GAMCO Global Gold, Natural Resources & Income Trust (NYSE:GGN) invests in mining and energy companies selling covered calls for income from which it pays investors dividends. With this approach, investors must follow both the price of the underlying investments and the strike prices for the calls. Should the prices exceed the calls, GAMCO loses shares and must repurchase at higher prices thus causing long-term asset degradation. We own a significant number of shares. Some are used for temporarily holding cash for other uses while getting paid. Some of the shares are permanent. Tailwinds for asset growth abound. In keeping with past articles, what we hope to understand is the nature of the plane and its ability to benefit from the winds. Let’s head to the tarmac.

The Company

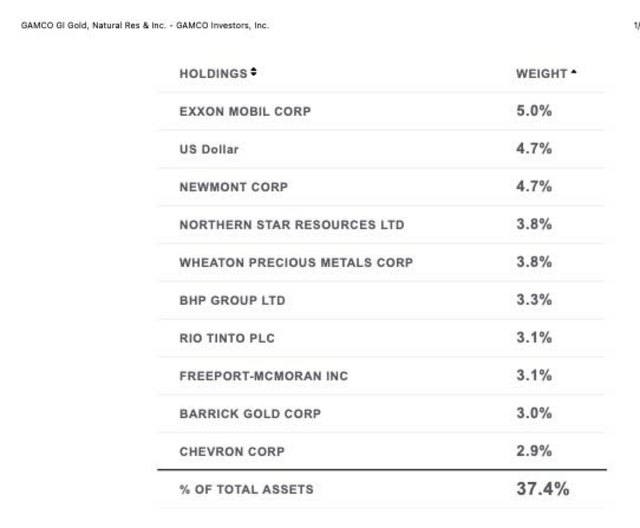

As stated above, the investment includes cash/bonds (16%), mining (precious metals) and energy. A summary of the top 10 percentage investments is shown next.

GAMCO

In its last quarterly update, management offered this investment comment,

“We have slowly redeployed exposure to the gold sector as volatility expanded, allowing for more upside to the sector. The maturity of the option portfolio naturally contracted to an average of 2.1 months.”

Going forward, the shift to gold might prove wise.

Gold/Metals

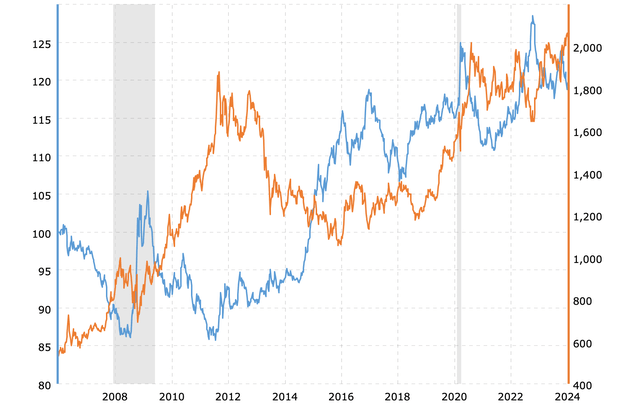

We begin with the first sector gold and mining. A long-known inverse relationship between the dollar strength and gold is likely coming back to play a positive role. The Federal Reserve stated recently that short-term interest rates peaked. This 15-year chart shows the reality of the inverse relationship with a twist. Notice that in the last three years a level of both inverse and direct co-exist. Central banks and others throughout the world, especially countries with significant levels of gold production, bought.

MacroTrends

Next, we include a two-year graph for the gold spot price.

GoldPrice

At the end of 2022, gold bottomed and since generated two higher lows, a bullish trend sign.

With an inverse relationship, once the Fed possibly begins its rate easing campaign, gold will rise again. So, what is the Fed thinking? In early December, an announcement from Fed indicated continued high short-end interest rates for a lengthy period. Then, from a Zero Hedge article,

“just two weeks after Jerome Powell had said he it was “premature” to speculate on rate cuts, the Federal Reserve did a shocking U-turn and pivoted dovishly, ending the Fed’s hiking cycle with inflation still running at double the Fed’s target of 2%, and said that it had in fact discussed the start of rate cuts, contrary to what Powell said ….”

To say the least, the financial world was stunned. Why? The Fed was forced. “[B]ecause the liquidity in the all-important systemic and interbank plumbing had hit dangerously low levels, resulting in the highest SOFR (repo market) print on record,” In addition, Nick Timiraos, from The Wall Street Journal, confirmed that slowing Quantitative Tightening (QT) is on the table. Could Quantitative Easing (QE) be just around the corner? Two recent events suggest it’s possible. First, J.P. Morgan included a slide in its fixed income strategy for. investors.

JP Morgan

From the slide,

“We now expect that the FOMC will have the outline of a timeline at the January meeting, communicated mid-February minutes to that meeting. We expect that this plan will be formally agreed to at the mid-March meeting and will be implemented beginning in April.”

From an investor’s point of view, pivoting from QT to QE and lowering short rates is bullish for precious metals especially gold. QE is inflationary possibly coming at a time of still higher inflation.

From another article, Gold Prices Poised to Break Records in the New Year, comes this gem, “As mining output hits a ceiling, demand for metals among industries, consumers, and investors continues to grow.”

With the Fed again most likely trapped bringing lower interest rates and demand strong, a perfect storm is heading right at gold prices, the target of Global Gold, Natural Resources & Income Trust. It should be noted that at the January meeting, the official statement held rates flat with a claim that more time is needed before deciding on when to cut.

Energy

Heading to the next major investment, energy, the jury deliberates. News, stories, forecasts and opinions are mixed. Take a stance, you’ll find credible support. Several factors suggest higher prices for oil including supply risks from the wars around the world, weather and lack of investment. Another claims flat prices in 2024. The latest weekly crude oil report contains a continuing fact, refineries are operating levels at or near 93%, essentially full capacity, this, in a period of low demand. In our view, oil isn’t heading lower, most likely higher.

The Two Together

With management pivoting toward mining/gold, the value of the fund’s assets is likely heading north. We aren’t predicting the price of gold, but if it breaks out above $2100, the price could reach $2500 – $3000 per oz. The direction of the price of crude is a coin flip, also a smaller part of the investment.

Option Positions

Next, a view of the option strike prices is in order. It brings understanding to the risk of asset degradation. The following table shows a random picked summary of a few from the last report.

* Expired mostly in October.

** Price range before the end of Oct. It has been as high as $72 since. We don’t know what the new strikes were since October.

A random look at short options shows that for the most part the company is keeping them above stock prices. But future strike prices might be lower, significantly lower, risking future losses when markets significantly recover. Remember, the last report stated that the average length of time was 2.1 months. We plan to view the next report carefully looking for this issue.

Risk & Investment

The major risk with GAMCO in our view resides with stock losses from short options being called against big upside sector runs. Over long periods of time, management seems competent. Investors should know that the Net Asset Value does move, yet price has remained within acceptable ranges. We use this entity for dividends and for temporary holdings for cash generation. We see the next move is upward after some weakness in the early part of the year. We believe that gold and other precious metals are headed higher, the weighed investment strategy. Tailwinds are in the wings of GAMCO Global Gold, Natural Resources & Income Trust. We rate this investment a continued buy especially on weakness.

Read the full article here