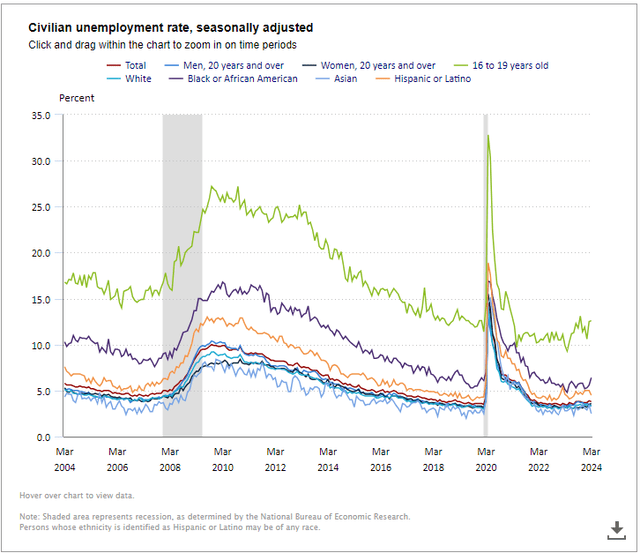

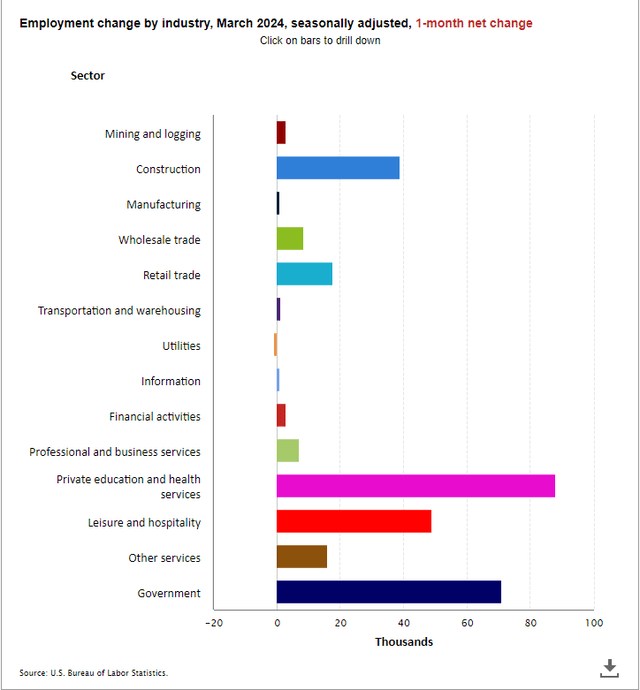

The March jobs report came in at 303,000, which was significantly more than expected. Initial expectations had been for 200,000 jobs and FOMC hawks have been talking about no cuts this year, yet markets rallied. While the market initially sold off, it recovered shortly after the report. The headline unemployment number came down from 3.9% to 3.8%. Overall, the report was very hot, but the job gains were concentrated in a few sectors.

The report means the many quarters of incredible strength in America’s labor market is hardily intact. The last report was hot as well – with the number coming in at 275,000 on expectations of 198,000. Yet the market is not concerned about hikes, and the economy is proving it can handle rates at the current levels.

BLS

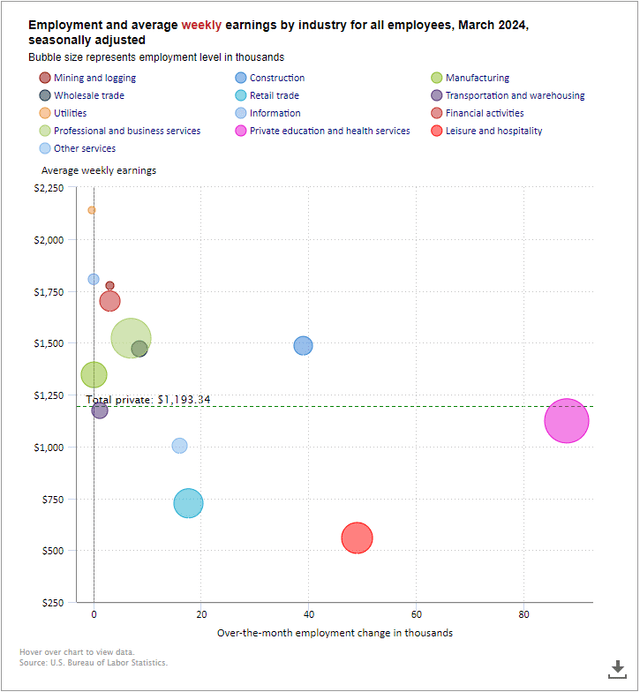

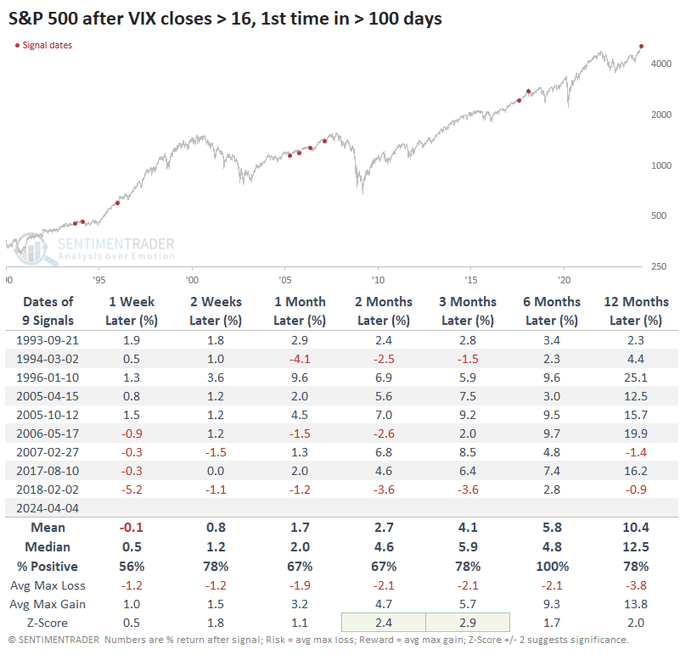

The closely watched Average Hourly Earnings came in at 0.3% month-over-month. Annual wage growth was the slowest in three years, which helped alleviate any inflation concerns. One mitigating factor, for instance, is that some areas of job strength like Leisure and Hospitality have far lower average weekly earnings than other areas of the labor economy. The bottom line was this – it’s very bullish that after a massive sell-off like yesterday with a 14% VIX spike the market responded as well as it has to such an upside surprise on jobs. This was a positive report despite the blowout.

- Wage pressures continuing to slow, which means the inflationary concerns are mitigated compared to labor market strength with increasing wage pressures.

- The Labor Force Participation Rate had a nice tick-up.

- The strong labor market is helping American consumers continue to weather economic obstacles like high interest rates.

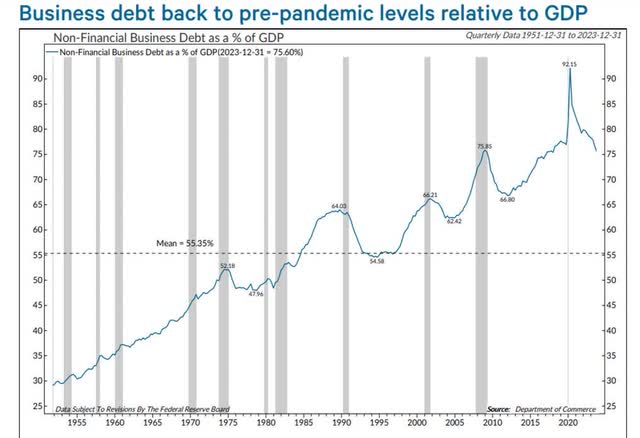

- The strong labor market is happening as American businesses are de-leveraging on an aggregate level.

Bureau of Labor Statistics

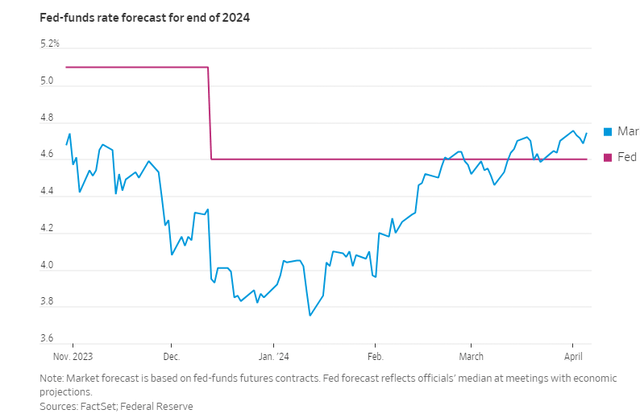

Markets sold off yesterday ostensibly because of Fed commentary and increasing tensions in the Middle East. However, even despite a very hot number that overshot by around 50%, the market was able to rally. The Fed commentary from FOMC members like Neel Kashkari who said, “If we continue to see inflation moving sideways, then that would make me question whether we need to do those rate cuts at all.” Recent developments have been casting dispersion on the recently empowered FOMC doves.

- Gold and silver have been spiking in the Middle East and other geopolitical concerns.

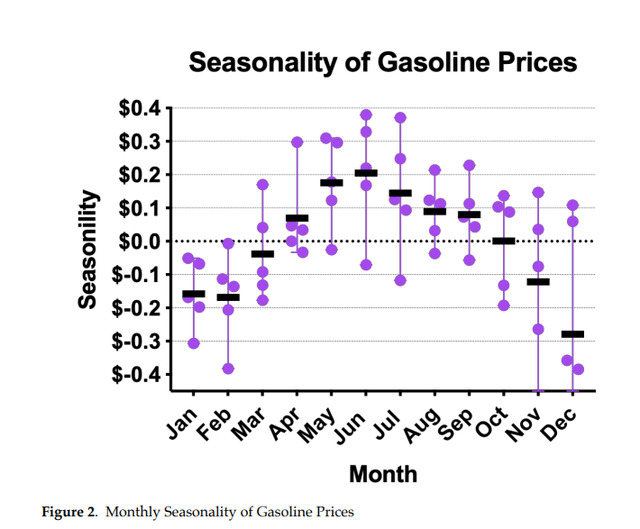

- Oil reached recent local highs, partially probably due to seasonality, and partially because of Middle East concerns as well.

- Wars can be thought of as an effective trade barrier that raises costs, and thus having three major hot spots on the globe that represent potential geopolitical conflagrations is potentially highly inflationary.

- Shelter and services inflation has been particularly sticky, but appears to be lagging and coming down. Still, many inflation hawks have more than enough reason to be spreading anxiety.

Comments from Kashkari and others on the FOMC brought doubts that as many cuts will come this year after Powell made an unusually dovish appearance at the FOMC. It would appear the hawks have struck back. But if they did, it wasn’t very effective, as the market is rallying in the face of a white-hot jobs number.

WSJ

After the apprehension around yesterday’s sell-off and the hot jobs report this morning, markets are now implying that the Fed’s projection for three rate cuts that it gave at the FOMC meeting was too dovish. The market now expects one or two cuts. In my estimation, this is largely overdone and will ultimately be proven incorrect.

I think the OER measurement of shelter will provide some needed relief in the coming readings, even if some seasonal upticks in inflation tick up. Remember too, Powell acknowledged at the last FOMC meeting that some noise was likely in the data, but his confidence in the ultimate path to the Fed’s target was unshaken. Under the hood of the jobs report, it’s frankly not very inflationary, but also the strength in the economy is matching declining inflation expectations.

Bureau of Labor Statistics

The other thing is, that despite a sour mood among consumers, their wages are still growing faster than inflation. This is a very positive trend for the economy and suggests the consumer can continue chugging along because of countervailing currents in the economy. The fabled soft landing is occurring, and the situation remains analogous to what I observed after the February Jobs Report.

This is incredibly bullish, and the continued strength in the economy is allowing for some pretty incredible things to go on in the economy that suggests those who have been calling for the elusive recession will continue to be wrong for the foreseeable future, absent some unforeseen external catalyst that is currently affecting markets.

Why? Because normally in an economic expansion as robust as we’ve seen in the wake of COVID-19 you would have a situation where businesses are taking more risk, taking more debt, and eventually building up the over-optimism that leads to financial crises and bankruptcies. As you can see above, the financial condition of US consumers is not appearing over-leveraged.

Department of Commerce

Furthermore, and perhaps even more importantly businesses have been able to de-leverage during this incredible economic boom. All else being equal, this means one of the primary mechanisms for delaying or reversing economic growth, a credit event, should be delayed. It’s a good environment for economic strength to continue in, and the best labor market in a generation appears slated to continue.

Risks and Where I Could Be Wrong

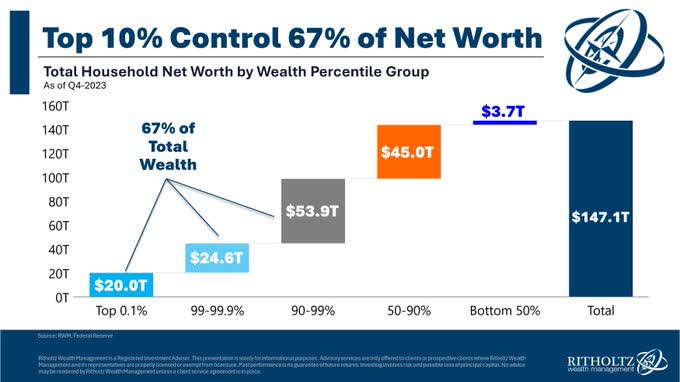

The bears have a lot of legitimate reasons to be concerned, but I worked for the great Tom Lee and learned to show equanimity when the data supports equanimity. And I always like to remember that markets are experts at climbing a wall of worry. Still, I cannot predict the future better than anyone else, and there are several risks stalking the market. One of the biggest direct risks to economic activity is rising gas prices. One of the reasons this is such a risk is because wealth is so concentrated in the United States and we live in a consumer-driven economy.

Ritholtz Wealth Management

So, on the one hand, this is a positive. The spending power of the wealthy and their lack of sensitivity to rates enables the economy to be more resilient than it might have been in previous cycles, but it also means if energy hits with a vengeance the reversal of fortune could be swift and sudden since the average US consumer control so little wealth and is unable to weather financial shocks very well.

AgManager.Info

The normal seasonality of gas prices already is picking up, so additional upward price pressure has the potential to be especially derailing to economic growth. So, because the current catalyst driving gas prices upward is primarily geopolitical at this point, there’s also the potential that it quickly reverses. Israel appears to be showing penance for recent strikes that killed foreign aid workers.

President Biden has ratcheted up pressure to previously unthinkable levels due to the recalcitrance of Benjamin Netanyahu in the face of increasingly potent requests from his primary strategic patron. I think the highest probability course is that geopolitical tensions decline from current levels, despite a reasonably high chance that they do not. I think favorable seasonal factors and the beginning of earnings season likely mean that markets can rally in the face of many risks.

- Escalation of geopolitical risks in China, Ukraine, or the Middle East.

- Fed policy error.

- The banking crisis worsens.

- Return of inflation.

- CRE meltdown.

- Write-downs of private assets.

Any of the above risks could derail the rally and cause skinned knees and tears, but the economy is very strong and doesn’t appear vulnerable to financial stability risks compared to previous periods. As I stated in previous pieces, the soft landing is in the process of occurring.

Conclusion

Worldly wisdom teaches that it is better for reputation to fail conventionally than to succeed unconventionally. – John Maynard Keynes.

Ultimately, the jobs report shows that the economy is strong, but that inflationary pressures from the labor market are alleviating. Increased participation is also a positive. There’s a lot of pessimism in the market, but most of it is first-order thought as far as I can tell. Inflation expectations are still going down and the danger of an inflationary spiral appears remote from our current vantage point.

Sentiment Trader

There have been ample predictions of recession and the bears have been accusing the rally of all the sins in the book, yet we are just off all-time highs, and yesterday’s volatility event seems like a healthy sell-off given how the market responded to today’s higher-than-expected jobs numbers. Currently, I still believe that we will get at least three cuts this year. Furthermore, as you can see above the implications of yesterday’s large VIX spike might be somewhat counterintuitive, it actually suggests there are gains ahead.

Read the full article here