Natural gas prices have staged a remarkable recovery since bottoming around ~$1.5/MMBtu. Chesapeake Energy (CHK) was the first U.S. gas producer to announce a sizable production cut (~0.73 Bcf/d), and just yesterday, EQT Corporation (EQT) joined the gang with a production cut of ~1 Bcf/d for March.

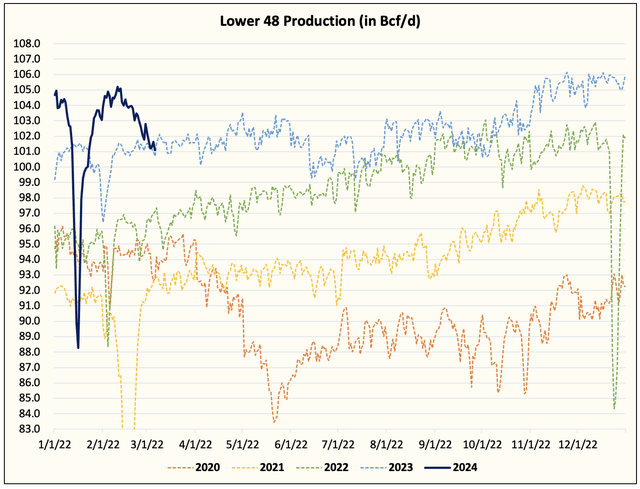

As the old commodity adage goes, “Low prices cure low prices.” Lower 48 gas production as of today is running around ~101 Bcf/d, a remarkable decline since hitting ~105 Bcf/d just last month.

HFIR

While some of the production decline is related to maintenance, we think the bulk of the recent decline is attributed to the low gas prices we are seeing. The market, in essence, has forced production shut-ins. With the announcement from EQT and CHK, the market has firmly found a bottom, which is much needed given how much excess storage we will have exiting this winter.

HFIR

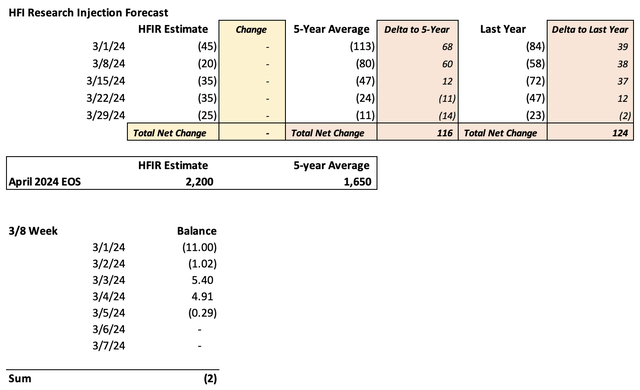

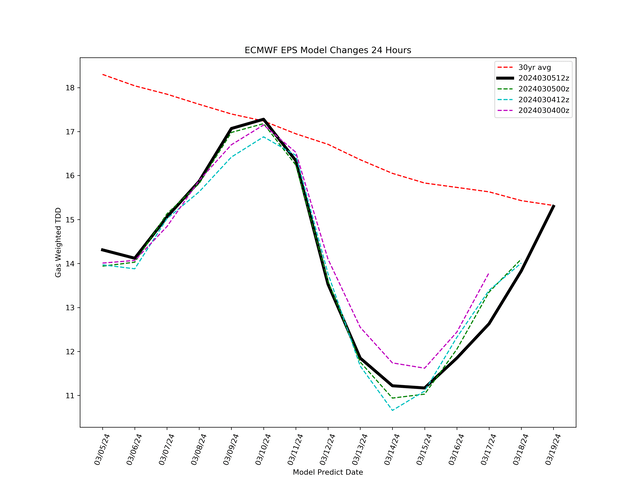

In our latest storage outlook, we have total withdrawals 116 Bcf lower than the 5-year average and 124 Bcf lower than last year. The weather outlook for the next 15 days will not be supportive of heating-related demand, so natural gas bulls can pretty much think of today as the end of winter.

HFIRweather.com

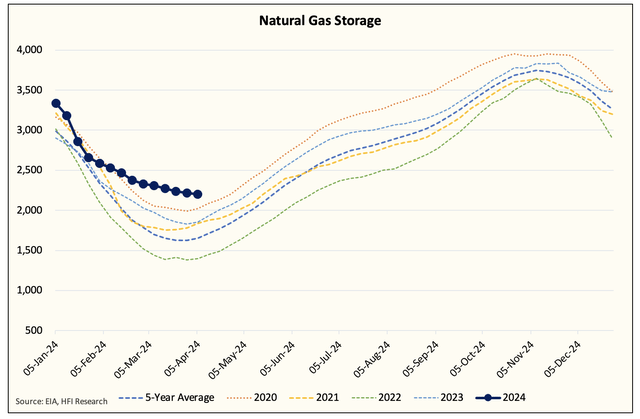

As a result, now we expect natural gas storage to exit this withdrawal season at a staggering ~2.2 Tcf.

EIA, HFIR

As you can see in the chart above, we will be materially higher than the 5-year average (1.65 Tcf), and with the surplus at ~550 Bcf, the math to normality is daunting.

Where do we start?

At 101 Bcf/d Lower 48 production, the U.S. natural gas market will be firmly in the deficit. We estimate that with a normal summer cooling season, the implied deficit is around ~2.5 Bcf/d. However, readers must take this caveat into account.

CME

By July, the Henry Hub futures curve put prices around $2.569/MMBtu. We don’t think Lower 48 gas production will see any production decline if prices are that high. So it would be factually incorrect to assume that ~101 Bcf/d will be sustained into this summer.

Looking at the production cuts, we think a fair average to assume for this summer will be around ~103 Bcf/d. At this level, the U.S. gas market will be slightly in deficit (~0.5 Bcf/d).

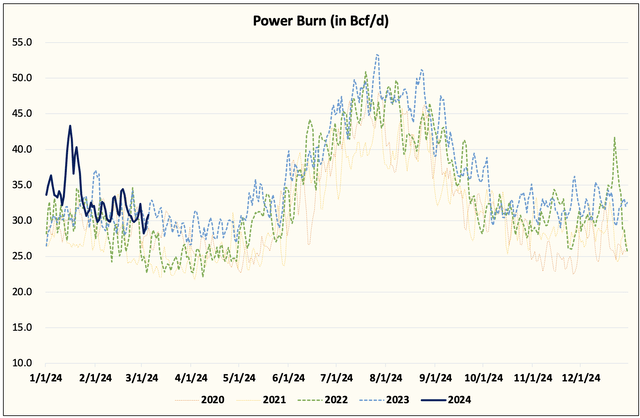

On the demand front, LNG gas exports + power burn demand is likely to push balances to the upside by ~2 Bcf/d.

HFIR

In total, we could see the U.S. gas market flip into 2.5 Bcf/d deficit beginning mid-June. If Lower 48 gas production surprises to the downside (below 103 Bcf/d), the deficit would pile on.

There are 31 weeks in the injection season, and 550 Bcf surplus translates into ~2.53 Bcf/d. In essence, the market has effectively pushed prices to the level to balance prices. In other words, ~101 Bcf/d of Lower 48 gas production or sub-$2 gas will take U.S. natural gas storage back to the 5-year average.

All eyes on production…

For now, the price recovery is coming on the heels of announced production cuts, but the reality is that higher natural gas prices will be self-defeating in nature given the bloated storage environment we are in. The moment prices recover, producers will increase production, which would then push prices back down. In essence, low prices are what’s curing low prices, so let the market do its job. Speculators trying to front-run the prospects of low production translating into lower storage may very well be doing the market disfavor.

With heating demand continuously disappointing all winter and storage coming in ~550 Bcf above the 5-year average, the market will be fixated on Lower 48 gas production. So long as we hold around the ~101 Bcf/d level throughout the shoulder season, we see injections surprising to the downside. The healing/rebalancing will take time for the natural gas market, so don’t expect prices to jump back to $2.5/MMBtu in a hurry.

Read the full article here