Summary

I am recommending a hold rating for Six Flags Entertainment (NYSE:SIX) despite a 20% potential upside, as I think it is better to wait 1 or 2 more quarters before assessing how successful the turnaround efforts are.

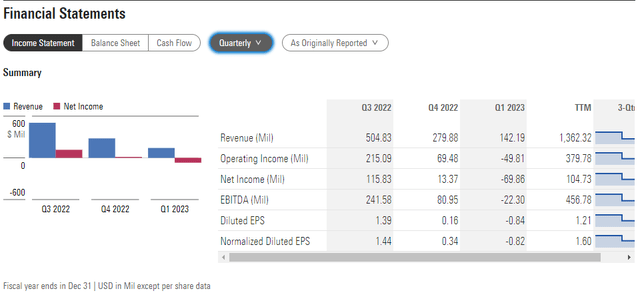

Financials/valuation

Morningstar

Revenues for 1Q23 were $142 million, which was above the $133 million expected by consensus. Adj EBITDA came in at -$17.4 million, which was better than the -$23.7 million that was expected by consensus as well. The improvement in operating expenses and higher theme park admission prices drove the improvement in the adj EBITDA Margin to -12.2%. Attendance dropped 5.9% to 1.6 million, which I believe is the primary reason for the poor 1Q23 top line performance. Nonetheless, I feel compelled to point out that the decline was significantly less severe than I had anticipated, given the severe weather in California and Texas parks. What came as a surprise, however, was a 7% increase in total guest spend per capita, to $80.88. However, selling, general, and administrative costs increased by 13%, largely due to increased advertising spending, which I anticipate SIX will maintain in order to sustain growth (more on this below).

As some background, in 2022, SIX rethought its business strategy, raising prices dramatically to attract higher-quality customers (i.e., the wealthy). The plan made sense because it would drive away low-income customers while placing a greater emphasis on revenue and satisfaction among those who did visit. This seems like a good idea at first, but I don’t think it would pan out as expected regardless. To begin with, there was no correlation between the price hikes and any upgrades to the parks, or at least there was a significant lag between the price hikes and any new attractions. It’s the same as shelling out $30 more for the same Netflix plan. Only a small number of parks had major new rides, and there were no noticeable upgrades to the parks’ food and drink options or general appearance.

Also, the pace of the price increase seemed too rapid to me, especially in light of the weak macroeconomic environment. In the past, SIX has relied heavily on cheap or even free tickets and coupons to attract more visitors to the parks. Management discontinued its popular meal plan at the same time it eliminated nearly all of these discounts and free tickets. I think the pricing shock was too great for a customer base that had grown accustomed to substantial discounts in an environment where government stimulus had been removed and gas prices and inflation were ticking higher.

Fast forward to today, and I think management has done a good job of reversing course after the extreme price increases in 2022 and restoring the dining plan. Despite starting April down 11% year over year, the active pass base recovered to be within 4% of last year’s levels by month’s end. Management also reported that first-quarter attendance was up 6% vs. last year, excluding the impact of weather, which I view as a very promising sign that things are improving. Looking at the next few quarters, I expect attendance rate to increase significantly back to historical levels as SIX reverse its strategy to attract back its usual crowd. However, this should only start surfacing in SIX’s financials in 2H23 as the comp gets easier (price hikes didn’t really take effect until 2H22).

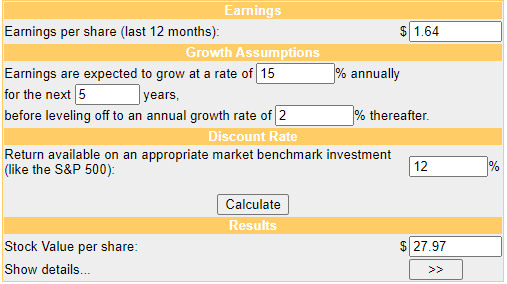

Based on my view of the business, if SIX is successful in this turnaround, it should be able to grow EPS 15% (mid-teen range), as per its historical pre-covid range (range between low-teens to 19%). Hence, in my DCF model, I forecast EPS to grow at 15% for the next 5 years before leveling off to an annual growth rate of 2% thereafter. I have placed a higher discount rate of 12% given the elevated execution risk and cyclicality of the business. With these assumptions, I got a target price of ~$28. This represents a 20% upside, and while attractive, I think it is wiser to wait 1 or 2 more quarters before making an assessment of whether the turnaround efforts are yielding positive results.

Moneychimp

Other comments

As was previously mentioned, SG&A costs are expected to rise, which comes as little surprise given the common correlation between increased advertising spending and rising attendance. Since 2019, however, advertising costs have dropped by nearly half, both in absolute terms and as a percentage of sales. SIX’s advertising budget has averaged about 5%-6% of revenues from 2014-2019 but has reduced to just 2.5% of revenues in 2022. To some extent, I attribute the low attendance thus far to the lack of promotion thus far. Therefore, in 2023, I anticipate SIX to increase advertising expenditures, possibly even more than what it used to spend historically, to convey the new company messaging and pricing. The 1Q23 results bear this out: SG&A grew by $5 million, or +3%, with the majority of the increase coming from higher advertising expenditures. This is despite the fact that Q1 is historically a slow advertising and sales period.

Risk & conclusion

SIX attendance per park has been underperforming peers. This has led to a decline in the company’s share of consumers’ spending. SIX is in a precarious position where it cannot reclaim market share if the strategy shift does not prove successful. This, in addition to costs brought on by fresh attractions and advertising, could severely cut into earnings.

In conclusion, I recommend a hold rating for SIX until we can further verify the results of their turnaround efforts. The management’s reversal of extreme price increases and restoration of the dining plan show promise, but they need to effectively communicate the new messaging and pricing to attract more visitors. Increased advertising spending, while potentially beneficial, adds to the execution risk and may impact earnings. By waiting for more data, we can better assess the long-term sustainability of the turnaround and make a more informed investment decision.

Read the full article here