Will the Federal Reserve lower its policy rate of interest or not?

That is the question.

But, as I keep writing, is that really the question that we should be asking?

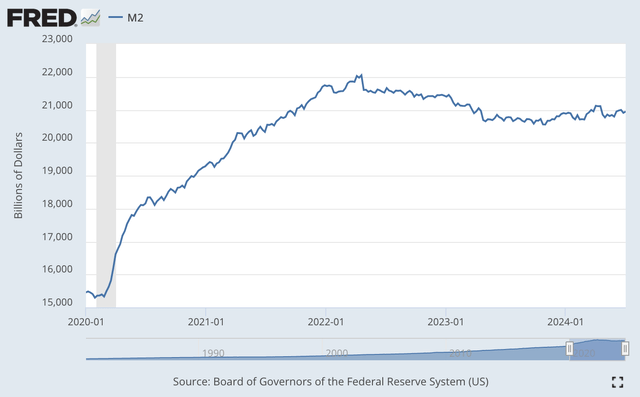

Some analysts are taking a longer look at the movements in the M2 money stock.

Concerns here is that the M2 money stock has been declining for a substantial period of time.

Let’s look at the chart.

M2 Money Stock (Federal Reserve)

The peak of the M2 money stock numbers comes in the week of April 18, 2022…just a few weeks after the Fed begins its current efforts of quantitative tightening.

The M2 money stock reached $22,048.8 billion in that week.

in the week of July 1, 2024, the M2 money stock totaled $20,947.5 billion, down $1,101.3 billion from the peak.

This 5.0 percent downward movement in the M2 money stock came over 27 months.

Historically, this length of a downturn in money stock growth was associated with an economic recession.

The problem with this conclusion is that over the past four years, ending in the first week of July 2024, the annual compound rate of growth of the M2 money stock was more than 8.0 percent.

This rate of growth of the M2 money stock could be associated with a period of substantial inflation. And, the U.S. economy has experienced a period of inflation during this time period.

But, the question could then be asked, why wasn’t inflation over this time period worse than was experienced?

The answer is that people did not spend money during this period as rapidly as they had done before.

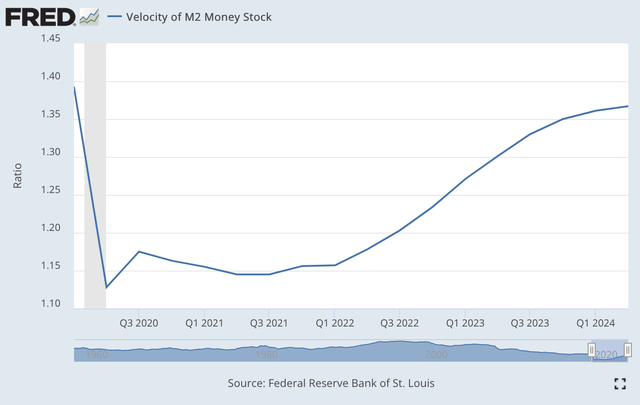

Let’s now take a look at the velocity of circulation for the M2 money stock.

Velocity of M2 Money Stock (Federal Reserve)

As can be seen, while the M2 Money Stock was growing very, very rapidly, the turnover of the money stock dropped precipitously during the short recession coming in 2020 and only moved back modestly until the Fed began its effort at quantitative tightening.

Once the quantitative tightening began, the M2 velocity of circulation began rising.

However, the M2 velocity has not reached the level it was at just before the latest recession.

In effect, the M2 money stock has grown very, very rapidly over the past four years, but…the M2 money stock has not really been “turned over” the way it has in the past.

The M2 money stock has grown somewhat like a “bubble” but the economy has not really felt the full “thrust” of this rise in the M2 money stock up to this point in time.

Yes, the Federal Reserve has done some work to remove all the reserve money it sent into the economy, but if people really were spending money at the rate that they had in the past…if the velocity of circulation had remained at levels reached before the last recession…inflation would have been much, much worse.

And, if the velocity of circulation continues to rise and regain the level it was at before the last recession…well…inflation could begin to accelerate again.

This is a reason why the Federal Reserve needs to maintain a higher level of its policy rate of interest.

If the velocity of circulation continues to rise, look out inflation!!!

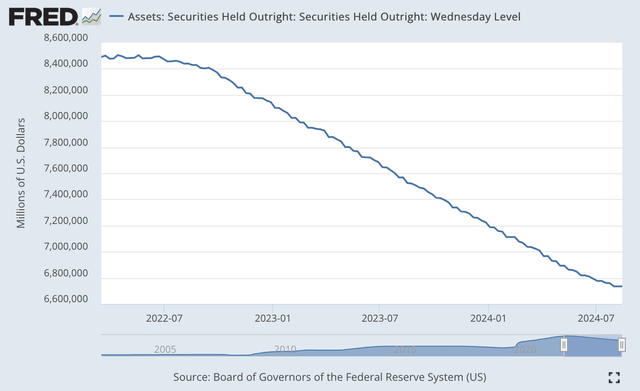

Quantitative Tightening

So, what is the Federal Reserve doing about its quantitative tightening stance?

Earlier the Fed indicated that it might begin reducing the amount that it was reducing the securities portfolio by each month.

The start date seemed to be around June 2024.

From June 6, 2024, to August 14, 2024, the Fed’s securities portfolio has only declined by $84.0 billion.

Securities Held Outright (Federal Reserve)

One cannot really see the shift clearly from this chart, but, the curve seems to be flattening out at the far right-hand corner.

It looks like the Fed is doing a little bit of “slowing down” in the reduction effort.

If the Fed has really slowed down this reduction campaign, phase I of the quantitative tightening was carried through from the middle of March 2022 until the end of May 2024… twenty-six months.

This is a very lengthy period of economic “tightening.”

And, now phase II of the quantitative tightening began in June 2024, so we are in the third month of this phase.

However, the big question that remains is…how much more “tightening” does the Federal Reserve have to do?

The Federal created the big “bubble” in reserves noted above. That is what got the M2 money stock growing.

If the velocity of circulation of the M2 money stock continues to pick up…inflation rates could take off again.

This is the last thing the Federal Reserve would want, especially after all the effort it has put into the quantitative tightening of the past two years, plus.

If one looks at the inflation picture from this angle, the Fed looks like it still has a bit of work left to do.

Maybe lowering the policy rate of interest could kick off an attitude change in the economy, one that kicks off a rise in the velocity of circulation…a rise that would surely result in an increase in the inflation rate.

It just seems to me that the Federal Reserve is not anywhere close to “declaring victory” and moving on to greater monetary ease and lower interest rates.

The truth is…the Federal Reserve pumped lots and lots of money into the financial system to combat the problems associated with the Covid-19 pandemic and the following recession.

The Fed has done well so far…but, there remain lots and lots of “excess funds” hanging around in the economy that could set off the inflation button once again.

Investors?

Well, investors have been waiting for the Fed to start lowering its policy rate of interest.

The wait for a move has extended well beyond the time that investors believed that changes would start to be made.

Yet stock prices continued to rise.

Why did stock prices continue to rise?

Because of all the money that still exists within the financial system.

Investors have continued to bet on stocks, even though the Federal Reserve has gone through more than two years of quantitative tightening.

My feeling is that unless something else happens to generate a reaction, one way or another by the Fed

is that the Fed will “keep on, keepin’ on” to continue the reduction of its securities portfolio, with maybe an interest rate reduction here or there.

If the Fed continues in this way, I see no reason for investors to stop putting money in the stock market…and stock prices will continue to hit new historic highs.

Read the full article here