NIO Inc. (NYSE:NIO) just made an announcement that said that the electric-vehicle company was curtailing its delivery forecast for 1Q-24 amid a soft demand environment in the company’s core market China.

While slowing growth is obviously a big challenge for NIO, and an obstacle for price appreciation for NIO’s stock, I think that the electric-vehicle company unduly suffers from a painful change in sentiment towards EV businesses.

NIO’s stock just made new lows, but the valuation is now at its most compelling point ever, in my view. It seems that investors are overreacting to the company’s forecast and NIO should profit from a rebound in deliveries later this year.

My Rating History

I modified my stock classification for NIO to Buy last December due to a strategic investment deal between NIO and CYVN Holdings. In 2023, the holding company chose to invest $2.2 billion into NIO and bankroll the electric-vehicle company’s EV growth strategy. Unfortunately, and against my expectations, NIO has traded consistently lower since December as concerns over electric-vehicle demand took center stage.

Though NIO’s electric-vehicle growth is flat-lining in the short-term, I think that the margin setup is convincing and that NIO has recovery potential.

Updated Delivery Forecast For 1Q-24 And Delivery Recovery

According to a delivery projection update from Wednesday, NIO anticipates approximately 30,000 electric-vehicle deliveries for the first quarter which is down from a prior forecast of 31,000 to 33,000 vehicles. This guidance implies that NIO will deliver approximately 11,813 vehicles in March. The guidance was clearly a negative catalyst, but I think investors might be a bit overreacting here.

Compared to the lower end of the previous guidance, NIO adjusted its outlook by only a moderate 3%, so the new guidance clearly should not be seen as a major deal-breaker.

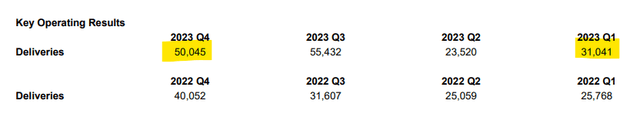

Based on this new forecast, NIO is on track to deliver 120,000 electric-vehicles in 2023, but the company is probably going to see a substantial increase in deliveries later this year. This is because first quarter delivery numbers are skewed due to the inclusion of the 15-day Chinese New Year period which means that NIO should see a rebound in deliveries in super-ceding quarters. Between 1Q-23 and 4Q-23, to give you an example, NIO’s deliveries jumped a whopping 61%.

During Chinese New Year holidays, factory activity slows to zero as workers in China’s manufacturing hubs, like Shenzhen, head home to their provinces. As a consequence, all electric-vehicle companies report a substantial decline with respect to their first quarter delivery volumes. As workers return, however, and factories return to normal, NIO and other electric-vehicle manufacturers should be able to grow production again.

Key Operating Results (NIO)

NIO’s Gross Profit Situation Is Improving

The outlook adjustment caused NIO’s stock to fall to new lows on Wednesday. With that being said however, NIO’s business is evolving in an encouraging way.

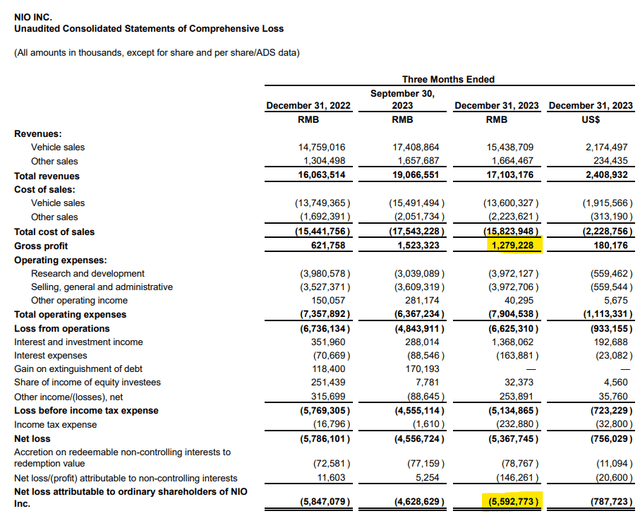

NIO’s gross profit in 4Q-23 was RMB 1,279.2 million (US$180.2 million) which was more than double than what the company used to make a year ago. Obviously NIO is still struggling mightily to drive the business toward a black zero (it’s net loss in the fourth quarter of 2023 was RMB 5,592.8 million (US$787.7 million), but with growth in deliveries likely to come back after 1Q-24, I think that NIO is actually on a really good path to grow its business in 2024.

Gross Profit (NIO)

NIO’s Sales Multiple Is Too Good To Be True

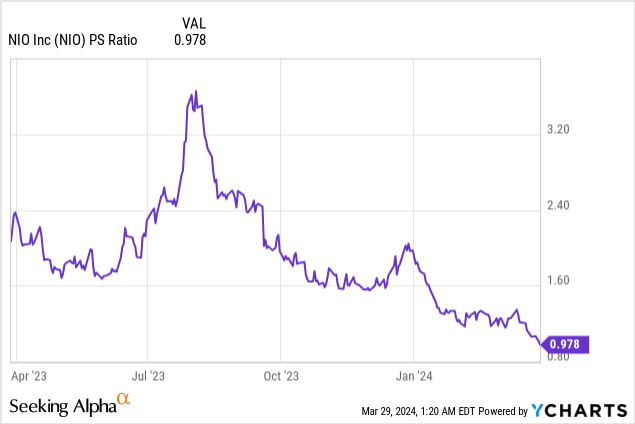

If NIO has one thing going in its favor right now it is its valuation multiple. NIO suffered new selling pressure and the company’s stock fell to a new low of $4.67 after the delivery outlook adjustment. With that being said, though, NIO’s sales potential is hardly overvalued right now which equates to a very favorable risk/reward relationship, in my view. NIO’s stock is valued at a P/S ratio of 0.98x which is calculated based on the company’s anticipated sales in 2024. The P/S ratio relates to the 2024 financial year. With NIO’s sales anticipated to grow in 2024, I think that the P/S ratio is the most appropriate valuation ratio for the electric-vehicle company.

XPeng Inc. (XPEV), a top competitor, sells at 1.4x sales (also based on current year sales). However, XPeng sees much lower deliveries for 1Q-24 than NIO: The electric-vehicle company guided for only between 21,000 and 22,500 deliveries in the first quarter.

XPeng reduced its net loss by 43% in 4Q-23, primarily because of surging sales growth, but the electric-vehicle company does have weaker gross profit margins than NIO (NIO had a 4Q-23 gross profit margin of 7.5% compared to XPeng’s 6.2% margin). XPeng also has a much smaller delivery target for 1Q-24 which is why I would prefer NIO over XPeng every day of the week.

Historically, NIO has sold for much higher sales multiples. In 2023, NIO was selling at a more than 3.0x sales and the company has made considerable strides in terms of improving its gross profit picture.

Why The Investment Thesis Might Disappoint

NIO obviously cannot escape market forces which in this case point to waning demand for electric vehicles in the company’s core market, China.

Obviously, the potential for delivery disappointments is a wildcard here for NIO in the short-term, but investors should keep in mind that 1Q-24 delivery numbers are not representative due to Chinese New Year. Most likely, they are going to rebound in the following quarters.

The thesis would be a disappointment for me if NIO suffered a deterioration in its gross profit margins throughout 2024.

My Conclusion

NIO’s stock price recently fell below $5, but in my view, now is the best time to buy NIO in years.

The long-term outlook for the electric-vehicle industry is positive and investors should anticipate ups and downs in both NIO’s underlying business as well as in the stock price.

The first quarter delivery adjustment was not great, but it also wasn’t a major disaster as the estimated decline was only a paltry 3% from the lower end of NIO’s previous guidance.

I continue to anticipate a gradual recovery in delivery volumes in the coming quarters and think that NIO presently has its best risk/reward relationship in years.

With the stock selling at such a low sales multiple, I think that NIO’s valuation actually embeds a very high margin of safety. Strong Buy.

Read the full article here