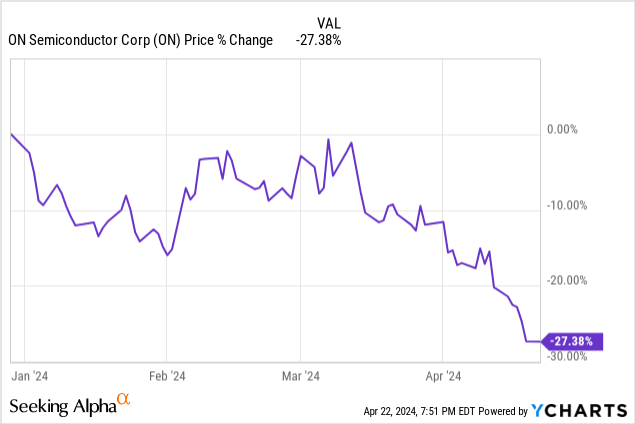

ON Semiconductor Corporation (NASDAQ:ON), rebranded several years ago as OnSemi, may be an interesting stock for those investors looking for value in the semiconductor manufacturing space. The company primarily supplies chips to the auto and industrial industries, markets that are currently in a cyclical downturn that began in the latter half of 2023. Worse for current investors, things don’t look like they will get better any time soon, with the company’s management being reluctant to call a market bottom on a recent earnings call. The chart below shows the stock is down over 20% for the year.

Despite excellent prospects for the business in the long term, near-term investor sentiment towards OnSemi is poor. However, suppose you are an investor looking to profit from secular trends like the adoption of electric vehicles (“EVs”) and advanced driver-assistance systems (“ADAS”) in new cars and renewable energy applications. In that case, the stock has good potential upside at current prices. The company focuses on products that should outgrow the broader semiconductor industry over the next five years.

This article will discuss a few of OnSemi’s end markets, how the company plans to expand margins, review its financial condition, highlight a few risks, review its valuation, and discuss why OnSemi is a buy today.

The company’s end markets

The following image comes from OnSemi’s fourth-quarter earnings presentation. It shows the size of the company’s primary end markets and those markets projected compound annual growth rates (“CAGR”) between 2022 and 2027. The company’s 2023 10-K states, “We provide intelligent power and intelligent sensing solutions with a primary focus towards automotive and industrial markets to help our customers solve challenging problems and create cutting-edge products for a better future.“

OnSemi’s fourth quarter 2023 earnings presentation.

The company’s intelligent power side provides solutions for producing longer-range electric vehicles (“EVs”) for the automotive market and in the industrial market, fast-charging battery systems, and solar inverters — devices that convert direct current electricity from solar panels to alternating current electricity for use in the home or on the electrical grid. The intelligent sensing side provides solutions for ADAS (advanced driving assistance systems), self-driving solutions for the automotive market, and factory automation solutions in the industrial markets. Last, the company has various solutions for 5G, cloud, medical, and Aerospace & Defense markets.

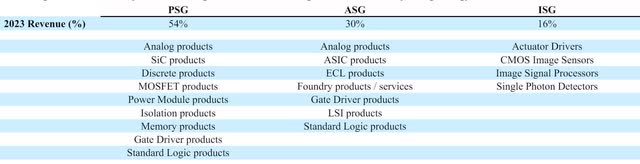

OnSemi makes semiconductor products that customers use in multiple end markets. Therefore, instead of reporting revenue by end market, OnSemi reports revenue by semiconductor type. The following image from OnSemi’s 2023 10-K shows how the company grouped the types of semiconductors into three segments: “the Power Solutions Group (“PSG”), the Advanced Solutions Group (“ASG”), and the Intelligent Sensing Group (“ISG”).“

OnSemi 2023 10-K

PSG generates 54% of its revenue and consists of semiconductors primarily used in high-power applications like fast-charging battery systems and solar inverters. ASG generates 30% of its revenue and handles low to moderate electrical power analog chips like power management circuits, audio amplifiers, and sensor interfaces. Customers use ASG products in factory automation, mobile, computer, and sensor applications. ISG generates 16% of its revenue and consists of image sensors and electronic circuits that drive actuators, which are devices that convert electrical energy into mechanical motion.

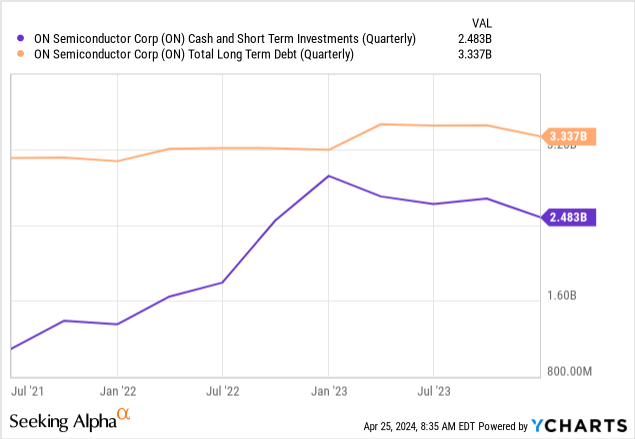

Financial Condition

Since OnSemi is in the middle of a downturn, an analysis of the company should include whether it can survive the downturn without undue financial stress. At the end of the fourth quarter of 2023, OnSemi had $2.48 billion in cash and short-term investments and $3.33 billion in long-term debt. Although the company has more long-term debt on the book than cash, it has a debt-to-equity ratio of 42.9%, meaning it is less risky as it funds its operations primarily through equity. It has a net debt-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) of 0.27, which means it can pay down its debt with its operating cash flow. OnSemi has interest coverage of 39.46, meaning that the company’s operating income is more than adequate to cover the interest expense. In my opinion, OnSemi has a solid financial position.

The company has a quick ratio of 1.74. Analysts use the quick ratio to measure a company’s ability to pay short-term financial debt using its most liquid assets. A quick ratio above 1.0 indicates solid short-term financial strength.

Expanding margins

The company plans to expand non-GAAP (Generally Accepted Accounting Principles) margins to 53%. The following image shows that management wants to achieve this by changing the mix to higher-margin products, increasing its Silicon Carbide business, and becoming more cost-efficient.

OnSemi’s fourth quarter 2023 earnings presentation.

Historically, OnSemi’s business sold chips in many different end markets, regardless of whether those end markets had become commoditized or not. However, moving forward, management plans to exit business lines that have become commoditized and cannot reach a certain margin threshold, which seems to be around a gross margin of 45% and above. The company exits a business by raising the price to an acceptable return, and when competing companies offer a lower price, the lower-margin business disappears.

Management has recently focused on selling more value-added products. The benefit of moving into higher-margin businesses is that the automotive and some of OnSemi’s other businesses are cyclical. By seeking the higher-margin segments of cyclical markets, when markets like automotive eventually turn down, OnSemi’s business should hold up better than competitors selling commoditized products in the future.

At the Morgan Stanley Technology, Media & Telecom Conference on March 5, 2024, OnSemi’s Chief Executive Officer (“CEO”) Hassane El-Khoury said (emphasis added):

The last couple of years, we’ve been dealing with a lot of things, obviously, we’ve had the height of the pandemic, which saw a lot of shortages that we were able to support customers, so we took the opportunity to accelerate the transformation. So some of the components that we’ve done is, one, we walked away from a lot of the business that you typically would see as commodities, where our focus right now on our portfolio is being able to extract the value and therefore, the customers see value. If customers don’t see value in the product, that’s a product that we’re not going to continue, number one, to support; and two, to invest R&D dollars in.

OnSemi has invested heavily in building up its silicon carbide (“SiC”) semiconductor manufacturing capacity in the last several years as part of management’s plan to increase the mix of higher-value chip products. One high-value application of SiC semiconductors is in EVs. In an article published in McKinsey, SiC semiconductors perform better in EV applications than chips based solely on silicon. The McKinsey article stated that SiC chips have “higher switching frequency, thermal resistance, and breakdown voltage.” Those attributes make them an excellent choice not only for EVs but also for solar inverters, aerospace, power supplies for 5G wireless towers, motor drives, and other power electronics. TrendForce projected that the SiC power device market would grow between 2022 and 2026 from $1.6 billion to $5.3 billion at a CAGR of 34.89% — a rapidly growing market.

The company’s investments in SiC have already started paying off in rapid revenue growth over the last several years. OnSemi is now number two in market share. The CEO said the following on the company’s fourth quarter 2023 earnings call (emphasis added):

We define technology as being the devices and the packaging because both together, when you’re talking about [SiC] high-powered devices, you have to be very competitive on the efficiency side, that’s the device, and you have to be able to get the heat off the device, that’s the package. That’s what allowed us to win most, if not all, of the designs at OEMs [Original Equipment Manufacturers]. And because of that superior performance both on device and package and therefore, system-level performance translating to the OEM, we’re able to capitalize on that, and you’ve seen the growth at 4x.And to put it in perspective, the growth, the 4x from $200 million to over $800 million that we saw from 2022 to 2023 is the highest growth percent in the industry and the highest dollar growth of all our peers.So it is not just because the market is a hot market or a growth market.We capitalized on the technology. We’ve increased share, and we went from number six to number two.

OnSemi projects to grow its SiC chip manufacturing business twice as fast as the industry moving forward and achieve a 35-40% market share by 2027. Management has vertically integrated the business, giving it a potential advantage over competitors that lack vertical integration. One huge benefit of vertical integration is that the company has better control over its entire supply chain and can potentially produce more consistent quality in SiC devices and packages. Since SiC chips are OnSemi’s locomotive for revenue growth over the next several years, it is vital to monitor what management says about this business in future company communications.

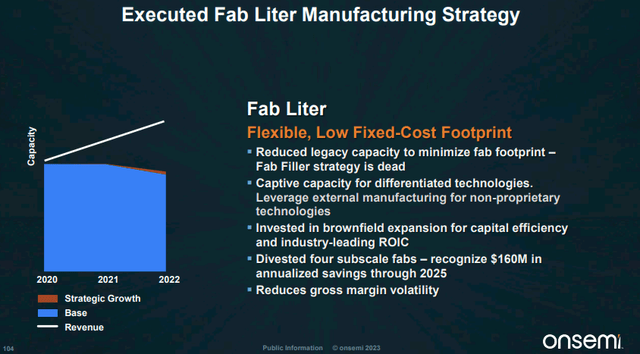

Last, OnSemi positioned itself for more efficient growth by divesting four “subscale” fabs (semiconductor fabrication facilities) in 2022. Subscale means the fab manufactures semiconductor wafers smaller than the current industry standard of 12 inches. The fabs that OnSemi sold were making wafer sizes of 200 millimeters (“mm”), which is around 8 inches. The smaller the wafer size, the more inefficient the manufacturing process. If OnSemi had continued manufacturing at these four subscale fabs, the company’s margins would have suffered. By selling the fabs, the company will recognize substantial savings. The “Fab Liter” strategy, followed by “Fab Right,” upgraded the company’s fabs to a far more efficient manufacturing operation over the long term. Fab Liter immediately reduces capacity in lower-margin products, represented by the blue “base” in the following image.

OnSemi First Quarter 2023 Investor Presentation.

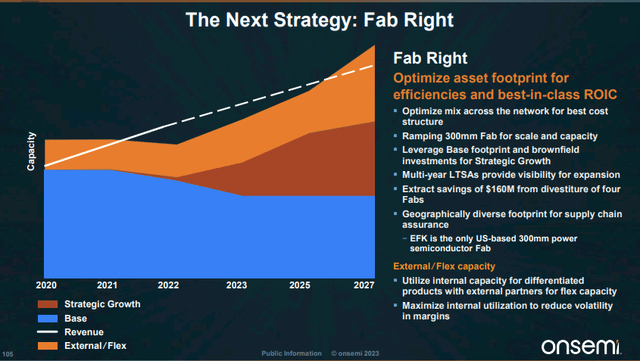

OnSemi is at the beginning of its “Fab Right” strategy. After selling its “subscale” fabs, the company purchased a 300 mm fab in East Fishkill, New York, from GLOBALFOUNDRIES Inc. (GFS) in early 2023. A 300 mm wafer is approximately the same size as a 12-inch wafer. The Fab Right strategy involves manufacturing the “strategic growth” portfolio, which consists of chips that can sell at higher prices and are manufactured on larger, more efficient wafers, resulting in expanding gross margins.

OnSemi First Quarter 2023 Investor Presentation.

The company also mentions in the above image that it will start “leveraging base footprint and brownfield investments for strategic growth,” which it is doing at its Bucheon, South Korea fab. An article announcing its brownfield investments in Korea states:

Construction of the new advanced 150 mm/200 mm SiC fab line along with the high-tech utility building and adjacent parking garage began in the middle of 2022 and was completed in September 2023. The expansion of the 150 mm/200 mm SiC Epi and wafer fab emphasizes onsemi’s focus on building out its vertically integrated silicon carbide manufacturing supply chain at brownfield locations. The Bucheon SiC line is starting with the production of 150 mm wafers and will be converted to 200 mm in 2025 upon qualification of the 200 mm SiC process.

Brownfield investments are the lease or purchase of existing locations in foreign countries to create a new production line. One of the biggest advantages of a brownfield investment is that it can be less costly than constructing a new manufacturing facility from the ground up. Using this strategy, OnSemi can have an international manufacturing site closer to some end customers or suppliers at less cost.

The image above mentions “multi-year LTSAs (long-term supply agreements).” One massive benefit of LTSAs is that the agreement requires customers to alert OnSemi when an end market is weakening so that it can proactively reduce factory utilization in response, helping prevent OnSemi from building up too much inventory. By managing inventory levels far better, management can dampen the cyclicality of its end markets. For instance, during the fourth quarter of the 2023 earnings call, an analyst asked how, compared to competitors, OnSemi avoided some of the worst of the recent downdraft in its end markets. CEO Hassane El-Khoury said (emphasis added):

Look, if you think about what helped us navigate better than a lot of our peers given the guide of companies that guided already…We talked about how, at a minimum, the LTSAs are going to provide us a phone call when things start getting softer. Those phone calls started happening in industrial before anyone talked about industrial softness. I’m talking six quarters ago, that’s when we started taking utilization down, that’s when we time even more what we ship into the channel to be way closely tied to what we believe the demand is at that point in time. The other thing in automotive, we talked about it in our Q3 earnings over 90 days ago when we talked about we started to see signs [of a downturn] because we started getting the calls about the LTSAs and customers wanting to get some relief on the volume. So those are the tools that we have implemented over the last few years in order to give us that visibility.

LTSAs can also help Onsemi plan for the future with budgeting and resource allocation because customers commit to purchasing a specific dollar amount of product over a given period. For instance, a leading solar inverter manufacturer committed to buying $1.95 billion in products in July 2023. The article states, “the company has signed LTSAs with eight of the top 10 solar inverter suppliers, emphasizing the reputation onsemi has earned as a trusted industry partner.” Investors may also be willing to award OnSemi higher valuations due to the certainty of future revenue that these LTSAs provide.

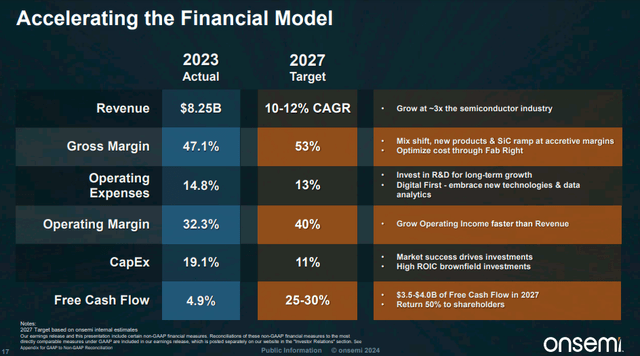

If all of the above moves work, the company should still have double-digit revenue growth in 2027 while reducing costs and expanding margins. If OnSemi can expand FCF from around 5% to the 25% to 30% range, as the following image shows, the stock has a significant potential upside from current prices.

OnSemi Fourth Quarter 2023 Investor Presentation.

However, there are a few risks that potential investors should know about before buying shares.

A few risks

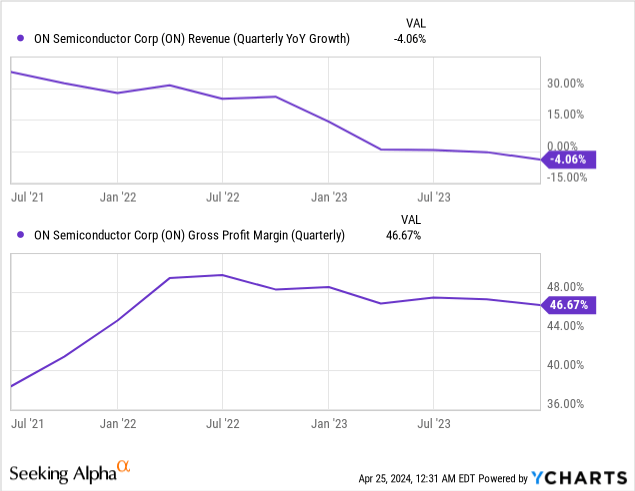

Although management’s “fab right” moves have blunted the worst of its market going into a downcycle, they haven’t completely eliminated the adverse effects. When management saw a downturn in a few end markets, it raised factory underutilization, lowering revenue and margins. The chart below shows revenue and gross profits declining over the last year.

The worst of the downturn may not be over. Suppose OnSemi hits the midpoint of the first quarter of 2024 guidance; the company will show a year-over-year quarterly GAAP revenue decline of 5.6%, and GAAP gross margins will shrink to 45.5% at the midpoint, down from 46.8% in last year’s comparable quarter. The market may not take the news well, especially if management guides second-quarter or annual revenue and gross margins down when it reports earnings on April 29, 2024.

When an analyst asked when the auto and industrial markets would recover, CEO Hassane El-Khoury said:

Look, I can only manage and comment on what we see. And therefore, what we see is kind of that inventory digestion and softer end demand. Therefore, that’s what we’re managing to. I’ve been very consistent over the last — almost two quarters that we’re going to manage 2024 as there is no recovery per se. And then if there is one, we’ll just take advantage of it and it will become a tailwind across all financial metrics. Margin goes up with utilization, revenue goes up, etc. So that’s how we’re going to manage.

So, anyone who decides to invest must become comfortable with the idea that things could get worse before they get better.

Another risk investors should be aware of is that although OnSemi’s SiC business has high upside potential, other well-capitalized semiconductor manufacturers could eventually threaten this business. For instance, since SiC can be hard to manufacture compared to traditional silicon semiconductors and has lower initial yields, major players like Taiwan Semiconductor Manufacturing Company Limited (TSM) have shown reluctance to make a big entry into the market. If Taiwan Semiconductor changes its mind and decides to enter the market in a big way, it may stunt OnSemi’s growth.

Valuation

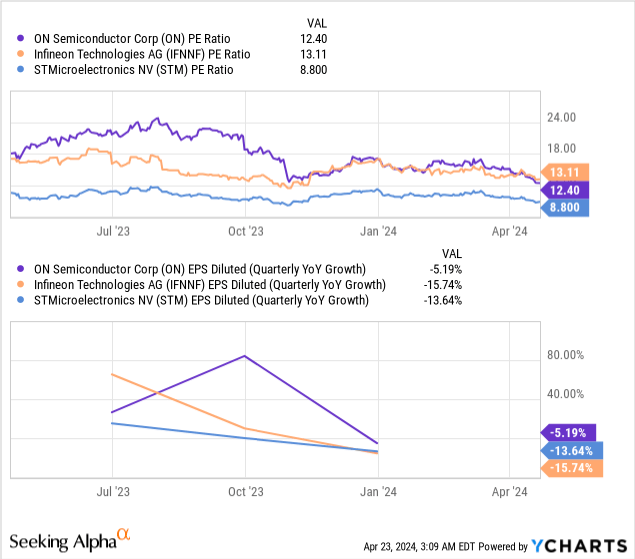

OnSemi’s price-to-earnings (P/E) ratio is 12.40, well below the sector median of 26.69, suggesting the market may undervalue the stock. The following charts compare OnSemi to two companies that it competes against in some of the same end markets. Infineon Technologies has the highest P/E ratio but the lowest quarterly EPS growth rates. Although the industries these companies compete in are down in the dumps, OnSemi’s profitability is holding up much better than that of its competitors.

Let’s do a reverse DCF on OnSemi to see if we can determine what FCF growth rate the current stock price assumes.

Reverse DCF

|

The first quarter of FY 2025 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$402 |

| Terminal growth rate | 3% |

| Discount Rate | 10% |

| Years 1 – 10 growth rate | 24% |

| Stock Price (April 24, 2024, closing price) | $65.53 |

| Terminal FCF value | $3.587 billion |

| Discounted Terminal Value | $19.759 billion |

| FCF margin | 4.9% |

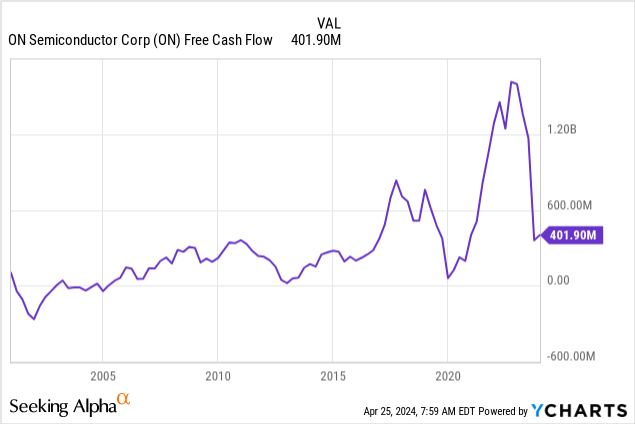

If I assume the long-term revenue growth rate is only around 8 to 10% over the next ten years, OnSemi’s ability to achieve an FCF rate of 24% over the same period would be nearly impossible. However, at peak cycle, the company projects its FCF margin will be 25% to 30%. If the company can achieve an average FCF margin of 15% over the next ten years through its up and down cycles, OnSemi would only have to grow FCF 8.8% over the next 10 years to justify the April 24, 2024, closing price. So, even though the stock is cyclical, it still may be at a fair value for a long-term buy. However, be aware that I made many assumptions in the above reverse DCF, some of which may be overly aggressive. Also, my assumptions may be inaccurate because cyclical stocks don’t produce a steady FCF growth rate, and FCF can go up and down with a cycle, like the chart below shows.

If you decide to invest in OnSemi, remember that it is around the bottom of a cycle and may remain down throughout 2024. However, this company may be at a peak in the upcycle by 2027. If that assumption is valid, OnSemi could have significant potential price appreciation over the next several years as the company projects FCF to grow to $3.5 to $4.0 billion by 2027, surpassing the previous high of $1.7 billion in December 2022.

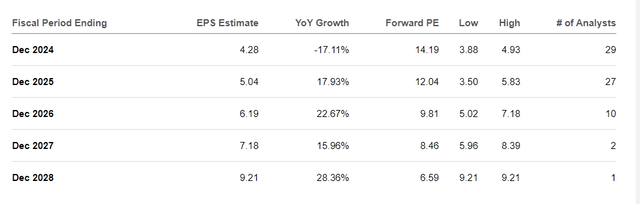

The following table from Seeking Alpha shows that analysts expect annual EPS (earnings-per-share) growth to shrink by 17.11% this fiscal year. However, at least one analyst expects the EPS to grow at a CAGR of 21.1% between 2024 and 2028. Because of a near-term focus and poor market sentiment, investors may not be factoring in potential earnings growth beyond 2024. For instance, OnSemi has a one-year forward P/E of 12.04, yet 27 analysts expect the company to produce 17.93% EPS growth. When a stock’s forward P/E fails to match the EPS growth rate in a given year, the market could undervalue the company’s potential EPS growth.

Seeking Alpha

If OnSemi’s one-year forward P/E matched its expected growth rate for fiscal 2025, the stock would trade at $90.37, up 49% from the April 22 closing price of $60.65, which I believe more accurately reflects the company’s potential growth after its end markets come out of a cyclical downturn.

The market may also undervalue the stock because of the massive decrease in FCF over the last several quarters, which was due to a cyclical decline in operating cash flow and a temporary increase in capital expenditures to build up SiC chip manufacturing capacity. Once OnSemi’s end markets rebound and the company finishes building up SiC capacity, the company should produce robust FCF growth.

A semiconductor manufacturing stock at a decent value

Suppose you are a cautious investor who thinks semiconductor stocks like NVIDIA Corporation (NVDA) and Broadcom Inc. (AVGO) have moved too far, too fast in the last several years based on Artificial Intelligence hype. In that case, OnSemi is a stock selling at a decent valuation, which is ideal for using a dollar-cost average strategy over the rest of 2024. I rate OnSemi a buy.

Read the full article here