In recent weeks I have published several articles on Seeking Alpha concerning Chinese companies, particularly Alibaba (BABA) and Tencent (OTCPK:TCEHY). We are at a stage where Chinese equity is severely undervalued relative to historical values, which is why it would seem like a good time to buy. Be that as it may, I noticed in the comments that many people were highlighting how risky it was to invest in Chinese companies because of the continuous restrictions imposed by CCP. Some even considered Alibaba and Tencent ‘uninvestable’ regardless of fundamentals.

I do not deny that these risks are real; indeed, it is not easy to invest in companies that do not have total autonomy. In any case, I cannot justify what I see as the underlying hypocrisy regarding China risk as a whole.

It seems that only Chinese companies are suffering the consequences of the U.S.-China tension, yet I believe the ones that probably are at risk the most are Western. Not having Alibaba or Tencent in your portfolio does not mean you are immune to China risk when much of the companies you have invested in manufacture their products in China as well as sell them. Yet, the market at the moment seems to have a distorted view on this.

The Western economy is totally dependent on China (as well as the other way around), and I will show you some examples of companies that would get the worst of it if geopolitical tensions escalate.

Semiconductor industry is not discounting China risk

The semiconductor industry is becoming increasingly important over time. By now, everything around us has chips, and where the chips come from can make all the difference.

Since the most advanced chips are used in the latest technological innovations, including even the production of weapons, it is inevitable that countries around the world are trying to increase their presence in this industry. Basically, having dominance over semiconductors means having massive power. Given this background, it is inevitable that there will be tensions between the major world powers, particularly between the U.S. and China.

China is the largest semiconductor market in the world, accounting for 31.40% of the world’s final sales, or $180 billion. However, it is not yet self-sufficient in the production of the most advanced chips; in fact, it depends (like everyone else) on Taiwan and the United States.

Tensions are very high between the world’s two largest economies, to such an extent that the United States has long banned exports to China of the equipment to create the most advanced chips. In fact, ASML (ASML), a company that makes the world’s most advanced lithography machines, cannot sell its latest technology to China: the goal is to isolate it and not to strengthen it with Western technologies.

While this ban has created quite a few difficulties for China, it has also been an incentive to achieve self-sufficiency faster in the semiconductor industry.

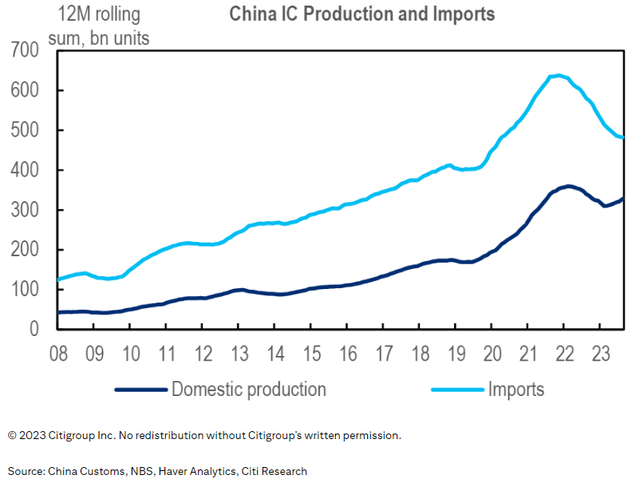

Citigroup

As can be seen from this image from the Citigroup report, domestic production of ICs (Integrated Circuits) has returned to growth, while imports continue their steep decline. Beijing aims to become self-sufficient in the coming years, which is why it is investing tens of billions of dollars in the chip industry. Moreover, just as the U.S. stands in the way of China’s development, the reverse is also true.

Last year China stated that it would ban imports of Micron’s memory chips because of national security concerns. There was not much explanation for this choice, anyway, this news was enough to cause Micron (MU) to plummet 5.30% in pre-market. At the time, Micron was generating about 10% of its sales in China, not that much compared to other U.S. semiconductor companies.

- 32% of Broadcom’s (AVGO) revenues come from China.

- 62% of Qualcomm’s (QCOM) revenues come from China.

- 22% of AMD’s (AMD) revenues come from China.

- 49% of Texas Instruments’ (TXN) revenues come from China. This number drops to 24% if we consider end customers headquartered in China.

- 21% of Nvidia’s (NVDA) revenues come from China, which becomes 47% if we add Taiwan.

- 27% of Intel’s (INTC) revenues come from China.

It is clear that sales to China are a key component for U.S. companies engaged in the semiconductor industry, and I am not considering many other aspects. Since China-U.S. tensions are high, we cannot completely rule out any unforeseen events along the way (as happened to Micron), yet the market does not seem to care since some of these companies are at all-time highs. Should China become self-sufficient sooner than expected, I don’t think it will have much trouble reducing imports, which it is already doing.

In other words, if we were to assess China risk objectively, it would be illogical to avoid Alibaba at all costs and glorify Nvidia when nearly 50% of revenues come from China and Taiwan. By this I do not want to discredit Nvidia’s outstanding achievements, but I do want to point out how differently the market is treating two companies subject to similar risk. In the case of Alibaba there is a lot of leverage on the limitations imposed by the Chinese government, but there is nothing to prevent the latter from meddling even in such an important area as semiconductors: after all, it has already done so. Certainly, should China-U.S. tensions escalate, it would not please either Alibaba or Nvidia, but the difference is that the former has already plummeted 78% from all-time highs while the latter has done nearly 300% in 2023 alone. The financial results of the two companies were completely different, it is undeniable, but in my opinion the performance achieved was extreme on both sides: Alibaba collapsed too much while Nvidia grew too much. The same is true for many other Chinese companies and American companies in the semiconductor industry in my opinion.

Many other industries depend on China

If I wanted to describe individually all the Western companies that depend on China, it would take me a year to write the article. There are really too many of them, so I will try to mention in this section the ones I think are most interesting.

For example, the apparel industry is totally dependent on China, both in terms of sales and manufacturing.

Almost all NIKE Brand footwear is manufactured outside the United States; about 18% of it in China. Although the company is gradually becoming less dependent on China, it still remains a relevant country in which to conduct business. Moreover, 15% of its sales come from China. This aspect applies to many other companies that have relied on China to date, not just Nike (NKE). Without going into too much detail, a similar argument can be made with Adidas, Inditex, and H&M.

The most striking case, in my opinion, is Apple (AAPL), the company that everyone wants to have in their portfolio and that no one dares to criticize. I certainly will not do so, however, I am surprised that few people seriously assess the China risk.

More than 95% of iPhones, AirPods, Macs and iPads were produced in China in 2022. The company’s goal is to gradually reduce this dependence and focus more on countries such as India and Vietnam, but this will not be easy at all. In these countries, there is not the same infrastructure, there is not the same logistics system, and there is not the same expertise of workers. In short, if many companies outsource the manufacturing process to China, it is because this country guarantees a certain result with rather moderate expenses. What’s more, about 19% of Apple’s sales come from China, and it is heavily dependent on TSMC (TSM) when it comes to chips in the most advanced devices. But there is more.

A few months ago China banned government officials and employees of state-owned enterprises from using iPhones at work, and this process is accelerating. As much as the media talked about it, the market completely ignored this news since Apple’s price per share reached an all-time high during that month. Although the ban is limited to a very small circle for the time being, no one can know for sure whether or not this ban may expand as happened to Micron. We are talking about one-fifth of Apple’s revenues that could fade away, but no one seems to care anymore even though the problem is still there.

A similar argument could be made with Tesla (TSLA), where 22% of revenues come from China and Chinese competition has become much stronger – especially BYD (OTCPK:BYDDF). In addition, the Shanghai Gigafactory is crucial since it can produce 750,000 vehicles a year and Tesla relies on China for 39% of its battery supply chain.

Conclusion

Overall, there are many Western companies that are heavily dependent on China, yet the market does not seem to care. China risk is only assessed when investing in Chinese companies, which is a mistake in my opinion. Ideally, one should do a general analysis of where revenues come from geographically and where manufacturing takes place.

Since China is ‘the world’s factory’ and has business dealings with virtually everyone, when digging into the details, almost every company would be affected in the event of an eventual breakdown in U.S.-China business relations. In any case, there are companies that would be affected more, some of which I have mentioned in this article.

Finally, I would like to emphasize that I do not want to take a catastrophic position: the U.S. and China are dependent on each other so a cessation of trade relations (even more so a war) is unlikely. Anyway, a more complex scenario than the current one cannot be totally ruled out, especially considering that China has never denied that it is interested in Taiwan.

The geopolitical chessboard could take resounding twists and turns in the coming years, yet at the moment it seems that only Chinese companies are being challenged; Western ones appear untouchable.

Read the full article here