Investment Thesis

Lamb Weston Holdings, Inc. (NYSE:LW) has good medium- to long-term growth prospects. The company’s revenue should benefit from the non-recurrence of one-time ERP headwinds that the company faced in Q3 FY24. Further, as the company wins back its customers lost due to these headwinds over the coming quarters, the volume should sequentially improve. This, coupled with easier comps should help the company return to Y/Y growth in the 2HFY25. Moreover, capacity expansion, improving revenue mix, and resilient demand for the fries category should support the company’s sales in the long term. So, while the company has faced headwinds in the last quarter, I am optimistic about its growth prospects moving forward.

On the margin front, the company should benefit from moderating potato prices, the carryover impact of price increases previously taken, cost synergies through the integration of the Lamb Weston/Meijer EMEA acquisition, and non-recurrence of one-time cost headwinds related to ERP disruptions and inventory write-offs taken in FY2024. The stock is currently trading at a significant discount to its historical averages. Given the good growth prospects ahead, I have a buy rating on the stock.

Lamb Weston’s Revenue Analysis and Outlook

I last covered Lamb Weston in December 2023. I liked the company’s execution and noted that despite lower guest traffic in the restaurant sector over the past year, Lamb Weston has been able to deliver good sales growth benefiting from resilient demand for the French fries category in the end market, international expansion through acquisitions, and price increases taken to offset inflationary costs.

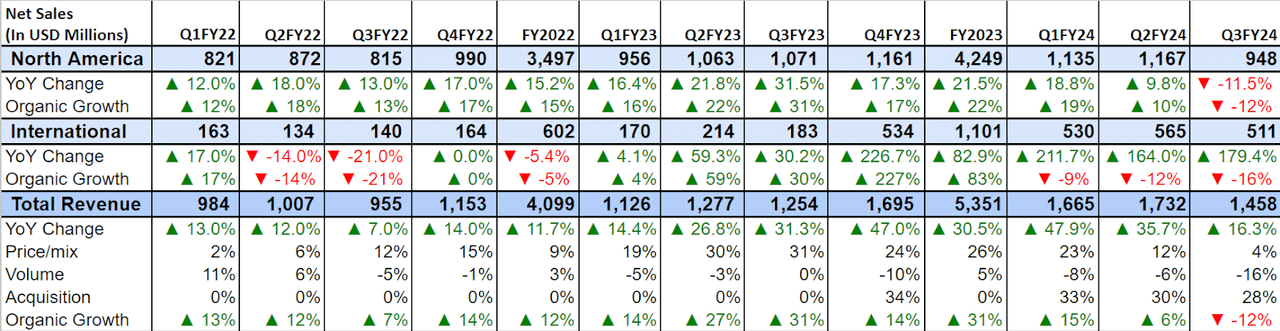

In the third quarter of fiscal 2024, while these dynamics continued, the company faced significant headwinds from supply chain disruptions due to its ERP transition. This disruption resulted in the unfulfillment of orders and impacted volumes. In addition, volumes were also impacted by lower restaurant traffic due to inflationary pressure and headwinds from the divestiture of lower-performing businesses in the previous year. However, these headwinds were offset by significant contributions from Lamb-Weston/Meijer JV acquisition and carryover price increases. As a result, net sales increased 16% Y/Y to $1.45 billion. Excluding a 28 percentage point benefit from acquisitions, organic sales declined 12% Y/Y, reflecting a 16 percentage point headwind from lower volume partially offset by a 4 percentage point benefit from carryover pricing.

On a segment basis, the North American segment’s sales declined by 11.5% Y/Y due to lower volumes associated with supply disruptions due to ERP transitions, lower restaurant traffic, and the carryover impact of the exit of lower-performing businesses in the previous year. This was partially offset by carryover price increases. In the international segment, sales grew 179% Y/Y as a result of healthy contributions from Lamb-Weston/Meijer acquisitions in the EMEA region. Excluding the benefit from acquisitions, sales declined 16% Y/Y due to carryover impact from the exit of low-performing businesses in the previous year, and unfilled customer orders due to export disruptions from the North American ERP transition.

LW’s Historical Sales (Company Data, GS Analytics Research)

Looking forward, the company’s revenue outlook is positive. The company’s sales were impacted by one-time ERP-related headwinds last quarter which significantly impacted its Q3 FY24 performance. However, the non-recurrence of these items should support sequential revenue improvement in the coming quarters. During the last earnings call, management mentioned that the order fulfillment issues caused by the ERP transitions have been resolved and service levels have returned to pre-transition norms. So, the sales disruptions are largely behind the company.

The company is focusing on regaining customers lost during the ERP transition which should pave the way for a steady recovery in sales, especially in the second half of FY25 when the company laps these one-time headwinds.

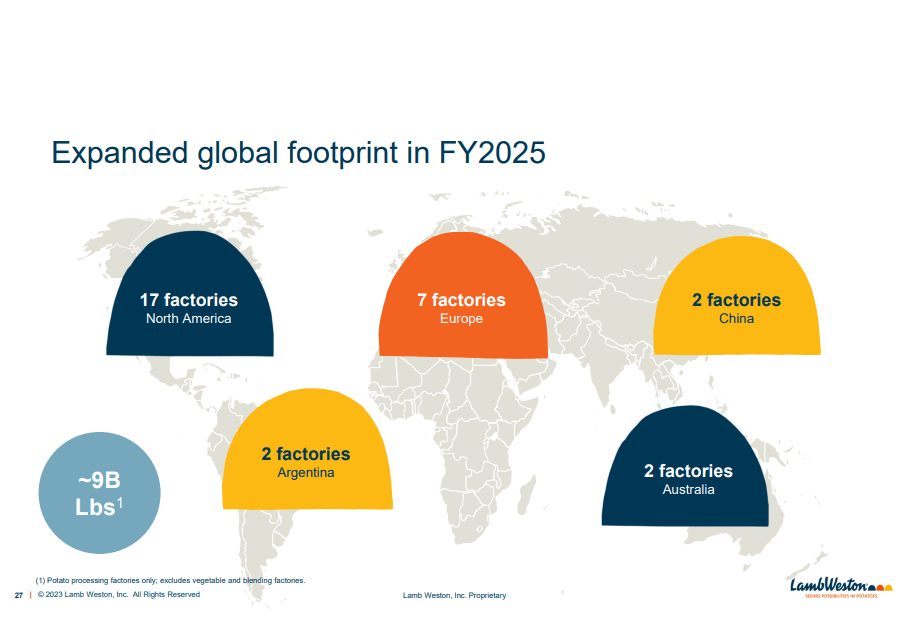

Additionally, Lamb Weston’s ongoing capacity expansion projects should also help in growing revenue in the coming quarters. The company is investing in new facilities in Idaho, the Netherlands, and Argentina which should increase its production capacity and enable it to offer more premium products. As these projects come online in FY25, they should help the company’s revenue through an improved product mix and higher volumes.

LW’s Capacity Expansion (LW’s October 2023 Investor Day Presentation slide)

I also expect the demand for fries to remain resilient despite inflationary headwinds impacting restaurant traffic. In order to attract traffic, I expect the company’s major quick-service restaurant customers to introduce value offerings that heavily feature fries. This should support Lamb Weston’s sales. On its last earnings call, management noted that while restaurant traffic has been impacted by higher menu prices, the fry attachment rates have remained consistent, indicating positive core product demand for the company.

Lamb Weston’s Margin Analysis and Outlook

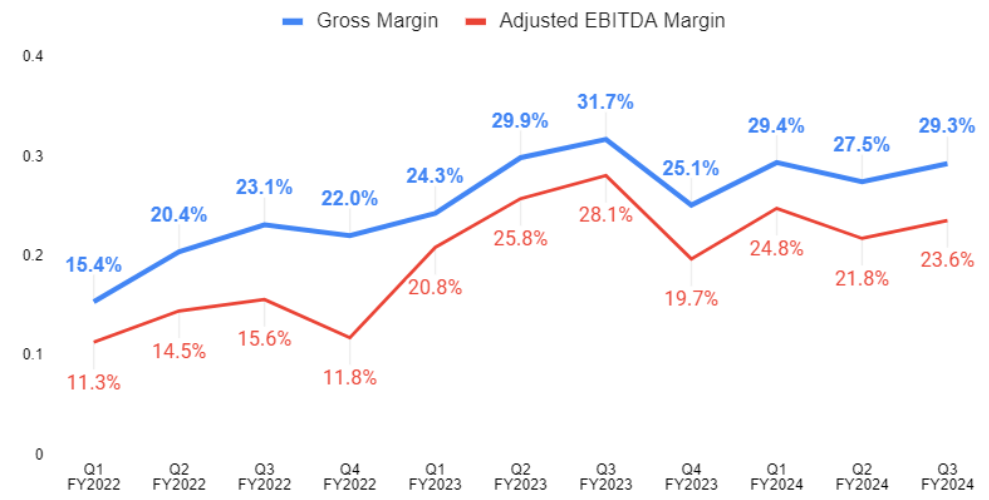

In the third quarter of fiscal 2024, the company’s margins benefited from price increases, lower transportation costs, and cost synergies through Lamb-Weston/Meijer acquisitions. However, these benefits were offset by inflationary raw material costs, and volume deleverage due to the ERP transition as well as incremental costs associated with it. As a result, the gross margin declined by 240 bps Y/Y to 29.3% and the adjusted EBITDA margin declined by 450 bps Y/Y to 23.6%.

LW’s Historical Gross Margin and Adjusted EBITDA Margin (Company Data, GS Analytics Research)

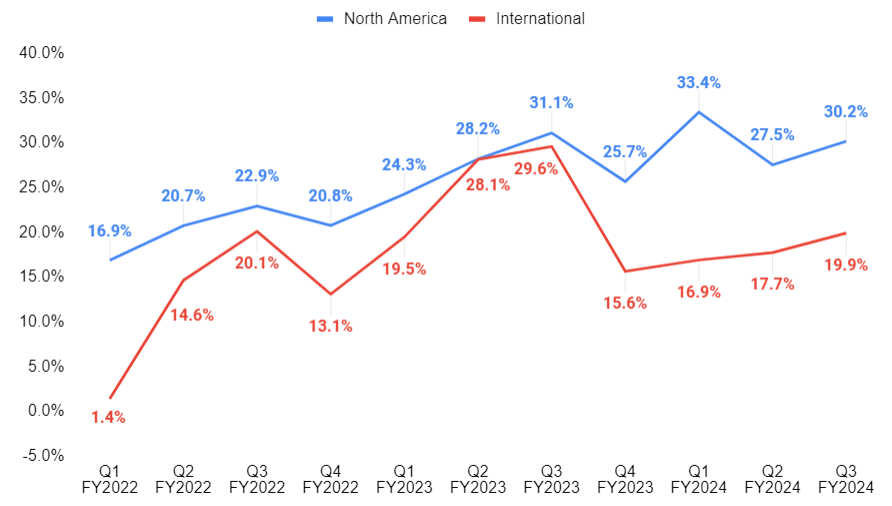

On a segment basis, the North American segment’s adjusted EBITDA margin declined 140 bps due to inflationary raw material costs, volume deleverage, and incremental costs associated with ERP transition. This was partially offset by carryover pricing benefits. The International segment’s adjusted EBITDA margin declined 970 bps Y/Y due to volume deleverage from lower organic sales. This was partially offset by cost synergies from the Lamb-Weston/Meijer acquisition.

LW’s Historical Segment-wise Adjusted EBITDA Margin (Company Data, GS Analytics Research)

Looking forward, I am optimistic about Lamb Weston’s margin outlook. The company should benefit from cost synergies from the full integration of the Lamb-Weston/Meijer JV in Europe. Further, the non-recurrence of several one-time costs that impacted the results in the last one-year like ERP disruptions and inventory write-offs should also help margins moving forward.

Additionally, the company is expanding its capacity to produce more premium products which should improve the overall margin mix. The company has also exited several lower-margin businesses in FY23 and I expect portfolio action to continue helping the overall margin mix.

Moreover, while the company expects inflationary costs to persist, its core raw material potato is currently experiencing Y/Y deflation. Management in the Q3 FY24 earnings call also commented that they expect favorable potato prices in the coming year. This should result in less of a drag from inflationary pressure on margins.

Also, sequential volume recovery over the coming quarters should help the company’s margins as it benefits from operating leverage.

Valuation and Conclusion

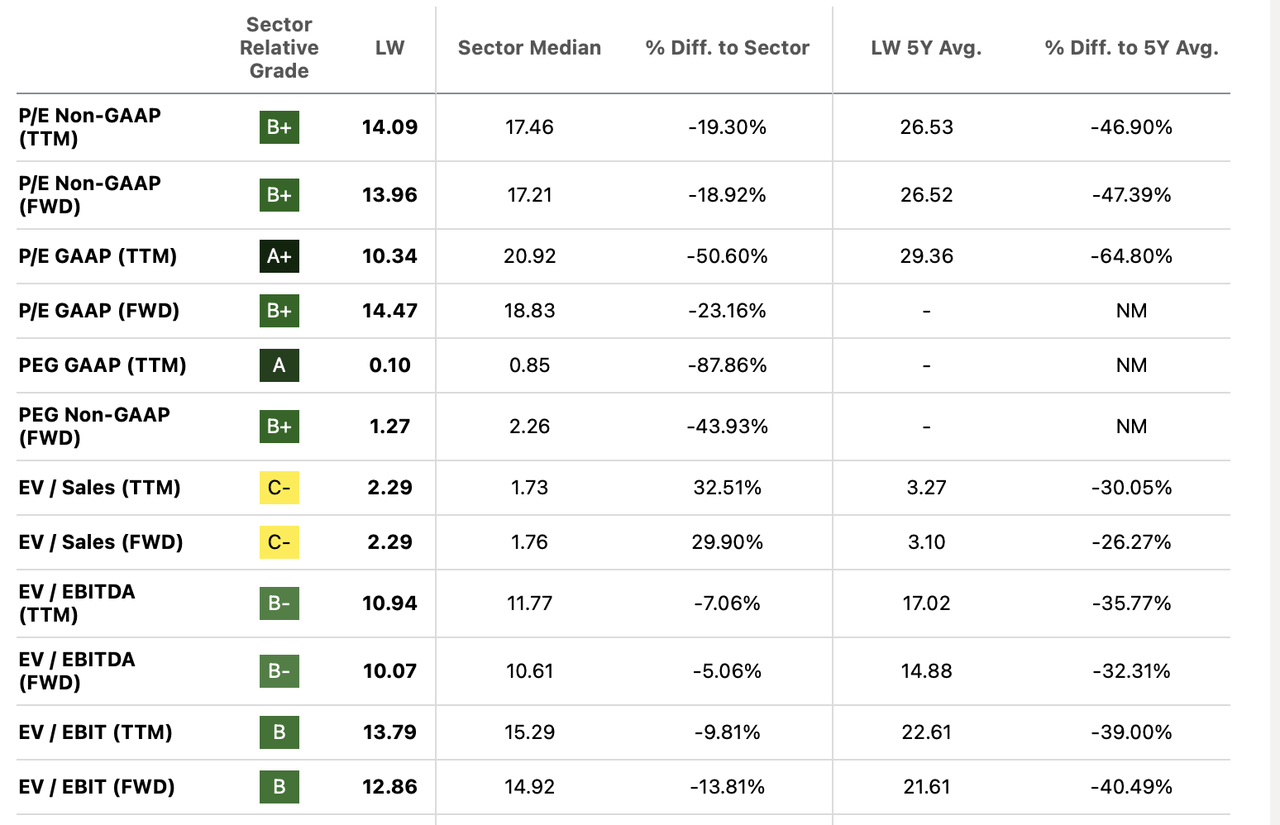

Lamb Weston is currently trading at 13.96x FY24 consensus EPS estimates of $5.55 and at 12.65x FY25 consensus EPS estimate of $6.12 which is at a significant discount to its historical five-year average P/E forward of 26.52x. It is also available at a discount versus the sector median and historical levels on EV/EBITDA and EV/EBIT basis.

LW Valuation Metrics ( Seeking Alpha)

I believe this lower-than-historical valuation is due to investor concerns about lower restaurant traffic and loss of market share related to customers going away due to the disruption related to the ERP transition. Prior to the Q3 FY24 results, the stock was trading at over $100 versus the current stock price of around $77.48. I understand investors reaction due to ERP headwinds that the company faced last quarter but after this stock price correction, these concerns seem to be already reflected in the price. Further, this was one-time in nature and revenues should start sequentially improving in the coming quarters. The company is set to report its Q4 FY24 results on July 24th and I believe any sequential improvement and positive commentary around revenue growth recovery can act as a catalyst for the stock and result in valuation multiple re-rating. Hence, Lamb Weston offers a good investment opportunity and I rate the stock a buy.

Risks

-

The company’s end markets are seeing lower demand due to lower guest traffic in an inflationary environment. I expect French fries as a category to remain resilient as restaurants are likely to to focus on value offerings which usually are heavy on French fries. However, if that doesn’t turn out to be the case, it could drag sales.

-

Any delay in winning back lost customers could impact investor sentiments.

-

Any disruptions similar to what we saw in Q3FY24 during future ERP roll-outs could negatively impact growth.

Takeaway

In my view, Lamb Weston offers a good long-term investment opportunity. The company’s stock has corrected significantly after disappointing Q3 FY23 results, making valuations attractive. The concerns around lower demand due to lower guest traffic in the restaurant sector and recent customer losses due to ERP headwinds explain the lower-than-historical P/E. However, I believe these concerns are already baked in, and moving forward, the company’s growth prospects look positive. The demand for the company’s core product French fries remains resilient despite a lower traffic trend in the restaurant sector and major QSR customers are offering value meals that heavily feature French fries. This should help in volume recovery. In addition, the non-recurrence of one-time disruptions caused by ERP transition, capacity expansions in high-growth markets, and improving product mix should also boost sales. Margins are also expected to grow thanks to acquisition cost synergies, moderating inflation, and improving product mix.

Moreover, the consensus is estimating a low double-digit EPS growth for the company’s FY25. These positives should eliminate any further downside in the stock price. As the company recovers its revenue in the coming year and wins back its lost customers, we should see an increase in stock price and P/E should re-rate. So, I believe the stock provides an attractive entry point and hence I have a buy rating on the stock.

Read the full article here