Kelt Exploration Ltd. (OTCPK:KELTF) is a company that tends to grow organically. Kelt management distinguished themselves by selling to major players in the industry. Originally, Celtic Exploration was taken over by Exxon Mobil (XOM) with the new spinoff becoming Kelt Exploration. Several of my older articles, touch on these sales.

Those events give this management a credibility that a lot of smaller company managements do not have. As such, the projects this management decides to undertake deserve the attention of investors. A management with a record like this often means that chances of success are far higher than is the case for many low priced and low market value stocks in the oil and gas industry.

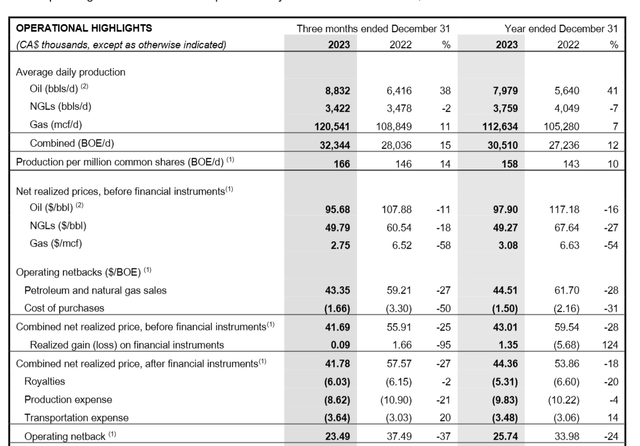

Fiscal Year 2023 Summary

(Note: This is a Canadian company that reports using Canadian dollars unless otherwise stated.)

Management did grow production despite the rather large percentage of natural gas production in the production mix and the relatively low prices of natural gas.

Kelt Exploration Fiscal Year 2023 Summary Of Financial Results (Kelt Exploration Fourth Quarter 2023, Earnings Press Release)

Probably the most important comparison in the chart above is the growth in oil production. If that growth continues (in excess of overall production growth), it will lessen the dependence upon natural gas prices in the future.

This time around, revenues, cash flow, and earnings all decreased with the price of natural gas. That may not be the case in the future. Should management succeed in increasing the percentage of oil (and likely condensate) production, this stock could be valued a lot higher in the future.

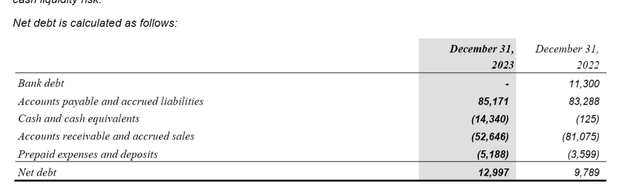

This management has a long history of growing production and selling what was developed while keeping a small amount of production to “start over.” The difference this time around is that management is not really willing to incur a lot of debt. Therefore, the organic growth will be slower than in previous cycles.

Net Debt Calculation For Kelt Exploration (Kelt Exploration Fourth Quarter 2023 Earnings Press Release)

But then again, companies with no bank debt (and no bonds outstanding) rarely get into serious trouble. The very strong balance sheet is definitely a risk reduction for investors considering this investment.

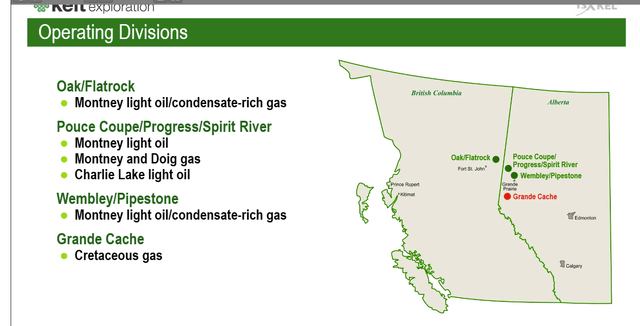

Operating Areas

Kelt operates primarily in Western Canada, where the operating conditions are considerably friendlier than is the case on the east side of the country.

Kelt Exploration Map Of Operations (Kelt Exploration Corporate Presentation March 2024)

Management has long been known for natural gas production. However, the guidance shows a continuation towards a greater percentage of oil (and likely condensate) production.

Like many Canadian companies, this company has a considerable interest in local midstream activities. That will tend to make the earnings a little less volatile than is the case for a pure upstream producer that has far less (if any) midstream exposure.

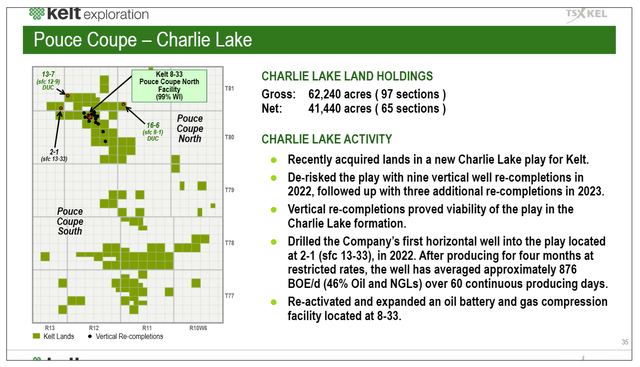

Lake Charlie

Lake Charlie appears to be a major focus area that allows the company to increase the percentage of oil produced.

Kelt Exploration New Lake Charlie Play With Preliminary Results (Kelt Exploration Corporate Presentation March 2024)

Many of the areas Kelt (and really a lot of the industry) operates in have actually been producing for a very long time. Technology improvements have allowed a “second life” to a lot of these areas.

Since many of the areas have stacked plays, there could be more growth and production opportunities as technology continues to advance. As shown above, the oil location is generally known. How to get it out of the ground is the key advance that has been made for many acreage acquisitions.

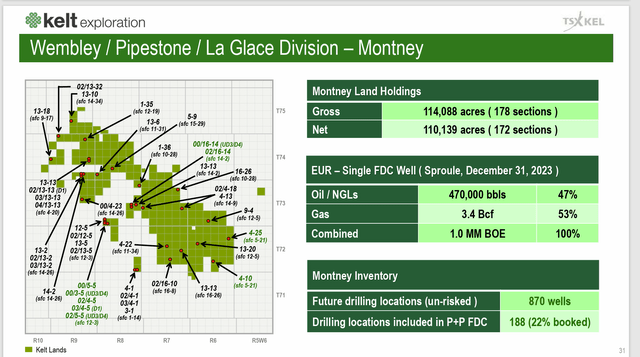

Wembley Pipestone

This is another liquids-rich area that the company has a considerable interest in. This area may actually end up commanding an outsized amount of capital.

Kelt Exploration Summary Of Wembley/Pipestone Operations (Kelt Exploration Corporate Presentation March 2024)

This actually follows a trend on the natural gas production side of the industry to increase the liquids production. Then, when natural gas prices are low, management can redirect funds to more profitable wells.

Summary Of Operations

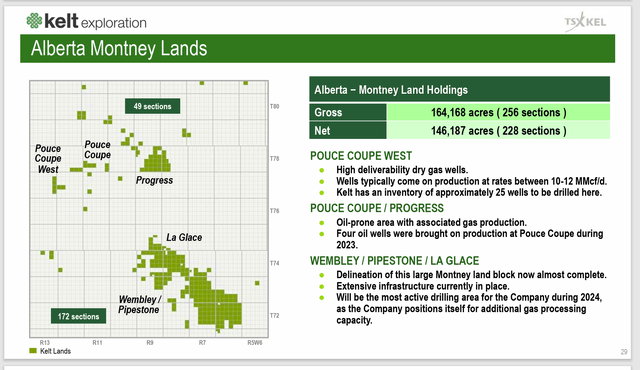

What follows is all of management’s choices as to where to direct funds depending upon industry conditions.

Kelt Exploration Alberta Holdings (Kelt Exploration Corporate Presentation March 2024)

Management does have the ability to shift capital funds to the dry gas areas of production when natural gas prices allow for sufficient profitability.

Canada has some of the lowest dry gas production costs in North America and a relatively weak Canadian dollar as advantages.

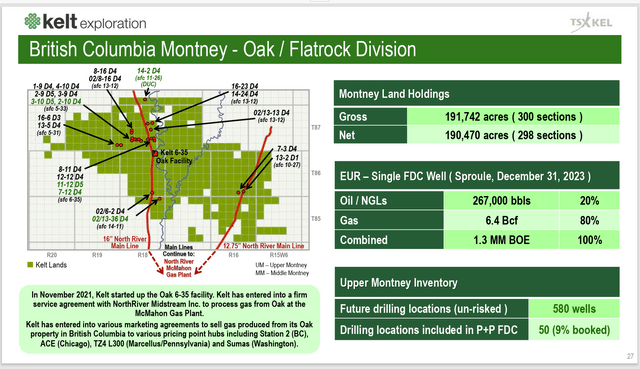

Kelt Exploration British Columbia Summary Of Operations (Kelt Exploration Corporate Presentation March 2024)

These natural gas properties will likely not be able to command more than maintenance capital under current market conditions.

However, Canada has Spring Breakup which often causes operations to shut-down until sometime in the third quarter. Management can use that time to reassess the situation. Sometimes that makes a difference because the industry is very low visibility and very volatile.

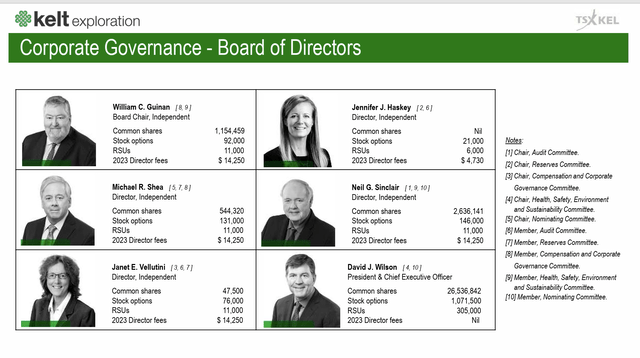

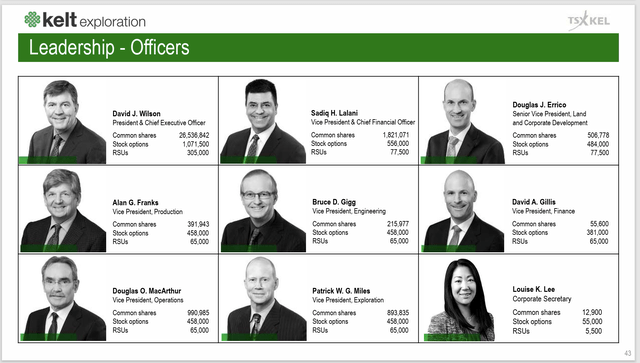

Insider Holdings

This company has an unusually large percentage of insider ownership. This may mean that insiders in practical terms control the company. But it likely also means that management and the board are aligned with current shareholders.

Kelt Exploration Board Of Directors Common Share Ownership (Kelt Exploration Corporate Presentation March 2024) Kelt Exploration Senior Management Common Stock Ownership (Kelt Exploration Corporate Presentation March 2024)

In total, management and directors control 18% to 20% of the outstanding shares. That is a big enough block to enable those insiders to largely control the company. It is not 50% of the potential votes by any means. But it clearly raises the bar for a raider to be successful.

Summary

This small company has a lot more going for it than is the case with many competitors. This is not one of the cheaper companies that I follow. But it is one of the smaller companies that is more likely to succeed. Maybe the current price is less of a bargain, but the management experience makes up for it.

Further risk reduction is obtained with that largely debt-free balance sheet. Companies that have experienced management combined with no bank debt (or bonds outstanding) rarely get into serious trouble.

That means this little company may appeal to a wider variety of investors because of the management experience and the debt-free balance sheet. Company size is not the only thing that reduces investment risk.

Kelt Exploration Ltd. management will likely continue to build the company until it can be sold for a decent profit. At that point, the history of this management indicates that they will again build another company.

Kelt Exploration Ltd. stock is a buy for a wide variety of investors as a result. The odds favor this investment treating investors well from the current price over the long term.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here