Introduction

As a dividend growth investor, I seek new investment opportunities in income-producing assets. I often add to my existing positions when I find them attractive. I also use market volatility to my advantage by starting new positions to diversify my holdings and increase my dividend income for less capital.

The energy sector is interesting as it is going through a transition. Oil and gas are still a prominent part of the world energy mix, yet we are seeing a fast shift towards renewables. Therefore, companies growing their oil and gas production while building solid foundations in the renewable world may become promising long-term investments. One of these companies is BP (NYSE:BP).

I will analyze BP using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

BP provides carbon products and services. The company operates through Gas & Low Carbon Energy, Oil Production & Operations, and Customer & Product segments. It engages in the production of natural gas and integrated gas and power, trading of gas, operation of onshore and offshore wind power, as well as hydrogen and carbon capture and storage facilities, trading and marketing of renewable and non-renewable power, and production of crude oil. In addition, the company is involved in convenience and retail fuel, EV charging, Castrol lubricant, aviation, B2B, and midstream businesses, refining and oil trading, and bioenergy business. Further, it engages in power and storage, digital transformation, carbon management, bio and low-carbon-related products, energy and environmental commodities, and mobility businesses.

Fundamentals

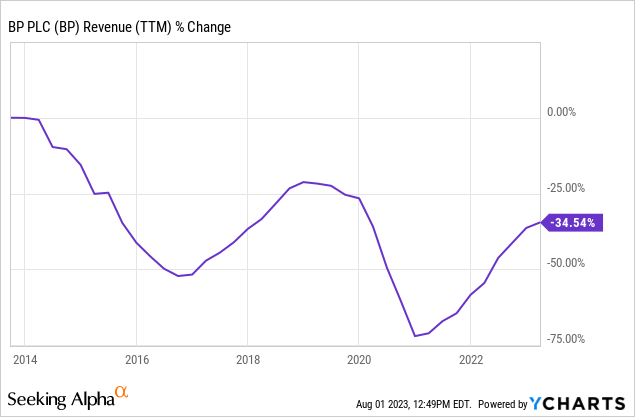

The revenues of BP have decreased by 35% over the last decade. During that decade, the company had to divest many of its assets to pay for damages following the massive disaster of the Deepwater Horizon oil spill. During that period, the company has also started shifting its business towards more renewable energy. In the future, as seen on Seeking Alpha, the analyst consensus expects BP to show sales declining by 18% in the medium term as energy prices will return to normal following 2022 and the Russian invasion of Ukraine.

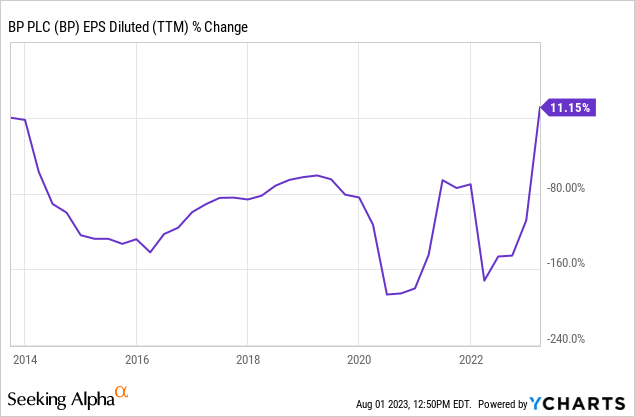

The EPS (earnings per share) during the same period increased by 11%. The increase is because the company sold its less profitable and lucrative assets. In addition, the company enjoyed the high energy prices we have seen, mainly in Europe, during the war in Ukraine. The buybacks also supported that increase in the last decade. In the future, as seen on Seeking Alpha, the analyst consensus expects BP to show EPS declining by 40% in the medium term as energy prices will return to normal following 2022 and the Russian invasion of Ukraine.

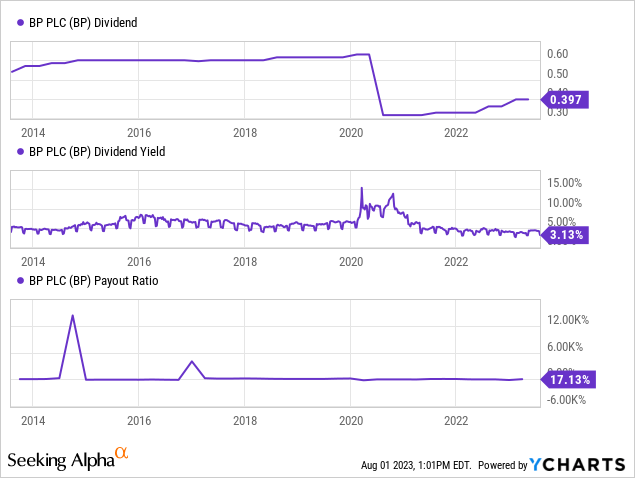

The dividend is a sensitive point. The company has cut its dividend twice in the last fifteen years. The first time after the Deepwater Horizon oil spill, as it had to pay fines, and the second time during the pandemic. In both cases, the company had to deal with what I see as Force Majeure. The company is once again growing the dividend, and today, after publishing its Q2 results, it increased the dividend by 10%, pushing the annualized yield above 4%. The payment is relatively safe, with a payout ratio below 20%. Therefore, the company can maintain the dividend even if energy prices are lower.

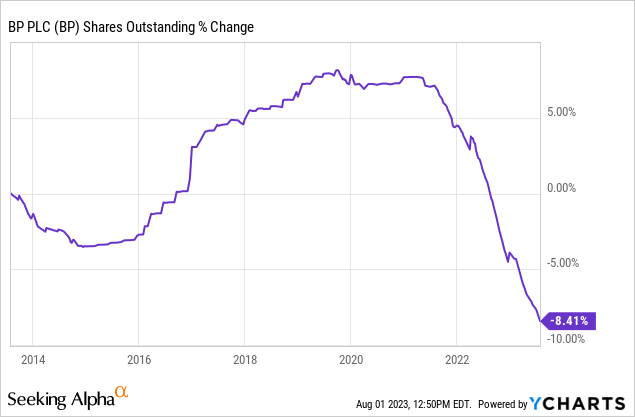

In addition to dividends, BP returns capital to shareholders via share repurchase plans. These plans support EPS growth as they lower the number of shares outstanding. Over the last decade, the share count has decreased by 8.4%. Buybacks are highly efficient when the valuation is low, as each dollar buys more shares. Today in its Q2 results, the company has increased the buyback authorization by $1.5B, equating to 1.4% of its shares.

Valuation

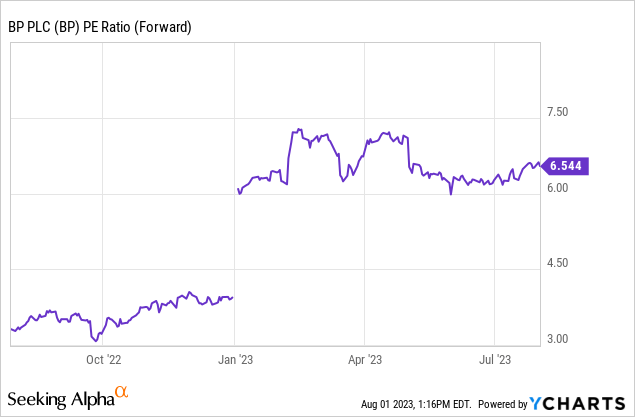

The P/E (price to earnings) ratio stands at 6.5 when using the EPS estimates for 2023. The valuation today is higher than it was twelve months ago, as, during that period, the EPS was declining. The EPS is forecasted to continue declining as energy prices today are lower than a year ago. Thus, the trend will continue. While there is some EPS decline, the current valuation is still attractive as a profitable company with a steady, safe dividend trading for a single-digit ratio.

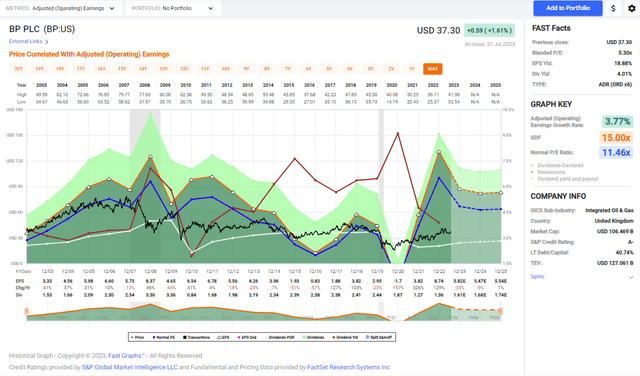

The graph below from Fast Graphs also emphasizes that the shares of BP are trading for an attractive valuation. The average P/E ratio of the company over the last two decades, which included several challenges, is 11.5. The current P/E ratio is almost half the average P/E ratio. Therefore, although the company will suffer from an EPS decline in 2023, I believe the current valuation is attractive.

Fast Graphs

Opportunities

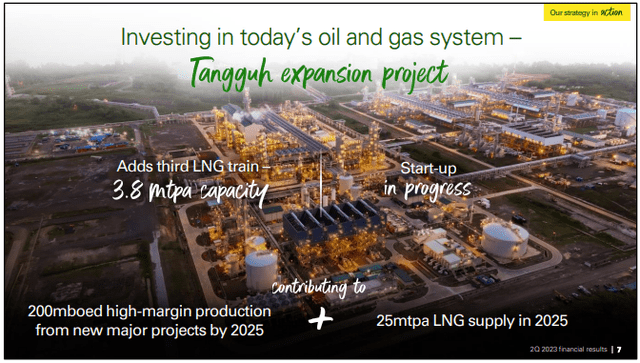

While the company acknowledges that the future of energy lies within renewable energy, it also capitalizes on opportunities in the oil and gas sector. LNG (liquified natural gas) is one of the most significant opportunities, and the company invests heavily in it. The slide below shows its project in Indonesia. LNG will become more prominent as Europe stops importing natural gas from Russian pipelines. BP can support European gas demand as the continent shifts to renewables.

BP

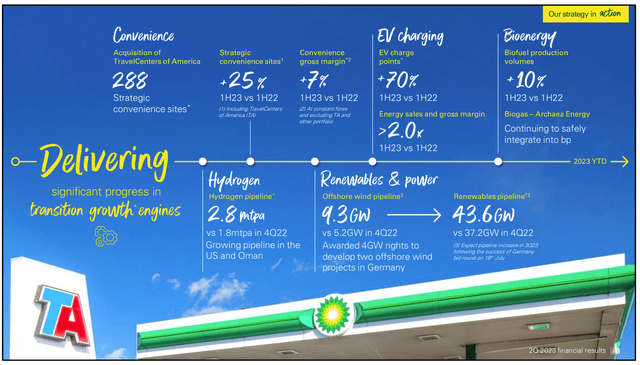

Regarding renewables, BP is making significant investments across the board. It invests in EV (electric vehicles) charging stations and convenience stores for clients waiting for their cars. It also invests in hydrogen and biofuels, the fuels of the future. Biofuels are carbon neutral, while hydrogen is clean, mainly green hydrogen. The ability to offer new green fuels and charging stations will position BP well for the future. Transportation will use electricity, while industry will use biofuel and hydrogen.

BP

In addition to the shift to enable energy sources, the company is also entering the realm of electricity generation. The goal is to create a fully integrated value chain that will include the power generation and later the distribution in its “gas stations” where electric cars will charge. At the same time, their owners buy some products in the convenience store. Therefore, BP can offer end users more efficient and hopefully profitable energy.

BP

Risks

BP is a price taker, meaning it doesn’t get to set the price of its commodity. Oil and gas are traded in exchanges where supply and demand set the prices. The inability to set the price by yourself means you have no pricing power. Thus, your sales and income may be highly cyclical and volatile. For dividend growth investors, there is a risk of a significant drop in energy prices, making it harder to cover the dividend.

Therefore, a prominent risk for energy companies is a recession. We see lower spending during recessions, so the demand for energy and fuel is plummeting. The risk of a downturn exists now that the economy has to deal with higher rates, which lower investments and spending. If the world enters a recession, it will significantly impact the EPS of BP in the short and medium term.

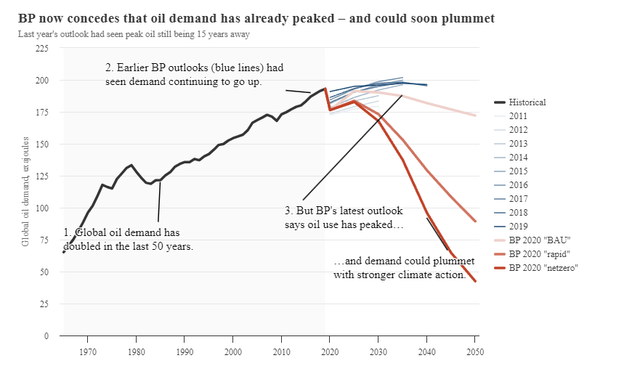

The core of BP is its oil and gas business, which will stagnate in the coming decades. The demand will stagnate, and the growth in demand will be extremely slow at most. At the same time, the company aims to grow through investments in new realms surrounding renewables and green electricity. However, the company lacks experience in these realms and thus doesn’t have the edge it has in oil and gas. Therefore, it should expect the business segments to be more competitive.

BP

Conclusions

BP suffers from relatively weak fundamentals following the pandemic and the oil spill disaster. However, it seems like the company has been stabilizing its fundamentals as the dividend and buybacks are growing, and there is a solid foundation for sales and income increase. That foundation is based on the ability to grow in its oil and gas core and renewable energy as the company aligns itself with new energy sources.

While there are risks to the investment thesis, I believe that the current low valuation for which the company is trading is more than enough to offer some margin of safety. Therefore, with promising growth prospects, stabilizing fundamentals, and an attractive valuation that more than compensates for the risks, the share of BP is a BUY.

Read the full article here