Investment Thesis

After an initial reaction of 7% rally due to positive 2Q FY2023 earnings results, Alphabet Inc. (NASDAQ:GOOG, GOOGL) has achieved a 46% YTD return, which is almost in-line with 44% YTD of the Nasdaq index. This can be attributed to the previous cautious sentiment in the online ads industry due to concerns about a potential recession. Unlike the software and semiconductor industries, which significantly benefit from an increasing demand for AI, online ad spending is more cyclical and closely tied to the economic cycle. Google generates 78% of its total revenue from online ads segment in the last quarter.

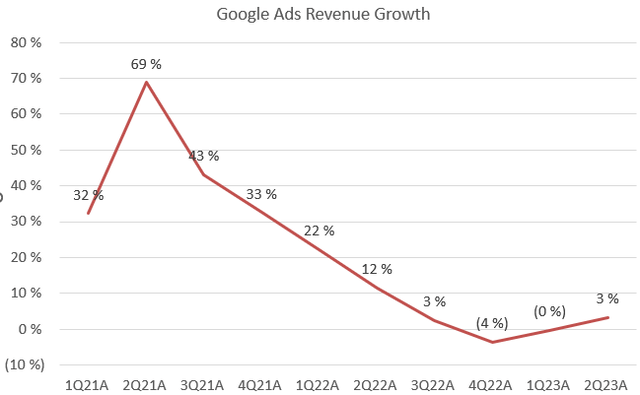

However, we saw both Google Search and YouTube ads revenue, significantly surpassing the street estimates and showing a growth acceleration compared to the previous quarter. This positive result could be seen as an early sign of an online advertising recovery. Despite this, the current valuation is considered relatively cheap, almost in line with its 5-year average. Therefore, I have upgraded the stock from hold to buy, as I see this quarter as a growth inflection point for long-term investors.

Q2 2023 Takeaway

The company model

Google’s 2Q FY2023 earnings were impressive, especially with a 3% growth acceleration in ads revenue, following two consecutive quarters of YoY decline. This positive development suggests that the industry might have reached its trough and is now showing signs of early recovery, which may further improve the market sentiment. For fundamental investors, this could present a buying opportunity as the company’s revenue acceleration indicates a potential upswing in the online advertising market.

The company model

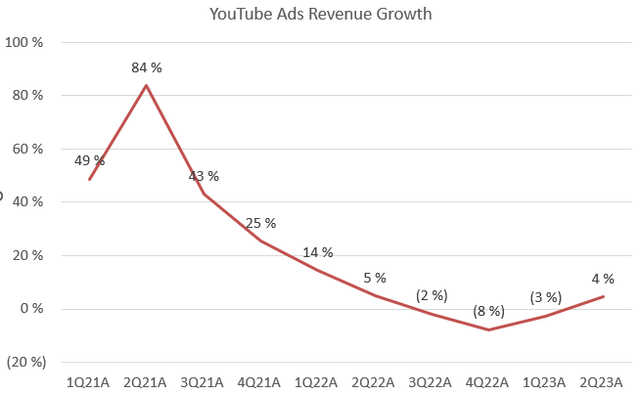

There was also a positive YoY growth of 4% in YouTube ads revenue, marking the first time in the past three quarters that Google achieved such positive YoY results. Before 3Q FY2022, Google had consistently shown positive YoY growth in its YouTube ads revenue. However, the growth started to turn negative since then. This recent performance may prove that the company’s ads revenue growth still remains intact, challenging the earlier concerns among investors about a growth bottleneck and potential structural impacts on its market share.

I believe that the positive growth in YouTube ads revenue indicates that Google is still able to attract advertisers and generate revenue from its video platform despite increased competition from TikTok. Moreover, the robust comeback of Google Search can also help ease the concerns and uncertainties that investors had regarding Google’s ad revenue trajectory. It suggests that the company’s online advertising business is regaining strength and competitive positioning, reaffirming Google’s position as a strong player in the online advertising market.

The company model

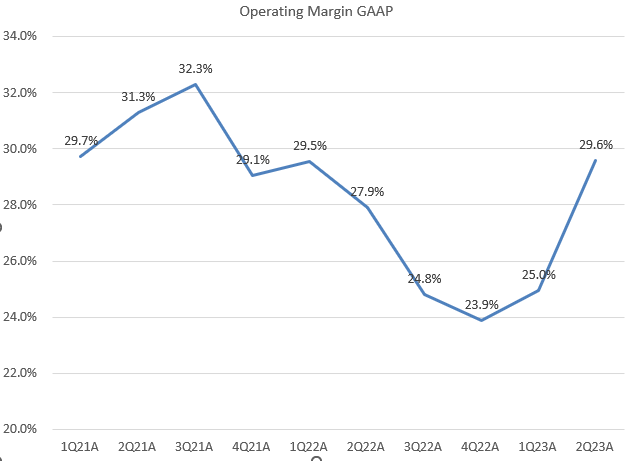

In addition, Google demonstrated a significant improvement in its operating margin in the last quarter, indicating a clear initiative towards cost reductions and improved operating efficiency. I believe this can have a significant boost on the company’s overall profitability. Moreover, considering the recent muted earnings revision from the market analysts, it has set a low bar for potential upside earnings surprises. This could further make the forward-looking valuation multiples of the company even more attractive for investors. In the next two sections, I’ll discuss two key factors that can further push the stock higher.

Soft-landing Scenario Can Reaccelerate Ad Revenue

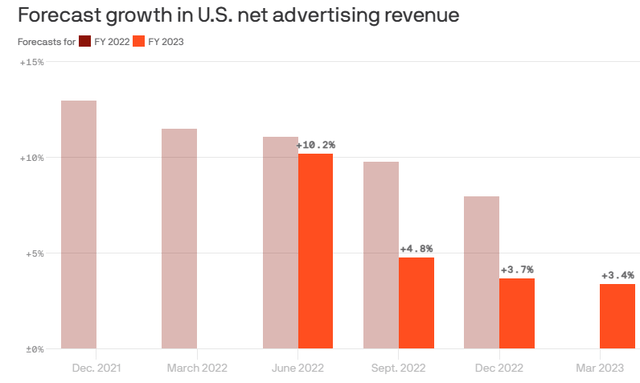

Axios Visuals

Firstly, based on the chart, we observe that the ad market is still projected to grow in FY2023, but at a lower rate of 3.4%, down from the 3.7% prediction made in December 2022. This less optimistic outlook suggests that the market has already partially factored in the anticipated growth slowdown, which aligns with lower GDP growth expectations in the 1H 2023. However, we also notice that the U.S. economy defied recession concerns and displayed resilience in both consumer spending and labor market conditions. This might explain the recent price action for Google.

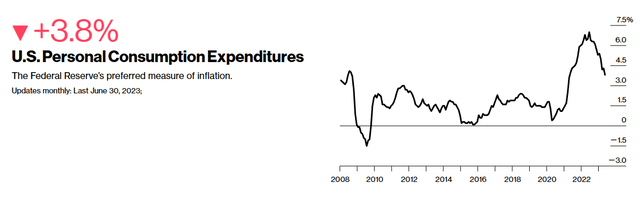

Bloomberg

The recent economic data indicates that consumer spending in the travel and entertainment sectors is still robust, which is expected to fuel a speculation on growth rebound in ad spending. Additionally, the rise of e-commerce advertising is being driven by consumer product brands reallocating their retail marketing budgets from in-store placements to digital advertising. This shift was accelerated by the Covid-19 pandemic, which prompted businesses to embrace digital transformation to adapt to changing consumer behavior and preferences.

If we end up in a soft-landing scenario, I believe that online advertising will be one of the leading sectors to recover. As Google derives a significant portion of its revenue from online advertising, a stronger and more stable economy can lead to increased ad spending by businesses. This, in turn, may positively impact Google’s top-line growth and profitability. Therefore, it’s possible that Google will see its revenue acceleration in the 2H FY2023, which could lead to positive upside surprises in the upcoming earnings results.

Incremental Monetization on AI and Machine Learning

Secondly, the impact of Generative AI (GAI) on Google Search and other businesses remains a highly debated topic among investors for the company. Investors are closely watching for any further comments from management regarding AI monetization initiatives. Microsoft’s (MSFT) early announcement in pricing Microsoft 365 Copilot at a premium suggests a potential trend of increased pricing and monetization in the AI software industry, which could serve as a significant catalyst for other AI-focused software companies. While improvements in AI integration and updates in Bard could boost Google’s valuation in the long run, I believe that another near-term driver for pushing the stock higher is the company’s ability to generate additional revenue streams through incremental AI monetization efforts.

Valuation

Seeking Alpha

Google’s current P/E GAAP TTM stands at 26.7x, which is nearly in line with its 5-year average. However, when looking at the earnings consensus for the next 12 months, P/E fwd is 22.4x, which not only closely aligns with the S&P 500 index’s ratio of 21x but also falls below Meta’s (META) 25x. In terms of P/E fwd, Google is the cheapest among the “Magnificent Seven.”

The current low valuation can be attributed to two main reasons. Firstly, online advertising spending remains relatively weak compared to previous years, largely due to its strong correlation with U.S GDP growth and corporate spending cycles. Investors are concerned about a potential economic downturn in the near future, even though consumer spending is currently robust. The inverted yield curve also signals a possible recession.

Secondly, Google’s revenue exposure to AI-related services is not as significant. As mentioned earlier, 78% of its total revenue comes from online advertising, and the monetization of AI-related services has not contributed significantly to overall revenue growth in the near term.

However, despite these factors, considering the substantial increase in valuations among AI-related stocks this year, I believe Google’s current valuation presents an attractive long-term opportunity.

Conclusion

In sum, Google’s 2Q FY2023 earnings performance, with a clear sign of growth acceleration in Google Search and YouTube ads revenue, indicates a potential rebound in the online advertising industry (soft-landing narrative materialized) and reaffirms the company’s competitive strength. Moreover, the significant improvement in operating margin reflects Google’s commitment to cost reduction and operational efficiency, which could positively impact its overall profitability. Considering the recent muted earnings revision, there is potential for upside surprises, making Google’s forward-looking valuation multiples even more appealing to investors. With its market dominance in online advertising and ongoing efforts in AI monetization, I believe Google stands as an attractive long-term investment opportunity. Therefore, I upgraded the stock from hold to buy.

Read the full article here