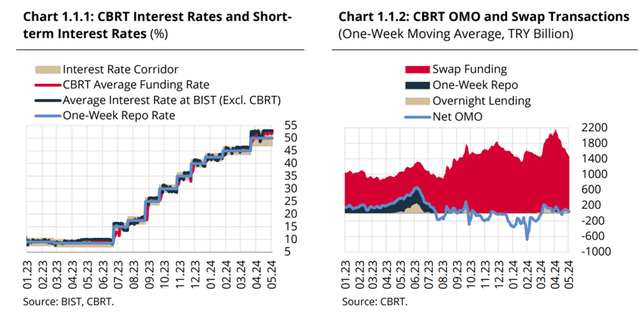

Things have gone mostly according to plan since I last covered the iShares MSCI Turkey ETF (NASDAQ:TUR) (see TUR: Deck Cleared, Turkish Equities Headed Higher Post-Election), the largest and most liquid Turkish large-cap tracker fund listed in the US. To recap, following a period of unorthodox policies pre-election, we’ve seen a significant post-election focus on macro stabilization, led by finance minister Mehmet Simsek. As for the monetary side, the current administration, despite some reshuffling at the head of the central bank, has overseen a faster-than-expected pace of interest rate hikes, underlining its commitment to a much lower inflation target (25% by next year vs 60-70% currently).

CBRT

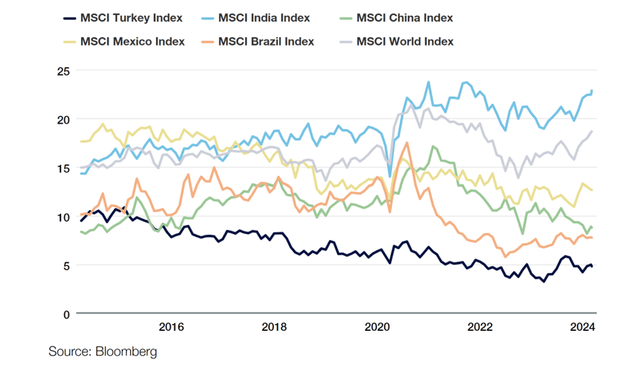

Tightening tends to be bad news for equities, but Türkiye is a unique case in that earnings growth has held up very well, particularly for banks (the key sector component for TUR). So well, in fact, that Turkish equities are now on offer at a cheaper-than-ever multiple of

Thornburg

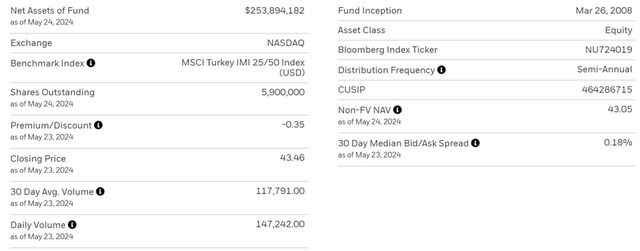

TUR Overview – Competitive Expense Ratio; Mind the Spread

Fundamentally, iShares’ MSCI Turkey ETF remains consistent with prior quarters. The fund maintains the same MSCI Turkey IMI 25/50 Index benchmark, a basket of the largest and most liquid Turkish stocks, subject to concentration limits. The big change in recent quarters, though, is the significantly larger managed asset base at $254m. Bigger size typically means better liquidity, though at a 30-day median bid/ask spread of 18bps, TUR still lags behind comparable iShares emerging market ETFs here. On the flip side, TUR’s relatively competitive ~0.6% expense ratio helps to offset the spread somewhat. And given the scarcity of single-country investment plays for Turkish stocks, TUR continues to stand out.

iShares

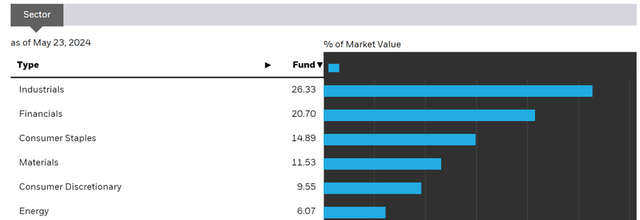

TUR Portfolio – Increasingly Skewed Toward Banks and Conglomerates

As for the fund’s sector composition, there has been some notable reshuffling at the top. Industrials, which Türkiye’s diversified conglomerates are classified under, continue to top the list, albeit at a lower 26.3%. Financials and Consumer Staples are the biggest gainers in recent quarters, now making up 20.7% and 14.9% of the portfolio, respectively. The more cyclical Materials sector, on the other hand, has ceded a hefty chunk of portfolio share at 11.5%. While the top five sectors contribute a seemingly high ~83% of the total portfolio, the outsized presence of diversified conglomerates means the ETF is less concentrated than its sector breakdown implies.

iShares

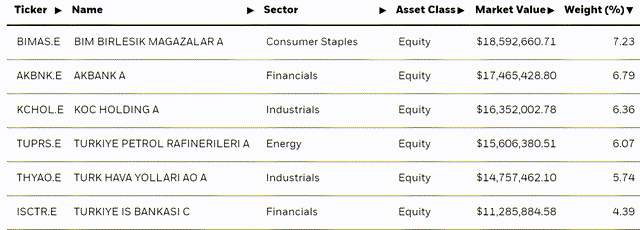

At the single-stock level, one big change is the wider breadth of TUR’s portfolio at 97 holdings. As for the breakdown, there’s also been quite a bit of reshuffling, with discount store Bim (OTCPK:BMBRF) now the largest exposure at 7.2%. Akbank (OTCQX:AKBTY) has also been upsized to 6.8%, along with other major Turkish banks, following a policy pivot toward monetary tightening post-election. Conglomerate KOC Holding has also gained share, though the underperformance of discretionary names like national carrier Turkish Airlines (OTCPK:TKHVY), formerly the top holding, has led to its reduced portfolio share at 5.7%. Including the fifth largest holding, Türkiye Petrol Rafinerileri (TUPRF), TUR’s top five holdings amount to a cumulative ~32%; while higher than before, this concentration isn’t out of the ordinary by emerging markets standards.

iShares

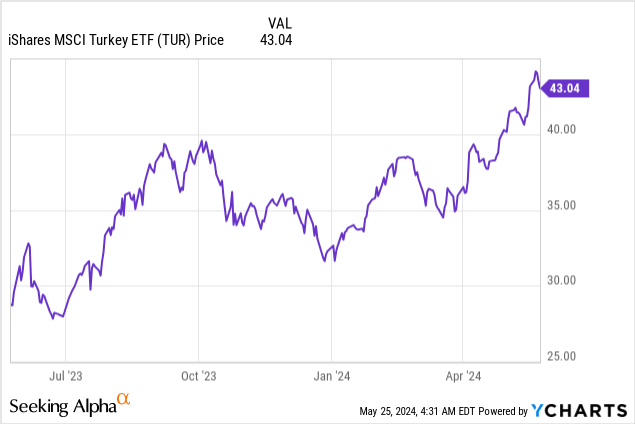

TUR Performance – Post-Election Rally in Full Swing

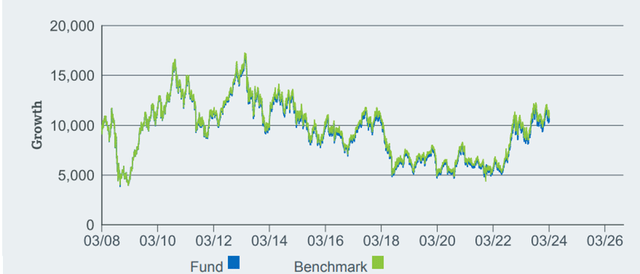

After years of underperformance, TUR has been on a hot streak in recent quarters. Having appreciated significantly through the back half of last year and on a year-to-date basis, the fund’s total one-year return now stands at +35.9%. In turn, its three and five-year annualized total return is also up to an impressive +24.7% and +15.3%, respectively.

Zooming out, though, it’s worth noting that TUR’s basket of blue chips has created little shareholder value through the cycles, only compounding at +1.1% since inception in 2008. And while the equity beta is among the lowest within the emerging market space at 0.13 (vs. the S&P 500 (SPY)), returns have been very volatile over the years. Note that in the last five years, the ETF has cycled between some big down years (-27.5% in 2021) and rallies (+106.4% in 2022); this outsized volatility means Türkiye isn’t an investment destination for the faint-hearted.

iShares

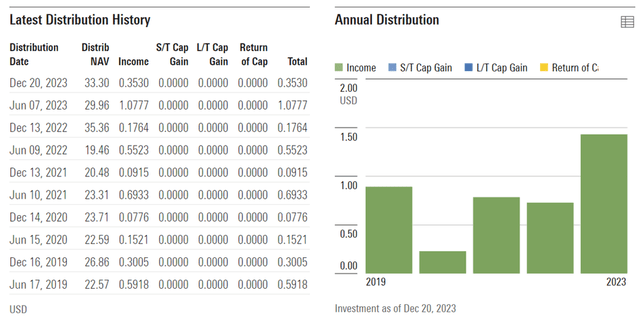

TUR distributions, despite mirroring the cyclicality of its return profile, remains quite strong at 3.6% on a trailing twelve-month basis. Given this yield is also funded by a diversified, cash-generative portfolio increasingly skewed toward banks, tighter monetary policy could actually be a positive for income. In any case, TUR’s blue chips have a demonstrated track record of earnings growth while weathering some vicious cycles, so expect income to trend higher in the coming years.

Morningstar

Turkish Equities Offer Value Through the Volatility

Türkiye has gone from strength to strength since last year’s election, led by a surprising commitment to policy normalization by the new administration. Inflation may not have been tamed just yet, but the fiscal and monetary policy direction of travel bodes well for a positive outcome in the coming years. Meanwhile, earnings momentum remains strong, particularly for the rate-sensitive banks, which stand to benefit from net interest margin expansion. As for the non-banks, positives from exiting a hyperinflationary scenario have outweighed near-term growth pains from tightening. Against this backdrop, TUR’s portfolio of equities offers good value – both by historical standards and relative to underlying earnings growth at the current ~5x forward P/E. Net, with plenty of re-rating potential still available from here, I remain upbeat on TUR.

Read the full article here