Introduction

Relay Therapeutics (NASDAQ:RLAY) is a pioneering clinical-stage biotech company that fuses cutting-edge computational and experimental technologies to revolutionize drug discovery. Its Dynamo platform targets previously intractable protein targets, with a primary focus on targeted oncology and genetic diseases. Leading its pipeline are candidates RLY-4008, RLY-2608, and GDC-1971.

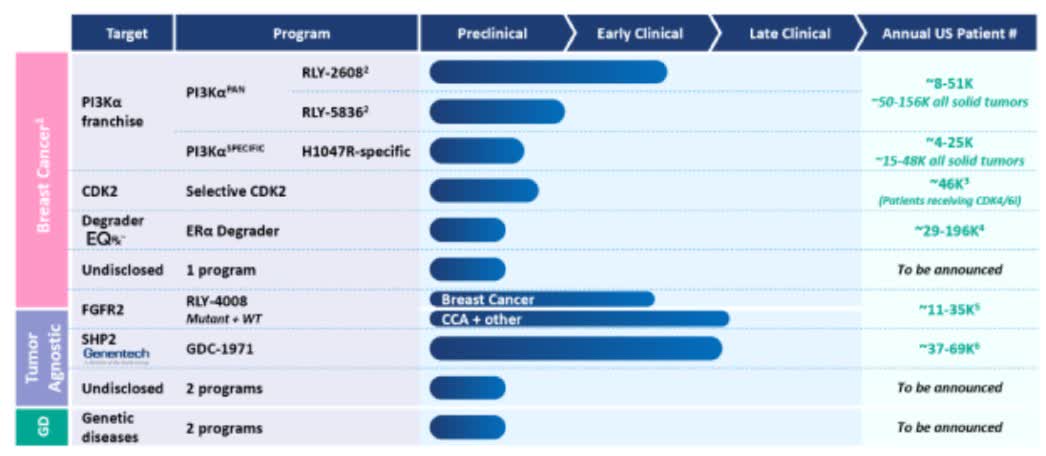

Relay’s pipeline (Relay 10-K)

The article discusses Relay Therapeutics’ pipeline, financial performance, and investor concerns over early clinical data for drug candidate RLY-2608.

Financial Performance

At the end of Q1 2023, Relay Therapeutics held $937.8 million in cash, cash equivalents, and investments, a decrease from $1 billion at the end of 2022. The company projects these funds will support operations into 2025. R&D expenses for Q1 2023 rose to $82.8 million from $51.7 million in Q1 2022, primarily due to increased clinical trial costs, employee-related costs, and preclinical programs expenses. General and administrative expenses also increased to $19.6 million in Q1 2023 from $16.1 million in Q1 2022, largely due to higher employee-related costs. The net loss was $94.2 million ($0.78 per share) in Q1 2023, compared to a net loss of $62 million ($0.57 per share) in Q1 2022.

RLY-2608: Early Clinical Data Sparks Investor Concerns and Analyst Optimism

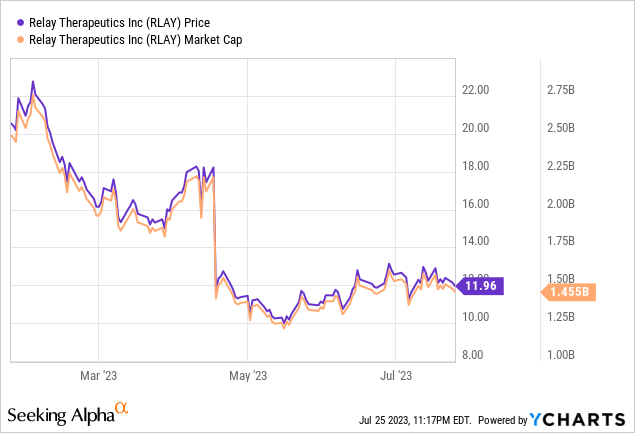

Relay Therapeutics released early clinical data for RLY-2608, an experimental drug that targets PI3Kα mutations, commonly implicated in various cancers. Despite initial data suggesting effective target engagement, good safety, and some antitumor activity, Relay’s stock declined by around 40% following this release in April.

One factor that may have contributed to this sell-off is the study’s early stage. While preliminary data are encouraging, investors might be hesitant due to the lack of robust evidence of efficacy. The trials involve patients with advanced disease who have not responded to other treatments, which may raise questions about the drug’s broader applicability and effectiveness.

Importantly, RLY-2608 is an isoform-selective PI3K inhibitor, a class of drugs with a history of challenges relating to both safety and effectiveness. Despite promising initial results, the past difficulties of this class of drugs may cause investor skepticism.

Moreover, only one partial response was observed among the patients in the trial. This result might have concerned investors, as it could suggest a lower efficacy rate than hoped for. In oncology, the number of responses to a new treatment is an important factor that often directly impacts investor sentiment. Although it’s early in the trial, a single partial response could be seen as a red flag.

Another point of uncertainty is that the optimal dosage for RLY-2608 hasn’t been established yet, which introduces future uncertainties regarding the drug’s safety profile and potential effectiveness. While no dose-limiting toxicities have been reported to date, we are still in the early stages of clinical trials, and unanticipated adverse effects might emerge as the research continues.

I concur with analyst Dane Leone’s stance that the sharp sell-off after Relay Therapeutics’ preliminary data for their cancer drug RLY-2608 was an overreaction. Although the initial response data might seem lackluster, it’s essential to remember that this is early-stage data from trials involving heavily pre-treated, advanced disease patients. Importantly, the trial findings serve as key validation for Relay’s Dynamo platform, suggesting its potential beyond this single drug candidate. Leone’s upgrade of Relay to a “Strong Buy” and her maintained $29 price target seem justified given the safety validation and the early nature of the disclosure. The revised projection by Raymond James for a full market entry of RLY-2608 by 2028 seems reasonable, considering the various stages of drug development. Overall, while the short-term market reaction was bearish, the longer-term perspective highlights the company’s potential.

Relay Therapeutics: Advancing Promising Lead Assets

Transitioning from Relay Therapeutics’ RLY-2608, the company also has two other promising lead assets. First, RLY-4008, a small molecule inhibitor designed to target FGFR2 in patients with advanced or metastatic FGFR2-altered solid tumors. Initial data from its first human trial demonstrated substantial FGFR2 inhibition without being constrained by off-target toxicities. After discussions with the FDA in 2022, Relay elected to proceed with a single-arm trial design for FGFR2-fusion CCA treatment-naïve patients to potentially expedite approval. RLY-4008 has received orphan designations for CCA treatment from both the FDA and the EMA. Interim data revealed a substantial overall response rate.

Secondly, GDC-1971 (previously RLY-1971) is another lead asset by Relay. This drug targets SHP2 in patients with advanced or metastatic solid tumors. The Phase 1a trial completed enrollment in 2022. Relay entered a collaboration with Genentech for the development and commercialization of GDC-1971, which led to the initiation of combination trials with Genentech’s KRAS G12C inhibitor and PD-L1 antibody.

My Analysis & Recommendation

To sum up, the present market sentiment towards Relay Therapeutics doesn’t truly capture the firm’s long-term prospects. Despite a dip in Relay’s stock value subsequent to the preliminary clinical data for RLY-2608, it’s vital to bear in mind that these studies represent merely the beginning of establishing this drug’s effectiveness and safety. I believe the market might be hastily discounting RLY-2608 based on a single partial response seen in the trial, failing to account for the fact that the trial subjects were intensively pre-treated and had late-stage illnesses.

In addition, this initial data affirms the efficacy and potential of Relay’s Dynamo platform, providing hope for upcoming drug candidates. It’s also significant to point out that Relay’s repertoire includes more than just RLY-2608, with drugs like RLY-4008 and GDC-1971 exhibiting considerable promise in their respective trials.

Considering Relay Therapeutics’ current market cap of $1.48 billion, investors should perceive this as a long-haul opportunity. Yes, the stock has dipped by 41% in the past year, but it’s essential to keep in mind that investments in biotech typically require a long-term perspective. An enterprise’s worth in this sector shouldn’t be assessed purely on the preliminary clinical data of a single drug candidate. Instead, investors should focus on the wider potential of the company’s unique approach and pipeline.

Relay Therapeutics could be an appealing option for investors who are prepared to tolerate some degree of risk and have the long-term investment mindset. Investors need to recognize that such investments are best suited for those who can patiently wait for data to evolve and navigate through the process of clinical trials.

At this point, I would recommend keeping Relay Therapeutics in your investment portfolio. This suggestion is founded on the reasoning that while there are intrinsic risks associated with the early phase of RLY-2608’s trials and the general volatility of the biotech sector, the company’s Dynamo platform, other key assets, and a strong cash position make Relay a fascinating firm to observe in the coming years.

Read the full article here