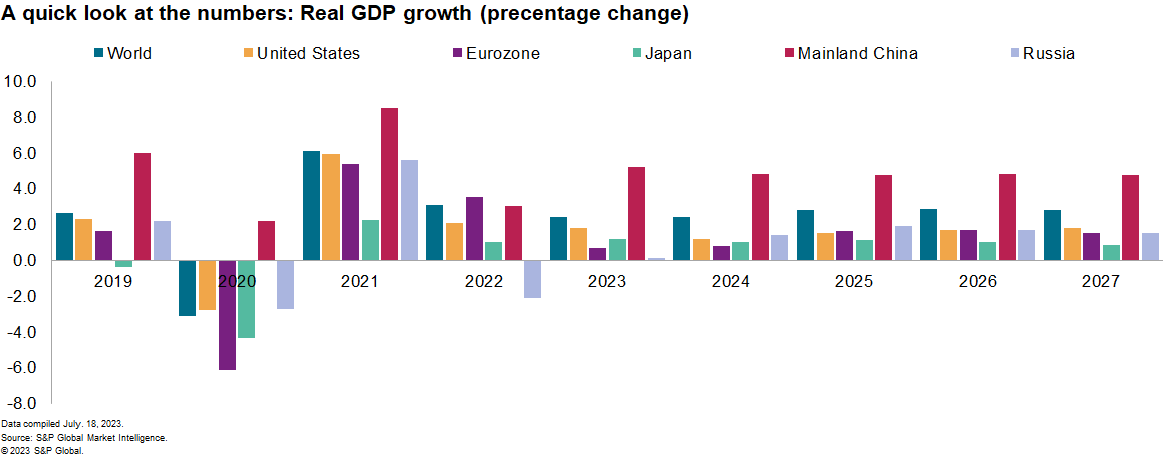

The economic environment is likely to remain challenging

While S&P Global Market Intelligence’s global real GDP growth forecast for 2023 is unchanged at 2.4%, this masks regional divergence. Growth forecasts for 2023 have been revised markedly upward in North America, primarily reflecting the recent resilience of economic activity. In contrast, the forecasts for mainland China and parts of Europe have been revised down. Moreover, the global real GDP growth forecast for 2024 has been lowered again to 2.4%. The lagged effects of tighter-for-longer financial conditions will continue to weigh on economic activity. Leading indicators remain consistent with global expansion but are losing momentum. The J.P.Morgan Global Composite Purchasing Managers’ Index™ (PMI™) by S&P Global fell in June to a four month-low.

Hiking cycles have further to go in advanced economies

Further 25-basis point interest rate increases from the US Federal Reserve and the European Central Bank are forecast in July, with the former, along with the Bank of England (BoE), expected to continue hiking until late in 2023. The BoE’s tightening to address a potential wage-price spiral is a key factor behind the forecast recession in the UK. Forecasts of policy rate cuts in advanced economies have been pushed back to mid-2024, against a backdrop of sticky core inflation and tight labor markets. Central bank balance sheet reductions will continue. This is a source of risk for eurozone countries with large debt burdens, low potential growth and political challenges. In parts of Latin America and emerging Europe, where the responses to soaring inflation rates were more rapid, rate cuts are forecast to begin later in 2023.

Inflation rates will continue to trend downward but at a slower pace

From a cycle high of over 8.0% in September 2022, global consumer price inflation has fallen to an estimated 4.7% in June 2023. As supply and demand continue to rebalance and wage pressures moderate, consumer price inflation is forecast to fall to 5.5% and 3.7% in 2023 and 2024, respectively — well below 2022’s 7.6%. As the downward pressure on headline rates from energy and food price effects will fade, the evolution of core inflation will be key. With industrial materials prices having softened, the moderation in core goods inflation is set to become more pronounced and widespread, consistent with tumbling producer price inflation rates and surveys of pricing intentions. Services inflation is expected to be comparatively sticky, given ongoing labor shortages and pent-up demand, although the PMIs suggest that the latter is starting to wane.

US real GDP growth has been revised up for 2023 but revised down for 2024-25

The upward revision to the former, from 1.5% to 1.8%, is mainly due to newly reported (and unexpected) strength over the first five months of 2023. This improved momentum, reflected in an upward revision to our estimate of second quarter GDP growth, will likely carry over into the third quarter. Despite the upward revision, we expect US real growth to remain below its potential rate. Looking further out, the growth forecasts for 2024 and 2025 have been lowered to 1.2% and 1.5%, respectively. The persistence of inflation alongside the resilience in labor markets will compel the Fed to continue to tighten policy until it is convinced that inflation is on track to return to target. Recent readings on consumer and producer prices, which have shown welcoming signs of disinflation, will unlikely be sufficient to sway policymakers from two more 25-basis point hikes in 2023.

The eurozone’s services-driven growth rebound is faltering

While a modest rebound in real GDP growth is still forecast during the second quarter, high-frequency indicators remain indicative of weak underlying momentum. Hard activity data have also generally remained soft, while the HCOB Eurozone Composite PMI® lost momentum in June. Weakness is spreading from the energy-affected manufacturing sector to hitherto perky service-sector activity. Against this backdrop, sub-1% annual real GDP growth is forecast in the eurozone for 2023 and 2024. Headline consumer price inflation continues to drop, helped by a deepening drag from energy, but core rates remain uncomfortably high. Both are expected to continue their downward trend during the second half of 2023 and beyond, which is pivotal to our forecast of only one more round of ECB rate hikes in 2023 (in July). Sticky services inflation and elevated wage growth are key risks to this forecast.

Mainland China’s post-pandemic recovery continues to disappoint

The forecasts for real GDP growth in 2023 and 2024 have been lowered to 5.2% and 4.8%, respectively (with the 2023 forecast below the market consensus expectation). Growth in the second quarter slowed markedly, reflecting weakness in exports, sluggish consumer demand and a struggling property sector. Over half of the cities surveyed posted month-over-month declines in new home prices in June. The latest run of data will add to the pressure for additional policy stimulus. Additional measures are expected, but the scale of the stimulus will likely be limited, partly due to mainland China’s high debt level. It will unlikely be sufficient to generate a robust recovery, given the headwinds facing the household and private business sectors.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here