Hedging overlays have helped a lot in this cycle for bonds. But the question ultimately comes down to what factor it is you want to hedge against. In the bond fund world, hedges tend to be focused more on interest rate risk rather than default risk. This matters more for junk debt portfolios, where bankruptcy can get priced in quickly when volatility rises for all assets. One fund that is designed to shield investors from interest rate risk while exposing them to the creditworthiness of high yield bonds is the iShares Interest Rate Hedged High Yield Bond ETF (NYSEARCA:HYGH).

Launched on 27th May 2014, HYGH offers investors an opportunity to access the world of high-yield corporate bonds while mitigating the associated interest rate risk. The fund achieves this by investing in the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) and maintaining short positions in interest rate swaps. The fund currently has $228 million in assets under management, with a net expense ratio of 1.12%

Breaking Down HYGH’s Holdings

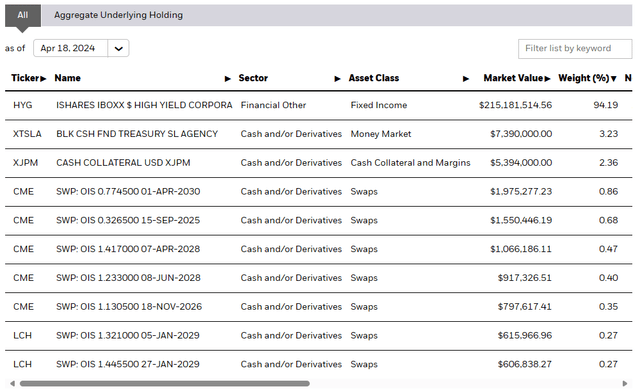

When it comes to the investment breakdown of HYGH, approximately 95% of its assets are invested in high-yield bonds, achieved indirectly through its investment in HYG. The HYG is the largest high-yield ETF in the market, boasting over 1000 bonds from all relevant industry sectors. This extensive diversification reduces the risk, volatility, and potential losses from any individual default or bankruptcy.

ishares.com

The remaining 5% of HYGH’s assets are invested in interest rate swaps to hedge away its duration exposure. This strategic allocation has led to a robust yield, despite the fund’s inherently high credit risk.

Sector Composition and Weightings

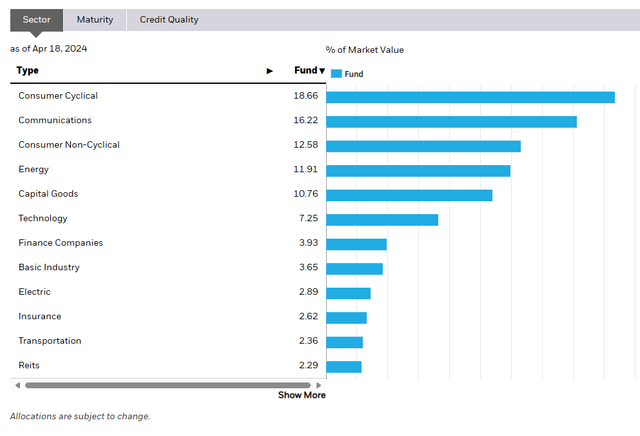

Unlike many ETFs that have a diverse sector composition, HYGH’s sector exposure is primarily towards high yield corporate bonds. This concentration risk is somewhat mitigated by the fund’s diversification within the high-yield bond market, which spans various industry sectors and credit ratings.

HYGH Vs. Similar ETFs

When compared to similar ETFs, HYGH stands out for its hedging strategy that reduces the impact of interest rate changes. This feature is particularly appealing for investors concerned about rate hikes, who wish to maintain exposure to high-yield bonds.

When we look through to HYG itself, we see that sectors skew towards the consumer sector overall, with consumer cyclical and consumer non-cyclical in the top 3 largest allocations.

ishares.com

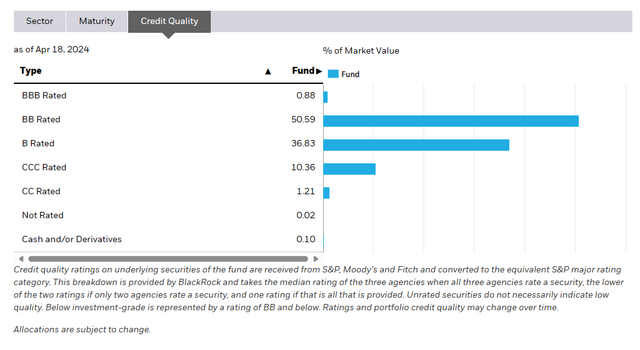

From a credit quality perspective, this is primarily a BB rated fund, with some CC as well.

ishares.com

So how has the interest rate hedge worked here? Clearly very well. When we look at the performance of HYGH versus HYG, it’s not even close. HYGH has done spectacularly better than HYG while holding 95% of the position in HYG because this was an interest rate/duration bear market for bonds, and not a credit quality one.

stockcharts.com

Pros and Cons of Investing in HYGH

Like any investment vehicle, HYGH comes with its set of advantages and drawbacks.

Pros:

- High Yield: With a 30-Day SEC Yield of 5.95%, HYGH offers an attractive return potential for income-focused investors.

- Interest Rate Hedging: The fund’s hedging strategy can protect investors from the negative impact of rising interest rates.

- Diversification: HYGH’s investment in over a thousand high-yield corporate bonds provides a high level of diversification.

Cons:

- High Credit Risk: Investing in high-yield bonds means taking on a high level of credit risk. These bonds are issued by companies with weak financial health, increasing the chances of default.

- Interest Rate Swap Risks: The fund’s use of interest rate swaps can lead to losses if the interest rate movements don’t align with the fund’s expectations.

To Invest or Not to Invest?

HYGH presents a unique proposition for investors seeking high-yield opportunities while mitigating interest rate risk. However, the fund is not without its risks, mainly stemming from its exposure to high yield bonds. While the fund has displayed strong performance in recent periods, investors must be mindful of the inherent credit risk and the potential impact of changes in interest rates. If you believe default risk in corporate credit will remain muted, and are still worried about rising rates, this is a good fund to consider.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The Lead-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award winning research. I’ll give you the signals–it’s up to you to decide whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).

Read the full article here