Moderna (NASDAQ:MRNA) is a pharmaceutical company best known for commercializing its COVID-19 vaccine. The rapid rollout of the vaccine was instrumental, especially in western countries, to flattening the curve. The company has been able to utilize its cash to build a massive pipeline on the back of its technology. As we’ll see throughout this article, this supports the company as a long-term investment.

Moderna 2023

Moderna had a rough 2023 as demand for its key vaccinations has declined.

Moderna Investor Presentation

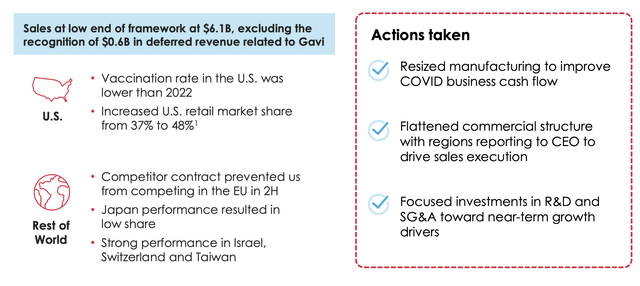

The company saw sales at the low-end of expectations at $6.1 billion, as its U.S. retail market share increased but vaccination rates decreased. The company has worked to improve what’s effectively a legacy business at this point, remaining focused on being able to drive reliable long-term cash flow for shareholders.

Moderna Investor Presentation

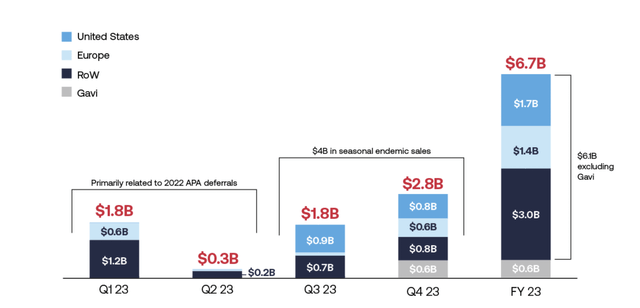

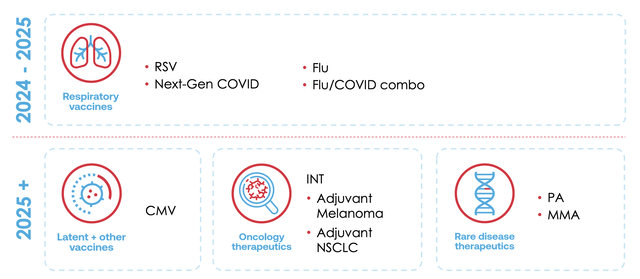

The company has numerous Phase 3 products going through with its new products. This includes respiratory vaccines, such as mRNA-1345 which is being filed for approvals around the world. The company excels in respiratory vaccines and has numerous programs expanding here. Joint flu / COVID-19 vaccines could have a very successful rollout.

The company also has numerous other bright spots in its portfolio. It’s the only true Phase 3 for a CMV vaccine and has fully enrolled its trial. It’s chasing oncology therapeutics and rare disease therapeutics. These products, many of which it is moving to Phase 3, are expected to have billions in revenue potential.

Moderna Financial Picture

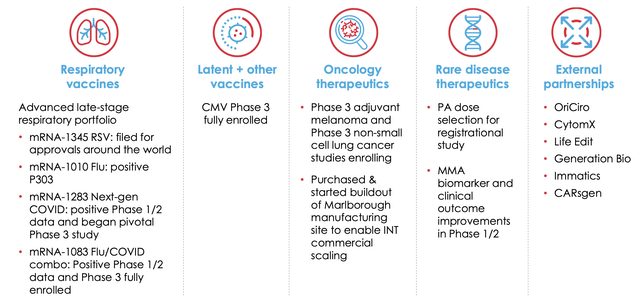

The company’s financial picture has remained volatile, but the company did perform much better in the endemic season.

Moderna Investor Presentation

The company saw $4 billion in seasonal sales, and most importantly, U.S. sales were less than half of that. Rest of world sales have remained quite strong, showing continued demand for the company’s products. The company maintains more than $13 billion in cash versus an almost $40 billion market cap, showing a strong financial picture.

Moderna 2024 Expectations

The company’s 2024 shows volatility in the business as the company struggles, with its only product for customers being its Covid-19 vaccine.

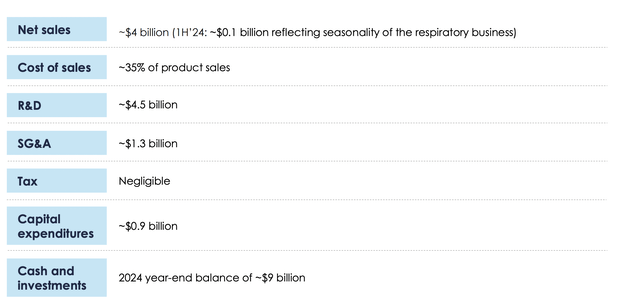

Moderna Investor Presentation

The company expects $4 billion in net sales, with cost of sales at only 35%. However, it’s impacted by $4.5 billion in R&D, almost $1 billion in capex, and $1.3 billion in SG&A. The company expects cash and investments to finish 2024 at $9 billion, a $4 billion YoY decline, and the company needs to find a long-term way to stem that flow.

Moderna Pipeline

The company has broken out its pipeline into two components.

Moderna Investor Presentation

For 2024-2025, the company needs to roll out its RSV, next-gen COVID, Flu, and Flu/COVID vaccines. These focus on the company’s current strengths, and the company’s current RSV vaccines and options. The company needs to see revenue from these vaccines scale up to a point where it’s at least breakeven rather than losing billions a year.

That’s because the company has massive R&D expenses. For perspective, the company has 80% of the R&D expenses of Gilead Sciences, a pharmaceutical company more than double its size, as the company chases the potential of its mRNA platform. In 2025+, the company has numerous exciting potential therapeutics that could help long-term revenue.

That pipeline helps highlight Moderna as a valuable investment.

Thesis Risk

The largest risk to our thesis is that the company’s original product has a fixed lifespan, and the company needs to prove it’s not a one-trick pony. If it can’t, financially, it might not have a very long future. That makes the company an incredibly risky potential long-term investment. However, over the next two years, we expect those risks to go down.

Conclusion

Moderna has a strong portfolio of assets. The company had a weaker 2023 as demand for COVID-19 vaccines dropped. However, it still expects reasonable revenue in 2024 with ~$4 billion in revenue most in the fall. It’s important for the company to see its other businesses ramp up in 2024-2025, specifically its RSV and Flu businesses.

The company is spending a massive amount on R&D and has a strong cash position. It expects to finish 2024 with $9 billion in cash and equivalents, but in the long-term, it needs to rapidly improve its losses and build new businesses. Phase 3 programs are expensive, and if they don’t pan out, it’s tough for the company.

That makes the company a valuable investment, but a risky one.

Read the full article here