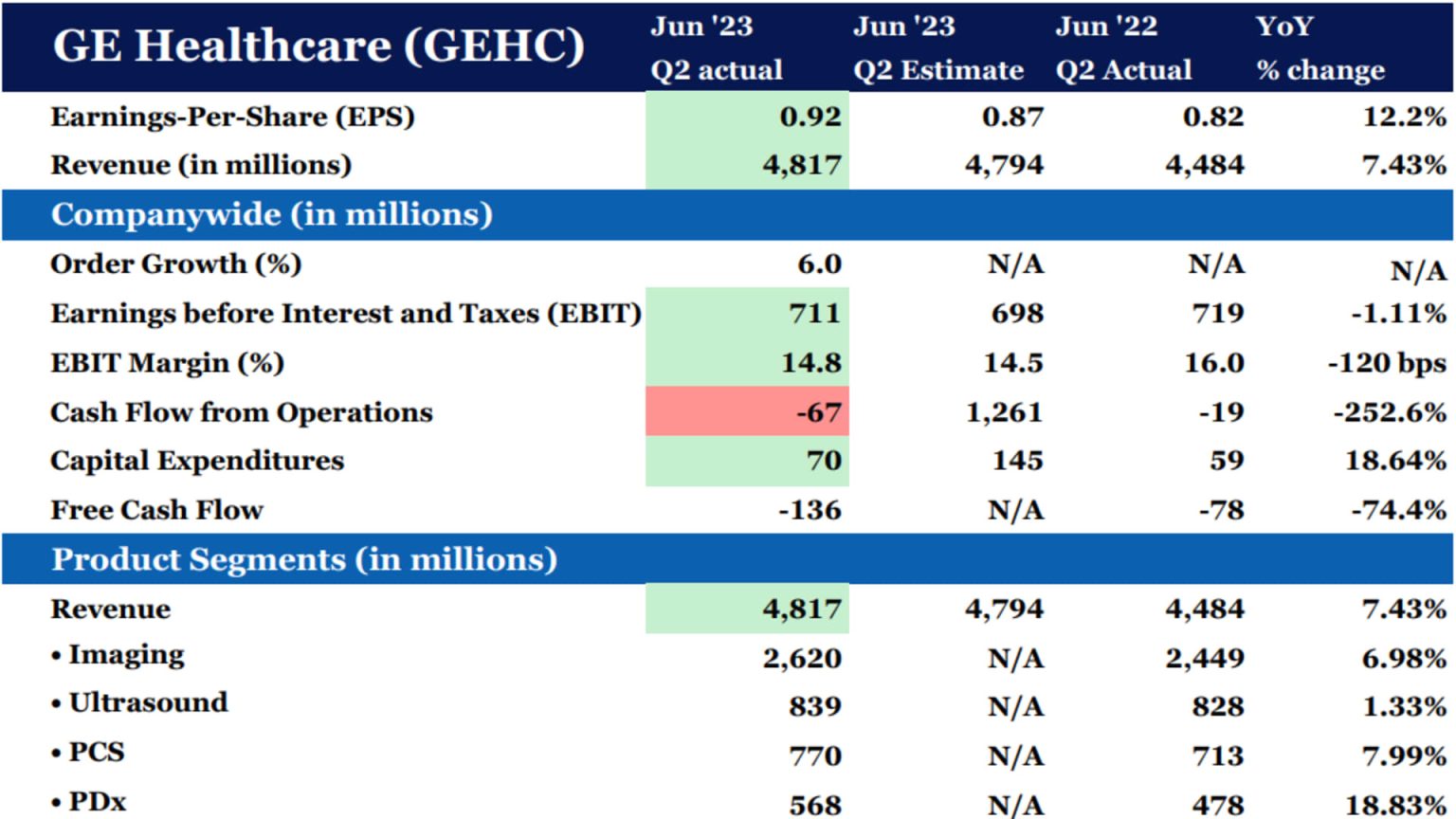

GE Healthcare Technologies ‘ (GEHC) second-quarter earnings beat and guidance raise are underappreciated by the market Tuesday, with the stock giving up early morning gains — but that only creates an opportunity to add to the Club’s nascent position. Total revenue for the three months ended June 30 rose more than 7% year-over-year, to $4.82 billion, beating analysts’ expectations of $4.79 billion, according to Refinitiv. Adjusted earnings-per-share (EPS) of 92 cents exceeded the Refinitiv estimate of 87 cents a share. Bottom line It was a solid quarter from this medical equipment giant — one that investors appear to be overlooking based on the selling pressure on the stock midday Tuesday. Shares were trading down around 0.85%, at just under $80 apiece. That small sell-off is misguided. The orders trend showed there is real momentum in the business, with a clear opportunity for more growth in the future as the company wins new business to support Alzheimer’s treatments. The company should be one of the big winners from recent advancements in the space, given it’s one of the few firms that offer a full suite of products and technological solutions to support patients with Alzheimer’s. With healthcare providers continuing to invest in equipment, leading to strong volumes across the board, and margins expected to improve in the back half of the year, GEHC is well-positioned. We first bought up a modest number of GE Healthcare shares in May, while patiently waiting for a retreat in the price. Now that we’ve seen shares pull back slightly, despite the beat and raise, we would look to add to our position once our trading restrictions allow. Second-quarter results Overall, GE Healthcare delivered solid second-quarter results. Total company orders increased 6%, representing an improvement from the 3% increase it saw last quarter. Investors tend to focus on orders because they’re indicative of customer demand. A mid-single-digit growth rate is a healthy one for this type of business. It’s also a much better result than that reported by Dutch peer Phillips (PHG), which Monday said its orders fell 8% in the second quarter, representing its fourth-straight quarter of declines. The difference between the two companies suggests to us that GE Healthcare may be taking market share in the industry. The company’s overall backlog value declined to $18.4 billion, from roughly $19 billion in the first quarter, though the figure is still commendable and sets the company up well for next year. Demand for GE Healthcare’s medical equipment is strong in large part because many health-care providers are investing to improve patient care and productivity. One theme in the health-care market over the past few months has been an increase in surgical procedures, which naturally drives demand for imaging, services and surgical equipment. The company’s management also noted that some of its customers in the U.S. are investing in products to improve productivity and increase their competitive edge in the market. Earnings before interest and taxes (EBIT) fell 120 basis points from last year. But excluding items related to the group’s transformation into a standalone company, EBIT only fell 10 basis points on an annual basis. General Electric (GE) spun off GE Healthcare at the start of this year. Still, management said its sees the potential to expand margins. The company anticipates an increase in its adjusted EBIT margin in the second half of the year relative to the first half, a result of higher volumes, productivity benefits and the contribution from new product introductions. The reported results show a decline in free cash flow in the quarter, but there’s a caveat. Free cash flow was negatively impacted by two spin-related items totaling $276 million that did not occur in 2022. If not for these items, free cash flow would have been positive and increased year-over-year. Guidance Off the strength of the first half of the year, GE Healthcare raised its full-year outlook for organic revenue growth and adjusted EPS. The company now sees organic revenues growing in the rage of 6% to 8%, up from a prior estimate of 5% to 7%. Although there was no change in the adjusted EBIT margin outlook for the full year, in a range of 15% to 15.5% — that would be a 50-basis-point to 100-basis-point improvement on 2022 — the higher sales guidance pushed management’s adjusted EPS expectations up to a range of $3.70 to $3.85, compared with a previous range of $3.60 to $3.75. The $3.78 approximate midpoint of the new EPS range is slightly above Wall Street’s consensus of $3.74 a share. Alzheimer’s opportunity We continue to see upside for GE Healthcare as it attracts new business to support the launch of nascent Alzheimer’s therapies. From the screening phase to assessment to diagnosis to treatment to ongoing monitoring, GE Healthcare’s products — including MR and PET scanners, amyloid imaging and digital solutions — have touchpoints at every key stage in a patient’s journey. Vizamyl is one of three amyloid PET tracers available today to detect, quantify and visualize beta in the brain for the diagnosis of Alzheimer’s disease. Looking out to 2024 and beyond, CEO Peter Arduini sees a “pretty profound growth opportunity across the space.” For the launch of these new therapies to be successful, it is going to require a significant increase in orders from GE Healthcare. While it’s true that some infrastructure currently exists, we think the demand for additional machines is underappreciated. This broader opportunity is not reflected in the numbers today but should support growth for many years to come. Jim Cramer will go more in-depth with Arduini about GE Healthcare’s broad Alzheimer’s opportunity when the chief executive appears on Mad Money on Tuesday evening. (Jim Cramer’s Charitable Trust is long GEHC. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

GE Healthcare Technologies‘ (GEHC) second-quarter earnings beat and guidance raise are underappreciated by the market Tuesday, with the stock giving up early morning gains — but that only creates an opportunity to add to the Club’s nascent position.

Read the full article here