Green Thumb Industries (OTCQX:GTBIF) is a very strong company. I say this because I want to be clear that I am not anti-GTI. It is also cheap, but, like I noted in January, it’s not as cheap as peers. In this article today, I review the fundamentals and the outlook, I look at the chart and I assess the valuation.

2023 So Far

GTI has already announced its Q2 conference call on the 8th of August after the close. Since my write-up in January, it has reported its Q4 and its Q1. In Q1, it generated revenue of $248.5 million, up 2%, and adjusted EBITDA of $76.2 million, up 14%. Analysts had expected revenue to be $250 million with adjusted EBITDA of $74 million. I think that investors kind of liked the better-than-expected profitability despite slightly weaker-than-expected revenue. I look at operating income as a key metric, and it fell 19% from a year earlier due to much higher SG&A.

One thing that stands out for the company is its tangible equity. In a growth industry that has many acquisitions, this metric isn’t generally important, but at this time of financial concerns it is. GTI ended Q1 with tangible equity of $514.6 million, while many of its peers have less (or even negative). Low net debt remained intact at $92.5 million, and cash flow from operations was very strong at $74.7 million, ahead of capital spending. The company had no tax payments due in Q1, but it had two due in Q2.

The Outlook

For Q2, analysts are expecting revenue to decline 2% from a year ago to $251 million. Adjusted EBITDA is expected to decline 5% to $75 million. While I don’t think how they do in a single quarter matters much, I do expect investors to be disappointed if the company doesn’t do better than expected.

The 2023 outlook has been steady since Q1 was reported, and the analysts currently are expecting revenue to grow 4% to $1.06 billion. They project adjusted EBITDA will increase 3% to $322 million. Ahead of the Q1 report, they were looking for revenue of $1.10 billion and adjusted EBITDA of $340 million, so the numbers did come down.

For 2024, which I think matters a lot to how investors will ultimately value the cannabis companies, analysts project that revenue will grow 10% to $1.16 billion with adjusted EBITDA gaining 13% to $363 million. Ahead of the Q1 report, they were expecting revenue of $1.19 billion and adjusted EBITDA of $375 million, so these too dropped a bit.

The Chart

GTI is very close to its recent low:

Charles Schwab StreetSmartEdge

I have been warning my subscribers at 420 Investor that we are near a price that if broken could augur poorly for the stock. The close below $7 caught my attention, but the level of importance, in my view, is $6.80. I shared that level on Wednesday afternoon with my subscribers, and it happened to be the low on Thursday.

Here is why I am worried about a slightly lower price:

Charles Schwab StreetSmart edge

GTI is the only MSO that hasn’t traded to its lows of early 2020 when the pandemic hit, and I fear that the stock could be pressured as shareholders start to worry that it could happen. I have support levels that are much higher than the low from early 2020.

The Valuation

In my January review of the company, I shared a year-end target of $16.71 based on a multiple of 10X projected adjusted EBITDA of $422 million in 2024. Ahead of the Q1 report, I shared with subscribers at 420 Investor an updated target of $11.91 based on a lower multiple (8X) and a lower outlook ($375 million).

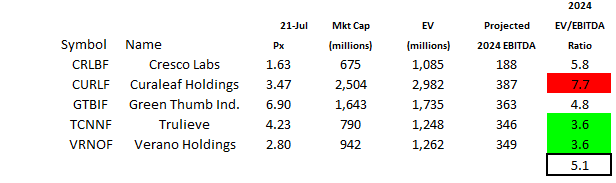

Here is how GTI compares to its 4 large peers:

Alan Brochstein, using Sentieo

Looking at the 2024 estimates for adjusted EBITDA, the average enterprise value to it trades at 5.1X, and GTI is just below average. Trulieve (OTCQX:TCNNF) stands out on the cheap side to me, and Curaleaf (OTCPK:CURLF), while it has declined since I wrote about it two weeks ago, is still expensive to peers.

While I think that the multiple of 8X adjusted EBITDA that I was using three months ago is quite low, I don’t believe that it will happen by year-end. Instead, as I think about cannabis stocks, I need to think about that multiple being a 2024 event. My year-end target is now based on 6X, which works out to be $8.75, up 27%.

Conclusion

I find GTI to be expensive relative to some peers, but it’s not a short in my view. I continue to view the market for cannabis stocks as very challenged, and the solutions I envision of NASDAQ allowing the American operators to list or, more importantly, the end of 280E taxation don’t appear to be imminent. My view on GTI is that it may decline and, if not, it’s not likely to rally more than peers. I like Trulieve a lot more, and I also like Ascend Wellness (OTCQX:AAWH), Columbia Care (OTCQX:CCHWF) and Planet 13 Holdings (OTCQX:PLNHF). I have written articles explaining why these stocks appeal to me. I continue to view other sectors, especially some of the Canadian LPs, as offering more than MSOs.

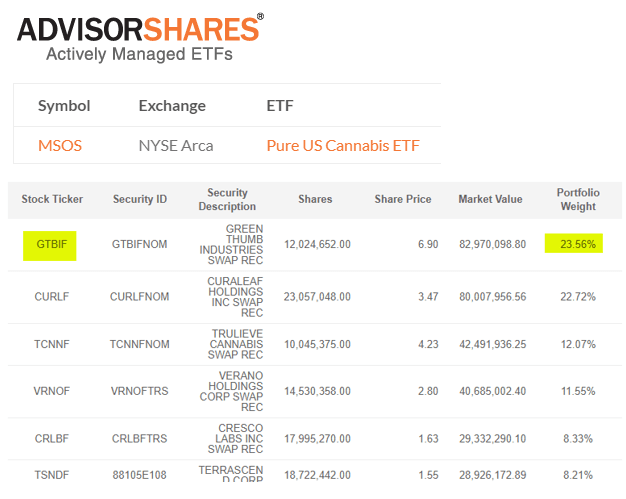

I discussed above the chart, and I said that I don’t envision GTI doing what every single one of its peers has done: going to the 2020 lows. But, it might. Again, my big concern about GTI isn’t really the company or how it operates. I worry most about its large holder, AdvisorShares Pure US Cannabis ETF (MSOS), which owns 12 million shares (23.6% of its portfolio).

AdvisorShares

The top 6 holdings, each above 8%, total 86.4% of the ETF, so it lacks diversity. These include the 5 largest MSOs by revenue and by market cap, which total 78.2%. This large amount is nowhere near the economic exposure of the five relative to the entire universe of publicly traded cannabis stocks. MSOS did sell some of the large MSOs earlier this year, when it had its shares exchanged, and it may do it again. The market has terrible liquidity right now, and any sort of selling could weigh on the stocks being sold significantly.

I continue to think highly of GTI, but I believe that many investors give them too much credit relative to peers for the balance sheet and all that they have accomplished. As the company celebrates the anniversary of its 5th year of being publicly-traded last month, I wish it and its investors all the best.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here