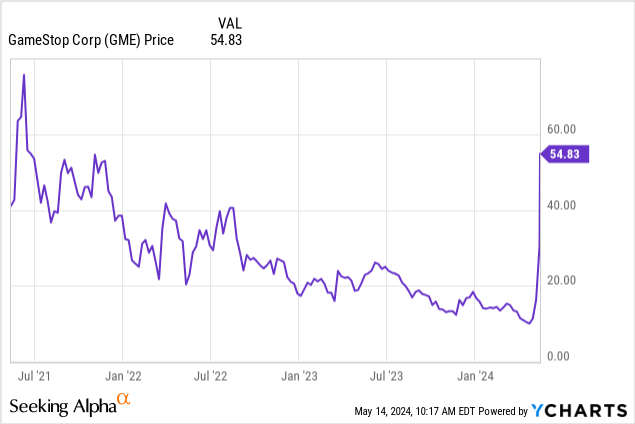

After a long slumber, meme stock mania is back. GameStop (NYSE:GME) was up over 100% pre-market today and is still up a little under 80% today as of my writing this. AMC Entertainment (AMC) was up even more. AMC disclosed it unloaded $250 million in stock yesterday– enough to cover about three months of the company’s ongoing losses. And a quick scan of Reddit WSB showed scores of people YOLOing their life savings on short-dated options in various meme stocks.

Roaring Kitty Is Back, After Unusual Activity In Short-Dated GME Call Options Last Week

So what triggered this? We can rule out a fundamental change in the companies because there has been none. The answer is that “Roaring Kitty” is back on Twitter. In the original GameStop rally, a guy from Massachusetts named Keith Gill invested in the company early on, along with other value investors like Michael Burry. Gill frequently shared his insights on YouTube as “Roaring Kitty” and on Reddit as “Deep F***ing Value.” The last time Reddit heard from Gill, he posted screenshots of positions that if sold would have meant he made $20-$30 million after tax on his trade (my calculations).

More money meant more problems here. Some of his fans attempted to sue him, he had to testify before Congress, and then he wisely dropped off the radar. Gill returned to Twitter on Sunday. He first posted a gamer leaning forward in his chair, and then some meme videos. Thousands of people took it as a signal to go all-in on GME options. But here’s where things get interesting. Analysts have flagged unusual activity in short-dated GME call options last week. Interactive Brokers chief strategist Steve Sosnick shared his analysis with Bloomberg. Is this a coincidence? Probably not.

I find it quite interesting that the volume and open interest in upside calls expiring May 17th steadily rose during the week. It all seems a bit “convenient”.

Interactive Brokers chief strategist Steve Sosnick, on GME.

Is this considered insider trading? It depends on how you define insider trading. All Gill technically did was post cryptic videos on Twitter. Elon Musk has done similar stuff on Twitter and profited hugely from crypto in short periods of time. Activist investors are allowed to trade ahead of their own actions, and one of the perks of having a large internet following is that you get to buy first and then tell everyone else to buy. This is fine as long as you’re not immediately selling after telling everyone to buy and it’s known on Wall Street as “talking your book.”

I believe that it’s more likely than not that the large rise in options interest and Gill’s return to Twitter are connected. This is probably legal, even if it results in a wealth transfer from the public at large to Gill and his friends, or to whoever bought all of these options. Could you reasonably expect sending ambiguous tweets to create a trading frenzy in GME options? That’s what happened. It’s still a gray area though, and I’d bet good money that there will be an SEC inquiry into whoever is behind these trades and what the circumstances were.

GameStop’s Fundamentals Are Unchanged

GameStop’s underlying business is in a weird kind of financial limbo. If you look at its income statements, you can see a severe decline in revenue from $5.9 billion in FY 2022 to $5.2 billion in FY 2023. GME was successful in cutting expenses at roughly the same rate as its revenue fell, so the company’s operating loss improved from -$363 million to -$32 million. While cost cutting has been effective for GME in the short run, it’s extremely difficult to create much value in the long run this way. And even if they did, say, making $100-$200 million per year in profit from a dramatically shrunken footprint of stores, then a conventional valuation for the company would be $1-$3 billion, not the $16 billion that GME’s market cap currently reflects. The balance sheet offers another view of the company, indicating that GME has roughly $2.7 billion in assets and $1.4 billion in liabilities. That indicates a value of roughly $1.3 billion for the company – or $4.38 per share.

Assuming you know what’s going on, you’re not buying GME stock because you think that the company is worth more than what you’re paying. You’re buying GME because you think that you can get someone else to pay a higher price than you in the short run, either out of fear of missing out (FOMO), as a punt (YOLO), or perhaps by short sellers being forced to cover. And on the last part, there aren’t all that many short sellers in GME at this point in time. While short interest in GME is elevated at a little over 20%, it’s a far cry from the 100%+ that triggered the epic short squeeze in 2021.

How high can GME go this time? While it isn’t an exact science to say, several of the factors in play in 2021 are not in play this time.

- Multiple rounds of stimulus checks in 2020 and 2021 were sent out during a time when there was a lack of services for consumers to spend money on. The money had to go somewhere, and many consumers chose to make speculative bets on stocks with their checks.

- Short interest in GME is currently elevated, but not extreme as it was in 2020 and early 2021.

- Traders have more experience trading meme stocks. This shows on Reddit, where some of the YOLO posts are actually about people selling for a profit after going all-in. Back in 2021, there was more of a mentality to hold on to your shares to corner the market and drive prices higher, but now people are actually taking their profits.

AMC’s management took it a step further, ruthlessly diluting shareholders at the first sign of this week’s meme stock squeeze. This increased the share count by over 20% in a flash. GME isn’t in an immediately dire financial position, but with the current pace of revenue declines, the company will have to continue cutting costs as fast or faster than revenue declines. For a retailer, that’s hard to do because so many expenses are fixed. GameStop’s latest earnings report reflected this and was somewhere between bad and terrible. If nothing changes, GameStop will be out of business in less than five years. I’m honestly surprised GME hasn’t been more aggressive about using secondary offerings and think it may shorten the company’s lifetime. We’ll see if anything changes, and if GME ends up issuing a bunch of shares.

How To Make Money In GameStop

GameStop’s options frenzy is driving the prices of options to extreme levels. Buying options is out of the question. One interesting trade you could do is to sell puts on GME. For example, with GME in the low $50s, I’m showing that $50 puts expiring Friday are currently trading for $12.40. That’s good for an implied volatility of over 616% annualized. However, GameStop’s historical volatility is only about 220%. This is an overlay of roughly 400% annualized, and it’s an ideal setup for a small trade. If you sell these puts at that price, your cost basis for GME shares would be $37.60, should the stock get put to you. This is simply the $50 strike price minus the premium pocketed for selling the puts ($12.40). If GME’s stock price is above $50 at the close on Friday, you keep the $1,240 for writing the put. And you can turn around and do it again next week if you like.

It’ll be a headache to watch, but I think you have more than enough compensation to sell puts on the stock, and you have limited downside.

Another way to make this same trade economically without the need for advanced options approval is to do a covered call trade on GME. If you buy 100 shares for $5,000 or whatever they cost, you can turn around and pocket $1200 for selling your upside between now and Friday. Making $1200 for four days off of a $5,000 investment isn’t rocket science, and based on my software modeling of GME’s actual volatility, the fair price is about $400. The price difference is being created by people looking to get rich quick on GME. Any time you can be on the other side of Reddit traders without directly taking any directional price risk, I think you have a profitable trading opportunity. Of course, you can also get crushed on this trade but if you want to know how I’d try to make money off it, this is probably your best bet. I’m just watching for now.

Bottom Line

Meme stock mania is back. Pop some popcorn and proceed with caution with your money.

Read the full article here