Amid a frothy market environment, most investors have forgotten one cornerstone rule again: valuation matters. While many market observers are pointing to AI as being similar to a watershed moment for the tech industry similar to the internet boom of the early 2000s, we have to be careful of soaring valuations particularly for stocks that aren’t tremendously benefiting from AI investments.

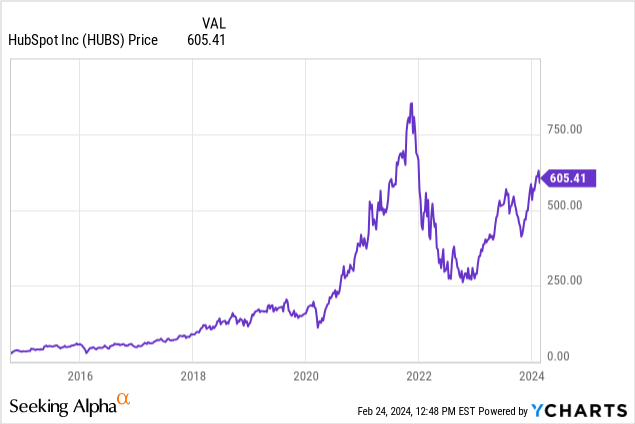

HubSpot (NYSE:HUBS) has been a market darling for years. The CRM platform, famed for its “inbound marketing” focus that emphasizes connecting with customers that have already engaged with your brand rather than direct sales, has seen its share price rise 10% year to date already after soaring more than 50% over the past twelve months. It’s a great time for investors to reconsider the bull and bear theses here.

I wrote a note on HubSpot in November when the stock was trading closer to the $400 levels, upgrading the stock at the time to neutral but still adopting a tone of caution on valuation. Since then, the stock has skyrocketed, with enthusiasm picking up steam after HubSpot’s recent Q4 earnings release. With this in mind, I’m downgrading HubSpot back down to bearish, owing primarily to valuation.

“High price for high quality” stocks are a dime a dozen in the software sector, and I do worry about a correction in the year ahead for these richly-valued stocks. At current share prices near $605, HubSpot trades at a market cap of $30.68 billion; after we net off the $1.71 billion of cash and $456.2 million of convertible debt on HubSpot’s most recent balance sheet, the company’s resulting enterprise value is $29.42 billion.

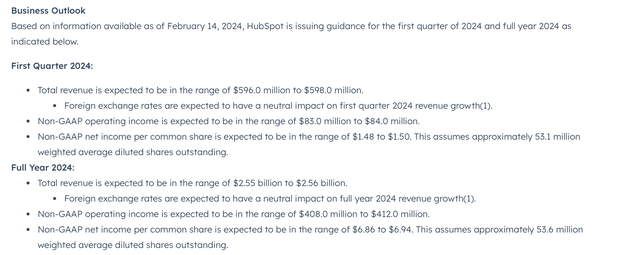

Meanwhile, for the current fiscal year, HubSpot has guided to revenue in a range of $2.55-$2.56 billion, representing 18% y/y growth. It’s also pointing to a pro forma operating margin of 16.1%, which represents only 90bps of expansion versus 15.2% in FY23 (a year in which operating margins expanded more than 5 points y/y).

HubSpot outlook (HubSpot Q4 earnings release)

Now, HubSpot does have a long history of setting its initial bars low in order to exceed them in a consistent “beat and raise” pattern throughout the year. But nevertheless, taking the high end of HubSpot’s revenue range and EPS targets for the year, the stock trades at:

- 11.5x EV/FY24 revenue.

- 87x FY24 P/E.

These are bloated valuation multiples to pay for a stock whose growth has fallen to the mid/high teens. In addition to valuation risk, HubSpot is not absent fundamental risks, either, which include:

- Sharp competition in the CRM space- HubSpot operates in arguably the most competitive vertical in enterprise software, competing against deeper-pocketed incumbents like Salesforce.com (CRM). Though HubSpot has certainly made a niche for itself in focusing on inbound marketing, the current macro landscape has many enterprises shrinking down their vendor counts and trying to consolidate their tech infrastructures as much as possible – which may favor larger “portfolio software” vendors like Salesforce and Oracle.

- Tough macro environment for sales and marketing- HubSpot’s core customer base is the exact headcount that most of corporate America is trying to reduce. Layoffs in sales and marketing departments have continued well into 2024, which will pressure HubSpot’s seat expansion as well as ability to land new clients in an age of downsizing.

- Expected gross margin contraction- HubSpot’s long-term operating model does call for operating margins to expand to a 20-25% range (from 15% in FY23), but pro forma gross margins are expected to fall ~4 points from 85% today to 81%, indicating that the company may need to lean in on a heavier unprofitable professional services mix down the line.

There is no doubt that for today, HubSpot continues to execute admirably in a challenging macro. The company’s ability to continue upselling its customers and pushing its multi-product platform is enviable – but all of this, in my view, is already reflected into HubSpot’s premium valuations.

HubSpot may be able to float on its high multiples in a frothy market, but as soon as the market turns south this stock is at risk (it wasn’t too long ago in November 2021 that HubSpot hit all-time highs above $800, and within the space of a few months it lost half of that value in the correction of 2022).

The best move here is to lock in gains and invest elsewhere.

Q4 download

That being said, it would be remiss not to acknowledge the strength that HubSpot has exhibited in its most recent quarter, which the company published in mid-February:

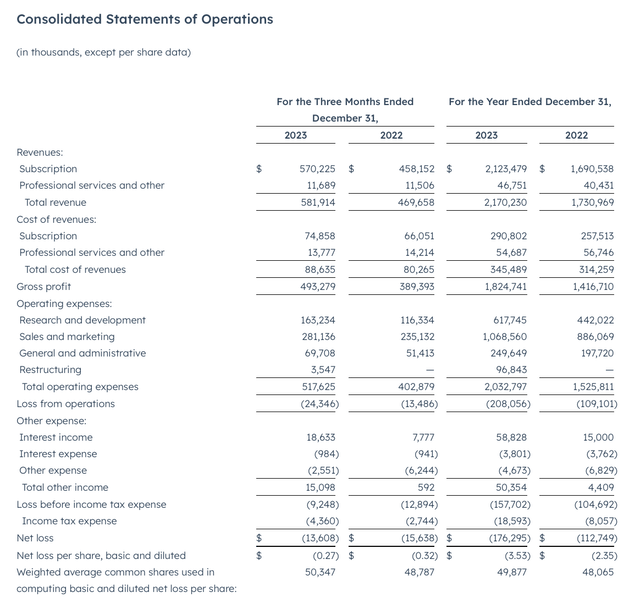

HubSpot Q4 results (HubSpot Q4 earnings release)

Revenue grew 24% y/y to $581.9 million, ahead of Wall Street’s expectations of $558.7 million (+19% y/y) by a five-point spread (a usual beat magnitude for HubSpot). Growth did, however, decelerate from 26% y/y in Q3; and though I do think that HubSpot’s guidance for FY24 will continue to be raised throughout the year, it is reasonable to expect HubSpot’s growth to continue decelerating to the low 20s/high teens in 2024.

The company’s count of customers grew 23% y/y to 205k; as a reminder here, HubSpot excels particularly in the SMB space, where companies may not have fully-fledged sales forces and sometimes rely on inbound marketing means as a necessity rather than as a choice. One disappointing metric, however, is the fact that HubSpot’s average subscription revenue per customer flatlined y/y at $11.3k, either indicating a mix-down into smaller customers or a slowdown in upsell/cross-sell momentum.

The company is experimenting with pricing this year, with new customers expected to see a ~5% increase in starting per-seat costs. Per CEO Yamini Rangan’s remarks on the rationale behind this during the prepared remarks portion of the Q4 earnings call:

Shifting gears I want to share context on the pricing change we recently announced and the strategic rationale behind it. As we have evolved from an app to suite to customer platform, we’ve had a simple strategy, make HubSpot easy-to-use and easy-to-buy. We’re doubling down on the strategy to make HubSpot even easier to buy. That’s why we announced a new seat space pricing model on January 30 that will go into effect for all new customers on March 5. For existing customers, pricing will remain the same at the time of the migration, but they will see a price increase of 5% or less at the time of their next renewal.

Now, there are three reasons for this shift. First, we want to make it even easier for customers to get started with HubSpot, and therefore we’re removing seat minimums for Sales Hub and Service Hub. This will remove friction for customers and will help us accelerate market share gains.

Second, we want to make it easier for customers to upgrade from Starter. We have heard feedback that the price jump from Starter to Pro or Enterprise is high. This is a point of friction as customers look to upgrade. So we’re changing the Pro and Enterprise seat pricing for Sales Hub and Service Hub and we are introducing view only seats, core seats for users who want to edit, and specialized seats for users who need specific functionality like sales or service. This change will bridge the gap between Starter and Pro, and drive more Pro plus adoption and upgrades. Third, and perhaps most importantly, we’re aligning price to the value from our AI-Powered smart CRM.”

Assuming elasticity is low, we may see revenue growth re-accelerate in Q2 once these pricing moves kick in. But the opposite could also be true: especially as a large portion of HubSpot’s customer base are SMBs that have less bureaucratic IT decision-making processes (relative to enterprise buyers), higher pricing may be the impetus to cut HubSpot at the time of renewal.

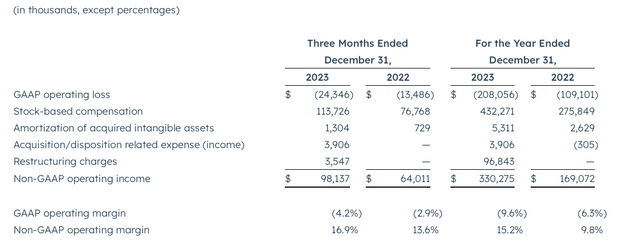

From a profitability perspective, HubSpot’s pro forma operating margins rose 330bps y/y to 16.9% in the quarter.

HubSpot profitability (HubSpot Q4 earnings release)

Profitability saw a tailwind from both HubSpot’s headcount reductions as well as a favorable change in the company’s reseller partner commission structure.

Key takeaways

The HubSpot narrative hasn’t changed: it’s an expensive stock that is performing well. But with HubSpot’s growth expected to slow to the high teens, we must critically evaluate the stock’s double-digit revenue multiple. In my view, it’s best to avoid this stock and invest elsewhere.

Read the full article here