The initial part of this year has been tumultuous for JD.com, Inc. (NASDAQ:JD), a top-tier e-commerce enterprise based in China. Its stock has seen a substantial dip, mirroring the larger struggles of the Chinese economy that is attempting to recover from the impacts of COVID-19. This article delves deeply into the technical intricacies of JD’s stock performance, aiming to forecast its future trajectory and reveal potential investment opportunities. The stock price is solidifying around the support level, hinting at the formation of a base. This discussion includes a detailed look at the thresholds where base formation might be verified and the points where investors might consider investing in the stock.

JD Dives Amid Challenges in the Chinese Economy

JD’s stock price experienced a sharp decline, over 40%, during the first half of 2023. The sluggish recovery of the Chinese economy from COVID-19 restrictions was a major contributor to this downturn. Despite a late 2022 rally in Chinese stocks, the narrative shifted significantly in the first half of 2023. JD’s performance and prospects mirrored the overall stagnation gripping the Chinese tech industry, which led to a depreciation in its stock value. Additionally, JD was under significant stress from fierce competition and price wars among domestic e-commerce counterparts, which was a key factor behind the slump.

Adding to the woes of the Chinese economy were the zero-COVID policies adopted by the government, its regulatory crackdown on large tech firms, and the bursting of the domestic property bubble. As a result, JD’s expansion slowed down, with a scant 1.4% increase in revenue as disclosed in the Q1 2023 earnings report compared to the same quarter the previous year – marking its most sluggish growth in recent memory. This sluggish growth, combined with JD’s heavy investments in logistics and delivery operations, caused some worry among investors.

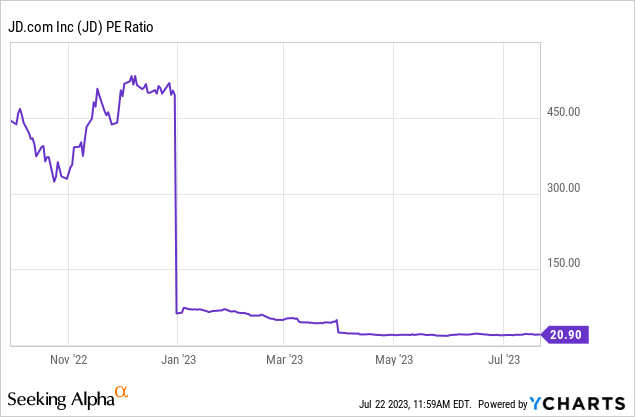

JD also faced its share of challenges, having announced the closure of its sites in Indonesia and Thailand. The move was seen as an acknowledgment of the e-commerce giant’s limited growth outside its home country, as well as an indication of stiff competition from local e-commerce companies in Southeast Asia. Furthermore, JD’s decision to invest in a new subsidiary focusing on low-cost items suggested that it was facing competition from low-priced platforms like PDD Holdings Inc. (PDD), which reported a whopping 58% growth in Q1 2023, a stark contrast to JD’s stagnant growth. Despite its poor performance in the first half, JD’s current valuation may appeal to contrarian investors, trading at roughly 21 times earnings but just 13 times this year’s earnings expectations and 11 times the projected 2024 earnings. These figures seem attractive but are contingent on the Chinese economy’s ability to regain momentum in the latter half of 2023 and beyond.

The Current State of Market Consolidations

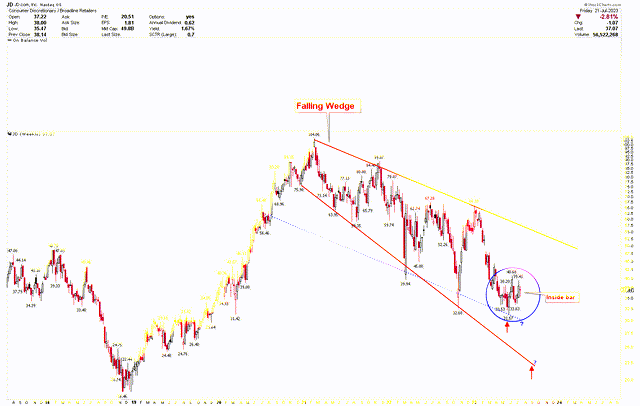

The weekly chart below offers a comprehensive technical outlook for JD, showcasing the unfolding of a falling wedge pattern from its all-time high of $104.06. This pattern, characterized by lower highs and lower lows, typically indicates a downward trend. Interestingly, while a falling wedge initially emits a bearish sentiment, it often presages a bullish reversal. This is largely due to its tendency to conclude with an upward breakout, hinting at a possible counter to the current downtrend. This pattern serves as a vital tool in technical analysis, aiding investors in identifying potential opportunities to buy or augment their holdings. The true confirmation of the falling wedge breakout, however, would be the stock price breaking above the $55 level, possibly even reaching new all-time highs.

At present, JD’s stock price is in a consolidation phase, with signs of bottom formation. The chart reveals that the stock price hasn’t successfully hit the lower line of the falling wedge, situated in the $20 to $23 support area. Instead, the price appears to be stabilizing at the blue-dotted trend line, with a low at $31.57. This trend line, drawn in parallel to the downward trend line originating from the all-time highs, forms a downward channel, marking the current level as a crucial support area.

JD Weekly Chart (stockcharts.com)

With the prevailing market environment, JD does not have to hit the falling wedge line at the $20 to $23 support. The price could rally from the blue dotted support line, and any break from $55 could ignite a potent and swift rally to all-time highs.

Key Action for Investors

From an investor perspective, it’s clear that JD’s stock price is currently stationed at a significant support region. The current consolidation suggests that the market is gearing up for the next move. Notably, the emergence of an inside bar following a bullish weekly candle points to price compression. If the price breaks above $41, it could trigger a short-term market rally. Inside bars are often indicative of a market preparing for a substantial move. Consequently, investors may contemplate buying JD at the current level and maintain their positions long-term.

Due to pronounced volatility, it would be wise for investors to hold these positions for an extended period. If the market breaks lower and initiates another move towards the long-term support of the falling wedge at the $20-$23 area, investors could capitalize on this by adding more positions.

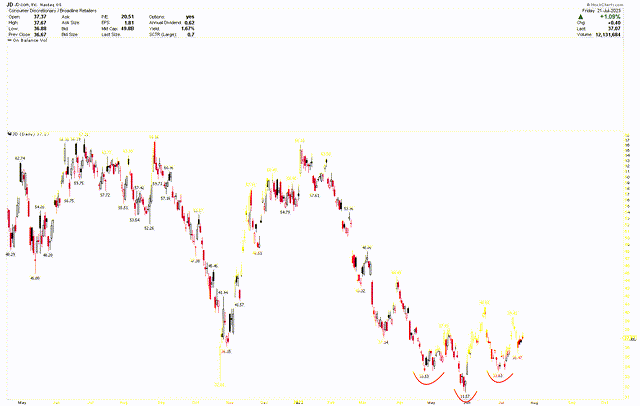

Further bolstering the short-term bullish outlook for JD is the daily chart below, featuring an inverted head and shoulders formation. The head is at $31.57 and the shoulders at $33.53 and $33.63 respectively. These formations suggest an underlying bullish momentum, indicating that investors could consider additional buying positions at the current levels.

JD Daily Chart (stockcharts.com)

Risk Factors

The Chinese economy’s less-than-expected recovery from the COVID-19 restrictions is a major risk for JD. A weak economic recovery can lead to less consumer spending, which could further hamper JD’s growth. If the economy doesn’t pick up pace in the second half of 2023 and beyond, it could continue to negatively affect JD’s stock. The Chinese government’s strict zero-COVID policies and the regulatory crackdown on large tech firms are significant risks. If these policies continue or intensify, JD may face increased operational difficulties, compliance costs, and potential fines or penalties.

Moreover, JD faces stiff competition in the domestic market, as evidenced by the aggressive price wars among its e-commerce rivals. If this competition intensifies, JD may be forced to lower prices further, thereby squeezing its margins. Also, the high growth of low-priced platforms like PDD indicates a possible shift in consumer preference towards cheaper alternatives, which poses another competitive risk for JD.

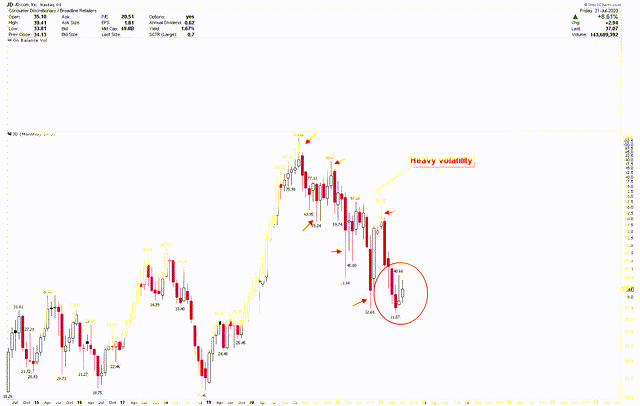

From a technical standpoint, the long-term chart does not hint at any imminent reversal. The monthly chart shown below captures the intense market volatility since the stock reached its all-time high of $104.06, creating considerable market fluctuations. While there’s a rebound from the current support level of $31.57, it does not affirm any form of strength in the market, which continues to be weak. There’s a potential for the market to rally in August and September, which may lead to some positive trends on the chart. However, should the market break below the $31.57 mark, it could further plummet toward the long-term support range of $20-$23.

JD Monthly Chart (stockcharts.com)

Bottom Line

In conclusion, the first half of 2023 has undeniably been a rough ride for JD, largely mirroring the struggles of the broader Chinese economy in the wake of COVID-19. Fierce domestic competition, regulatory pressure, macroeconomic challenges, and operational difficulties have all taken a toll on the e-commerce giant’s performance, causing its stock value to tumble significantly. Factors such as the company’s current valuation, relative stability towards the end of the first half, and the potential for an economic rebound in the latter part of the year offer some hope amidst the challenges. Furthermore, the technical aspects of the JD stock, while highlighting the recent downward trend, also suggest potential investment opportunities. The present consolidation phase suggests an increased buying interest in the market. It might be a viable strategy for investors to buy JD at its current levels for long-term investment purposes. If the price drops below the $31.57 mark, it may trigger another drop toward the $20-$23 range, which represents a strong long-term support level.

Read the full article here