iShares Global 100 ETF (NYSEARCA:IOO) is an exchange-traded fund whose mandate is to invest in a broad range of large companies internationally in both developed and emerging markets, specifically 100 companies. The fund’s assets under management were just shy of $4 billion as of August 4, 2023, and the fund’s benchmark index was the S&P Global 100 Index.

While the fund is global, there is a significant weighting in favor of the U.S. market. This is perhaps a misleading element of many “international” funds, as they are not weighted equally or rebalanced regularly to accommodate a truly diverse array of companies. Instead, the funds follow largely market-cap-weighted methodologies. Therefore, the largest and deepest market, the United States, reigns supreme. IOO’s allocation to the United States was 74.84% as of August 3, 2023, followed by the United Kingdom at 6.49% and Switzerland at 4.88%. Other countries include France, Japan, Germany, and South Korea. With the top three countries representing 86.21% of the fund, is IOO truly global?

In any event, the large allocation to this ultimately tight selection of developed markets means that the cost of equity is low. That is, relatively speaking; I use 10-year yield data, plus country premium data, to work out a cost of equity of the sum of 3.86% plus the equity risk premium. We solve for the equity risk premium, as this is a function of earnings projections and other assumptions in relation to the current market price. The 3.86% is the sum of Professor Damodaran’s suggested country risk premiums (weighted by myself per IOO’s current geographical allocations), with a similar methodology using 10-year government bond yields (as proxies for risk-free rates).

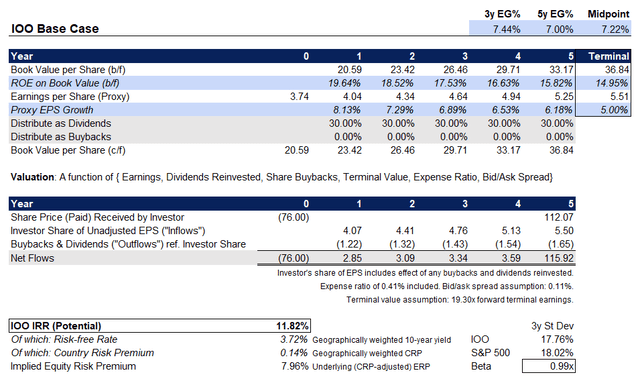

Using the benchmark index’s most recent factsheet as of the end of July 2023, we know that IOO’s likely trailing and forward price/earnings ratios are 20.87x and 19.3x, respectively, with a price/book ratio of 3.79x. The indicative dividend yield was 1.89%. This implies a forward return on equity of 19.64% and a forward one-year earnings growth rate of 8.13%.

Morningstar, meanwhile, provides us with a three- to five-year earnings growth rate (on average) of 9.75% as a forward projection. I disagree with this figure, as it would require a fairly hefty forward return on equity assumption holding constant. Instead, it makes sense to project a maturing return on equity for the current portfolio, in line with a deceleration of the earnings growth rate. It is not wise, for example, to project an average earnings growth rate of almost 10% when the forward one-year projection by S&P is a mere 8% (or thereabouts). In my experience, S&P is also more objective and less forgiving than Morningstar’s adjusted operating profit growth projections.

Holding most other factors constant, including implied past dividend distribution rates, and assuming no share buybacks, etc., we have a model that implies an underlying equity risk premium of 7.96% (adjusted for the country risk premium) and a headline IRR figure of some 11.82%. On a volatility adjusted basis, this is a strong return, given that IOO’s beta is essentially the same as the S&P 500 U.S. equity index.

Author’s Calculations

Therefore, given that a fair equity risk premium for a mature equity market might be in the region of 4.2-5.5% (aberrations owing to surprises and/or variable market sentiment), IOO appears to be undervalued. Even if stocks have performed well so far this year (IOO has moved up by almost 19% year-to-date, excluding dividends), my sub-consensus earnings projection model suggests that IOO is still undervalued.

I think this bodes for global equities generally. Also, the fact that IOO is undervalued in spite of its matching beta with the S&P 500 index, and additionally provides some embedded non-U.S. diversification (which will include indirect foreign currency exposure, too) provides IOO with more appeal. The only remaining factor to consider is the expense ratio at 0.41%; however, this is in line with iShares funds and I have already factored this into my above calculations (as well as the median 30-day bid/ask spread of 0.11%). All considered, IOO offers very good value in spite of these costs.

Read the full article here