We previously covered SoFi Technologies (NASDAQ:SOFI) in February 2024, discussing why we had maintained our Buy rating, with the online bank likely to continue generating excellent results as the management kickstarted the growth trend for the lending/ tech segment.

Combined with the growing bank deposits, the contribution to its lower cost funding, the promising reversal in its GAAP profitability, and the stock price’s pullback, we had maintained our Buy rating then.

Since then, SOFI has unfortunately pulled back by another -13.1% well underperforming the wider market at -2.5%. Despite so, we are maintaining our Buy rating, due to the promising growth in its top/ bottom lines as the management executes the dual pronged growth as both an online bank and a fintech.

At the same time, investors must also temper their near-term expectations, with the stock likely to trade sideways until the company achieves substantial GAAP EPS profitability and the lending/ tech segment emerges as the top/ bottom line driver.

The SOFI Investment Thesis Remains Robust, Though The Market Likely Needs Some Convincing

For now, SOFI has reported a double beat FQ1’24 earnings call, with revenues of $580.64M (-2.1% QoQ/ +26.3% YoY) and adj EBITDA of $144.38M (-20.4% QoQ/ +89.4% YoY), implying rich adj EBITDA margins of 24.8% (-5.6 points QoQ/ +8.4 YoY).

Much of its top/ bottom line tailwinds are attributed to the robust growth observed in the online bank’s Net Interest Incomes to $402.71M (+3.3% QoQ/ +70.6% YoY) and Net Interest Margins to 5.91% (-0.11 points QoQ/ +0.44 YoY).

With interest rates still elevated, it is unsurprising that the management has been able to generate excellent spreads from its members’ Saving balances with 4.60% in Annual Percentage Yield, as the deposit base swells to $21.6B (+16.3% QoQ/ +116% YoY).

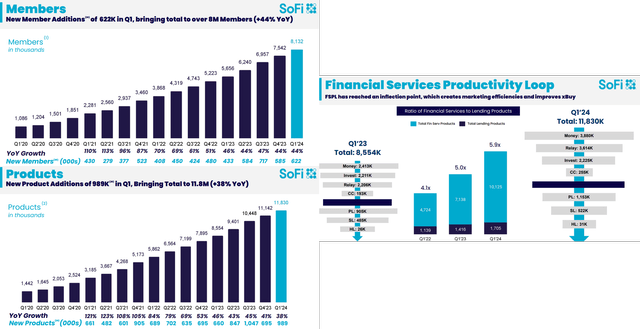

SOFI’s Growing Fintech Segment

SOFI

At the same time, thanks to SOFI’s growing members and increased cross-selling/ products sold in the Lending and Financial Services segment, it has reported accelerating non-interest income of $242.27M on a QoQ basis in FQ1’24 (+7.3% QoQ/ +2.5% YoY).

Most importantly, the Financial Services/ Technology Platform segment also comprises a growing portion of its revenues at 42% in FQ1’24 (+2 points QoQ/ +9 YoY), naturally diversifying its revenue stream, with it “on track to finish 2024 with a revenue mix near 50:50.”

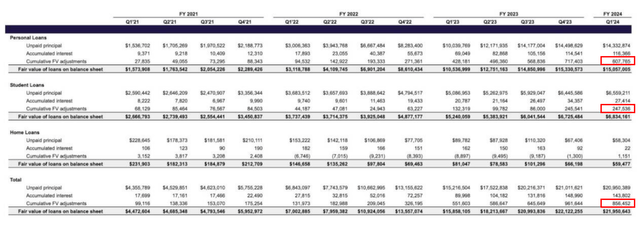

SOFI’s Delinquency Rates

Seeking Alpha

After eight consecutive quarters of growing loan delinquencies, it appears that things have started to moderate for SOFI as well, with a declining “cumulative fair value adjustments” of 3.9% (-0.4 points QoQ/ +0.6 YoY) at $856.45M in FQ1’24 (-10.9% QoQ/ +55.3% YoY).

With the US labor market still robust, it appears that consumers remain liquid enough, further aided by the borrowers’ overall weighted average origination FICO of 750 as of March 2024.

This also explains why SOFI has moderately raised its FY2024 guidance, with the Financial Services net revenue growth to be at least +75% YoY and Tech Platform growth at +20% YoY in FY2024, compared to the original blended guidance of +50% YoY for the overall Tech Platform and Financial Services segment.

This is on top of the raised FY2024 financial guidance, with higher adj EBITDA of $595M (+37.8% YoY), adj EBITDA margins of 24.6% (+4.3 points YoY), and GAAP EPS of $0.08 (+122.2% YoY), compared to the original guidance of $585M (+35.5% YoY), 24.5% (+4.2 points YoY), and $0.07 (+119.4% YoY), respectively.

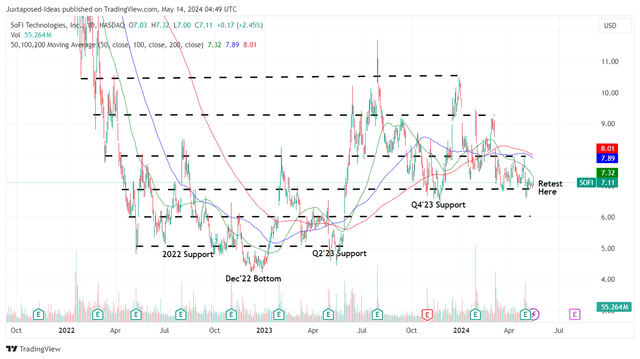

SOFI 2Y Stock Price

TradingView

Despite so, SOFI has already lost much of its 2024 gains, while trading below its 50/ 100/ 200 day moving averages and well underperforming the wider market.

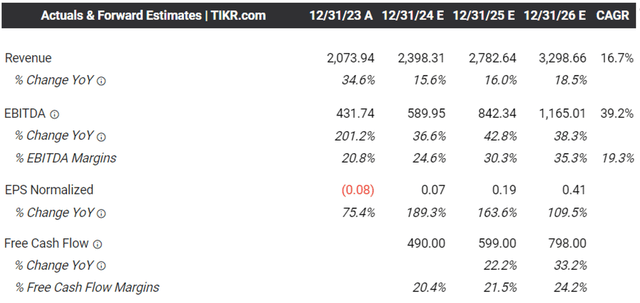

The Consensus Forward Estimates

TIKR Terminal

With minimal adj EPS profitability, we will be looking at SOFI’s adj EBITDA for now. Based on the Enterprise Value of $6.14B at the time of writing and the adj EBITDA of $500.41M generated over the LTM (+137.9% sequentially) and the consensus estimates above, it appears that the stock is trading at LTM EV/ EBITDA of 12.26x and FWD EV/ EBITDA of 8.57x.

When comparing SOFI’s FWD Price/ Sales of 3.06x and FWD EV/ EBITDA of 8.57x to its fintech/ lending/ digital wallet peers, such as Block (SQ) at 1.75x/ 15.44x, PayPal (PYPL) at 2.06x/ 10.35x, Upstart (UPST) at 4.14x/ NA, and Affirm (AFRM) at 4.32x/ NA, respectively, it is apparent that the former has been discounted here.

This is especially since SOFI is expected to generate an impressive top/ bottom line expansion at a CAGR of +16.7%/ +39.2% through FY2026, building upon the historical growth at +43%/ +278% between FY2021 and FY2023, respectively.

SOFI’s numbers are notably accelerated as well, when compared to SQ’s projected growth at +11.8%/ +35.1%, PYPL at +7.7%/ -1.5%, UPST at +19.1%/ NA, and AFRM at +26.6%/ NA over the same time period, respectively.

We believe that SOFI may continue to enjoy robust bottom-line tailwinds, thanks to the higher for longer interest rates as inflation remains sticky, with it likely to boost the online bank’s Net Interest Income before the Fed eventually pivots, and before the macroeconomic environment normalizes over the next few years.

Combined with the management’s intensified efforts on the Lending and Financial Services segment, as observed in the updated FY2024 guidance above, we believe that SOFI may very well emerge as a winner in the online bank/ fintech market, lending strength of its robust growth prospects.

So, Is SOFI Stock A Buy, Sell, or Hold?

As a result of the attractive risk/ reward ratio, we are maintaining our Buy rating for SOFI, though with no specific entry point since it depends on an individual investor’s dollar cost average and risk appetite.

With the stock currently retesting its H2’23 and H1’24 support levels of $7s, interested readers may want to observe its movement for a little longer before adding if this floor holds.

It goes without saying that SOFI is only suitable for those with higher risk tolerance, attributed to the fintech’s slower GAAP EPS profitability, the elevated short interest of 18.6% at the time of writing, and the stock’s massive volatility since early 2021.

At the same time, we believe that the stock is likely to continue being discounted until its fintech segment emerges as the top/ bottom line driver, with its long-term prospects now overly weighted toward the online bank.

Read the full article here