Instead of an investment thesis

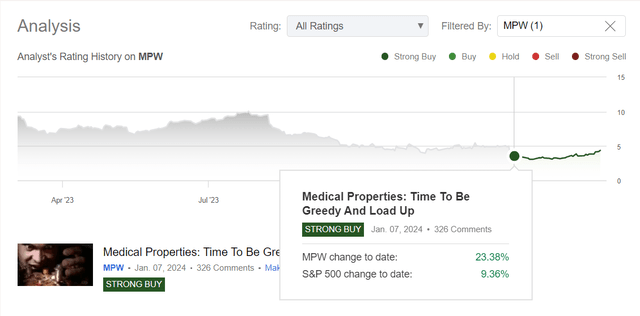

I initiated coverage of Medical Properties Trust, Inc. (NYSE:MPW) stock 2 months ago and since then, my strongly bullish view has been successful – MPW is up 23.3% compared to the S&P 500 Index return of 9.36% since January 7th. So basically, my ‘Strong Buy’ call outperformed the broader market index by a factor of ~2x.

Seeking Alpha, Oakoff’s article on MWP

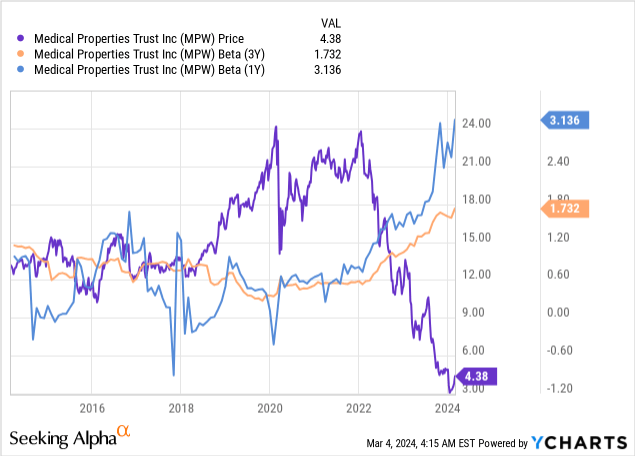

Of course, MPW’s beta measures of 1.723 (3-year data, YCharts) and 3.136 (1-year data, YCharts) may explain the larger move in an upward market.

Although when moving away for long time frames above MPW looks like bottoming out steal today, I have decided to downgrade the stock to “Hold” given the uncertainties and the technical setup that is currently unfolding.

My Reasoning

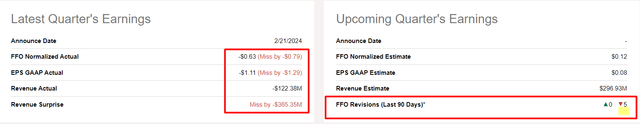

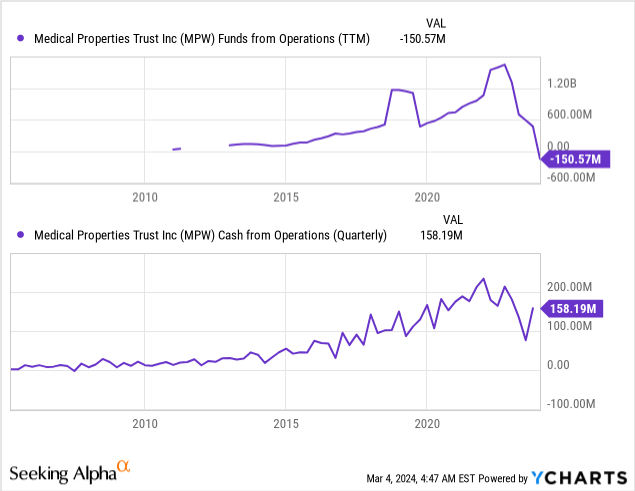

In Q4 FY2024, Medical Properties reported a net loss of $1.11 per share and normalized FFO of -$0.63 per share, significantly missing the consensus estimates.

Seeking Alpha, Oakoff’s notes

According to the management’s commentary, these weak numbers were affected by various issues, including significant charges of ~$770 million related to problems with Steward. The company changed the way it accounts for Steward’s finances from January 1, 2024, resulting in adjustments to rental reserves and other areas – hence the large discrepancy between what analysts expected and what happened.

As detailed in our press release this morning, we have moved Steward in prospect to cash basis accounting and divided our portfolio into two categories. Our hope is that this split will make it easier for investors to track the performance of our stabilized portfolio, which consists of more than $11 billion of assets and is accounted for using the accrual method.

-Source: Q4 2023 earnings call

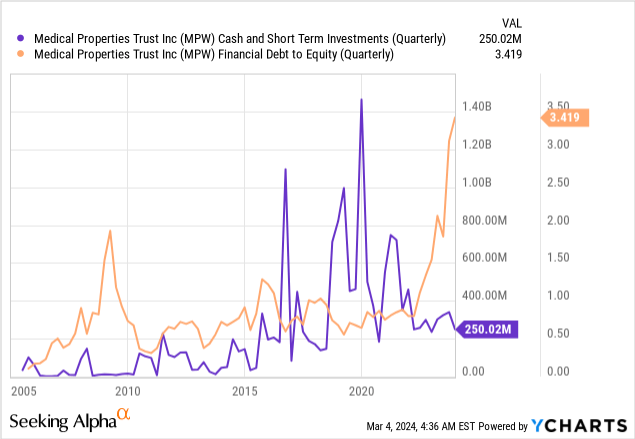

MPW ended FY2023 with $250 million cash, which is significantly less compared to the average balance of the past few years. They sold 4 Australian facilities for $305 million and agreed to deals worth $480 million, including selling hospitals to Prime. They’re also working on more sales to hit their target of $2 billion in extra cash for 2024, based on what I read from the earnings transcript. But so far, the progress has hardly been noticeable: the company’s leverage has continued its lightning-fast upward trajectory.

Cash flows from operations improved to ~$158.2 million, but since we’re dealing with a REIT, we need to look at FFO – and it’s falling like a rock:

In response to analysts’ questions about whether Steward will be able to pay its bills in the future (to date, there’s a shortfall since October 2023), MPW asserts that the company is implementing aggressive asset repositioning and monetization strategies to strengthen Steward’s finances. So far, however, we haven’t really seen anything positive – at least I haven’t.

On the contrary, everything now looks unfavorable for a continuation of the relief rally we have seen in MPW stock over the last 2 months.

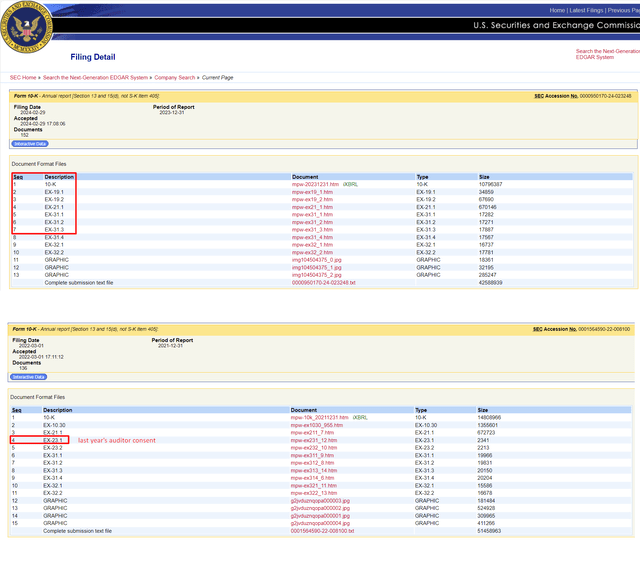

I picked up on another red flag, revealed by Viceroy Research last week – MPW has not received an auditor’s consent (its 2023 10-K was published without it) like they did in previous years.

![@HedgeyeREITs, X [ex-Twitter]](https://wikiwake.com/wp-content/uploads/2024/03/53838465-17095464542989616.png)

@HedgeyeREITs, X [ex-Twitter]

I double-checked that information and found out that indeed, MPW’s 10-K supporting files in the EDGAR system look exactly like it’s shown above. Just compare the content of the database for 2022 and 2023 and you’ll see what’s missing.

EDGAR System, Oakoff’s notes

MPW’s 10-K report for 2022 included a document titled “EX-23.1” that contains the required auditor’s consent. However, it is not provided for the 2023 10-K.

Important note: I attempted to contact MPW’s IR department of MPW about the absence of the auditor consent filing, but have not received a reply.

I believe that the lack of the auditor consent filing should raise concerns among investors about the accuracy and reliability of the financial information presented in the 10-K.

MPW’s relatively small market capitalization (~$2.6 billion) makes it, in my opinion, less effective in terms of dissemination and primary influence of public information on the stock price. I mean, not all small caps are ineffective in terms of disseminating public information, but size does matter here, and in very many cases new information is priced in with a delay. Therefore, I fear that there could be a further selloff once more investors understand that MPW’s 10-K was issued without the auditor’s consent. So for those investors who picked up shares of MPW near the bottom, I think it’s logical to book some profits today (in case he or she bought MPW speculatively and continues to hold the position as I did).

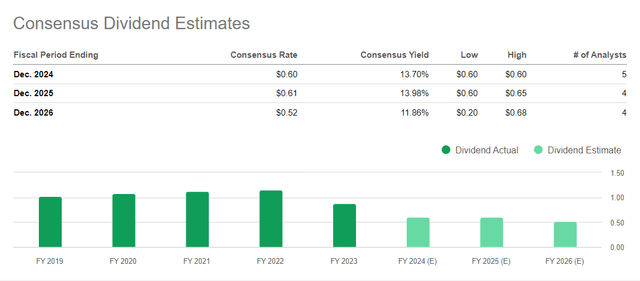

The other risk lies in the priced-in improvement in the company’s financial condition: the market expects double-digit dividend yields for the next 3 years and a slight deterioration in the payout in E2026 (but without major cuts). I don’t believe that MPW’s dividend is safe or that it is unlikely to be cut – at least at this stage it looks like something that is far from the truth, given the FFO dynamics and the excessive leverage.

Seeking Alpha, MPW’s dividend estimates

The technicals also don’t promise anything but a challenge ahead. I’m not much of a technical analysis expert, but looking at the anchored volume weighted average price (AVWAP), MPW is now approaching the inflection point where institutional investors, aka ‘smart-money’, might start selling again.

TrendSpider Software, Oakoff’s notes

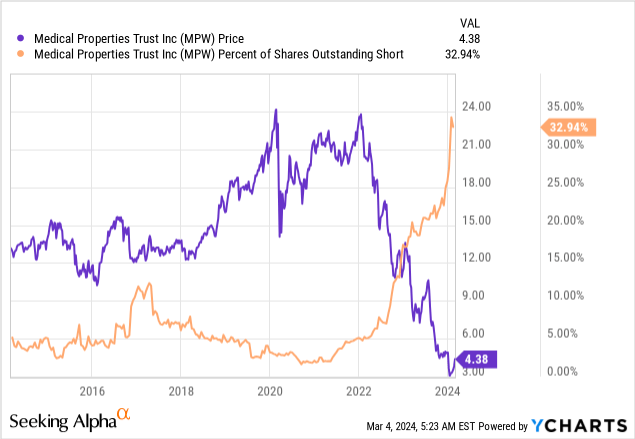

On the other hand, MPW’s short interest is still very high – moreover, we are now at almost 33%, which has never been the case in the company’s public history.

The “fuel” from short sellers who may be forced to close their positions could be enough to run even higher before my fears come true.

Your Takeaway

As a brief conclusion to my downgrade today: although MPW looks like an oversold and over-shorted stock, its medium-term downward momentum is influenced by the risks that are reasonably assigned to the company.

Hoping for recovery growth now, when MPW’s 10-K lacks auditor’s consent (PWC has been auditing MPW since 2008), and Wall Street analysts are predicting the relative stability of the dividend, seems too bold to me. I’m not willing to take that much risk, so I’m going to reduce some of my profitable position today and move the sell-stop order of the remaining portion to about breakeven. I recommend anyone still holding MPW to do the same. But make sure to do your own due diligence first.

Since I am not liquidating the entire position, but only trimming it, I’m downgrading MPW from “Strong Buy” to “Hold” today.

Good luck with your investments and trades!

Read the full article here