The semiconductors industry has performed well over the past year, with the popular chip ETF (SOXX) rising by ~60% TTM. The top semiconductor companies, NVIDIA (NVDA), AMD (AMD), Qualcomm (QCOM), and Broadcom (AVGO) have all risen by over 50%. NVDA has led the pack, increasing by 260% over the past year, boosted by a compounded speculative fervor surrounding crypto mining and AI. Overall, there is a strong correlation between the size of the chipmaker or innovator and its performance, with the most prominent companies performing very well and the smaller ones losing out.

One of the weaker performers in the SOXX ETF is Skyworks Solutions (NASDAQ:SWKS), which has lost 7% of its value over the past year. As the largest have risen, SWKS only accounts for ~1% of SOXX’s total holdings. SWKS’s notable underperformance has occurred despite generally strong Wall Street and analyst sentiment surrounding it. Historically, I am among the smaller number of bears on SWKS, having published a “sell” rating in September. Since then, SWKS has lost around 5% of its value but was down by nearly 20% before the “Santa Claus” rally in Q4.

I am revisiting most of my bearish picks from Q3 2023. Many rallied in Q4, erasing losses, but are now facing considerable resistance as the market’s fuel slows. Skyworks is a particularly interesting stock because it is highly dependent on Apple (AAPL), accounting for 66% of its 2023 revenue (10-K pg. 62), rising from 58% to 59% in 2022 and 2021, respectively. Clearly, Skyworks is becoming more dependent on Apple despite its efforts to do the opposite. As this issue expands, Skyworks is left with the risk that Apple will seek to improve its vertical integration and look to other contractors, or Apple’s electronics hardware business will naturally slow over time. Accordingly, I believe it is crucial to analyze SWKS to determine if it may soon recover from its difficulties or if those challenges will continue to grow.

Skyworks Needs Results, Not Buzzwords

I first became bearish on SWKS in 2020, with the stock losing around 30% of its value since. At that time, the company was very dependent on Apple. Still, its investor presentations and investor calls often focused on moving away from Apple through the Internet of Things and 5G. Today, nearly four years later, Skyworks is even more Apple-dependent, but its managers continue to claim that it is focusing on expanding into IoT, 5G, and now, of course, AI. In its last investor call, IoT and 5G were mentioned six and five times, respectively, while AI was mentioned ten times, but Apple, its driver, was mentioned zero times.

Of course, its focus on IoT, 5G, and AI is not mutually exclusive of its Apple-focused business model, as the two may go together. Still, it is problematic when a company puts a great deal of investor material focus on popular buzzwords and not necessarily on its core business. Buzzwords can sell shares, but they do not necessarily translate into EPS.

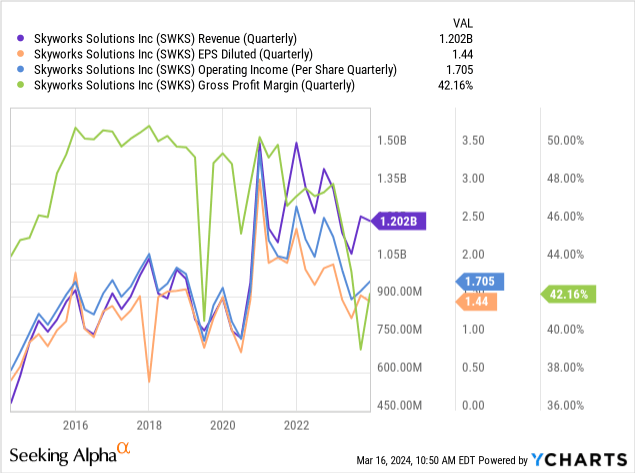

I feel this issue is exacerbated in Skywork’s case because its investor marketing pitch has remained buzzword-focused since 2020, while its core business is trending in the wrong direction. It has become more dependent on Apple and has seen its income, margins, and revenue crash. See below:

On the one hand, Skyworks benefited in 2020 as many people looked to replace smartphones, aiding its core sales categories. However, there has been a sharp reversal in its sales, nearly back to 2020 levels, mainly if we account for the inflation that has occurred since then. Further, its gross margins have collapsed, adding strain on its net income.

Still, there are some silver linings. From 2013 to 2023, Skywork’s broad market revenue climbed to $1.8B at a CAGR of 15%, and its total customer base rose from 2K in 2016 to 8K in 2023. The company’s Apple-focused business has grown faster than its broad business, but it has still set the foundation for an eventual shift away from Apple. Problematically, its gross margins may be slipping as it looks to compete in the non-Apple markets. Other mobile platforms like Android, which Skyworks is fighting to expand into, are naturally more competitive because there are far more manufacturers, likely leading to lower profitability.

Overall, Skyworks is in a difficult position. Its core area of profit potential is undoubtedly Apple, as that has been a great source of “bread and butter” for the company. Its efforts to move away from Apple appear to have significant competitive barriers. However, if it ever becomes true that Apple will vertically integrate, Skyworks will lose a considerable portion of its business.

While Apple and analysts have discussed this possibility for years, Apple has never actively pursued significant direct competition with Skyworks. From that standpoint, Skyworks may be better off becoming more dependent on Apple to make Apple more dependent on it, as is partially the case today. Apple is worth around $2.67T, while Skyworks is around $16.7B. Realistically, Apple would likely be better off acquiring SWKS than spending years creating a new platform or finding a new hardware contractor.

Despite Skyworks talk of becoming less dependent on Apple, its Apple share of sales rose to 73% in Q4. To me, this indicates the company may be aware that focusing on its Apple business is best for its bottom line, particularly in the short term, contrasting its “away from Apple” investor market pitch.

Not an Apple Problem, But a Smartphone One

Skyworks is fundamentally a mobile hardware company, with that being its primary income driver. Problematically, we see a similar trend in smartphones as in automobiles. Compared to the past, smartphones cost much more, last longer, and are not improving as much each year. Thus, global smartphone sales are on the decline after peaking around 2017. In 2013, the replacement cycle for a smartphone was, on average, 2.3 years. Today, it is around 3.6 to 3.7 years. Some experts predict the figure will decline, believing the rise to be driven by economic woes.

However, I believe the technological maturation of smartphones essentially drives the rise in replacement cycles. Like desktops and laptops, the annual rate of improvement of new smartphones is meager, while the replacement costs and lifespan are more extended. Apple understands this and plans to limit significant design alterations in the future, instead focusing its hardware business on wearables.

Of course, there is an economic element to Skywork’s mobile-focused business. For one, many people in the US and Europe have lower excess spending capacity as their saving rates decline amid higher living costs and generally stagnate wages. In the US, credit card debt has surged by roughly 40% over the past three years as many Americans look to credit due to lower discretionary spending capacity. Now, while there is a slowdown in retail sales, overall consumption activity has remained despite the weakness in consumer financial stability.

Consumer debt cannot perpetually rise at such a fast pace, and given the state of overall US debt in both private and public spheres, there is little reason to believe this situation will improve and more to indicate people will need to pull back excess spending. For many, that will delay annual smartphone upgrades, which is likely a sensible option as smartphones last longer and are not changed as much each year.

The Bottom Line

The current analyst consensus points to a continued decline in Skyworks EPS to $6.92 this year, given its relatively high “P/E” valuation at 15X. That is not necessarily a “high” valuation compared to most stocks, but, to me, it is given I disagree with the consensus view that SWKS’s EPS will rebound by 2027. Indeed, given that its efforts to move away from smartphones are not paying off and smartphone sales may slow quicker, I expect SWKS’s EPS to continue declining over the coming years.

I am bearish on SWKS and believe it was more fairly valued around the end of Q3 when it traded in the $80-$90 range. That said, I am not “very bearish” on SWKS and would not bet against it as its immediate downside risk does not seem to be over 20%. I believe a correction is more likely as it fails to break resistance. Still, the opposite may also occur, particularly if it catches steam from NVDA and others that have risen to extreme levels. Still, my long-term outlook for Skyworks is generally negative due to continued smartphone market weakness and a lack of focus on its core profit drivers.

Read the full article here