Co-authored by Treading Softly.

When I first bought my home, I had plenty of land. It was full of potential opportunities with very little structure present on that property. There was a home, a beautiful home that my family and I lived in, but other than that and a little bit of fencing, the entire acre-plus property was completely kept.

I’ve always hated when people say that there’s so much potential in something. All potential is, is just opportunities that have not been tapped. Someone with a lot of potential that does nothing is just another person who’s done nothing – there’s nothing special about them. So, by understanding those prospects, I was unlocking the potential of my land by building more structures on it, such as a chicken run, a chicken coop, and a shed. But to do so, I had to decide where I was going to set my limits and what I was going to need prior to tackling those tasks.

When it comes to the market, I’m a professional income investor; I live and breathe, looking at the market to find companies and investments that will pay me to be a shareholder so that I can pay for the daily expenses of my life. If it doesn’t pay me a dividend, I am not interested in it because that means that the company does not find me worthy of being paid to be part of that company. It’s not a statement of pride – it’s a statement of fact that I demand to be paid for the investments that I hold.

I want to present to you multiple preferred security opportunities that yield a bare minimum of 8%. These are investment opportunities that you can buy and hold for the long haul. When I buy any sort of fixed-income investment, I am not looking to flip it once it rises a nickel in value. There are those out there who like to trade in and out of fixed-income securities. That’s not my jam; I buy them for income. I hold them and sell them when I think I can find a better opportunity for more income – not just because the price changed a nickel and it annualizes out to be a 20% return after five days. I don’t like to play those types of games.

So today, I’m going to show you two different families of preferred securities that I think are well worth being part of your income portfolio.

Let’s dive in!

1) TWO Preferred Shares – Yields Up to 9.4%

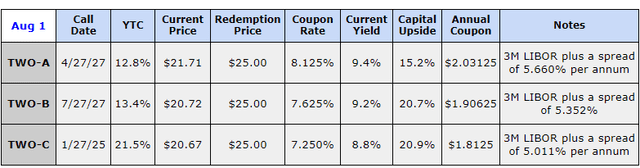

- 8.125% Series A Cumulative Redeemable Fixed-to-Float Preferred Stock (TWO.PA)

- 7.625% Series B Cumulative Redeemable Fixed-to-Float Preferred Stock (TWO.PB)

- 7.250% Series C Cumulative Redeemable Fixed-to-Float Preferred Stock (TWO.PC)

Two Harbors Investment Corp. (TWO) is an internally managed agency mortgage REIT. As an agency mREIT, TWO only purchases Residential Mortgage Backed Securities (“RMBS”) that are guaranteed by government agencies like Fannie Mae, Freddie Mac, and Ginnie Mae. This effectively leads to zero credit risk for the company, but their business strategy involves interest-rate risk.

TWO also holds a substantial $3 billion portfolio of Mortgage Servicing Rights (“MSRs”) that provide a high degree of stability in this climate of elevated mortgage rates. This is because when rates are higher, people typically don’t refinance their mortgages. Refinancing and early payment are among the biggest risks for MSRs, and elevated rates, liquidity drying out, and recessionary environments reduce these risks considerably. In fact, the Fed’s continued rate increases should benefit TWO’s MSR portfolio.

In FY 2022, TWO repurchased 2.9 million of its preferred stock, effectively reducing its quarterly preferred interest expense by ~$1.5 million. As a result of its book value decline, TWO recently slashed its common dividend by 25%.

As hedging costs are rising (due to the banking system uncertainties) and mortgage spreads are widening, TWO’s book value has experienced a decline in Q1, forcing management to make the unpopular 25% common dividend cut. As investors in TWO’s cumulative preferreds, this is actually positive because it improves the dividend safety through the preservation of cash outflows.

TWO spent $12.3 million on preferred dividends in Q1 2023 and $52.1 million on common dividends. The mREIT ended Q1 with $825.6 million in cash and cash equivalents, providing adequate safety for preferred dividends. It is notable that TWO has been active and opportunistic with its funding strategy and has utilized market conditions to improve its cash flows. In 2021, TWO redeemed two of its preferreds – series D and series E preferred shares. In FY 2022, TWO repurchased 2.9 million shares of its preferred stock for $22 million and retired $143 million of its senior notes that were due.

Despite headwinds to the common stock price from economic conditions and subsequent dividend cuts, TWO preferreds present safer income opportunities at this time.

Author’s Calculations

mREITs investing in agency MBS carry no credit risk and present excellent counter-cyclical investment opportunities during recessions. They carry interest rate risk, but the Fed is close to the finish line with quantitative tightening, and we expect better stability for fixed-income picks in the near term. TWO preferreds present attractive buys to lock in big yields and get even higher yields if the coupon switches to an even higher floating rate in the coming years.

2) DBRG Preferred Shares – Yields Up to 8.5%

-

7.125% Series H Cumulative Redeemable Perpetual Preferred Stock (DBRG.PH)

-

7.150% Series I Cumulative Redeemable Perpetual Preferred Stock (DBRG.PI)

-

7.125% Series J Cumulative Redeemable Perpetual Preferred Stock (DBRG.PJ)

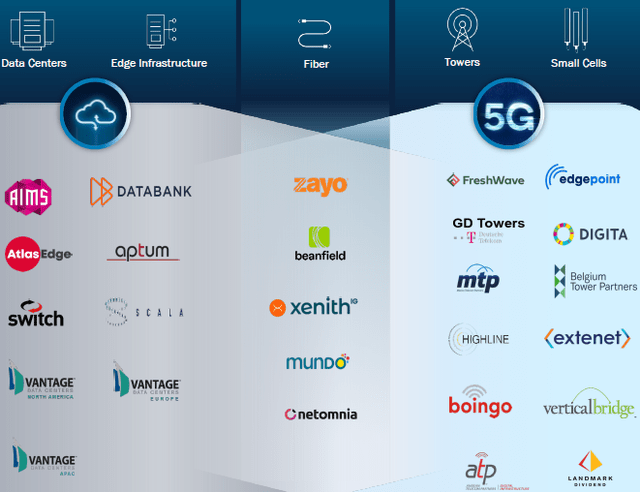

DigitalBridge Group, Inc. (DBRG) is a Florida-based digital infrastructure investment firm managing nearly $69 billion in assets globally. Source.

June 2023 Investor Presentation

In January 2022, the company completed a significant change by selling its legacy real estate holdings and transforming into a pure-play digital infrastructure investment manager.

Note: DBRG has elected to be taxed as a C-corp from FY 2022.

June 2023 Investor Presentation

DBRG continues simplifying its portfolio by selling non-core positions (such as its holdings in BRSP) and transitioning from a business operator to a pure-play investor.

“We are focused on our single business unit, which is our high growth digital infrastructure investment manager on a global basis.” – Marc Ganzi, CEO.

DBRG is expanding its presence in the Middle East and recently announced its new partnership with the Saudi sovereign wealth fund Public Investment Fund, one of the largest sovereign wealth funds in the world. This partnership will initially prioritize investments in the data center sector and eventually expand into towers, fiber, small cell, and edge infrastructure.

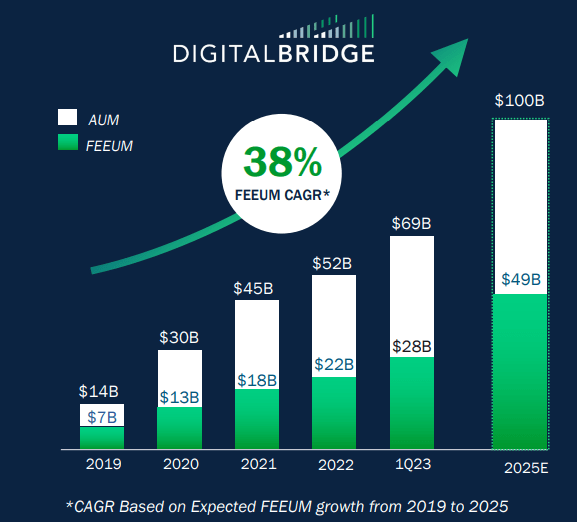

CEO Marc Ganzi said that Fee-Earning Equity Under Management (“FEEUM”) is the company’s number one KPI for the year, as this metric will drive revenue and cash flows and help unlock shareholder value. During Q1, DBRG reported an impressive 47% YoY growth in FEEUM, indicative of rapid progress in their transition into an investment company. Management projects a ~38% CAGR of this metric through 2025, indicating substantial growth.

June 2023 Investor Presentation

DBRG is focused on deleveraging and has paid off $200 million of its 2023 convertible notes, bringing down its corporate debt by 35%. This month, the company plans to call its 2025 convertibles to complete its deleveraging goals for the year. Management mentioned during the Q1 conference call that they intend to repurchase the preferreds as it makes sense. We expect lower YoY interest expenses and preferred dividend spending in FY 2023.

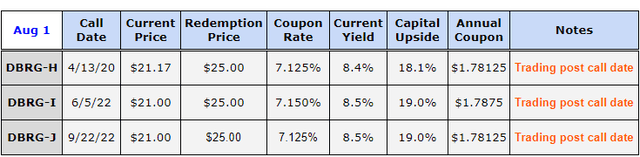

DBRG has three classes of preferred stock, all trading post-call dates at deeply discounted prices.

Author’s Calculations

DBRG’s TTM interest expenses were $136.1 million, and the company spent $60.5 million on preferred dividends. These were adequately covered by the company’s TTM net cash from operating activities of $281.5 million. The company’s recently initiated $0.01/share quarterly dividend came at the expense of $3.2 million for the same period. DBRG ended Q1 2023 in a comfortable liquidity position with $668 million in cash and cash equivalents.

All three preferreds have a high current yield and offer ~19% upside to par. Despite the preferred trading post-call date, we don’t expect a redemption anytime soon, but we believe that the company will continue purchasing a significant amount of its preferred stock at these discounted market prices. This will continue to offer considerable value and safety for preferred shareholders.

Embracing digital transformation is not just a choice but a necessity to compete in today’s global economy. DBRG is an experienced investor in this attractive sector and is well-positioned to reap the rewards over the long term. We are happy to collect our fees from this pursuit with DBRG preferreds.

Conclusion

A portfolio should be viewed like building a home. The fixed-income investments in that portfolio should be the foundation.

If you’re a homeowner, you know that a firm foundation is key to having a long-term solid building. You also know that it can be very expensive and costly to fix or repair a foundation that is cracked or crumbling because it was not built correctly or is unstable. Within High Dividend Opportunities, we recommend to all of our members that they should hold at least 40% of their portfolio in fixed-income investments because then they will have a stable baseline of steady income pouring in from their portfolio to their bank account. It also helps reduce volatility as far as price movement, which many novice investors and retail investors find stomach-churning. No one likes to see the value of their portfolio whipsawing back and forth.

The two families of preferred securities that we’ve looked at today are excellent bricks to lay as part of the foundation of your portfolio. They are holdings that you combine and rely upon for income for years to come. You won’t have to sell them off tomorrow because the firm no longer has enough money due to overvaluation to pay the dividends you were counting on. When I look for fixed-income investments, I look for an investment that I can hold until the company calls it away or matures on its own. I’m not a trader; I’m an investor, and I invest for income. These are investments for income. They can benefit you by simply investing in them and holding them for that reason. Simple right? I think so. So do 6500 others just like you.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Read the full article here