Note:

I have covered Perion Network Ltd. (NASDAQ:PERI) previously, so investors should view this as an update to my earlier articles on the company.

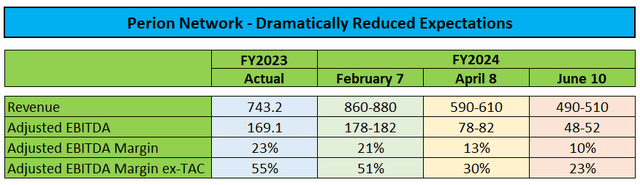

On Monday, shares of Israel-based provider of digital advertising solutions Perion Network, or “Perion,” cratered following the company’s second major earnings warning within just two months.

Company Press Releases

In recent days, Perion was notified by Microsoft Bing of its decision to exclude a number of publishers from its search distribution marketplace. Similar notices were provided to other Microsoft Bing search distribution partners.

As a result of these actions, in addition to the changes in advertising pricing and mechanisms implemented by Microsoft Bing during the first quarter of 2024, search revenue from our agreement with Microsoft Bing is expected to represent less than 5% of Perion’s revenue in the second half of 2024. As the company continues to work with other search engines, our agreement with Microsoft Bing is no longer material to Perion.

(…) While these actions are the primary driver of the reduced EBITDA guidance, Perion has also seen a recent decline in revenue from standard video and display formats. The company believes these declines reflect market conditions as well as a transition to higher premium formats that offer advertisers higher ROI. Perion continues to see increased revenue from higher premium formats but not at a level sufficient to offset the revenue decrease from this change.

Two months ago, Perion attributed the massive warning at that time to:

“a decline in Search Advertising activity, attributable to changes in advertising pricing and mechanisms implemented by Microsoft Bing in its Search Distribution marketplace.”

This time, Microsoft (MSFT) Bing is apparently cracking down on so-called “Made for Advertising” or “MFA” sites – content farms with a poor user experience designed solely to attract as much ad spend as possible.

Please note that Perion already warned about the issue in its recent annual report on form 20-F:

Some of the supply inventory is known as “Made for Advertising” and is less attractive to or excluded by some of our advertising customers. Restrictions from advertisers, DSPs or SSPs regarding usage of this inventory source have impacted us and could materially adversely impact our operations and revenue.

The Association of National Advertisers or “ANA” estimates that advertisers unknowingly spend an eye-catching $13 billion annually on MFA sites, which translates into 21% of all impressions and 15% of ad spend.

Recently, the industry has started to crack down on MFA sites as they disrupt the user experience, compromise content value, introduce potential security risks and erode trust in the digital advertising ecosystem.

Leading industry players like Magnite (MGNI) and PubMatic (PUBM) are now blocking these sites, making it more challenging for them to benefit from their deceptive practices.

However, until last month, Perion operated its own MFA division, a company named “Content IQ” which was acquired for $73 million in early 2020.

On May 10, metadata provider Sincera released a report called “Detecting Resold MFA Subdomains at Scale” which outlined Content IQ’s modus operandi in great detail.

Just two days later, Perion reportedly shut down Content IQ’s entire MFA network.

Perion “separated” – their word – with all of Content IQ’s UK-based content producers, including its last-remaining editor and seven freelance writers. Perion had also laid off a handful of other Content IQ editors late last year.

Going to Content IQ’s own website now results in a 404 error message. Its LinkedIn page was removed, and all of the websites under its umbrella are offline, including Boredom Therapy, Film Oracle, Honest to Paws, Historical Genius, Pets Fanatic, Eternally Sunny, NightDaily, The Atlantic Mirror and Mental Flare.

Perion told AdExchanger these moves are part of a long-term strategic shift that began last year away from Content IQ’s “legacy activity and brand” so as to “focus on technologies for advertisers.”

With the company’s MFA site network shut down and the company now being excluded from Bing’s search distribution marketplace, Perion no longer generates revenues from these activities and consequently lowered its top-line guidance by another 100 million.

Quite frankly, it’s disappointing to see that the company’s strong growth and decent profitability recently was at least partially the result of an aggressive MFA strategy.

In addition, the search division disaster appears to have impacted the company’s core advertising business, with customers likely pulling budgets in an attempt to avoid potential association with the company’s MFA practices.

With the Microsoft Bing revenues largely gone, Perion’s core advertising segment looks pretty bad, with Adjusted EBITDA margin apparently in the single digits.

Moreover, with the company’s reputation now tarnished, further material revenue declines might be on the cards.

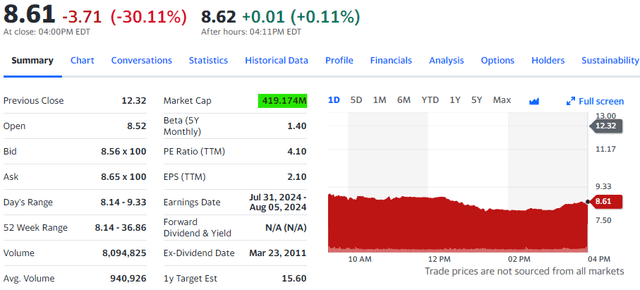

Given these issues, I am struggling to assign any meaningful value to the company’s core advertising business, and neither does Mr. Market:

Yahoo Finance

Following Monday’s 30% decline, Perion is now trading at an approximately 13% discount to the company’s $480 million in cash, cash equivalents and marketable securities reported at the end of Q1. The company continues to have no debt.

That said, up to $75 million of these funds will likely be spent on near-term share buybacks, which should provide at least some support to the company’s ailing share price:

(…) management and our Board of Directors are equally committed to delivering shareholder value by leveraging our strong balance sheet to invest in technology, acquire complementary solutions and execute our $75 million buyback program, which has already begun.”

Bottom Line

With the key Microsoft Bing relationship essentially dead, Perion Network Ltd. will have to rely on its low-margin advertising business going forward, which is apparently facing headwinds resulting from the search division disaster.

Even with Perion Network now trading below cash value and an active buyback program in place, investors should abstain from buying the selloff as the company’s near-term prospects remain cloudy.

However, with the repurchase program likely to provide some support to the shares, I am reiterating my “Hold” rating on Perion Network Ltd. stock.

Read the full article here