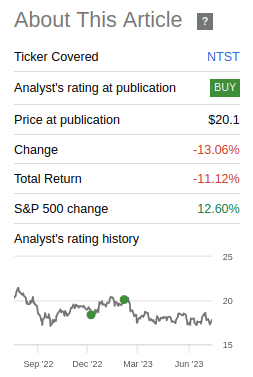

Interest rate increases have continued to prove a very significant headwind for REITs, and Netstreit (NYSE:NTST) is now ~13% cheaper compared to when we wrote our last article on them. Fundamentally things have not changed much since then, and we now believe the valuation to be quite attractive, motivating us to upgrade our rating from ‘Buy’ to ‘Strong Buy’.

Seeking Alpha

Growth has been decent, but far from spectacular, yet their portfolio continues to prove it is high quality by maintaining 100% occupancy at the end of the quarter. If there is one thing we have heard some investors complain about is that Netstreit has been quite stingy with dividend increases. It had maintained the dividend constant at $0.20 per quarter for a long time, and finally announced a modest raise of 2.5% to the dividend starting with the next payment. Given the low AFFO payout ratio, we expect bigger dividend increases in the future.

Q2 2023 Results

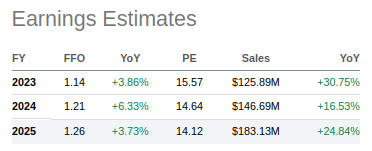

In the second quarter, core FFO totaled $0.29 per diluted share, a 12% increase from the previous year, while AFFO was $0.30 per diluted share, a 7% increase year over year. With respect to forward guidance, 2023 AFFO per share guidance is $1.20 to $1.23. That puts the valuation at ~14.4x price to guided AFFO, which we see as quite reasonable.

The company is gaining some scale advantages as it grows, with G&A now representing 16% of total revenues in the second quarter compared to 21.5% the previous year.

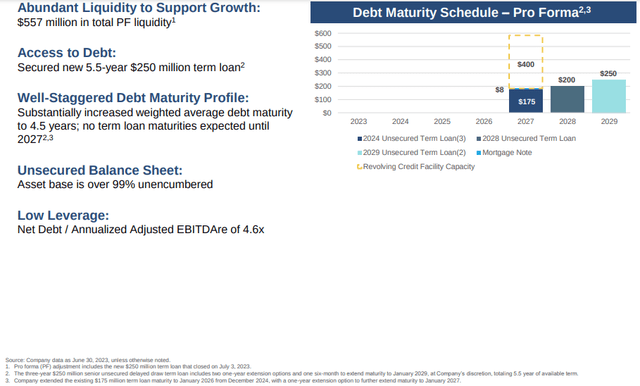

The company has ample liquidity to continue growing its portfolio, with pro forma liquidity of $557 million. The company recently refinanced a term loan, which will have an impact to earnings when the interest rate moves from 1.37% at the end of November of this year to 3.12% afterwards. The good news is that the company now believes they have basically locked in their long-term debt needs through 2025.

One issue we have with the company is that it has been issuing shares at what we consider undervalued prices. During the most recent earnings call there was an interesting question from an analyst pointing out that the company had some issuance a little below the Street NAV. We would rather see the company slow down its property acquisition pace rather than issue shares below fair value.

Nick Joseph

And maybe just on that, when you talk about accretive equity. How are you thinking about that either relative to investment spread? Or is it — it seems like in the second quarter, it was a bit below where Street NAV is. So how do you triangulate between that when making the decision?

Daniel Donlan

Yes. I mean, look, we look at next 12 months AFFO yield, we look at run rate AFFO yield, and we look at implied cap rate when we think about raising equity. But as you — as Mark alluded to in the quarter, we did have $90 million of well-priced capital from the August 2022 raise. And so we definitely achieved a nice spread, call it, 30, 40 basis points relative to our all-in equity that we pulled down this quarter. So going forward, spot cost equity continues to be favorable. So it’s — I think if you think about where we just raised the debt at 5%, we’re looking at investment spreads kind of around 130, 120 basis points.

Current Investment Environment

While the current environment makes financing more expensive for the company, it has also brought some positives. For example, the company is increasingly able to negotiate rent escalators in some of its new deals. The company is also able to make acquisitions at slightly higher cap rates, as there is less competition from highly leveraged buyers and companies find more difficult to get capital from community banks and smaller regional banks. This has resulted in an increased willingness by retailers to sign leases with longer lease terms and embedded rent escalations.

Balance Sheet

The company no longer has any debt maturing before 2027, and its only exposure to variable rate debt is via its revolving line of credit, which has currently nothing outstanding. We wouldn’t mind the company increasing its leverage a little bit, instead of issuing more equity at current prices, if it wants to continue pursuing acquisition opportunities.

Netstreit Investor Presentation

Portfolio

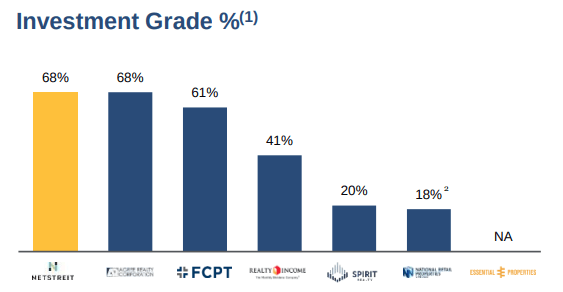

The current portfolio consists of 531 investments, leased to 87 tenants across 45 states. Approximately 82% of the portfolio is leased to investment-grade ratings and investment-grade profile tenants. Occupancy remains at 100% and the weighted average remaining lease term is 9.4 years. This makes Netstreit’s portfolio very high quality, looking good even when compared to investors’ favorite Realty Income (O).

Netstreit Investor Presentation

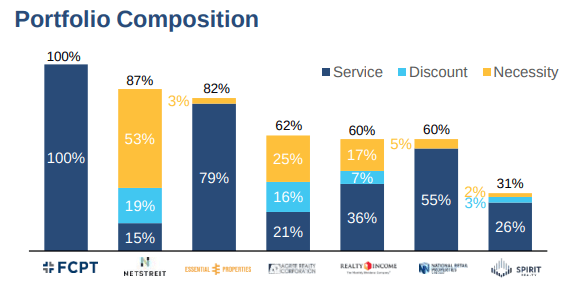

It also beats Realty Income and several other popular REITs in the percentage of tenants in highly resilient sectors, with 87% coming from necessity-based discount or service-oriented retailers.

Netstreit Investor Presentation

Dividend

Netstreit finally rewarded investors with the first dividend increase since the company’s IPO. It was a modest increase of 2.5%, but it sounds as if the company is realizing their payout ratio is getting too low and might have to further increase the dividend, as this was said during the prepared remarks of the most recent earnings call:

Based on this new dividend amount, our AFFO payout ratio for the second quarter was 68% and which we believe bodes well for future dividend increases.

Valuation

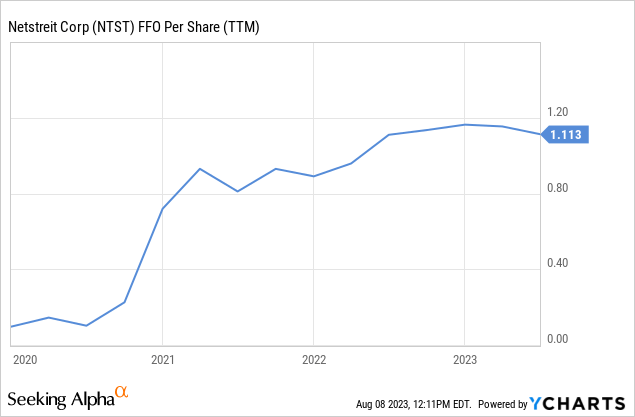

As the company built its portfolio after its IPO, its FFO started rapidly increasing, but growth has stalled recently. At current prices shares yield a very respectable 4.6%, and this is a well-covered dividend that we expect will grow in the future.

Analysts are forecasting some growth for the company’s FFO, but the average expected increase is relatively small. We think the bar is really low, and that there is a good chance the company will outperform these estimates. At a ~14.4x multiple to guided AFFO for 2023, we find shares inexpensive given the quality of the portfolio and that it is operating with relatively low leverage.

Seeking Alpha

Risks

Netstreit is a relatively new REIT without the extensive history that a competitor like Realty Income has, and which certainly provides a lot of reassurance to investors and lenders. It is also small, which could limit or complicate its access to certain types of financing. It would also reassure us to see the weighted average debt maturity increase from the ~4.5 years to better align with its weighted average lease term.

Conclusion

We find Netstreit shares very attractive at current prices and after reporting a solid quarter. The company is not very well known, even among REIT investors, given its relatively small size and short history in the public markets. At current prices shares are trading for an undemanding ~14.4x multiple of guided 2023 AFFO. Shares offer an attractive 4.6% yield, which is well-covered by its adjusted funds from operations. The interest rate environment has been a headwind for the company and its shares, but we believe current prices offer an attractive entry price for long-term investors. As such, we are upgrading our previous ‘Buy’ rating to ‘Strong Buy’.

Read the full article here