Our previous coverage on Merck & Co., Inc. (NYSE:MRK), a large (~$272 billion market cap) biopharmaceutical, rated it a Hold. This was due to its top two products Keytruda and Gardasil facing a U.S. patent cliff in 2028, sparse insurance coverage for Reblozyl, and lack of sales support from the company’s newer non-vaccine drugs (Prevymis, Verquvo, Zerbaxa, and WELIREG). Accordingly, share prices have been flat since that prior article’s publication, but that’s not a positive. The reference SPDR® S&P 500 ETF Trust (SPY) has outperformed Merck by close to 14% during that period.

In the first quarter, things have gotten worse. Merck became even more reliant on Keytruda and Gardasil, which combined to generate $7.77 billion (an impressive +24% year-over-year) but also comprised 61% of pharmaceutical sales, compared to 57% in Q4 2022 (Table 1). Merck inexplicably became a Strong Buy according to Seeking Alpha’s Quant system on July 11, despite no change in any component grade from the day before, no news, and no SEC filings, prompting a similar Strong Buy from another SA analyst. Unfortunately, given how the market has greeted the company’s clinical/regulatory catalyst events so far, there seem to be few if any real sources of relief for Longs for the rest of the year.

Table 1. Merck Quarterly Product Sales

|

2022 |

2023 |

||||

|

1Q |

2Q |

3Q |

4Q |

1Q |

|

|

TOTAL SALES |

$ 15,901 |

$ 14,593 |

$ 14,959 |

$ 13,830 |

$14,487 |

|

PHARMACEUTICAL |

14,107 |

12,756 |

12,963 |

12,180 |

12,721 |

|

Oncology |

|||||

|

Keytruda |

4,809 |

5,252 |

5,426 |

5,450 |

5,795 |

|

Alliance Revenue – Lynparza |

266 |

275 |

284 |

292 |

275 |

|

Alliance Revenue – Lenvima |

227 |

231 |

202 |

216 |

232 |

|

Alliance Revenue – Reblozyl |

52 |

33 |

39 |

41 |

43 |

|

Welireg |

18 |

27 |

38 |

40 |

42 |

|

Vaccines |

|||||

|

Gardasil / Gardasil 9 |

1,460 |

1,674 |

2,294 |

1,470 |

1,972 |

|

ProQuad / M-M-R II / Varivax |

470 |

578 |

668 |

526 |

528 |

|

RotaTeq |

216 |

173 |

256 |

139 |

297 |

|

Vaxneuvance |

5 |

12 |

16 |

138 |

106 |

|

Pneumovax 23 |

173 |

153 |

131 |

145 |

96 |

|

Vaqta |

36 |

35 |

64 |

39 |

40 |

|

Hospital Acute Care |

|||||

|

Bridion |

395 |

426 |

423 |

441 |

487 |

|

Prevymis |

94 |

103 |

114 |

118 |

129 |

|

Primaxin |

58 |

64 |

63 |

54 |

80 |

|

Dificid |

52 |

66 |

77 |

67 |

65 |

|

Noxafil |

57 |

60 |

62 |

58 |

60 |

|

Zerbaxa |

30 |

46 |

43 |

49 |

50 |

|

Cardiovascular |

|||||

|

Alliance Revenue – Adempas/Verquvo |

72 |

98 |

88 |

82 |

99 |

|

Adempas (Merck territories) |

61 |

63 |

57 |

57 |

59 |

|

Virology |

|||||

|

Lagevrio |

3,247 |

1,177 |

436 |

825 |

392 |

|

Isentress / Isentress HD |

158 |

147 |

161 |

167 |

123 |

|

Neuroscience |

|||||

|

Belsomra |

69 |

69 |

62 |

59 |

56 |

|

Immunology |

|||||

|

Simponi |

186 |

181 |

173 |

166 |

180 |

|

Remicade |

61 |

53 |

49 |

44 |

51 |

|

Diabetes |

|||||

|

Januvia |

779 |

756 |

717 |

561 |

551 |

|

Janumet |

454 |

476 |

417 |

353 |

329 |

|

Other Pharmaceutical |

602 |

528 |

603 |

583 |

584 |

|

ANIMAL HEALTH |

1,482 |

1,467 |

1,371 |

1,230 |

1,491 |

|

Livestock |

832 |

826 |

829 |

814 |

849 |

|

Companion Animals |

650 |

641 |

542 |

416 |

642 |

|

Other Revenues |

312 |

370 |

625 |

420 |

275 |

Excluding COVID-19 antiviral Lagevrio, the duo led pharma sales to $12.7 billion (+13.5% YOY) and a revenue beat. However, Reblozyl regressed by 18% and none of the other newer products contribute at least $130 million (1% of sales). Keytruda and Gardasil just don’t seem to excite the masses.

There has, at least, been some recent progress in the pipeline:

On March 1, Keytruda delivered positive top line results from the Phase 3 KEYNOTE-671 trial as a perioperative treatment regimen for patients with resectable stage II, IIIA or IIIB non-small cell lung cancer (NSCLC). The FDA review of Merck’s supplemental Biologics License Application (“sBLA”‘) based on these data and has set a Prescription Drug User Fee Act (PDUFA), or target action date of Oct. 16, 2023.

On April 3, the FDA granted accelerated approval of Keytruda in combination with Astellas Pharma’s (OTCPK:ALPMY) Padcev for the treatment of adult patients with locally advanced or metastatic urothelial carcinoma who are not eligible for cisplatin-containing chemotherapy, based on data from the KEYNOTE-869 trial.

In April, the FDA accepted Merck’s sBLA based on the pivotal Phase 3 KEYNOTE-859 trial, where KEYTRUDA in combination with chemotherapy significantly improved overall survival (“OS”‘) versus chemotherapy alone as first-line treatment of patients with human epidermal growth factor receptor 2 (HER2)-negative locally advanced unresectable or metastatic gastric or gastroesophageal junction adenocarcinoma. The Agency set a PDUFA date of Dec. 16, 2023.

On June 1, the FDA approved LYNPARZA plus abiraterone and prednisone or prednisolone (abi/pred) as a first-line treatment of adult patients with BRCA-mutated (BRCAm) metastatic castration-resistant prostate cancer (mCRPC). Hopefully, this will bolster the drug’s 3% Q1 YOY performance next quarter.

On June 6, the FDA approved a new prophylactic indication for antiviral agent PREVYMIS in adult kidney transplant recipients at high risk for cytomegalovirus (“CMV”) disease. A study demonstrated that PREVYMIS was non-inferior to valganciclovir, the current standard of care (“SOC”), at preventing incidence of CMV. Insurance will require the cheaper generic valganciclovir treatment first, but PREVYMIS will see use as a second option, and will finally contribute more than 1% to Merck’s sales.

On June 8, the FDA accepted the sBLA for Keytruda as a treatment of patients with locally advanced unresectable or metastatic biliary tract cancer (“BTC”), based on data from the KEYNOTE-966 trial, in which Keytruda plus chemotherapy demonstrated a statistically significant improvement in OS compared to chemotherapy alone. The Agency set a PDUFA date of February 7, 2024.

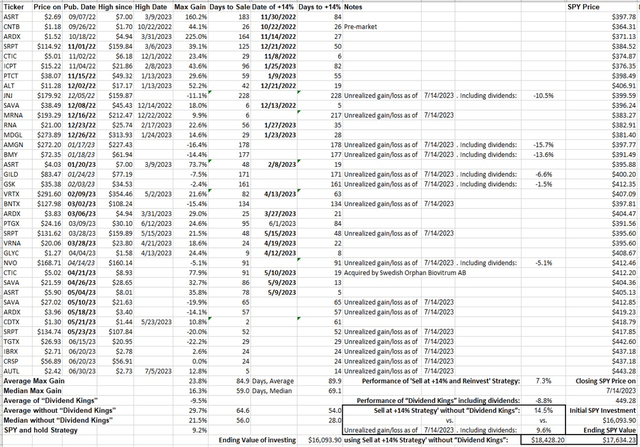

While the list of developments is long, none of these are likely to improve total sales until at least next year, when approved KEYTRUDA label expansions are adopted into clinical practice. None have impacted share price. Merck retains an A+ Quant Profitability grade due to high margins, but the B for Momentum is a relative mirage compared to the broad market. Big Pharma stocks promoted for their dividends have all underperformed among my personal recommendations since last year (Figure 1). Why hang on for so-so yields when the underlying stock is stagnant or depreciates at a larger clip? Merck has nothing special that sets it apart to gain a Buy rating. To conclude, the lack of positive MRK price action, and the apparent continuing movement by the market away from dividend-carrying large-caps as suitable defensive healthcare stocks in a bear market, keep Merck a Hold.

Figure 1. Performance of CSI’s Buys and Strong Buys from September 2022 compared to SPY

Seeking Alpha

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here