Investors were given a lot of reasons to celebrate the performance of the stock market in H1 supported by steady earnings growth in Q1 with 79% of companies topping estimates, and a resilient US economy despite the inverted yield curve, which often signals an incoming recession.

Instead of recessionary fears, the S&P 500 (SP500) is hovering near an all-time high with a year-to-date return of 14.9%, driven largely by the AI-centric narrative, in which 10 companies alone are responsible for 71% of the returns, with Nvidia (NVDA) contributing as much as 5%.

On the flip side, the Dow Jones Industrial Average (DIA), being less tech-heavy, has returned only 5.5% this year showcasing the risk of being under-exposed to the main investment theme.

Q2 earnings are going to kick off in July, determining the appetite of investors for the second half of 2024 as expectations are sky-high, particularly in the semiconductor industry, which often serves as a barometer for the economy, and any missteps or underwhelming guidance may be punished severely.

S&P Global (SPGI) is projecting EPS for the S&P 500 index to grow 13% this year, reaching $238.40. At the current price of $5420, this prices the index at 22.7x its 2024 earnings, well above its 15Y average of 19.2x.

Even though the analysts are bullish for H2, the risk of an economic slowdown triggered by the interest rates staying “higher for longer” remains, and I advise caution. I suggest being opportunistic and picking individual stocks with good risk-adjusted return expectations, instead of buying market-weighted ETFs.

With that, let me show my top 4 picks, where I still see a good balance between valuation and growth expectations.

1. Amazon.com, Inc. (AMZN)

- Market Capitalization: $1.93T

- Year-End Price Target: $264

- Potential Upside: 42.4%

- My Rating: Strong Buy

Amazon, formally known as the e-commerce juggernaut in the US and Europe, has evolved into a much more diversified company, reigning supreme in cloud business with its AWS’ 31% market share. AWS is crucial to Amazon’s success even as the unit contributes only 15% to its $580B Annual Revenue. Thanks to its profitability, the business represents 55% of Amazon’s Operating Income and is still growing at 17% YoY as of Q1 2024.

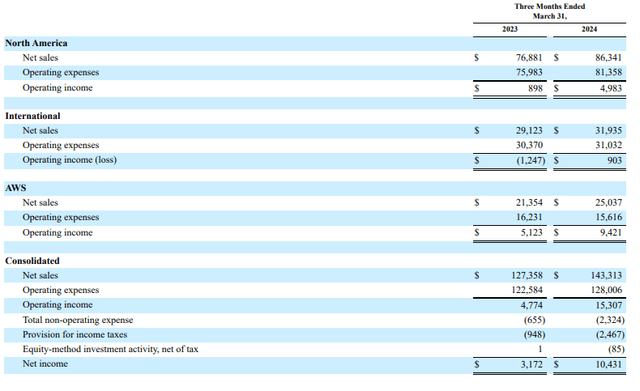

Amazon Q1 Earnings (AMZN IR)

The remaining 85% of the sales are earned through Amazon’s e-commerce business and advertising. Advertising, in particular, is considered to be the next key growth driver for the company, showcasing 24% YoY growth, bringing in $11.8B in Q1 2024, with much more room to grow.

Amazon is one of the prime beneficiaries of the AI investing theme, integrating generative AI solutions into its cloud business, making AWS more attractive to its large customer base. Amazon has developed its own AI chips and partnered with Nvidia to build industry-leading data centers for computing to deliver the most advanced large language models or “LLMs”. Yet, there is the ever-growing threat of Microsoft’s (MSFT) strategic partnership with OpenAI, which is unlocking more advanced tools, helping Microsoft Azure to gain market share, growing to 31% in Q1 2024.

Amazon’s stock is up 22% on a year-to-date basis and up 94% in the last five years. Thanks to the company switching focus to improved efficiency with Operating Margin hitting a record of 10.7% in Q1, increasing for five consecutive quarters, I am expecting better returns over the next few years.

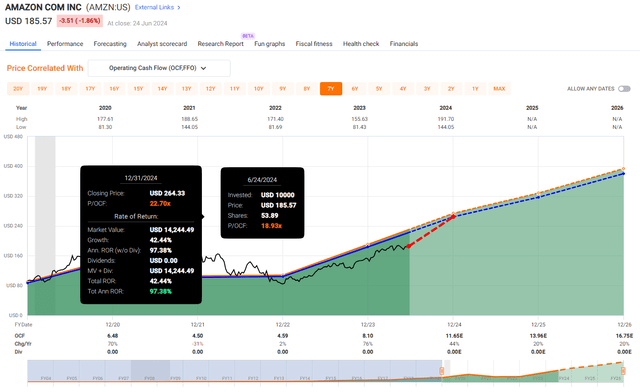

Instead of valuing Amazon based on a conventional P/E, I prefer to use Price to Operating Cash Flow or “P/OCF”, better highlighting Amazon’s cash generation potential, given the heavy reinvestment into the business.

The stock is currently valued at 18.9x its P/OCF, well below its 15Y average of 25x. Historically, the OCF grew at an annualized rate of 28%, and analysts are expecting Amazon to deliver the OCF growth anywhere from 20% to 44% over the next three years.

As Amazon matures, I am expecting the OCF growth rate to slow down towards 22% to 24% annual growth, at which point I would expect Amazon’s fair value to be around 22-23x its P/OCF. Thanks to the expected 44% OCF growth this year, this gives us a 2024 share price target of $264 or a potential return of 42.4% in H2.

AMZN Valuation (Fast Graphs)

2. LVMH Moët Hennessy Louis Vuitton (OTCPK:LVMHF)

- Market Capitalization: $388B

- Year-End Price Target: $170

- Potential Upside: 10.8%

- My Rating: Buy

LVMH, being a luxury goods conglomerate with 75 brands with heritage names underneath its umbrella such as Luis Vuitton, Dior, Fendi, Givenchy, Loro Piana, and Tag Heuer is well recognized by almost all consumers worldwide thanks to its wide-moat, legacy, and exclusivity.

Thanks to the Arnault family, which owns 48.6% of LVMH’s shares and 64.3% of the voting rights, the founding family has significant “skin in the game”, ensuring a shareholder-friendly focus, which is partially responsible for the average annual 9.1% organic growth over 35 years.

Even as the heritage brands unlocked tremendous organic growth for the company, the current CEO, Bernard Arnault, has been acquiring other businesses and thanks to his deal-making skills, delivered a 5Y average ROIC of 13%, compared to the industry’s average of only 2.6%. Only Hermes International (OTCPK:HESAY) and Christian Dior (OTCPK:CHDRF) delivered better ROIC in the industry with 23.4% and 24.4% respectively.

Despite its reputation as one of the highest quality companies money can buy, LVMH’s performance year-to-date has been underwhelming, with a total return of -3.14%. This decline is a result of the industry slowdown, with stretched consumers shopping for more accessible goods and the political situation in France where the far-right political party won the European Parliament elections and general elections are expected to take place later this year, potentially signaling a more hostile environment for corporations, where the domestic shares are issued.

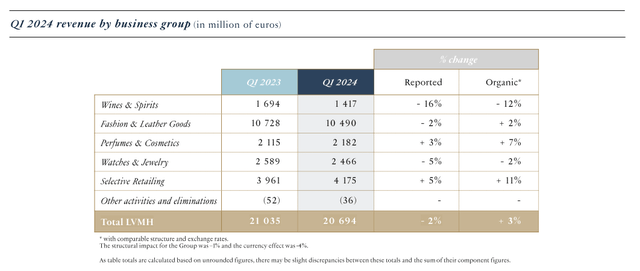

As a consequence, LVMH has reported an underwhelming 3% organic revenue growth in Q1 2024 weighted down by poor performance in its Wines & Spirits and Watches & Jewelry segments.

LVMH Q1 Earnings (LVMH IR)

Yet, this uncertainty in the industry and volatile political situation brings me to the point, that LVMH very rarely trades at a discount and if you want to pay a fair price, you need to buy it during times of uncertainty.

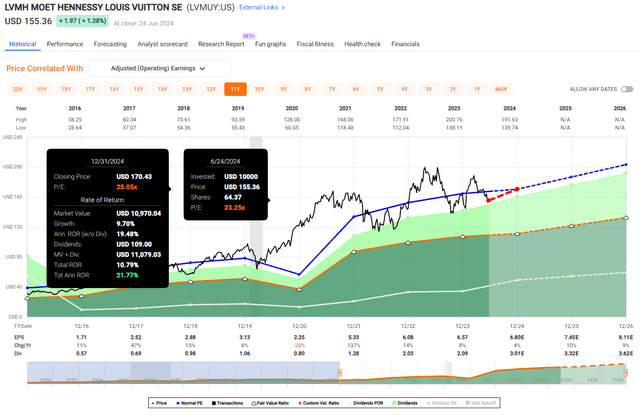

The average valuation of the past 10 years has been 25.8x its P/E. Today the stock is valued at a Blended P/E of 23.3x with the expectation of slower, 4% EPS growth in 2024 and resumption of double-digit growth in 2025.

Replicating the 11.4% annual EPS growth since 2011 may be difficult going forward, but thanks to the wide moat of the existing brands and new opportunities to diversify away from luxury goods, towards experiences, the business has many non-organic growth opportunities that will drive the EPS for the remainder of the decade, estimating the fair price at 25x its earnings.

This brings me to my 2024 share price target of $170 for the US-traded shares, implying a potential for 10.8% return, including the dividend in H2.

LVMH Valuation (Fast Graphs)

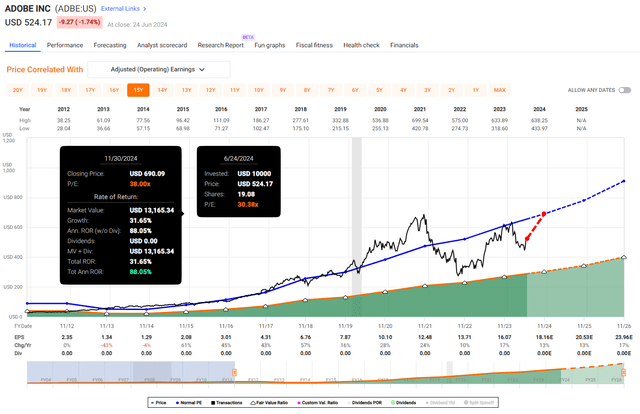

3. Adobe Inc. (ADBE)

- Market Capitalization: $235B

- Year-End Price Target: $690

- Potential Upside: 31.6%

- My Rating: Strong Buy

The software company Adobe is certainly less known than Microsoft, yet the company is the de facto go-to for content creation thanks to its products focused on marketing, advertising, design, and creativity. The company offers a wide range of products such as Photoshop, Acrobat, Illustrator, and Premier Pro catering to professionals and individuals with over 30 years of history.

Adobe has been one of the beneficiaries of the rise of social media and increased demand for content creation, delivering a 5Y return of 76%. However, the stock has underperformed in 2024 delivering a negative return of -11.5% due to what I call “overblown” fears of AI disrupting its core business, without any further need of having to pay for content-creating software, opening an opportunity to buy the stock at a better valuation for long-term investors.

Adobe runs a very profitable business model with a 5Y average gross margin of 87.2%, compared to the industry’s average of 60.9%, partially thanks to a shift to a subscription-based model, unlocking the more stable recurring revenue and eliminating high upfront costs for customers while minimizing piracy.

The company is well-known for its non-organic growth through acquisitions, as recent as 2023, when Adobe was trying to acquire Figma to further empower product designers and developers, however, the $20B merger has been abandoned following regulatory challenges.

The company is a great asset allocator with a 5Y average of 26.2% ROIC, compared to the industry’s average of 2.9%. The ROE of the past five years has been a staggering 35.4%.

As the company navigates near-term challenges of slowing momentum in the Creative Cloud after a few years of elevated growth thanks to its business model switch, we can expect Adobe to grow its EPS at a rate of 13% in 2024 and 2025, with expectations to re-accelerate the growth in 2026.

In the last 15 years, the company managed to grow its EPS at a rate of 16.7%, slightly above what the expectations are for the next two years, however, the average valuation during that time was 38x its P/E, and in the last 10 years it was above 40x its earnings.

Today, the stock is valued at a Blended P/E of 30.4x, well below the historical valuation, even though the company has a long potential trajectory to drive growth organically and inorganically. As I am expecting P/E valuation expansion through the remainder of H2, back towards P/E of 38x, I am setting my share price target at $690, with a potential for 31.6% return in H2.

ADBE Valuation (Fast Graphs)

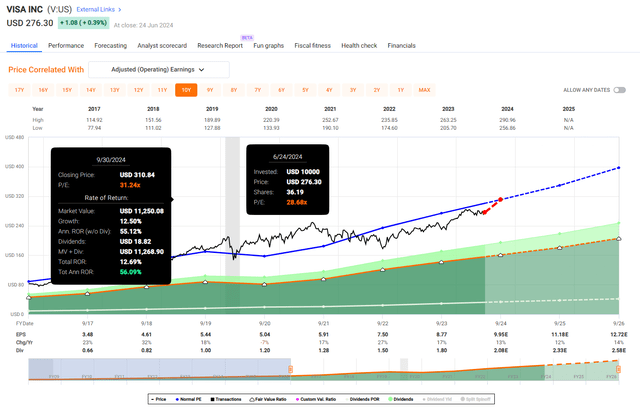

4. Visa Inc. (V)

- Market Capitalization: $553B

- Year-End Price Target: $310

- Potential Upside: 12.7%

- My Rating: Buy

Visa, and Mastercard (MA) as well, are both beneficiaries of the movement towards a cashless society which was greatly boosted during the COVID-19 pandemic, with countries like the Netherlands pushing the boundaries where payment in cash is a rarity.

The business model of both Visa and Mastercard is charging a small transaction fee ranging from 1% to 3%, depending on the type, with Visa’s industry-leading gross margin of 80%, thanks to the minor COGS and CAPEX needed to maintain the existing payment networks. For reference, the tech industry average gross margin is 47.7%

Visa dominates the domestic business in the US, with a 61% market share and $5.8T of transaction volume back in 2022 alone.

Even though high margins generally attract competitors, similar to fin-tech businesses such as PayPal (PYPL) and Block (SQ), Visa and Mastercard operate in a duopoly, as a result of the regulatory environment which virtually makes it impossible to build a similar payment network today, ensuring price stability and expanding market as the money supply in the US alone has increased by 85% in the past decade.

Visa is a great capital allocator, with a 5Y average ROIC of 21% compared to the industry’s average negative -1%, this puts Visa in a group of wide-moat quality businesses with Meta Platforms (META) which has a similar track record of 21.4% ROIC.

Visa usually trades at a premium thanks to its quality business with industry-leading profitability with long-term tailwinds, driving stable double-digit EPS growth. Today the stock is priced at 28.7x its Blended P/E, compared to the 10Y average of 31.3x, implying a slight discount.

Certainly, with 10Y average EPS growth of 16% and expected EPS growth of 14%, Visa is not a “get-rich-quick” type of stock, but buying the shares anywhere below 30x generally pays off in the long-term with my price target of $310, implying the potential for 12.7% total return in H2.

V Valuation (Fast Graphs)

Takeaway

All in all, the market is becoming more expensive thanks to the resilient US economy, strong consumers, and companies delivering stable EPS growth in Q1.

Q2 earnings are just around the corner and as the expectations are sky-high I am more cautious, capitalizing on opportunities only where I see good risk-adjusted returns.

In this article, I have presented you with two companies that I rate as a “Strong Buy” and two companies with “Buy” ratings based on their potential returns, thanks to uncertainty in their industries or simply by mispricing.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here