Asset allocation isn’t dead. While we’ve been in a cycle where any diversification around the U.S. large-cap stocks detracted from performance, it’s still just a cycle which in turn will end and bring with it a new set of potential outcomes. If you’re in agreement, and are looking for a fund that provides a mix of asset class exposure designed to generate real return, then the SPDR® SSgA Multi-Asset Real Return ETF (NYSEARCA:RLY) is worth considering.

RLY was launched in April 2012 as an actively managed exchange-traded fund, or ETF, seeking real returns through capital appreciation and current income. The fund uses a quantitative model which follows a proprietary algorithm, complemented by fundamental analysis, to determine where to allocate to. RLY focuses on inflation-protected securities, real estate securities, commodities, infrastructure companies, and firms operating in natural resource/commodity-intensive sectors such as agriculture, energy, metals and mining. RLY charges an expense ratio of 0.50 percent, and generates income for investors through a 30-Day SEC Yield of 3.62%.

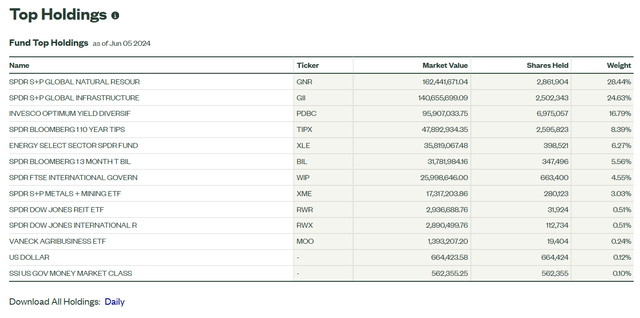

A Look At The Holdings

This is an eclectic mix of ETFs, with the SPDR S&P Global Natural Resources ETF (GNR) at the top, making up nearly 29% of the fund. This is an ETF of ETFs, so even though these are large allocations, it is highly diversified when you consider the pass through on the securities in each position.

ssga.com

GNR broadly invests in energy, metals, and agriculture-related products produced and sold by businesses located around the world. GIL invests in global companies that construct, operate and maintain infrastructure assets (e.g., transportation, utilities and energy infrastructure). PDBC, which tracks a basket of energy, precious and industrial metals, and agricultural products goods. TIPX is made up of inflation-protected US Treasury securities maturing in 1 to 10 years. And XLE is designed to give direct exposure to the energy sector of the market, including those harvesting, processing, or distributing energy.

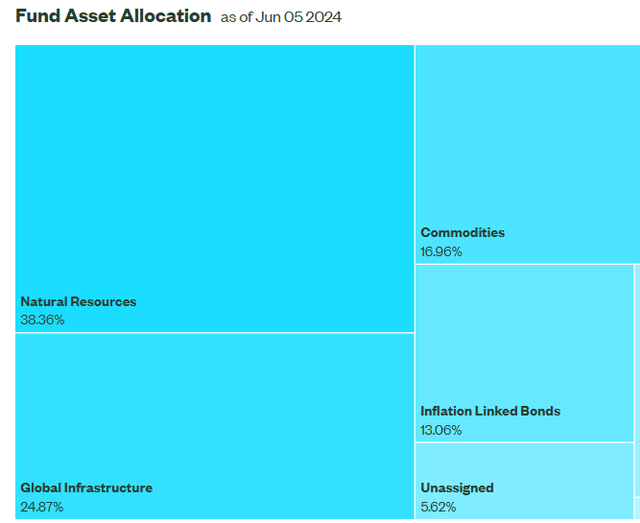

Sector Composition and Weightings

The allocations match the names of the ETFs. Natural Resources makes up the biggest overall bucket, followed by Global Infrastructure and Commodities.

ssga.com

I like the mix here. Clearly, the return pattern will look different from what you’d otherwise get from the S&P 500 (SP500), and these areas should likely perform well in inflationary environments like what we have today from a real return perspective.

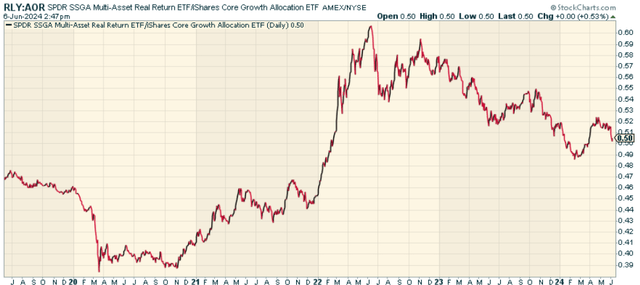

Peer Comparison

As this is a multi-asset fund, it might be worth comparing it to a more traditional core basket like the iShares Core Growth Allocation ETF (AOR). This fund of funds has a heavy allocation toward growth-oriented asset classes such as domestic and international stocks, bonds and real estate investment trusts (REITs). When we look at the price ratio of the two, we find that RLY outperformed up until 2022, but then lagged pretty consistently. That shouldn’t be a surprise as AOR has tech stock exposure, and that’s been the only game in town for the past 2 years roughly.

stockcharts.com

Pros and Cons

On the plus side, this fund provides investors with a nice mix of asset classes that should help preserve and grow real purchasing power after inflation. It’s a nice fix of funds and the hope would be that this provides diversification benefits against equities, with the fund’s model helping to navigate weightings to where strength is highest.

On the downside? It’s a fund of funds that isn’t super active, which means you may want to consider doing this yourself without the added management fees. I like the convenience factor here, though. It’s also worth noting that there is no guarantee, of course, that the fund does what it’s supposed to do as an inflation beneficiary.

Conclusion

In an era where inflation risk is a critical consideration, SPDR® SSgA Multi-Asset Real Return ETF provides investors with a way to protect and possibly grow their purchasing power. The combination of its exposure to multiple sources of inflation-hedging assets and sectors with an active strategy approach has a lot of appeal, I think. It certainly looks and acts differently than a stock-only portfolio, and I think that will matter more and more as the cycle continues to change.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here