The last few weeks have been a really interesting time for shareholders of Medical Properties Trust (NYSE:MPW). The company, which operates as a REIT that owns and leases out medical properties for other firms to run, saw its shares spike after the market closed on April 12th. That move higher, about 12.3% as I type this, was driven by a rather significant update that should allow the company to pay down a nice chunk of its debt. If this move higher holds, it will mean that shares will be up 28.8% since I last wrote about the firm, rating it a ‘strong buy’, back in January of this year. At the end of the day, this reduces the risk for shareholders who are worried about the company’s condition, especially in light of the trouble that its largest tenant, Steward Health Care faces.

I have long been a fan of Medical Properties Trust. My overall track record in recent years when it comes to investing has been quite solid. But it has been one of two companies in my portfolio that has been problematic. I initially started buying shares in early 2022 at a price of $18.55. But as the stock dropped, I loaded up on it, eventually bringing my weighted average purchase price down to $5.79. With shares at $4.50 after the market closed on April 12th, I am still underwater. However, I am also now within striking distance of breaking even. But that’s not my objective.

At the end of the day, I firmly believe that shares are worth at least $8 as things stand. This is based on taking the company’s book value of equity and stripping out non-controlling interests, intangible lease assets, straight-line rent receivables, and ‘other assets’ that consist of certain derivatives, prepaid costs, etc…), and then applying a 10% margin of safety to the equation. This is based on the idea of stripping out the assets that would be most likely to be worth little to nothing should matters really go south. Technically, it’s about $8.27, but I round it down to be safe. And if the company can continue to improve its financial condition and can solve the problems that Steward brings to the table, I wouldn’t be surprised to see the stock higher. In the meantime, investors get an effective yield of about 13.3%, which is difficult to come by even in this environment. All combined, these developments makes me feel confident in the ‘strong buy’ rating I assigned the stock in the past that I have maintained through the present day.

Important developments

There have been three key developments, as well as one smaller and expected development, worth mentioning when it comes to Medical Properties Trust. The most significant of these, at least from what data is currently public, came out on April 12th. After the market closed, the management team at the business announced that they have sold off the company’s interest in five hospitals that it owns in Utah. The buyer is a joint venture set up between it and a firm that the company describes as ‘a leading multi strategy, multibillion dollar institutional asset manager with a proven track record in real estate investments’.

Author – SEC EDGAR Data

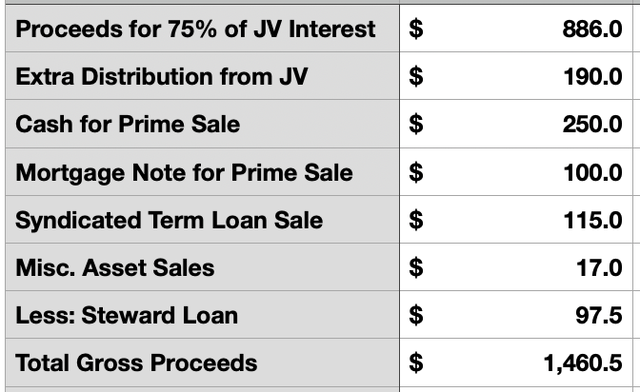

As part of the deal, Medical Properties Trust will retain a 25% ownership interest in the joint venture. And in exchange for the other 75% ownership of these assets, it is receiving $886 million. This is important because, as management stated, this fully validates the company’s underwritten lease base of roughly $1.2 billion. To be precise, it should be $1.18 billion. Also as part of the deal, the joint venture is taking out a new non-recourse secured loan and allocating $190 million of that amount toward Medical Properties Trust, bringing total gross proceeds up to just under $1.08 billion.

Already, management has plans for this capital. For starters, they intend to pay down and Australian term loan that is supposed to come due this year. In the press release, management said that this amounts to roughly $300 million. However, as of the end of the 2023 fiscal year, it totaled about $320.2 million. For the purpose of this analysis, I will be more conservative and use the year end results from last year. Unfortunately, this bears an interest rate of only 2.85%. But that’s still about $9.1 million in interest savings annually. While the company did say that it could use some of the funds for general corporate purposes, it’s heavily hinted that the rest of the proceeds will be allocated toward paying down its revolving credit facility. In all, the company had $1.51 billion outstanding under that as of the end of last year. And at the time, it had an interest rate of 5.9%.

What’s really exciting about this development is that total liquidity from asset sales year to date come out to approximately $1.6 billion. That’s 80% of the $2 billion target that management has been aiming for this year. This brings us to some of the other developments. But before I get to the other significant ones, I’ll touch on the minor expected development. Also after the market closed on April 12th, management announced that they were paying out their regular quarterly dividend. This amounts to $0.15 per share, or $0.60 per share each year. Given the after hours trading price of the firm, we are looking at a 13.3% yield as things stand. I don’t expect to see the distribution increased this year. But I wouldn’t be surprised if, by this time next year, the company is talking about increasing the payout.

Just a few days earlier, on April 9th, management announced that they had completed another asset sale. This involved 5 facilities split between California and New Jersey. The buyer ended up being Prime Healthcare and the purchase price was $350 million. If this sounds like deja vu, you might have read the company’s annual report. Because it was disclosed that this transaction was on the table. Specifics, however, did not come out until the other day. What we did know at the time was that the deal would involve $250 million that would be paid in cash. The other $100 million would be an interest-bearing mortgage note that will come due in nine months. What we also understood was that the buyer agreed to a new 20-year master lease for the other four hospitals that were leased to the company, with annual escalators of between 2% and 4%.

This transaction also includes with it an option for Prime to buy up the properties in exchange for $260 million. However, if the buyer ultimately decides to do this on or before August 26th of 2028, they will receive a discount, with a total purchase price of $238 million instead. Not counting this potential purchase but counting the $100 million mortgage note, we are looking at $1.43 billion in cash, before costs, coming Medical Properties Trust’s way. However, there are some other adjustments that need to be factored in before we can see the total impact on net debt. Digging into the company’s annual report, for instance, we see that, following the end of the 2023 fiscal year, Medical Properties Trust sold off a syndicated term loan to another party in exchange for $115 million. It also sold off other miscellaneous assets for $17 million on top of that. On the other hand, the company did also lend out another $97.5 million to Steward.

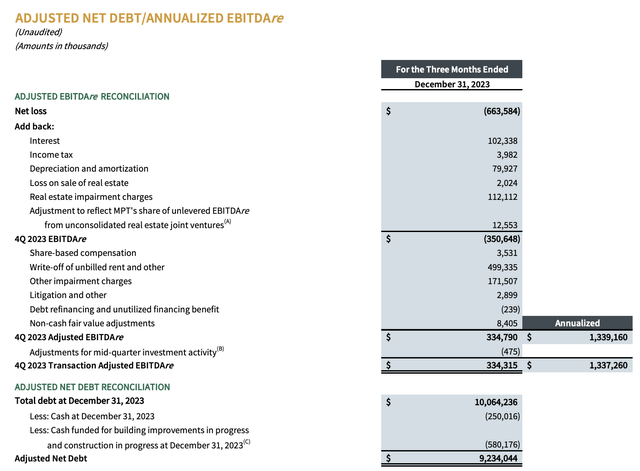

When we factor this all into the equation, we get about $1.46 billion that the company has to work with. If we assume that all of it, besides the amount for the Australian term loan, goes toward paying down the revolving credit facility, we get a reduction in annual interest expense of about $68.7 million. More importantly though, net debt for the firm will fall from $9.81 billion down to $8.35 billion. If this seems a bit high to you, consider that I am not including in the picture cash that has been funded already for building improvements that are in progress, as well as construction and progress, that was classified that way as of the end of last year. Management does factor this into its own calculations, and it amounts to $580.2 million. Although it is cash that the company theoretically has, the fact that it is earmarked for works that are already in progress makes me feel as though it would be prudent to remove it from the equation.

Medical Properties Trust

We don’t know the full impact that this series of transactions will have on profitability. In all likelihood, there won’t be much of a difference on the bottom line. But because of its very nature, EBITDA could fall by some amount. I would venture to say it won’t be terribly large. But if we assume that the annualized EBITDA that the company calculated at the end of last year still holds true, we would see a reduction in its net leverage ratio from 7.34 down to 6.25. This does not factor in many other adjustments that we could see moving forward. Not only do we have the prospect of another $400 million worth of asset sales on the table if management can pull through on them, we also have what is going on with Steward.

In January of this year, the management team at Medical Properties Trust announced that they were ‘accelerating’ their efforts to recover uncollected rents and outstanding loan obligations from Steward. They were also looking at ways to ‘significantly’ reduce their exposure to the beleaguered chain of hospitals. One thing that the company disclosed was that Steward was looking into strategic transactions of its own, with one of these being the potential sale of its managed care business. In the event of that sale, net proceeds would be used to repay ‘all outstanding obligations’ to Medical Properties Trust.

To be perfectly honest, it’s difficult to know exactly what this means. Part of the problem is that we don’t know what the sales price is that Steward ultimately agreed to when it announced, in late March of this year, that it was selling off its physician network to Optum Care, a subsidiary of UnitedHealth (UNH). There has been some controversy regarding this development. Namely, politicians are concerned that this will result in higher health care costs or reductions in treatment for those in the areas impacted. However, according to the state Attorney General’s Office in Massachusetts, as well as the state’s Department of Health, they lack the ability to either approve or veto any such transaction.

Author – SEC EDGAR Data

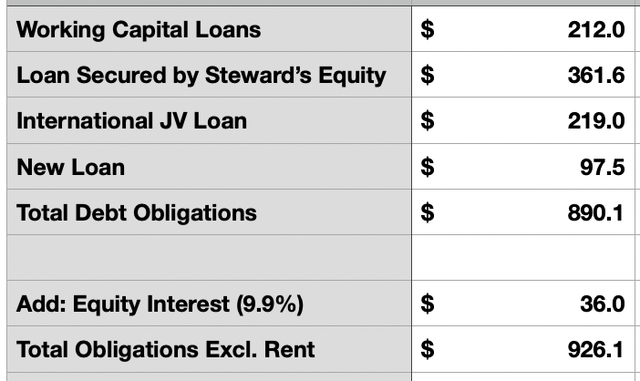

We also don’t understand the four impact this will have because we don’t know what they define as an ‘obligation’. For instance, last year, Medical Properties Trust saw $459 million in reserves for billed rent, almost all of which was associated with Steward. The company ended up booking a $700 million impairment charge associated with Steward. Some of the pain also involved a reduction in the value of its 9.9% ownership over Steward that, in the third quarter of last year, was worth $126 million and, by the end of the year, was estimated to be worth only $36 million. If you focus only on that equity interest, as well as all loans that Medical Properties Trust has granted to Steward, you would get about $929.1 million. But stripping out the equity component, you arrive at $890.1 million. Regardless of the amount, it should come out to the hundreds of millions of dollars of additional cash that can be used to reduce debt.

Medical Properties Trust

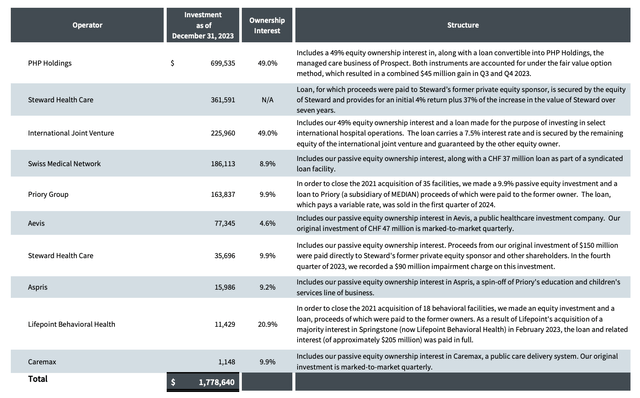

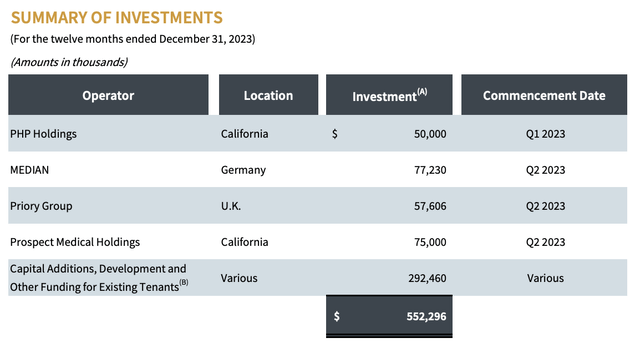

Also keep in mind that Medical Properties Trust has a lot going for it as well. Other businesses that it has dealt with in the past have resulted in it getting various types of investments. As of the end of last year, for instance, under its investments in unconsolidated operating entities, the company had $699.5 million worth of value baked into PHP Holdings, which is the managed care business of Prospect Medical Holdings. This involves a 49% ownership in the company, along with a loan that is convertible into equity in the business. It also has another $50 million worth of investments in that entity. This is just one example of value baked into the company’s balance sheet that can eventually be tapped for the purpose of reducing debt.

Medical Properties Trust

Takeaway

Until we get some more details regarding the Steward transaction, it remains to be seen exactly how much debt Medical Properties Trust can pay down in the near term. However, from the most recent transactions announced, we are looking at a nice amount of debt reduction. This ultimately reduces annual interest expense. But more importantly, it lowers leverage in a manner that reduces the risk for shareholders in the long run. More work needs to be done in order for the company to truly be in a healthy state. But it is undeniably moving in the right direction. At the end of the day, I believe that the value of the firm is substantially higher than what shares are trading for at the moment. But it will require additional patience for things to work out.

Read the full article here