Investing In General Mills

General Mills (NYSE:GIS) shares are usually found in income-seeking investors. After all, 124 years of uninterrupted dividends combined with a 9% CAGR in shareholder returns over the past three decades are two outstanding achievements that won’t go unnoticed by several cohorts of investors.

I am initiating my coverage of General Mills as it approaches its Q4 and FY 2024 report. This seems to be an opportune time to share my research on the company and explain why it could be a good investment for some, but currently not for me.

General Mills: The Company

General Mills is a widely-known food company, with its main focus on packaged food and snacks.

Per its 2023 Annual Report, the company has four operating segments: North America Retail; International; Pet; and North America Foodservice.

General Mills usually sells its goods to grocery stores, mass merchandisers, and similar. As we read in the Annual Report, North America Retail’s product categories include “ready-to-eat cereals, refrigerated yogurt, soup, meal kits, refrigerated and frozen dough products, dessert and baking mixes, frozen pizza and pizza snacks, snack bars, fruit snacks, savory snacks, and a wide variety of organic products including ready-to-eat cereal, frozen and shelf-stable vegetables, meal kits, fruit snacks, and snack bars.”

The International operating segment covers General Mills’ business outside of the U.S. and Canada. The product categories are a bit different: “super-premium ice cream and frozen desserts, meal kits, salty snacks, snack bars, dessert and baking mixes, and shelf-stable vegetables.”

The Pet segment addresses the pet food products market, which is growing at a 4% CAGR, which, for General Mills, is a fast-growing market. Primarily, this segment sells its products in the U.S. and Canada.

The fourth segment, North America Foodservice, consists of food service businesses whose major products are “ready-to-eat cereals, snacks, refrigerated yogurt, frozen meals, unbaked and fully baked frozen dough products, baking mixes, and bakery flour.”

As we can see, the global food categories General Mills focuses on are snacks, cereals, meal kits, dough, baking mixes, yogurt, ice cream, and pet food.

General Mills’ brand portfolio has over 100 labels, nine of which are $1+ billion businesses. Among the most popular brands, we find Cheerios, Nature Valley, Blue Buffalo, Pillsbury, Betty Crocker, Old El Paso, and Totino’s.

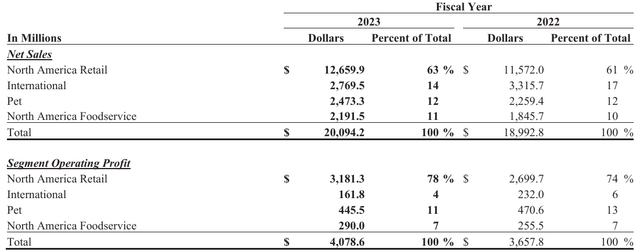

At the end of FY2023, General Mills reported $20.1 billion in net sales, with North America Retail accounting for over 63% of the total. If we look at the operating profit by segment, we see that North America Retail makes up 78% of the company’s operating profit, showing how strategic this segment is for General Mills.

GIS FY 2023 Annual Report

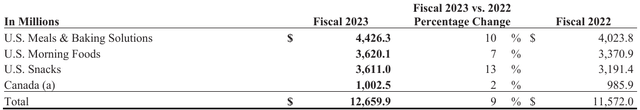

Within this segment, we see that over $4.4 billion comes from U.S. Meals & Baking Solutions. This means this business unit contributes to almost 22% of General Mills’ total sales and to almost 32% of North America Retail sales.

The second largest unit in North America Retail is U.S. Morning Foods, with $3.62 billion in sales, followed by U.S. Snacks, which grossed $3.61 billion last year.

GIS FY 2023 Annual Report

General Mills operates globally, but it has eight core markets: the U.S., Canada, China, Brazil, the U.K., France, Australia, and India.

Among its customers, we have to be aware that Walmart accounts for 21% of General Mills’ net sales and 28% of net sales of North America Retail.

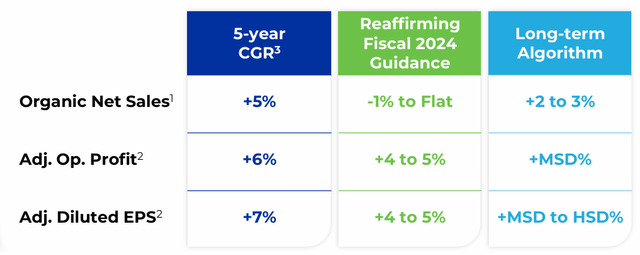

General Mills is a mature business and, as such, it can be rightly classified as a cash cow in the BCG growth-share matrix: low growth and high share represent most of General Mills’ products. As such, it is a company that can be milked for cash. We see General Mills’ overview reflects this: over the past five years, its net sales grew 5% annually while EPS grew around 7% per year. At the same time, going forward, General Mills expects milder growth. This fiscal year should see net sales flat or slightly negative, while long-term the company targets a 2% to 3% net sales growth, with operating profit margin expected to grow in the mid-single-digits and the company’s adj. EPS to compound mid-to-high-single digits.

GIS 2024 CAGNY Conference Presentation

This is not extreme growth and these long-term targets do open up the possibility to see flat growth now and then — just like we are currently seeing.

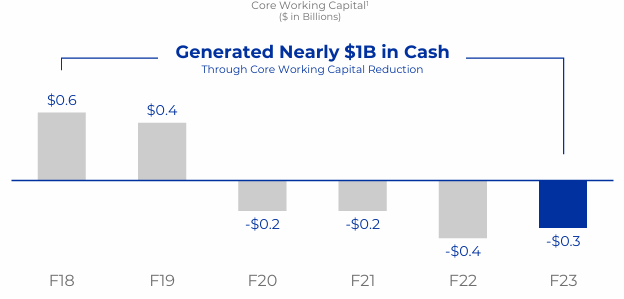

Two more notable things about the company: General Mills proudly boasts its achievement of a $1 billion working capital reduction from FY2018 to FY2023, which has actually been negative from FY2020 onwards.

GIS 2024 CAGNY Conference Presentation

Usually, negative working capital means a company’s current liabilities are greater than its current assets. In this case, the company’s current assets are not enough to pay its current liabilities. But in some cases, negative working capital can have a positive meaning. If a company generates cash before it has to pay its suppliers, then its working capital is negative and we can rightly state that the company is using its suppliers’ money to run its business. General Mills is moving in this direction and usually collects money before paying its suppliers.

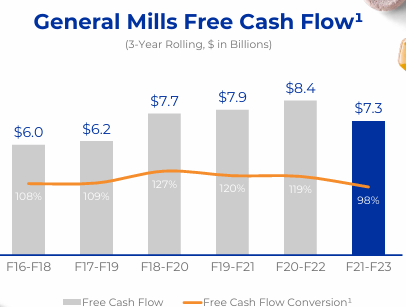

This leads to a second important aspect many investors like about General Mills: its free cash flow generation. As we can see, General Mills’ three-year rolling FCF conversion rate is usually above 100%, with peaks of 127% and lows of 98%. This is why General Mills has a long track record of paid dividends.

GIS 2024 CAGNY Conference Presentation

General Mills’ Recent Financials

Let’s take a quick look at the company’s capital structure. Currently, General Mills has a market cap of $37.87 billion. Its total debt amounts to $12.51 billion and the company only has $588 million in cash. However, such a low amount is not an issue for the reasons we have just seen: General Mills doesn’t need a great deal of available cash for the simple reason it doesn’t need to pay upfront a lot of money to fund its operations. As per the latest financial data available, General Mills reported $4.65 billion in current assets – that is, resources that we should reasonably expect to be converted into cash within a year – and current liabilities – that is, obligations General Mills has to pay within a year – of $7.06 billion. We can also see General Mills’ accounts receivable are $1.77 billion vs. its accounts payable of $3.61 billion. This shows once again that General Mills has a quick turnover and receives cash for its goods before it pays it has to pay its suppliers.

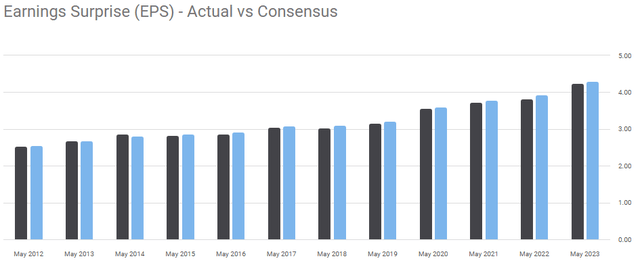

Now, let’s take a look at what General Mills may report for this quarter and the whole fiscal year, putting together several pieces of information that have so far been released. One note: in the past ten years, General Mills’ earnings have always come really close to what analysts were expecting. This is because its business is rather predictable, with surprise percentages never being more than 3.15%.

Seeking Alpha

This is why I consider General Mills’ own guidance quite credible.

General Mills’ Earnings Preview

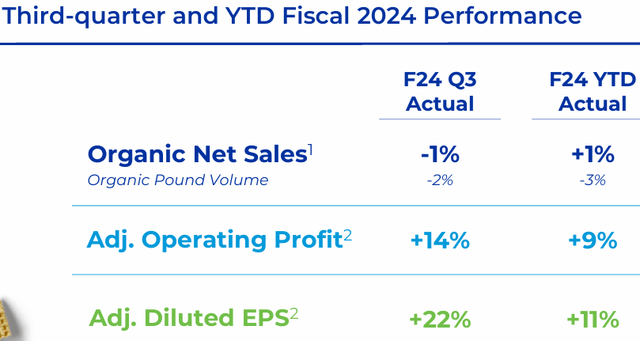

During its Q3 Earnings, General Mills actually increased its FY24 guidance, expecting its net sales to be slightly positive. At the same time, profitability is seeing great improvements up to the point its margins will end up higher than in 2019, the last normal year before the pandemic.

GIS Q3 FY2024 Earnings Presentation

However, I must spend a few words on something I didn’t like during the earnings presentation. General Mills states that among the current headwinds, there are value-seeking behaviors. To me, this misrepresents a bit two aspects. First, a company such as General Mills should thrive in an environment where customers seek value. True, private labels make up a tough competitor in the same areas, but General Mills has the size, scale, and efficiency to protect its market position. Secondly, if customers look for value, they can’t be blamed. They simply are being coherent with their nature. A company can’t blame customers if its sales don’t grow. It is not the customers’ goal to spend more and more without any criteria. Customers seek value and won’t buy at any cost those goods that may easily be substituted.

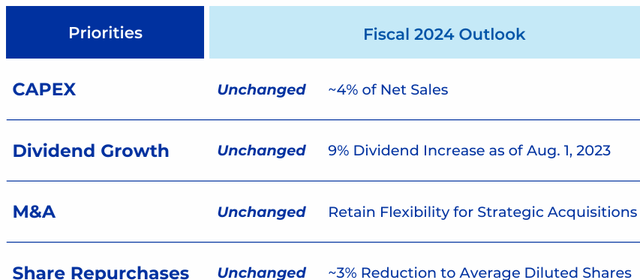

Aside from this note, let’s take a look at the overall picture. As for the other main financial goals for this fiscal year, General Mills keeps high control over its expenses and capex usually doesn’t exceed 4% of net sales.

Dividend investors will be pleased to know General Mills’ dividend has been hiked by 9% with the support of share repurchases which are reducing by 3% the average share count. Currently, General Mills has a 3.52% yield, with a payout ratio usually below 50%.

GIS Q3 FY2024 Earnings Presentation

Given what we have seen and said, I expect General Mills to report $20 billion in revenue for the fiscal year and around $4.9 million. At the same time, its profits should improve thanks to cost-saving measures and to effectively manage expenses.

Therefore, I am still expecting a net income margin of around 12%, which would mean General Mills could report around $588 million in net income. This translates into Q4 EPS of $1.04, a bit higher than the current EPS estimate of just $1.00. However, considering the macro-environment seems to be improving and that inflation is cooling, there might be some extra tailwinds that will help General Mills expand its internal profitability range.

By expecting an overall net income margin of 12.75%, we would have annual EPS between $4.50 and $4.60.

As a result, the company is trading at 14.6x upcoming earnings, which I think is a fair multiple. After all, General Mills is not a fast-growing company and therefore rewards its shareholders mainly through its dividends.

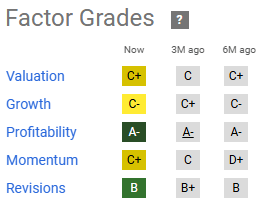

In this case, I agree with Quant Factor Grades. Valuation and growth are the two important categories to assess a stock.

Seeking Alpha

Both grades suggest that General Mills is fairly priced. Some may say that a PE ratio has to be more or less in line with a company’s earnings growth. True, from time to time General Mills can grow its bottom line at a 14%-15% pace, which is more or less in line with the PE ratio. But the current fwd LT EPS growth (3-5yr) is forecasted to be around 3.5% and management’s guidance invites us to expect a growth between 4% and 9%.

As a result, I find myself in an interesting situation. On one side, General Mills is a safe business with rather low volatility and high dividends. On the other, its growth is just too slow to be a good fit for my portfolio. Here is what I think: General Mills can be a good investment based on one’s age and expectations. Retirees, or those close to retirement, may find its 3.5% dividend attractive when coupled with a rather stable stock. Younger cohorts of investors may find too high the opportunity cost of holding an underperformer of the index. I rank myself among these latter cohorts since I am in my 30s.

As a result, I rate General Mills a hold, reflecting my own choice regarding this stock. This, however doesn’t imply I am bearish on the stock, or that I consider it a poor investment for those who have picked it as part of their dividend stocks.

Read the full article here