates using a collection of well-known brands, including Estée Lauder, Aramis, Clinique, Lab Series, Origins, M·A·C. The company sells consumer products that are being applied directly on the body, and therefore there is an advantage to well-known brands that have gained consumers’ trust. Operating with renowned brands with the people’s trust allows the company to increase prices, spend less on sales and marketing and maintain its market share.

Diversification is another growth opportunity. The company sells its products globally. It sells in developed markets like Europe and North America and developing markets like Africa. Moreover, the company also sells a large variety of products. The company has a broad and diverse offering in every market, from skincare to perfumes. Therefore, the company can capitalize on growth opportunities in different products and markets. It allows them to grow whenever an opportunity presents itself.

The company is showing a healthy growth rate in the Americas. This geography has seen a 6% increase in sales in the last quarter. That segment enjoyed growth across the board, benefiting from increases in Makeup, Skin Care, and Fragrance sales. Despite the growth in sales, profits have decreased in that geography. The decrease reflects the higher cost of sales, and as inflation is being tamed, the company will be able to increase profits together with its sales.

Risks

The most significant risk for Estee Lauder Companies is the competition. While there is power to the brand, and it is harder to gain a substantial market share, there are no high barriers to entry. The company competes with other well-known Western, Chinese, and Korean powerhouses in the beauty market. Therefore, the company must develop and market new products globally to maintain and increase market share.

The entire growth trajectory in the short term relies on the recovery in Asia. The Asian market is recovering slowly when it comes to retail travel. If it recovers as expected, the company is likely to perform well. However, if it recovers slower than expected, there will be a much slower increase in the group’s EPS. Slower growth implies slower dividend growth and potentially a lower share price.

Another risk for investors is the high volatility and the limited margin of safety. The beta of Estee Lauder Companies, a measure used to measure volatility, stands at 1.21, which is higher than the broader market. Therefore, while most companies in the consumer staple are less volatile than the index, Estee Lauder offers a thriller ride. Moreover, with the lack of margin of safety due to the high valuation, there is a higher risk for even more volatile trading if the company doesn’t manage to grow as analysts expect it to.

Conclusions

To conclude, Estee Louder Companies is a stable blue-chip company. The company has grown its sales and EPS for decades. Doing so fuels dividend growth and buybacks, which return capital to shareholders. Moreover, the company has several growth opportunities with its strong brands across continents and products. The future looks bright for the company as the world recovers from the pandemic.

However, the company does deal with risks-a slower-than-anticipated recovery, competition, and a low margin of safety. Combined with an extremely high valuation, all three make the company a less appealing investment. Therefore, as long as the valuation is high, I rate the shares a HOLD. I will consider buying the shares for 20 times earnings, and it will happen if the company manages to capitalize on the anticipated recovery in Asia.

Read the full article here