Can the leading software stocks survive a tech wreck in 2024? That’s the question I asked myself in reviewing iShares Expanded Tech-Software Sector ETF (BATS:IGV), which is one ETF on a slimmed-down watchlist of 100 ETFs I now focus most of my work on. In recently cutting my watchlist in half, one of the key drivers in determining what to keep and remove was the degree to which equity ETFs that target sectors and especially industries are “concentrated.” That means that fewer stocks drive the proverbial bus. I think that investors who want opinions about ETFs, just as with stocks, prefer that analysts focus most of their attention on their “best ideas.” That’s analogous with a software industry ETF putting many of its eggs in a small number of baskets, rather than equally-weighting hundreds of stocks.

IGV gets a Hold rating from me here, but because of valuation in its sector, not because of the quality of the businesses within it. It is part of my watchlist, so of course I’ll continue to track it. But I don’t own it and the Hold rating simply communicates that if I did own it, I would be looking for more evidence before selling it. That evidence, if it develops, would likely come in the form of an acceleration in the price decline that has apparently started in tech in early 2024.

IGV: Key features

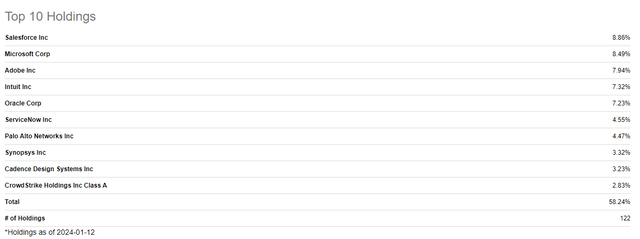

The ETF tracks an index of companies that represent a sub-sector (aka industry) within the broader technology sector, the software index, which is heavily concentrated in its largest 5 holdings. The top 5 stocks occupy 40% of the ETF and the top 10 represent 58% of the current IGV portfolio.

Seeking Alpha

IGV’s focus is clearly as it says, on the software industry. The portfolio is invested in the technology sector (96%), with 3% in the Communications sector, and minor allocations to Financials and Industrials. It opened in 2001, so it essentially represents and has assets under management of about $7.6B and trades about $300 million a day in dollar volume. So it is plenty large and plenty liquid.

IGV currently has 122 holdings, but that doesn’t really tell the story, given the facts I cited earlier on how concentrated this ETF is. IGV, as with other focused ETFs, provides me with a better sense of what it is, and what is likely to drive its future performance.

IGV’s potential: Concentrate!

As I have written here often, I am not like the typical ETF analyst or strategist. I adhere to the many studies that show that diversification can quickly turn from adding value when you add a stock to another stock, then another and another and so on. However, once you get past about 20-30 stocks, the benefits of diversification drop off sharply.

Here, we are talking about IGV, which will likely be a modest part of a portfolio. When I invest in industry ETFs like this, it is typically 5%-15% of a total portfolio. So I don’t prefer to have hundreds of stocks spread across such a small portion of my total stock “basket.”

So, I don’t look at IGV as 122 stocks, but rather as these 5 tech/software giants (which make up about 40% of the ETF) plus a bunch of “pals” alongside for the ride.

Performance has been strong, but now what?

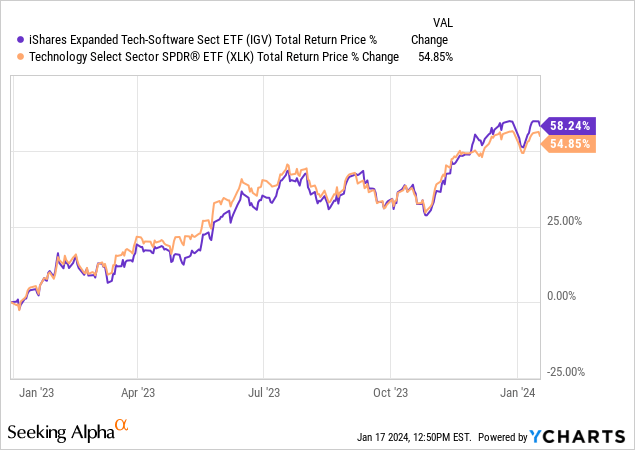

Performance was strong in 2023, Exceptionally strong recent performance has driven up valuations. However, there is still growth potential in the software market. And, while this is a focused group of very strong, profitable businesses, the biggest risk is not the fate of those business. Rather, it is the short-to-intermediate-term fate of their stock prices. Its heavy concentration in the more stable large cap software companies should allow it to better weather volatility in the tech market.

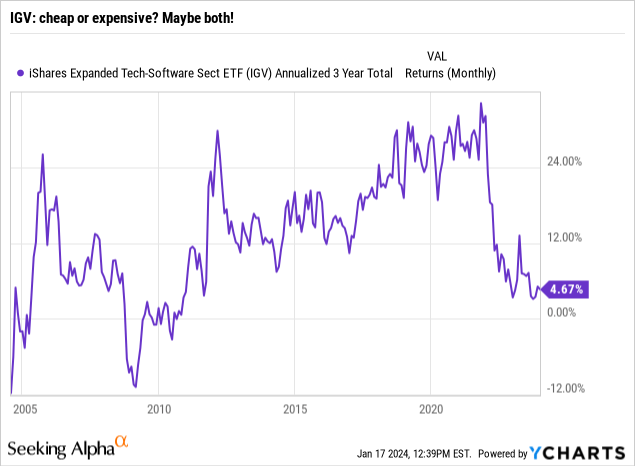

Note the chart above. The most bullish-tilted thing I can say about IGV is that its 3-year annualized return has not been this low since 2012. Sure, it could be in the process of being a proverbial “falling knife.” But this at least makes me keep one eye on it, particularly as a potential tech sector leader if we should get a wide scale drawdown this year.

IGV soared with the tech sector in 2023, but now what? Let’s take a look at Seeking Alpha’s excellent factor grade system to review those 5 top stocks.

Factor grade highlights

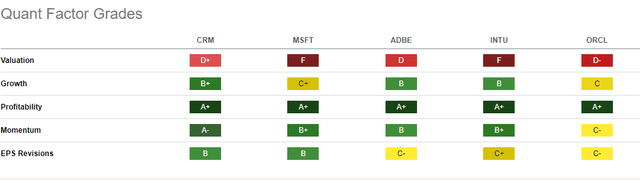

Here’s what I see when analyzing the 5 biggest holdings, which make up 40% of IGV. Look at that profitability line! A+ across the board. So, step one of my process is encouraging. These are great businesses. They are great stocks, too. But are they priced right?

Seeking Alpha

Momentum is strong, but that is past-tense, and I’m not the biggest fan of momentum as an investment factor when it is new money involved. The valuation row for these 5 top-weighted stocks looks like a report card I’d have thrown out and not shown my parents, back in the days I grew up (1970s-1980s) and the paper report card was still a thing. Fortunately, I never had to face that decision (solid B+ student).

IGV carries a P/E ratio of 47x trailing earnings into early 2024. That’s ok if these companies continue to grow like mad. However, that might be darn near impossible. So I have my reservations.

IGV might be a victim of its own success, along with the broader tech sector

IGV is a must-have on my watchlist of 100 ETFs. I like its focus, its collection of quality business, and its potential use as a way to target a narrower part of the broad tech sector in this post-pandemic era. But I just can’t get there on valuation, and the technical picture, while better than tech as a whole, is still not screaming buy. Nor is it screaming long-term sell. Thus, my Hold rating.

Read the full article here