Overview

I’ve come to the realization that this is probably the best time in history to be an income investor. There are so many new funds at your disposal that you can tweak your portfolio in a plethora of ways to match your needs. The Neos S&P500 High Income ETF (BATS:SPYI) provides a way to gain the exposure and diversity of the S&P500 while providing a double digit dividend yield. The current dividend yield sits at 11.6% and distributions are paid out on a monthly basis.

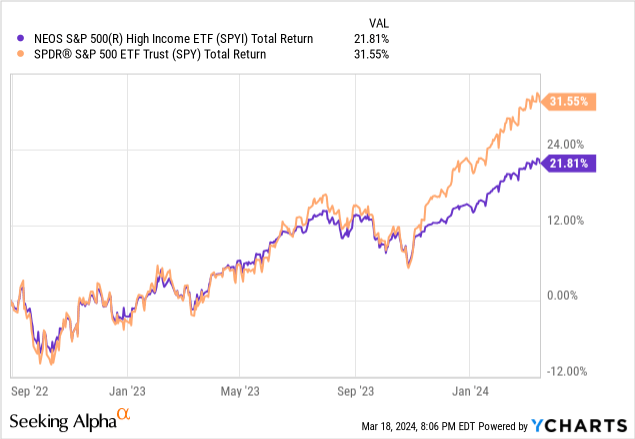

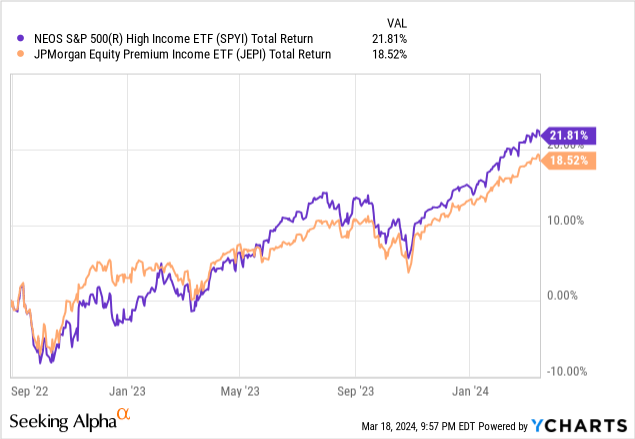

We can see that SPYI has traced the total return of the S&P 500 (SPY) pretty closely until the recently movement upward over the last two quarters. The fund’s stated objective is to generate a high level of monthly income in a tax efficient manner. Equity appreciation comes secondary. The gap in total return isn’t surprising however because of the structure of a covered call ETF. They are essentially selling some of their upside in exchange for income generation. SPYI has a similar issue as JPMorgan’s Equity Premium Income ETF (JEPI) in nature but we will compare the performance of the two later on.

SPYI has performed excellently so far and can provide retirees with a stream of monthly income. Although the income may vary month to month, the fund aims to generate high income on a consistent basis. So far, the fund has done this successfully since inception. In addition, the fund aims to generate this income in a more friendly approach which means that even investors far away from retirement can juice up the overall yield of their portfolio with the inclusion of SPYI.

Who Is This Fund For?

SPYI primarily serves as a solid income ETF for those who rely on the income generated from their portfolio. The monthly distributions makes this a great choice for those who do not have time on their side and cannot afford to stay invested to await capital appreciation. The high dividend yield of 11.6% means that you can generate a sizeable income stream while requiring less capital compared to an ETF like SPY or even Schwab’s Dividend Equity ETF (SCHD).

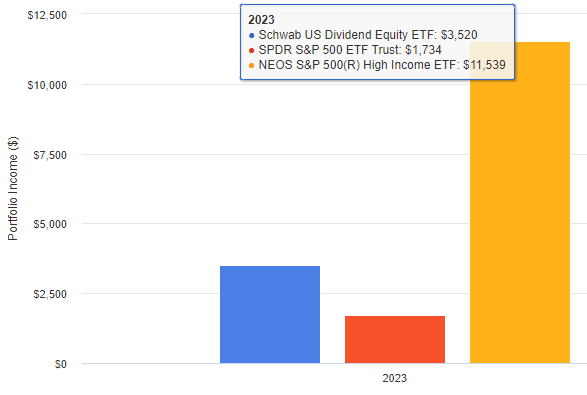

For example, if you invested $100k in each of these funds, the results over the last year would differ drastically. Using Portfolio Visualizer, we can see the amount of income generated with $100k of invested capital. As you can see, the income generated from SPYI is much higher than alternatives. You would have received approximately $961 per month over the course of 2023 with SPYI.

Portfolio Visualiser

Since the distributions aren’t classified as qualified dividends like they would be from a regular S&P ETF like SPY, investors should be aware of the tax consequences here. There is a trade off that needs to be made with a fund like this: are you willing to receive a higher level of income in exchange for a limited upside and cost of paying taxes?

On the other end of the spectrum, if you don’t need the income the peers here are a great alternative. With regular ETFs like SPY or SCHD, you will experience a much smaller dividend income but the dividend will likely grow consistently every year and you will experience more upside appreciation.

Therefore, if you value and want to prioritize income generation then SPYI is more preferable over a regular index fund like SPY. SPYI provides a higher level of income that can be used to fund your daily life. SPY would require nearly $1M invested to generated the same amount of income that SPYI could generate with $100k invested. SPYI caters to the income focused investor by issuing distributions on a monthly basis. While we don’t have much historical data of dividend growth, I do think the current strategy implemented will result in a sustainable stream of income throughout all market cycles.

Strategy & Dividend

SPYI’s strategy is to concentrate its investments in a way that replicates the S&P500 index. The fund can hold more than 25% of its total assets in any particular industry at a time if it helps align with the scope of the index it aims to mirror. At the moment, tech stocks make up more than 25% of the holdings within.

However, SPYI’s strategy also means that the fund can make use of a “representative sampling” approach. This basically means that the fund can invest in a selection of securities from the S&P that closely replicate an aligned level of risk and return. SPYI currently has $930M in AUM (assets under management). Considering that this is a covered call ETF, the fund has a reasonable management fee of only 0.68%.

The fund employs a call options strategy and aims to capture the premiums acquired through S&P call options. In addition, SPYI also generates the income from the dividends gained from their the holdings in their portfolio. SPYI may also utilize a tax loss harvesting strategy by realizing losses from specific equity positions to offset taxable gains from the option gains that have been realized.

The fund aims to also generate this income in a more tax friendly manner. This is achieved when the premium from selling the call options surpasses the expense of purchasing the long OTM (out of the money) call options. While this provides a high monthly income, this strategy may also cap the potential upside during bull runs, like we saw in the chart earlier. Thankfully, the holdings are diverse and filled with high quality companies so I am not too worried about downside risk.

The dividend yield currently sits at 11.6% and the distribution frequency is monthly. The payout per share is declared around the 20th of each month so we can expect it soon. What makes SPYI stand out, is that the fund managers have stated that they aim to keep the income consistent. They can do this by increasing or decreasing the duration at which the options are written OTM. For example, an option further out in time means that there’s less probably of the option being executed which means greater growth potential. However, this also means less income potential.

In addition, they can adjust the total percentage of the portfolio that they write options on. Using a higher portion of the portfolio means more income but less growth potential. They’ve performed well so far and there’s no indication that the objective of the fund hasn’t been reached yet.

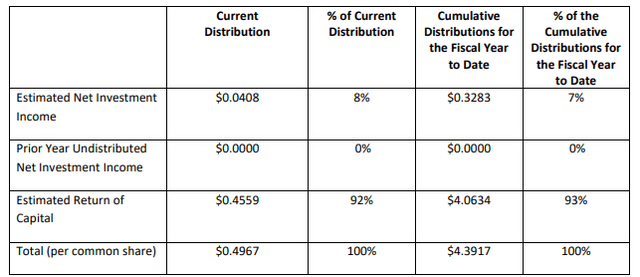

SPYI February Distribution Notice

Something that should be mentioned is that the majority of the distribution is classified as ROC (return of capital). While this commonly causes red flags to go off, there’s no need to worry here. The return of capital classification here does not mean that investors are getting their capital returned to them as a distribution and this form of ROC is not harmful to the fund’s growth.

Instead, return of capital here is merely a tax classification. SPYI distributes a combination of dividends and income from selling covered calls. The income gets generated by selling options against the S&P500 which entitles the earnings to be classified as a “1256 contract”. The result of this is that some of the distribution gets classified as ROC.

Holdings

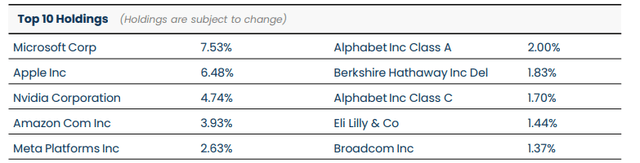

I really prefer SPYI’s holdings over an alternative covered call ETF like JEPI. While they both have exposure to the S&P500, I believe that SPYI is likely to see more price appreciation over time. This is because SPYI has exposure to many of the magnificent seven such as Microsoft (MSFT), Apple (AAPL), Nvidia (NVDA), and Meta (META).

SPYI Fact Sheet

As previously mentioned, SPYI aims to mirror the S&P so you are getting diversification across the board here. The majority of the fund’s portfolio falls within the tech sector at 31%. Financials make up the second largest bulk of the portfolio at 12.6% and healthcare makes up about 12.4%. It looks like the fund has massively grown in size over the last few months due to an inflow of capital. Back in December, AUM was about $500M compared to the current $930M of AUM.

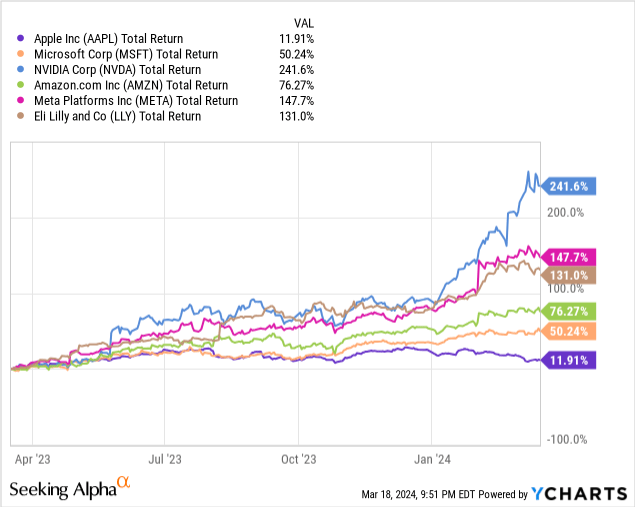

Taking a look at the growth of some of SPYI’s top holdings, we can see they’ve all performed excellently over the last year. I believe most of the top holdings still have strong upside potential. I recently published a Strong Buy rating on Meta (META) as well as a Strong Buy rating an Microsoft (MSFT).

In comparison, a fund like JEPI does not have the same bulk of growthier companies in their portfolio. For reference, only 19% of JEPI’s portfolio is comprised of tech holdings. In addition, the second largest portion of JEPI’s portfolio is within industrial holdings at 14%. As a result, I believe that SPYI will outperform JEPI on a greater time horizon. We can already see the outperformance in total return since SPYI’s inception. Although the gap here isn’t too significant at the moment, I think time will see the margin widen.

Risks

I’d like to advise caution for the younger investors reading this. I remember when I first started building out my dividend portfolio, I was overly fixated on the high yielding funds. As a result, I found my portfolio underperforming the S&P500 and wasn’t prepared for the tax bill I owed when tax season arrived. It’s important for potential investors to understand how SPYI’s option strategy works and the tax implications of receiving distributions here in a taxable account.

If you have time on your side and do not need the distribution income, maybe SPYI is not the best fit for you. This is especially true if your goal is to achieve a high total return. The way the fund is structured leaves a lot of limited upside potential and SPYI is likely to fail at capturing market upsides in strong bull runs.

Lastly, if you are a retired investor and only care for consistent income, SPYI seems a great choice. Although, it’s important to be aware that the distributions are likely to be different each month based on the performance of the market and the fund’s success with their option strategy. While the short historical data we can reference has been consistent so far, we have yet to see how the fund performs in a market that is high in volatility.

Valuation

While there is no clear price target in mind for a fund like this, I believe that over time we will see modest price growth. While we shouldn’t expect any major upside because of the covered call aspect, I think we are likely to see modest growth as long as the S&P continues rising over the next few decades.

Goldman Sachs’s analysts believe that the technology sector’s fundamentals are solid and lifted their year end S&P price target to 5,400 points. In addition, I do believe that the growth of AI will serve as a huge catalyst for growth within the tech sector. Since tech makes up the majority of this fund, SPYI may even see growth as new innovations are made in the AI space.

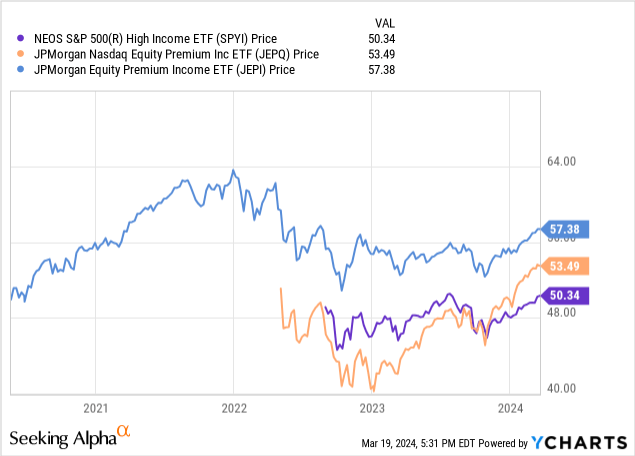

Although the timeline for similar funds such as JEPI and JPMorgan’s NASDAQ Equity Premium ETF (JEPQ) are short, we can sort of see the price movement play out as such. We also have the potential interest rate catalyst that can send the markets higher. The Fed may forecast at least two interest rate cuts over second half of 2024. Lower interest rates can serve as a stimulus to the economy while also allowing businesses to borrow and invest into growth areas of their company at a lower cost.

We’ve seen some of the top holdings of the fund perform well over the last year and we can expect SPYI to capture a percentage of this growth. Although limited, upside is certainly possible from here. Taking a look at the top holdings, we see excellent levels of price growth so far from companies like Microsoft (MSFT), Nvidia (NVDA), Amazon (AMZN), JPMorgan (JPM), Eli Lilly (LLY), and Meta (META).

Even if the fund only manages to capture an annual average growth of 1% every year, you’d still be receiving a total return upwards of 12% when including the distributions. The value here is in the sustained income that SPYI can provide and so far there are no indications of them stopping. The way I see it, SPYI is a play on the S&P where you can capture high levels of income whether the market is up or down. Reinvesting large portions of the monthly dividend during down months would be an excellent strategy so that your income stream can grow over time.

Takeaway

The Neos S&P500 High Income ETF (SPYI) is a good choice for income investors that are looking for a high yield and monthly distributions. SPYI offers a set of holdings that mimics the S&P 500 and provides a level of instant diversity across all sectors. While performance since inception has mostly stayed on par with the S&P 500’s total return, SPYI’s covered call strategy prioritizes income generation. Therefore, we will probably see the total return gap widen over time as the S&P continues growing.

SPYI’s high dividend yield of 11.6% means that you do not need as much invested capital to produce a large income stream as you would with alternatives like SPY or SCHD. In addition, the portfolio make-up of SPYI is more preferable over alternative covered call funds like JEPI as the fund has more exposure to the technology sector. A huge consideration when investing in SPYI would be the potential tax implications from the ROC (return of capital) distributions.

Read the full article here