For those who are bullish about oil, 2024 is looking to be a very solid year. Already, Brent crude prices are up 12.1% year to date, while WTI crude prices are up an impressive 15.6%. The most recent move higher was driven by news that, in addition to OPEC+ extending its voluntary production cuts, Russia has committed to cut production by around another 0.5 million barrels per day for the foreseeable future. While some might argue that these temporary measures will cause only a short-term blip in prices, we could be setting ourselves up for a sustained move higher. But at the end of the day, this depends largely on whose data is correct. If the data provided by OPEC is accurate, subject to some reasonable adjustments, the outcome for the market could be prices that will exceed $100 per barrel later this year. But even if the far more conservative EIA (Energy Information Administration) is accurate, we could see prices hover where they are or move a bit higher before leveling off.

A look at the bullish case

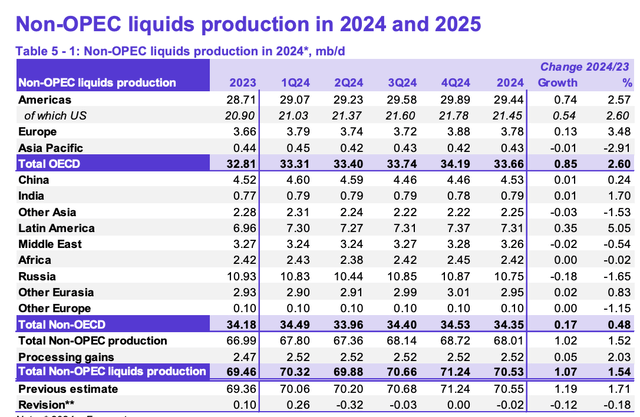

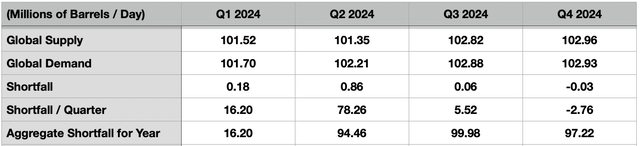

It might be best to start with the case according to OPEC and the data it provides. Every month, the group comes out with its own oil report. This looks at production from its member nations, as well as provides a global outlook of supply and demand. What’s interesting about the estimates provided by OPEC is that they already result in a rather sizable production shortage without taking into consideration this additional cut from Russia. In the first quarter of 2024, for instance, it was estimated that OPEC would need to produce 27.55 million barrels of crude and gas condensate per day in order to meet global demand. However, it’s looking like their output will be around 26.50 million barrels per day. That’s a shortfall of 1.05 million barrels per day, or 94.5 million barrels for the entire quarter.

OPEC

When looking at their estimates for Russia, you see a decline from 10.83 million barrels per day in the first quarter to 10.44 million barrels per day in the second quarter. This seems like a large spread compared to the 9 million barrels per day that Russia is planning to cut output back to. But keep in mind that about 1.4 million barrels per day of output is gas condensate. You strip that out, and we get a number approximating the 9 million that the country has announced. So it appears as though OPEC is factoring in the aforementioned production cut from that nation. However, as the image above illustrates, we see a reversal in the third quarter of this year. But by that time, Russia will have only just reached their 0.5 million barrels per day target. I find it highly likely that they would just spring output back to those levels.

Author – OPEC Data

Instead, it might be wise to assume that they keep their production cut throughout the rest of this year in order to keep oil prices elevated. As the table above shows, this would have massive ramifications when it comes to additional production coming offline. By the final quarter of 2024, we could be looking at a shortage of 2.91 million barrels per day globally. Spread across the entire year, this could amount to 788.06 million barrels of crude less in storage than what we have today. Even if we assume that Russia goes back to producing a more normal level in the third quarter and fourth quarter of this year, the shortfall could still amount to as much as 696.06 million barrels.

At the end of the 2023 fiscal year, according to OPEC, OECD nations had commercial inventories of around 2.76 billion barrels. This was in addition to 1.44 billion barrels on the water, most of which is just oil in transit. Generally speaking, an oil surplus or shortage has been defined based on the number of days of supply that exist in commercial inventories amongst OECD nations. Using the data for the end of 2023, we had 60.26 days worth. A typical number should be somewhere between 55 days and 60 days. So if anything, we started this year with a very modest surplus of crude. But even if half of the shortfall in oil ends up impacting commercial OECD inventories, excluding the extra Russian output, we would have a decline of 7.63 days. That would push us down to 52.63 days worth of inventories. To put this in perspective, back in 2016 when Brent crude prices averaged $43.64 per barrel, we had excess inventories of only about 3.91 days. It wouldn’t be surprising, seeing the pendulum swing the other way, to see a rather significant surge in prices should any of these scenarios play out.

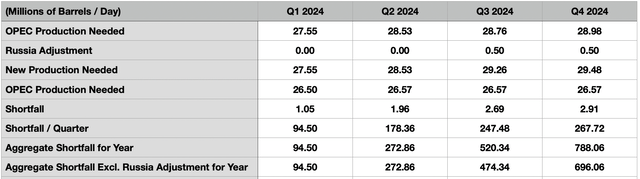

Not as bad

It’s worth noting that OPEC is not the only source of estimates in this space. We should also be looking at data provided by the EIA. Interestingly, based on my own observations, they have already accounted for sustained production cuts from Russia for the rest of this year, with only small increases to that output forecasted by the end of the year. This means we don’t need to make any adjustments to their numbers. However, even in that case, we could see demand outpace supply by a decent amount. Yes, by the final quarter of this year, the data suggests a surplus of crude amounting to 0.03 million barrels per day. But even with that, we are looking at an aggregate shortfall of about 97.22 million barrels this year compared to last year.

Author – EIA

This does create some confusion if you dig deep enough into the data provided by the organization. I say this because, even though output is expected to fall short of demand, OECD commercial inventories are forecasted by the organization to drop from about 2.78 billion barrels at the end of last year to 2.72 billion barrels at the end of this year. This suggests that all excess inventories, and then some, will move be isolated to non-OECD nations. What’s more, at 59.64 days at the end of last year and 58.59 days of supply this year, the EIA data seems to suggest that we will not have a production shortfall that’s large enough to push us terribly high. In fact, the organization even went so far as to forecast that Brent crude prices will average around $83 per barrel this year. That’s $3 per barrel higher than what their previous forecast called for before Russia decided to increase its production cut. And it’s also a bit lower than current prices.

Some important notes

For those wondering about the disparity between the EIA and OPEC, it actually has very little to do with expected output from the OPEC+ nations. Instead, it has to do with expected oil demand for this year and next. Globally, OPEC sees oil demand averaging 2.03 million barrels per day more this year than the EIA is forecasting. And next year, the expectation is for demand to be 2.49 million barrels per day above what the EIA thinks. Although the EIA is less likely to be biased than OPEC is, I would venture to say that OPEC probably has a better idea of what’s going on in the global oil markets than the EIA does. Either way, this seems to point to either a scenario where we have probably more or less found a floor in pricing or a separate scenario where prices can be expected to rise rather materially from here. What this means is that lower pricing, which would be bearish for many of the companies operating in the oil and gas space, likely will not come to pass.

EIA

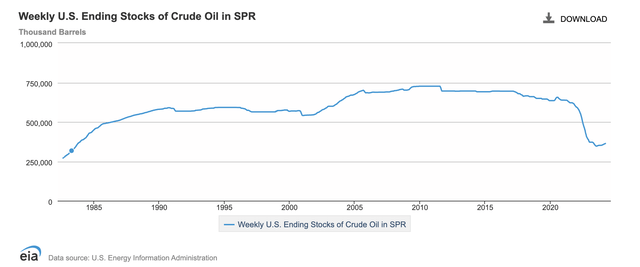

There are two additional topics I would like to touch on briefly. The first would be the idea that some might have that the shale producers might just ramp up output in response to these higher prices. I won’t go into detail here because I wrote an article about this topic earlier this year that I believe you should read. But in short, the massive decline seen in DUC wells likely means that additional significant output from the US will not be easy to achieve. The second relates to one possibility where oil prices might be able to come down, at least temporarily. Given that it’s an election year, it wouldn’t be surprising to see the Biden Administration tap the SPR (Strategic Petroleum Reserve). The Trump Administration did this and other administrations have done it in the past as well. As a short-term thing, this could be possible. But I can’t imagine it lasting more than a few months. I say this because the SPR has already seen significant drawdowns over the past decade or so. Back in 2011, inventories in the SPR exceeded 725 million barrels at one point. But even as recently as late 2021, inventories in the SPR we’re in the 600 million barrel to 650 million barrel range. As of the end of 2023, inventories stood at 426.4 million barrels. Tapping this further, especially to a significant extent, could prove worrisome from a national security perspective.

Takeaway

The way I see it, we are in a heads I win, tails I don’t lose situation when it comes to oil prices. Those who are bullish on oil will likely enjoy elevated prices this year and possibly next. It’s highly unlikely that we will see any meaningful pullback below $80 per barrel based on the data that’s currently available. But that’s under the more conservative scenario. Under the more liberal one, it’s not unthinkable that prices could hit $100 per barrel or more. There could be a short-term reprieve if the government decides to tap into the SPR. But outside of that, I think it would take a significant global economic downturn to see prices travel below $80 per barrel for Brent and to travel below $75 per barrel for WTI for any meaningful window of time.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here