Thesis

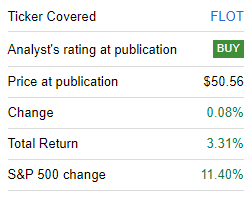

We wrote about the iShares Floating Rate Bond ETF (BATS:FLOT) in January, where we said the following:

We like FLOAT for 2023. The fund runs very limited credit risk via its holdings, has a short duration profile that has kept it afloat in 2022 and will keep increasing its dividend as the front end of the rates curve rises.

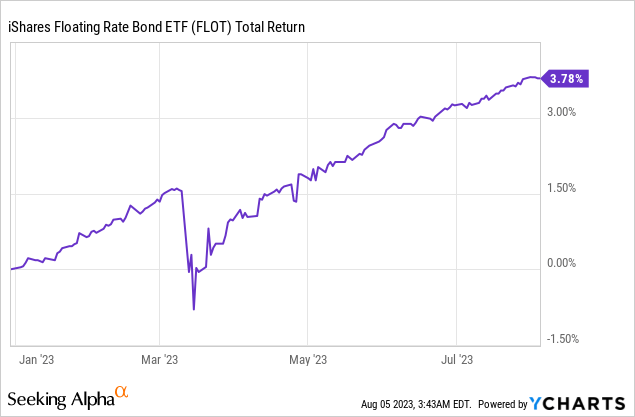

The fund is up since our Buy rating, posting a nice upward sloping accrual rate:

Performance (Seeking Alpha)

Now some investors might say that the S&P 500 is up over 11% since we put a Buy rating on FLOT. The answer to that statement is that investors need to ascertain the difference between a very volatile equity fund with an 18% standard deviation, and FLOAT, a short term bond fund with a 1% standard deviation. To translate this into English, an investor should expect a -18% drawdown in the SPY during a significant risk-off event, while FLOAT should only record a -1% drawdown.

Equity is not the same as debt, and they represent different slices of the capital structure with different risk/reward metrics. We said in the beginning of the year that 2023 is going to be a tough year, and unless an investor was convinced a new bull market was starting, it made sense to be more conservative.

FLOT is on track to deliver an annual total return for 2023 close to 7%:

The fund had a 1.5% drawdown during the regional banking crisis in March, but has since recouped that mark-to-market impact and moved forward with its high dividend yield.

Is it worth it to sleep well at night?

We think the answer to that question is yes. A retail investor should care about a total return for a year, and the ultimate goal is the net amount gained at the end of the year. What you invest in should not be exciting or sexy if it is a tough year. You should focus on making a high return with as little risk as possible.

Many people are calling for a new bull market. A cyclical one, rather than a bear market rally. We are of the opinion there is none to be had, but we will let you make up your own mind.

But less us think about some very basic items first to establish this ‘new bull’:

- we are close to the old highs for the SPY, yet Fed Funds have moved from 0.25% to 5.25%

- mortgage rates have moved from 3% to over 7%

- credit card APYs and Prime rates have gone through the roof

- auto payments have increased exponentially

While the economy has held up quite well, it is just a matter of time until higher rates take their toll. We are not advocating for a crash, but just look at the housing market – it is quasi frozen in many locations, with unrealistic prices being asked. When there are sales and transactions, there is an entire ecosystem that feeds the economy there – broker fees, notary fees, lawyers as applicable. Sooner or later the lack of that cash-flow is going to be felt.

Same with credit card debt and auto payments – things have held up well, but we cannot honestly say that somebody who had a 10% APY on their credit card debt two years ago does not feel the pinch now with 20% APYs.

The argument here is that while the market might not crash, there will be another risk-off event this year just because things are not the same in the economy, despite it having held up very well. It just takes time for rates to percolate down the chain.

FLOT Holdings

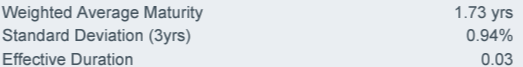

FLOT is a short dated corporate bond fund with a de-minimis duration profile:

Analytics (Fund Fact Sheet)

Its short duration has kept the fund chugging along this year, despite the move up in rates.

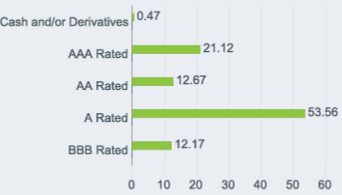

From a ratings standpoint, the vehicle is entirely investment grade:

Rating Profile (fund fact sheet)

From the above table we can see that the entire collateral pool is on the investment grade side, with a large concentration in ‘A’ credits. Highly rated funds like this one, especially with a granular build, run ignorable default risks.

Despite its high ‘Banking’ concentration of 49%, the fund correctly navigated the rough March regional banking crisis, and has moved back to doing what it is supposed to – i.e. slowly accrete upwards via its dividend. The fund now sports a 5.85% 30-day SEC yield which will keep increasing if rates move higher in the front end.

Conclusion

FLOT is a fixed income ETF. The fund invests in short dated corporate bonds, having an overall duration of only 0.03 years. This build has helped it navigate a rough 2022 for fixed income and a tricky 2023. The vehicle only contains investment grade bonds, with the ‘A’ rated bucket containing most of the collateral.

The fund is on track to achieve a total return for 2023 close to 7%, with a very small drawdown of only 1.5%. We called this fund a top pick for 2023 at the beginning of the year, and we are of the same opinion now. We are on Hold with respect to this name, clipping the dividend and sleeping well at night.

Read the full article here