The following segment was excerpted from this fund letter.

INTERNATIONAL WORKPLACE GROUP (OTCPK:IWGFF)

During the fourth quarter, we made one material new investment in London-listed IWG, a company that manages shared workspaces. IWG operates 19 different brands, the most well-known of which is Regus, that represent over 3,400 locations spread across 120 different countries serving 8 million customers ranging from freelancers looking for a desk outside of the home all the way up to multi-national companies.

Most conversations about IWG begin with: how is IWG different from WeWork (OTC:WEWKQ), which is in bankruptcy? Well, unlike WeWork, IWG did not engage in a growth-at-all-costs campaign. Unlike WeWork, almost all IWG leases can be terminated by the company with minimal breakage costs.

Unlike WeWork, IWG’s management has earned investors’ trust. To return to the Fight Club metaphor, IWG’s management is quite different from that of WeWork, which was initially run by a CEO who appeared to front-run his shareholders by personally buying buildings and then selling them to WeWork for a profit. The same “enterprising” CEO also personally licensed the name “We” and charged the company millions of dollars per year for its use. In sharp contrast, IWG is run by its founder Mark Dixon, who still owns 28% of the company and has a very reasonable compensation package.

IWG has more scale with more than six times the number of locations as WeWork. This is important because it allows for more efficient customer acquisition and retention, and better property level monetization. Unlike smaller peers who generate most of their revenue from short-term leases, around one-quarter of IWG’s location-level revenue comes from ancillary products and services.

IWG also has much more suburban exposure, which lines up well both for companies that are requiring employees to come to the central office a couple of days per week (since they can provide a workspace closer to the employees’ homes for the other days) and to tap the vast array of companies not located in major cities. A final difference is profitability. Unlike WeWork, IWG has survived the Great Recession and Covid and has a 30-plus-year track record of profitability. In summary, IWG has better lease structures, better management, better locations, and better earnings.

Just being different from WeWork would be a terrible investment thesis. Fortunately, we believe that the company’s improving business model gives IWG the opportunity to significantly grow earnings and see its multiple expand from today’s depressed level. It’s unlikely that we would have invested if they were just sticking with their historical business of signing long term leases with landlords, improving the spaces, and then renting the space to individuals or small businesses on a short-term basis. The original flexible workspace model is both cyclical and capital intensive.

To address the cyclicality, IWG has taken several important steps beyond ring-fencing locations, which makes it easier to walk away. Specifically, the company started tying landlord payments to location revenues. This change has been going on for quite some time. Today, approximately 40% of rent expense is variable in nature. However, these variable rent locations still require significant upfront capital outlay by the company.

More recently, the company has introduced a new asset-light “partnership” model, which eliminates both cyclicality AND capital intensity. In this model, IWG asks landlords to put up all capital investments and pick up all operating costs of a location. In return for managing these locations, IWG takes a management fee, approximating 15% of revenues.

IWG’s business model transition is possible, in part, because of the headwinds facing the corporate real estate market. With vacancies continuing to rise, landlords are being forced to be more flexible and find new ways to fill their buildings. While a landlord’s first choice may be signing a credit-worthy tenant to a 20-year lease with terms very favorable to said landlord, those deals are harder and harder to find these days. In the face of the waning demand for office space, IWG is presenting landlords with a solution that helps them fill and monetize space that would otherwise sit empty. For its 15% fee, IWG oversees the build-out, marketing, and client onboarding, and uses its technology systems and networks of vendors to manage the space on a daily basis. By partnering, a landlord gets a turnkey solution to a revenue-generating shared workspace in their building and IWG gets paid for their services, and upside if the property performs.

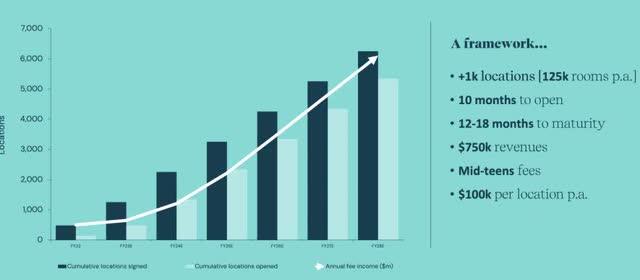

In simple terms, IWG puts out no cash and incurs no liabilities. The asset light and risk light partnerships model drastically changes the company’s economics of growth away from its historical constraints. In 2018, the company laid out over $400M in growth capex to add 299 locations. In 2024, growth capex is projected to be just $60M (15% of the former) to finance the opening of more sites. The primary constraint to growth now is signing up partners, not capital. Below is a chart from their investor day, looking at just their largest market, the United States. This is a different business going forward.

In 2022, IWG signed up approximately 462 locations for their partnership model; the number of new contracts likely exceeded 800 in 2023 and in 2024 should be in excess of 1,000 locations.

Partnering with IWG makes the process of turning vacant space into flexible workspace much easier for a landlord than doing it on their own. IWG has all of the vendors and systems in place to manage the transition to and operation of the property as flexible space, the landlord does not have to recreate the wheel. IWG has the marketing and sales teams in place, as well as the billing, staffing, and systems for things such as booking a conference room. In addition, IWG is also set up to monetize ancillary offerings such as printing, copying, internet, parking, and coffee from day one. IWG has scale that individual landlords do not have. Landlords who work with IWG see a path to higher revenues and lower costs with less “brain damage.” Similar to Hilton Hotels’ value proposition to property owners, a landlord working with IWG should make more money, even after paying IWG fees and revenue sharing, than if they managed the property on their own.

So, for both IWG and landlords, there are clear benefits. How about the customers? Yes, it is highly likely that the days of everybody working five days a week from an office are over, but most employers also don’t want a fully remote workforce. For employers, using shared workspace allows for up to 50% lower operating costs and zero capital expenditures; it keeps long-term leases off a company’s balance sheets, provides flexibility, and retains employees by allowing them to work closer to home.

IWG benefits from the following five attributes:

Network Effects – As the largest operator of flexible office space, they have the best geographic footprint. Signing a lease with IWG can provide access to spaces when you travel or allow the flexibility of access to a desk both when in your nearest city and when closer to home.

Scaled Economies Shared – A term coined by coined by Nick Sleep and Qais Zakaria of Nomad Partners, scaled economies shared is a strategy where a company that benefits from economies of scale shares those benefits with its customers, typically by offering lower prices, to gain long-term market share. As the scaled operator of flexible office space, IWG passes on most of the savings to their tenants and landlord partners. It is less expensive to partner with IWG than to be independent of them.

Improved Competitive Landscape – IWG’s largest competitor is in bankruptcy. Gone are the days of WeWork growing at all costs, signing leases that did not make sense, and subsidizing their customers. A rational competitive environment favors the rational – in this case, IWG.

Secular Tailwind – According to the HR Report, 90% of employees want flexibility in where they work, and 89% of employers report better retention because of flexible work options. It is highly likely that companies will continue to offer employees places to work outside of but near home. Flexible office space is approximately 2% of the corporate real estate market today and likely going far higher with IWG as the scaled leader.

Proven Track Record of Success – landlords are not accustomed to these managed partnership deals. For many, it is their first time ever considering going this route with some of their space. IWG’s scale and duration of having a profitable track record makes them the safest route for landlords as they determine who to partner with.

The foundation of our investment in IWG is their partnership business. In round numbers, each partnership, when open and scaled, will generate $100K per year in contribution. So, the 1,000+ signups projected for this year should grow contribution by $100M per annum on a go-forward basis. Now, there is nothing magical about adding 1,000 locations per year. Given that they require no capital from IWG, it can open as many partnership locations as there is demand. It took IWG 34 years to get to 3,000+ locations under their old model. Capital was one of the biggest constraints to growth. With their partnership model, IWG is on track to add more than 1,000 locations in a single year with virtually no incremental capital.

As the partnerships are just ramping up, the business transition’s impact on the financial statements has been limited so far, but the wave is coming. Partnership locations take 10 months to open and 12-18 months to reach maturity. As shown in the chart below, all of the partnership signing activity to date has yet to really flow through the financial statements. But it will! With each day, we are one day closer. The wave is building.

In addition to the core business of managing shared workspaces, IWG has their Worka division, the largest flex workspace marketplace, which connects businesses and their employees to 40K+ flex spaces across 170 countries and 5,500 cities. Worka also has a real estate consulting business that assists corporates in their analysis of and transition to flexible workspaces. Worka (formerly Instant Group) is a business that has been built through acquisitions and is in the midst of integrating the acquired companies. As an example of how far they are from fully integrating, the Worka.com website, which will integrate all of the disparate pieces, is still being built out.

Worka could be an independent company, and there has been talk of spinning it off/selling it. There are benefits to having marketplace and consulting companies being independent, not owned by the largest supplier in the industry. For now, Worka is financially a fully owned subsidiary of IWG, but in practice is operated as a stand-alone company with its own management team and independent board. The division generated approximately $450M in revenue and $150M in EBITDA in 2023. Over the last decade, Worka’s revenue grew at a 20%+ CAGR on a combined basis. The company expects this growth rate to continue over time. Profitable marketplace businesses with 20%+ growth rates should be worth 10X EBITDA in my book. If the growth and profitability sustain, it is not hard to see Worka commanding a valuation in excess of $2B.

Before we ascribe a high multiple to the fast-growing-no-capital-required Worka, let’s look at the overall company. At the time of our purchases, in round numbers, IWG had a market capitalization of just under $2B USD and net debt of another $750M. There are three divisions. The majority of revenues and profits currently come from the “company-owned” locations, which are expected to contribute $700M. Worka is the second largest contributor at $200M, and the quickly growing partnership business is yet to be material at $50M. Corporate activities partially offset the $950M in contributions outlined above. All of this yields a 2023 EBITDA of approximately $400M, projected to grow double digits in 2024 and reach $1B in the medium term. If you believe the guidance, we are paying less than 3X the medium-term EBITDA.

Could multiples compress on IWG? In a deep recession, they certainly could, but if they hold steady, EBITDA/earnings/cash flow should all grow significantly. It is also quite likely that, as more and more of the revenues and earnings come from the partnership business, a higher multiple is ascribed to the business. In 2027, more than half of the EBITDA should come from fees, which is a more stable asset-light business that investors often ascribe higher multiples to. I see a clear path to the share price tripling over time from the combination of revenue growth, earnings growth and multiple expansion.

Trying to explain share price and the movements in share price can be a fool’s errand, but in the case of IWG, there are at least three factors that may partially explain a mispricing of shares:

The Stench of “Office” – while a weak office market is driving the partnership business for IWG, many investors will not look at anything office-related. Large Shareholder Liquidating – two of the company’s largest outside shareholders were forced sellers in 2022: one is in the process of liquidating and the other was selling to meet redemptions. Partnerships Not Showing Up in the Financials – As previously discussed, between the time to renovate the space and the time to fill the space, it takes almost two years from signing for a partnership location to mature. The economic benefits of the scaling partnership business are not yet evident in the financial statements.

Investing in anything to do with the much-maligned office real estate market is an act of courage and took some handholding. Yaron Naymark of 1 Main Capital was helpful in laying out the business model transition, assets, and potential long-term economics of this investment, so thank you, Yaron.

|

Disclaimer: This document, which is being provided on a confidential basis, shall not constitute an offer to sell or the solicitation of any offer to buy which may only be made at the time a qualified offeree receives a confidential private placement memorandum (“PPM”), which contains important information (including investment objective, policies, risk factors, fees, tax implications, and relevant qualifications), and only in those jurisdictions where permitted by law. In the case of any inconsistency between the descriptions or terms in this document and the PPM, the PPM shall control. These securities shall not be offered or sold in any jurisdiction in which such offer, solicitation or sale would be unlawful until the requirements of the laws of such jurisdiction have been satisfied. This document is not intended for public use or distribution. While all the information prepared in this document is believed to be accurate, MVM Funds LLC (“MVM”), Greenhaven Road Capital Partners Fund GP LLC (“Partners GP”), and Greenhaven Road Special Opportunities GP LLC (“Opportunities GP”) (each a “relevant GP” and together, the “GPs”) make no express warranty as to the completeness or accuracy, nor can it accept responsibility for errors, appearing in the document. An investment in the Fund/Partnership is speculative and involves a high degree of risk. Opportunities for withdrawal/redemption and transferability of interests are restricted, so investors may not have access to capital when it is needed. There is no secondary market for the interests, and none is expected to develop. The portfolio is under the sole investment authority of the general partner/investment manager. A portion of the underlying trades executed may take place on non-U.S. exchanges. Leverage may be employed in the portfolio, which can make investment performance volatile. An investor should not make an investment unless they are prepared to lose all or a substantial portion of their investment. The fees and expenses charged in connection with this investment may be higher than the fees and expenses of other investment alternatives and may offset profits. There is no guarantee that the investment objective will be achieved. Moreover, the past performance of the investment team should not be construed as an indicator of future performance. Any projections, market outlooks or estimates in this document are forward-looking statements and are based upon certain assumptions. Other events which were not taken into account may occur and may significantly affect the returns or performance of the Fund/Partnership. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. The enclosed material is confidential and not to be reproduced or redistributed in whole or in part without the prior written consent of the relevant GP. The information in this material is only current as of the date indicated, and may be superseded by subsequent market events or for other reasons. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Any statements of opinion constitute only current opinions of the GPs, which are subject to change and which the GPs do not undertake to update. Due to, among other things, the volatile nature of the markets, and an investment in the Fund/Partnership may only be suitable for certain investors. Parties should independently investigate any investment strategy or manager, and should consult with qualified investment, legal, and tax professionals before making any investment. The Fund/Partnership are not registered under the Investment Company Act of 1940, as amended, in reliance on exemption(s) thereunder. Interests in each Fund/Partnership have not been registered under the U.S. Securities Act of 1933, as amended, or the securities laws of any state, and are being offered and sold in reliance on exemptions from the registration requirements of said Act and laws. The references to our largest positions and any positions listed in the Appendix are not based on performance. All of our positions will be available upon a reasonable request. All hyperlinks contained herein are not endorsements and we are not responsible for such links or the content therein. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here