Introduction

The gig economy is experiencing explosive growth, and Payfare (TSX:PAY:CA) is at the forefront, providing financial solutions tailored explicitly to gig workers. Their innovative Earned Wage Access platform tackles a significant pain point for this workforce by offering immediate access to earned income, improving financial well-being, and eliminating reliance on predatory payday loans. Not only does Payfare boast a loyal customer base and partnerships with industry giants like DoorDash and Uber, but it has also achieved profitability with impressive financial metrics. With a focus on expanding services and entering new markets, Payfare is well-positioned for continued dominance in this dynamic space. Finally, I think its shares are undervalued, so, in my opinion, Payfare is a ‘Buy.’

Business Model

Payfare provides mainly payroll fintech solutions in the gig economy, facilitating daily or after-task payments to gig workers. The former receives the name of Earned Wage Access (‘EWA’). Furthermore, Payfare offers various other fintech services, such as Digital Banking, ATM Services (through NCR Corporation), Digital Insurance (through Avibra), and Rewards Programs (through Cardlytics), principally cash back on purchases of food, gas, and vehicle repairs, as Payfare’s key customers are Lyft, DoorDash, Uber, and Uber Eats.

Payfare doesn’t charge businesses and workers for payroll payments; instead, the company generates revenue from interchange fees when gig workers use their cards to pay for something and fees related to ATM services, money transfers, and foreign exchange. According to its last Annual Information Report (download here), 75% of revenue comes from interchange fees and 25% from other financial services.

According to its Annual Information Report, Payfare allows workers to initiate the account opening process with Payfare in near real-time through their platform’s API. Once identity verification is complete, a Payfare account is created, offering them the flexibility to receive earnings as often as the platform determines, whether daily, per task, or after a series of tasks. Workers can receive a physical Visa or Mastercard debit card for traditional purchases or instantly provision it to their Apple Pay or Google Pay mobile wallets for secure contactless payments. Managing their finances is equally convenient with the co-branded “powered by Payfare” app. Here, workers can activate their cards, view their account balance and transaction history, access any available rewards programs, transfer funds, pay bills, and even locate ATMs. Finally, the gig platform utilizes Payfare’s API once more to effortlessly send earnings directly to the worker’s account, with immediate access to the deposited funds. This process empowers gig workers with greater control over their finances, eliminating the wait for traditional pay cycles.

Lastly, the company has partnered with many financial companies to offer all its financial solutions without the larger investment requirements, regulatory burden, and the need for developing scale. For instance, Payfare partners with People’s Trust Company in Canada and Stride Bank, N.A. in the United States to offer Payfare Accounts and payment cards, with i2c to process instant payments in the US and Canada, with Artist Growth to expand into the creator economy, with NCR Corporation to offer ATM services, etc.

Industry

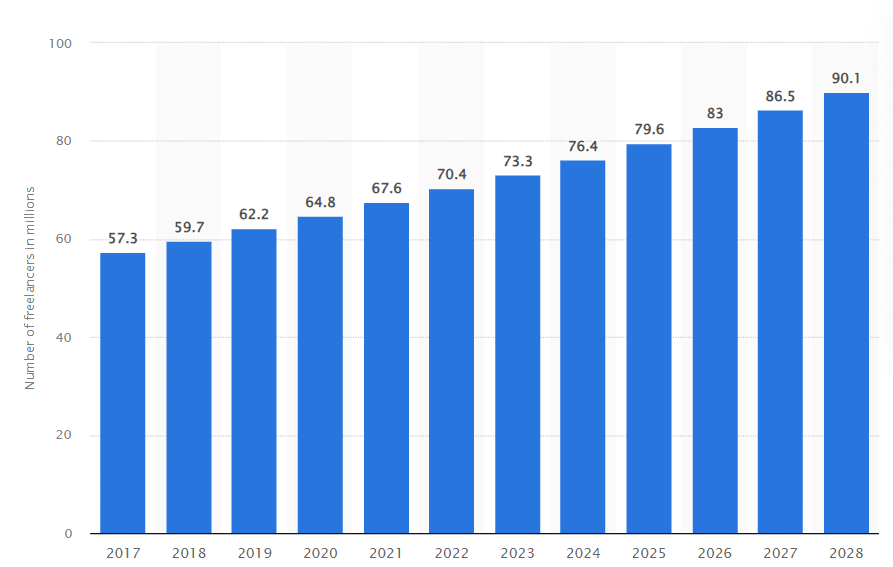

According to Statista, the US gig economy (from where Payfare makes over 98% of its revenue) comprised 57.3 million workers in 2017. Gig workers work between 11 and 30 hours per week and highly value their work-life balance and flexible working times; 55% make under $50 thousand annually; however, gig work is not always the primary source of income.

Furthermore, gig workers are expected to grow to 90.1 million in 2028. In this sense, Gitnux states that the gig economy represents a third of the world’s working population, and by 2027, the United States is expected to have more gig workers than non-gig workers. On this basis, the global gig economy will grow at a CAGR of 17% until 2027.

Statista

A study by PayQuicker (a Payfare competitor) reveals that the most common gigs are restaurant, grocery, and delivery products (12%), ride-sharing/transportation services (8%), child-care and elder-care services (7%), and freelance photography, design, and copyediting (4%). In addition, 61% of gig workers were not paid immediately after the completion of their gig, while 51% mentioned that factors related to compensation, such as frequency of payments, payment methods, and payment security, were significant at the moment of taking up gig work. In this context, Statista reported that 51% of freelancers suffered from wage theft. Consequently, timely payment is a way to promote payment security among gig workers, so they will be more willing to work for a company that will pay them as soon as they finish a gig or at the end of the day, as payment is more secure than a company that promises them to pay them within a month or two weeks.

Continuing with PayQuicker’s study, the most common payment methods were cash or cheque (41%), direct bank transfer (35%), mobile wallets/ e-payments (21%), and digital currency (4%). Thus, companies like Payfare have yet to penetrate much of the market. Nevertheless, as most gig workers come from restaurants, grocery stores, and delivery products, the cash payment portion may be difficult to penetrate as tips are usually given in cash.

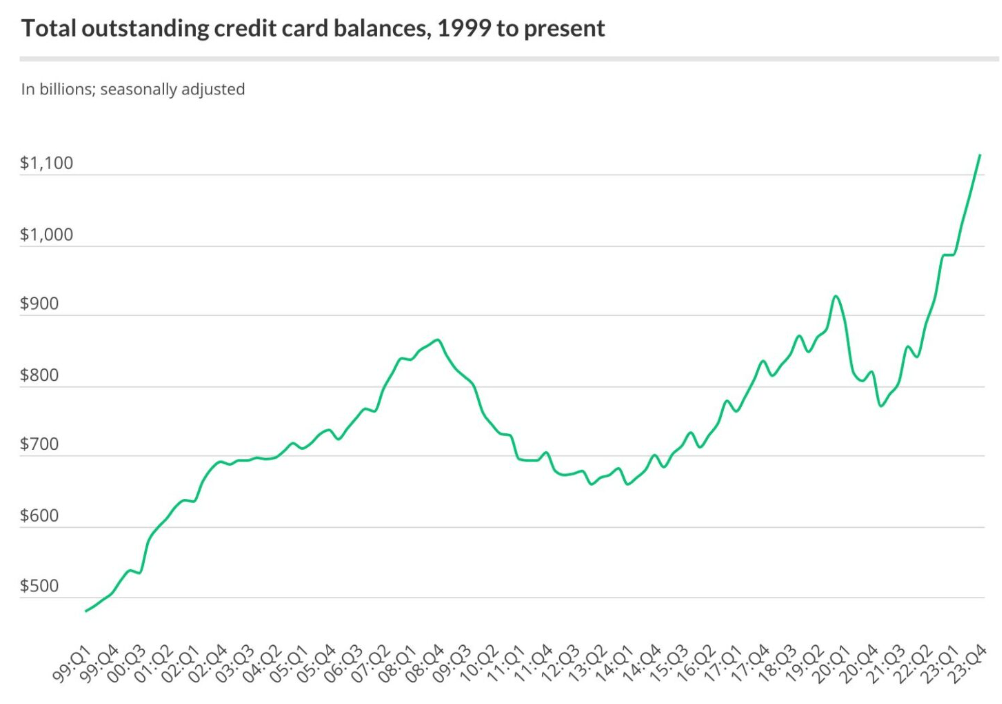

Taking a broader perspective, timely payments are also ideal for hourly workers in the US, as more than 60% of Americans live paycheck to paycheck, and two of every five Americans can’t pay $400 of emergency expenses. Thus, the lack of emergency savings and extended periods without payments left few options other than payday loans, credit cards, and overdraft accounts. For instance, 12 million Americans use payday loans yearly, with an average interest rate of 391% APR. 80% of payday loans are rolled over within 14 days, 78% are taken to meet recurring expenses, and 69% for essentials. Meanwhile, overdrafts affect 23 million households yearly, and credit card balances continue to skyrocket.

LendingTree

More frequent payments could reduce the financial stress of many employees while better matching work with payments, keeping motivated employees who can work more when they need more money. A study by DailyPay (another competitor) found that 95% of workers who began using its services stopped using payday loans. Moreover, a study found that daily payments lowered employee turnover by 42%.

Nonetheless, payment frequency may be problematic for many companies because of cash flow constraints and higher costs, as companies have to carry out the payroll payment job more frequently. However, companies like Payfare aim to streamline this process by leveraging technology like i2c’s building block technology.

Finally, 43% of US companies pay every two weeks, while 27% pay weekly and 10.3% monthly. Hence, there is a potential market beyond the gig economy, and that’s why Payfare is looking to penetrate this market with over 131 million workers who earn less than $75 thousand annually.

Competitive Landscape

Payfare is in a highly competitive industry with many competitors, including PayQuicker, Branch, DailyPay, Instant, Zayzoon, Clair, B9, and EarnIn. I think high barriers to entry protect the industry, as companies need to build scale to offer competitive fees and remain profitable. For instance, Payfare had to reach 1 million employees before becoming a profitable company. Moreover, the marginal cost of adding one more employee tends to be minimal, so companies compete to spread their fixed costs over the maximum amount of accounts possible. Another reason is mild shifting costs, as employers won’t be willing to change from the provider as it can be disruptive for employees during the period of change, which means that the offer of the new entrant has to be significantly better (by a lower price or by a broader financial services portfolio), so employers consider to shift provider.

Most competitors focus on hourly or gig workers in the healthcare and restaurant industries. I didn’t find any other company serving drivers with EWA in the US, which is Payfare’s most important market. However, PayQuicker is an established competitor offering EWA and many other financial services in the gig economy with enough scale to represent a formidable competitor, especially in the global market.

Additionally, as Payfare’s growth strategy expands to hourly workers, it will compete with most companies mentioned above for customers. Even if the market is highly competitive, I believe Payfare will leverage its scale and partnerships to offer better prices and services than most companies. In this sense, Payfare is not lagging behind the competition; even if its position in the transportation market is strong, it continues adding more services to its platforms through partnerships so that new entrants cannot match its financial service portfolio.

Moreover, it’s essential to consider the high growth of the gig economy, alongside the benefits of daily pay on employee turnover and productivity, will undoubtedly attract new entrants. Still, as I said before, I think most of them will fail as they won’t reach enough scale to be sustainable. However, incumbents in other areas of the fintech industry with enough scale could diversify their services and enter this market, threatening Payfare’s competitive position.

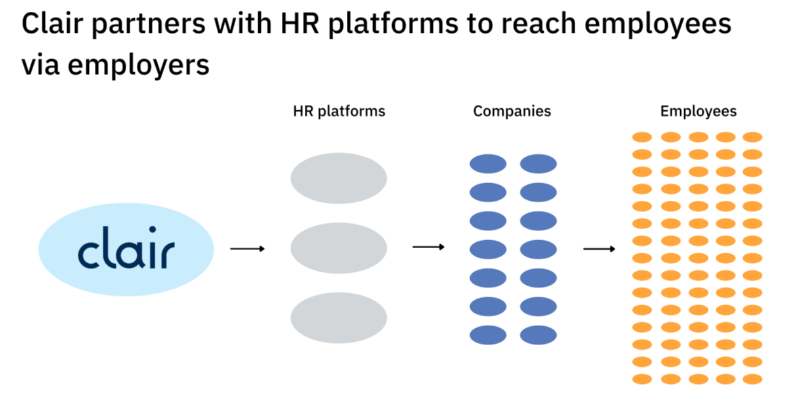

Lastly, I want to highlight the performance of Clair, a company founded in 2019 with over 12,000 employers as clients. Clair’s business model differs from competitors in that it has a different distribution channel; instead of offering its services to employers, Clair partners with HR management companies that distribute its services to employers. This business model allows Clair to scale rapidly from its first client in the summer of 2020 to more than 12 thousand businesses in 2024.

Generalist

Management and Growth

Payfare is led by its co-founders, Marco Margiotta (CEO) and Ryan Deslippe (‘CRO’); under their leadership, the company turned profitable with a TTM ROE of 19.58%. Moreover, the return is likely to expand as margins keep expanding. Furthermore, the revenue grew from CAD 6,309 thousand in 2019 to CAD 174,421 thousand in TTM.

According to the Annual Information Form, the management and board had 25.6% of the total outstanding shares at the end of 2022, which makes me think they have skin in the game, so their and shareholders’ interests are aligned.

On this basis, management compensation represented 5.06% of sales in the last nine months, and less than half of the base salary was paid in SBC, which could be worrisome if the management doesn’t have a significant ownership stake in the company.

Sharing thoughts with Hourglass Investing, I think Payfare’s growth strategy has three areas: First, the company keeps expanding to new verticals and offering more financial (such as credit-like features, insurance, rewards programs, etc.) and payroll services to its current clients so it can increase its revenue per client. Second, expanding to the hourly workers market, which, even if it’s competitive, Payfare’s scale and reputation can help it gain customers. Third, increasing the number of gig workers from current clients.

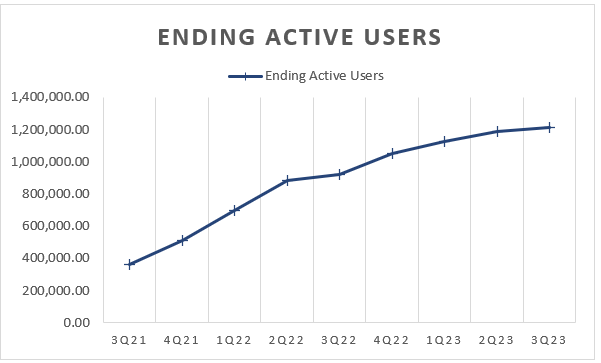

Regarding the third growth area, as of September 30, 2023, the company had 1,211,275 active users. For instance, DoorDarsh has 2 million gig workers quarterly, Lyft has roughly 2 million (including Canada), and Uber has 1.5 million; thus, the company still has room to grow with current main clients; there are still approximately 4.29 million workers only in the US. Moreover, the company is considering expanding globally with current clients, as the partnership with i2c is expanding to Canada and the UK.

Regarding the second growth area, there are plenty of opportunities to grow as most companies in the US still pay every two weeks. Many Americans are experiencing financial stress, which affects their productivity and increases turnover. There are 131 million workers in the US earning less than $75 thousand, more than 100 times the current Payfare clients.

Financial Performance

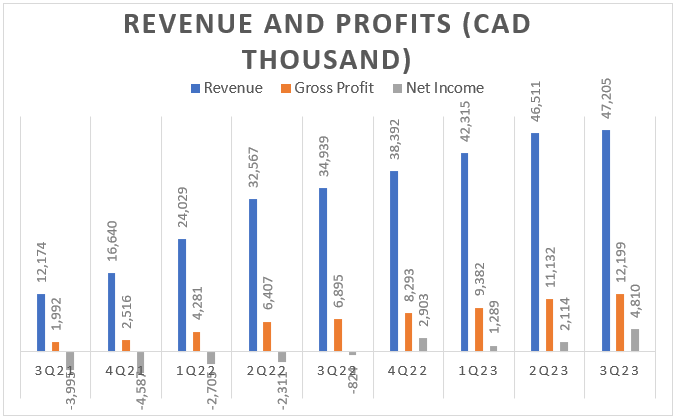

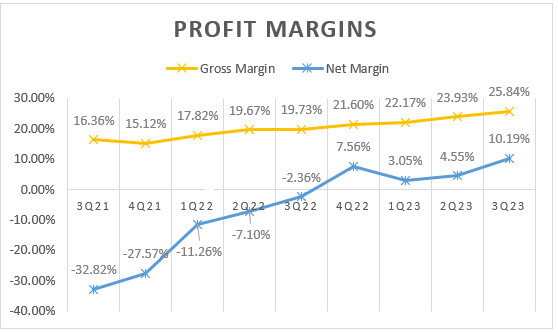

The company has reported outstanding financial performance since 2021; revenue hasn’t stopped growing quarterly, and the company has turned profitable since 4Q22, reporting already four profitable quarters.

Author’s Elaboration with data from Payfare’s Interim Reports

Margins continue to expand as the company experiences operational leverage, effectively spreading its fixed costs over more active ending users (gig workers).

Author’s Elaboration with data from Payfare’s Interim Reports

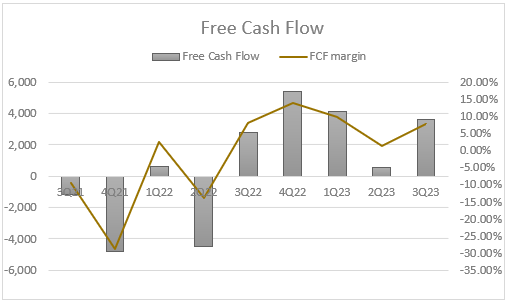

Moreover, the company has generated positive free cash flow (operating cash less investing cash) every quarter since 3Q22. From my perspective, the asset-light business model will allow Payfare to continue increasing its FCF generation, slightly offset by investing in intangibles as the company develops software capacities to maintain growth.

Author’s Elaboration with data from Payfare’s Interim Reports

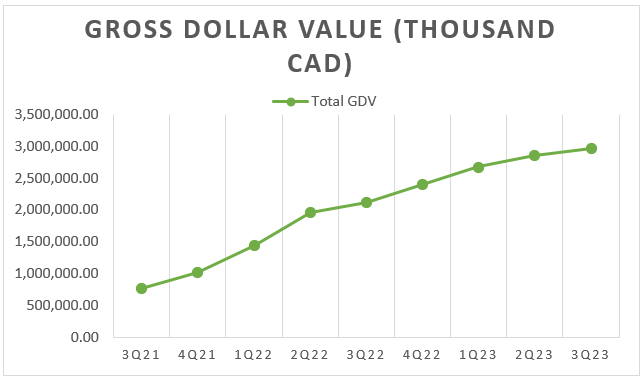

Meanwhile, ending active users and the total gross dollar value keep increasing. From my perspective, these two indicators are crucial to analyzing Payfare’s future performance.

Author’s Elaboration with data from Payfare’s Interim Reports Author’s Elaboration with data from Payfare’s Interim Reports

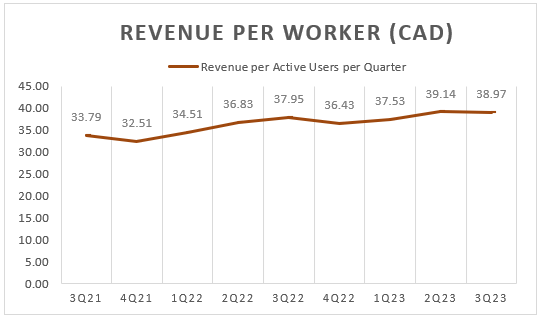

Furthermore, the firm has increased revenue per ending active user, signaling that new services have been successful and that more gig workers are using its financial services.

Author’s Elaboration with data from Payfare’s Interim Reports

Finally, the company had no outstanding debt as of September 2023.

Risks

Competition

Even if Payfare enjoys a solid competitive position in the gig driver market, it still faces competition from many other EWA providers. Even if these EWA companies have focused on different markets, such as hourly workers in restaurants, healthcare, and HR management, the competition may threaten its current position or at least make expansion to new markets complex, as incumbents already have a stake in the cake.

Customer Concentration

Payfare relies on three crucial customers (DoorDash, Lyft, and Uber); losing any of these customers will significantly affect financial performance and cash generation. Furthermore, this concentration gives these gig platforms extraordinary bargaining power. The company estimates the concentration will reduce as they keep adding new clients; however, these companies are among the largest in the gig economy, so diversification may take a while.

New Entrants

I consider the industry to have high barriers to entry for new entrants without scale; nevertheless, some other players in the financial sector with sufficient scale could enter the market, leveraging their scale and network to disrupt Payfare’s competitive position.

Reliance on Key Suppliers

Payfare depends on a few suppliers to provide its services; this makes the company vulnerable to the termination of partnerships, disruptions in the suppliers’ activities, and higher bargaining power. i2c is a crucial supplier for instant payments, so if anything happens to it or to the relationship with Payfare, the company’s core service (‘EWA’) may be threatened; however, both companies continue to deepen its relationship, as Payfare relies on i2c for global expansion.

Valuation

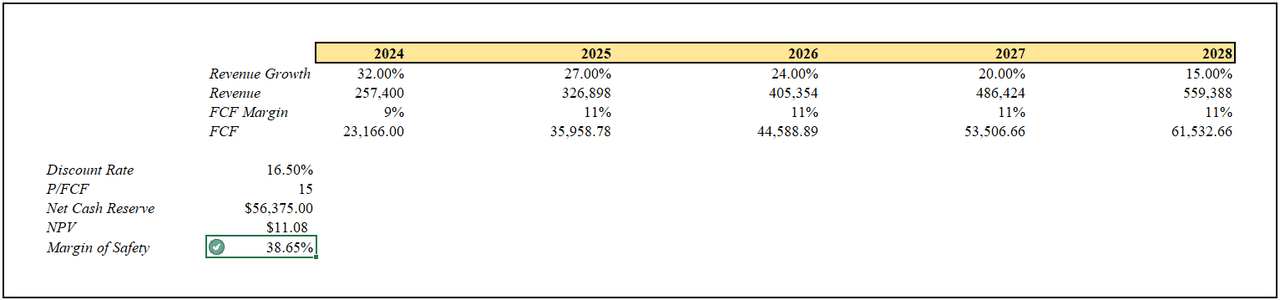

As the company has little financial history, I used an estimated FCF margin of 9% in 2024 and 11% for the rest of the years. Payfare TTM FCF margin is 8.15%, and I think it will expand as margins continue to grow due to operating leverage; however, to be conservative, I limited the expansion to 11%.

Revenue will grow as the company adds more ending active users and services. Still, the revenue growth rate will fall as the company captures most of the gig workers of its principal clients and more competitors enter. Payfare’s last nine months’ revenue growth is 48.61%.

The terminal value was obtained with a P/FCF of 15, as I expect the company to keep conserving its solid position in the gig economy and growing at a double-digit rate. Moreover, based on the 10-year Treasury rate (risk-free rate) of 4.21%, I added a ~12.30% to the risk-free rate to compensate for the higher risk of customers and suppliers concentration, competitive pressures, and the threat of new entrants.

Lastly, I assumed that FY23 revenue will be CAD 195 million, the upper limit of the Payfare’s2023 guidance.

Author’s Elaboration

Given the abovementioned premises, Payfare NPV per share is CAD 11.08; thus, at the current price of CAD 6.8, the stock is deeply undervalued, offering a margin of safety of 38.65%. In my opinion, this margin of safety is enough to bring enough downside risk protection; hence, I consider Payfare to be a ‘Buy.’

Conclusion

Payfare offers a compelling solution for gig workers and businesses in the rapidly growing gig economy. Its EWA platform provides workers immediate access to earnings, improving their financial well-being and reducing their reliance on expensive payday loans.

Financially, Payfare is performing exceptionally well. They’ve achieved profitability, expanded margins, and generated positive free cash flow. The asset-light business model allows for continued growth with minimal investment.

While competition exists, Payfare has a strong position in the gig driver market and enjoys partnerships with significant players like DoorDash, Lyft, and Uber. Their focus on expanding services and entering the hourly worker market positions them for further growth.

The stock is currently undervalued, offering a significant margin of safety. Considering the strong financials, high-growth market, and potential for expansion, Payfare presents an attractive buying opportunity.

In conclusion, Payfare is a well-positioned company in a thriving market. Their strong financials and growth potential make them a compelling ‘Buy.’

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here