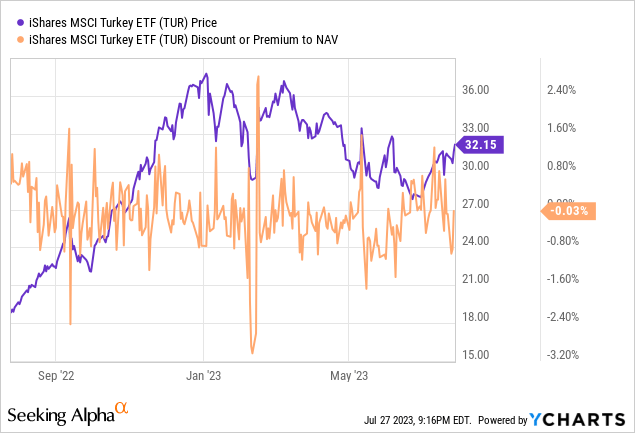

Having been rightly cautious about the iShares MSCI Turkey ETF (NASDAQ:TUR) earlier this year, I think it’s time for a change of stance now that the political uncertainty has cleared post-President Erdogan’s election success. The emerging theme here is policy normalization, with the new central bank governor (Hafize Gaye Erkan) kicking off the process with a massive benchmark rate hike to 15% (from 8.5% previously). And if the central bank’s post-meeting statement is anything to go by, more rate hikes are in the pipeline, along with quantitative tightening measures. New finance minister Mehmet Simsek has taken positive steps to balance the books as well (tax hikes and external funding from the Middle East), effectively de-risking the fiscal side. With the reset largely priced into stocks following the pullback in equity valuations post-election, the path for Turkish stocks is likely higher, particularly with the TUR portfolio priced at a discounted ~7x P/E (vs. mid-teens % fwd earnings growth estimates).

Fund Overview – Competitively Priced Turkish Investment Vehicle

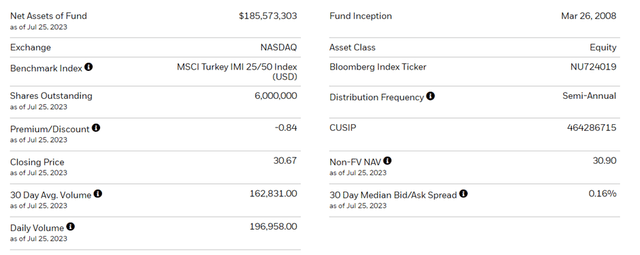

The US-listed iShares MSCI Turkey ETF tracks (pre-expenses) the performance of the MSCI Turkey IMI 25/50 Index, a basket of large-cap Turkish stocks (subject to investment limits). The ETF has seen significant outflows since I last covered the fund, declining to $186m of net assets at the time of writing (down from ~$332m). The expense ratio remains consistent, though, at 0.6%, in line with comparable iShares global emerging market ETFs.

iShares MSCI Turkey ETF

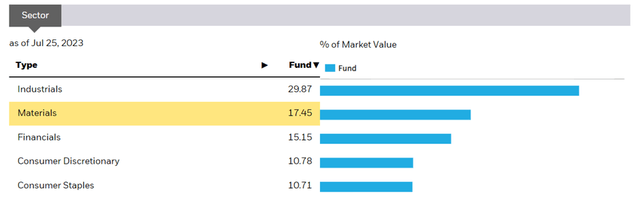

The fund’s sector composition is mostly unchanged, with the Industrials sector leading the allocation at 29.9% (vs ~28% prior). Materials and Financials remain the second and third-largest allocations, respectively, followed by Consumer Staples and Consumer Discretionary (21.5% combined). While the top five sectors contribute ~84% of the total portfolio, the presence of diversified conglomerates (broadly classified as ‘Industrials’) means the ETF isn’t as concentrated as it appears.

iShares MSCI Turkey ETF

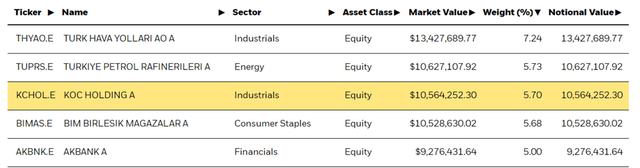

The 69-stock portfolio has seen some reshuffling at the top, with national carrier Turkish Airlines (OTCPK:TKHVY) replacing refiner Türkiye Petrol Rafineleri (OTCPK:TUPRF). Conglomerate KOC Holding remains the third-largest holding at 5.7%, followed by discount store Bim (OTCPK:BMBRF) and Akbank (OTCQX:AKBTY). For an emerging market fund, the concentration of the top five holdings is relatively low at ~29% of the overall portfolio.

iShares MSCI Turkey ETF

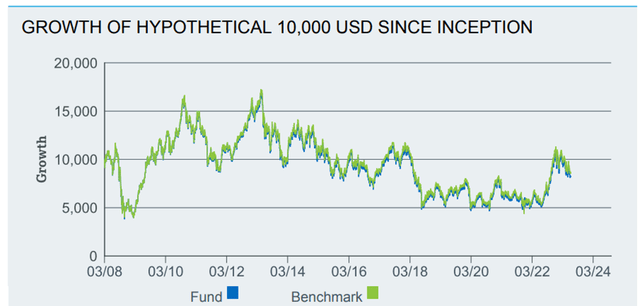

Fund Performance – Poor Track Record, but the Solid Distribution Yield Helps

Coming off a monster 2022 rally, TUR has declined by 14.1% on a YTD basis. Zooming out, this year’s underwhelming performance means the fund has compounded at a negative rate (-1.3% total return) since its inception in 2008. While the equity beta is low at 0.29 (vs. the S&P 500 (SPY)), returns have been volatile over the years, with the ETF suffering two calendar years of low-double-digit % declines before recovering to +106.4% in 2022.

iShares MSCI Turkey ETF

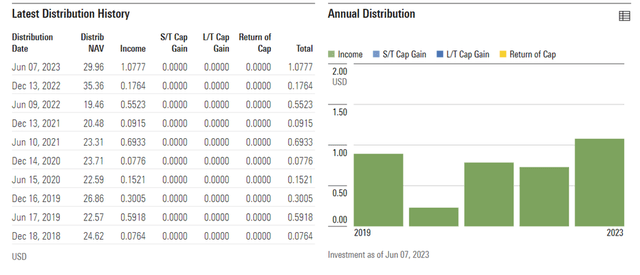

Despite the lack of capital growth, the distribution yield has been a redeeming factor at 4.5% on a trailing twelve-month basis, reflecting the fund’s cash-generative portfolio holdings. With this year’s half-year payout also coming in significantly higher YoY, the fund is well on course for another strong year of distributions.

Morningstar

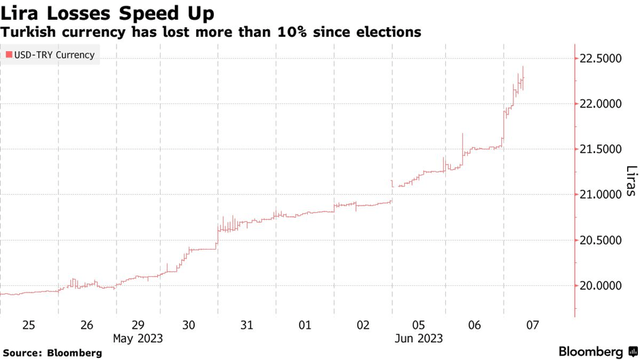

Major Post-Election Changes Signal a Return to Policy Orthodoxy

President Erdogan’s key post-election appointments (economist Mehmet Şimşek as the finance minister and ex-banker Hafize Gaye Erkan as governor of the Central Bank of Türkiye (CBRT)) have made it clear that a monetary and fiscal policy reset is now on the cards. In tandem, the long-held defense of the exchange rate, a key contributor to the depletion of the CBRT’s FX reserves, has been abandoned, allowing for a large adjustment to the overvalued lira post-election. As for the budget, recently announced tax hikes and external funding from the Middle East amounting to $8.5bn of Islamic bonds (‘Sukuk’) should help to balance the books after a widening deficit post-election and earthquakes earlier this year. As the current account also moves further into balance later in H2 2023, expect Turkish credit spreads to tighten, easing funding pressures for the economy.

Bloomberg

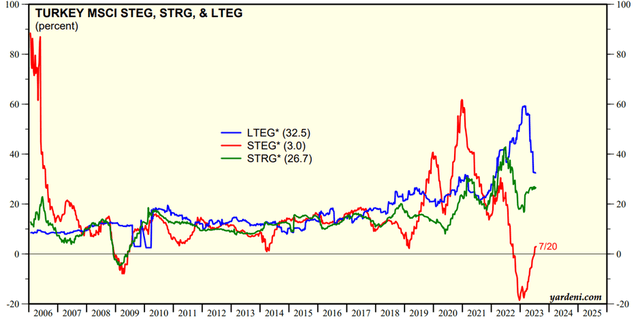

In terms of foreign participation, Türkiye remains one of the most under-owned equity markets in the global emerging market universe. This is changing, however, with foreign inflows reaching new highs in June following the policy pivot. And as the Turkish government’s stabilization program gains further momentum, there is a clear case for more technical upside from here. In the meantime, TUR valuations reflect a rather bearish outlook at the current ~7x P/E (~5x fwd earnings) – a significant discount to its low-double-digits % underlying growth potential. So even with Türkiye not yet out of the woods with regard to inflation and domestic demand set to slow from higher rates, Turkish equities offer a compelling margin of safety here.

Yardeni

Deck Cleared, Turkish Equities Headed Higher Post-Election

Following a blockbuster 2022, Turkish equities have pulled back significantly this year, catalyzed by the post-election normalization of the country’s economic policies. Case in point – the new central bank governor led a big monetary policy reset with a 6.5%pt hike and subsequently outlined guidance for further tightening post-June meeting. Similarly, the new finance minister has prioritized stabilizing domestic economic conditions and the external balance, which bodes well for long-term credit spreads and currency pressures.

Yet, investors remain skeptical of the Turkish investment story, with foreign participation still low (but recovering post-election) and valuations lingering well below historical levels at ~7x P/E (~5x fwd P/E). Against a backdrop of mid-teens % consensus earnings growth estimates next year and a wave of positive earnings revisions over the last month, the current discount seems unwarranted. Net, owning a diversified basket of domestic and export-oriented Turkish stocks via the TUR ETF makes a lot of sense here, in my view.

Read the full article here