Introduction

Navigating through the turbulent waters of COVID-19 and China’s stringent lockdown measures, numerous companies including USANA Health Sciences (NYSE:USNA), faced a challenging period. In a previous piece, I delved into how USANA is strategically positioning itself to reap the benefits of China’s recovery. Fast forward to now, the company is on the brink of releasing its quarterly results. USANA is scheduled to report after the market closes on Tuesday, July 25, followed by a conference call on July 26. Unquestionably, the impact of China on the earnings will be a focal point in the release, but there are a couple of other significant elements to keep an eye on. Despite the possibility of reporting a decline in revenues and earnings, there’s still a promising horizon to anticipate.

Revisiting USANA’s Challenges

USANA Health Sciences, a manufacturer and distributor of nutritional, dietary, and personal care products, has a wide reach across numerous markets, though nutritional products account for over 85% of its sales. The company has established its presence in 24 global markets, with China being its largest, accounting for half of its total revenue. Lately, however, USANA has been wrestling with decreasing revenue, profits, and active customer counts, primarily owing to China’s economic deceleration as well as inflation, pandemic-induced constraints, and the global economic slowdown.

Based on the company’s predictions, it anticipates EPS ranging from $2.40 to $3.30 per share from revenues of between $875 million and $950 million for 2023. The midpoint of this forecast signifies a revenue reduction of 8.66% and a plunge in earnings by 20.6%. In the first quarter of 2023, USANA reported a profit of $0.95 per share, showing a year-over-year decrease of 17%, and a revenue of $248 million, representing a 9% year-over-year decline. The total number of active customers reached 491,000, marking an 11% dip compared to the same quarter of the previous year.

However, it hasn’t been all bleak. Encouragingly, China’s economic resurgence post its extensive lockdown and travel restriction periods might favorably impact USANA’s performance. The company has also accelerated its marketing initiatives in China to take advantage of this economic recovery. This renewed focus is something I believe will be highlighted in the upcoming earnings report, and I will be keenly looking for signs of stabilization, potentially indicating growth in the years to come. More precisely, I will be honing in on three particular areas in the company’s earnings report.

Key Things To Watch

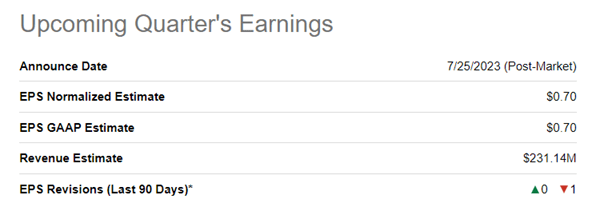

It’s crucial to keep in mind that USANA is recovering from a downturn, and I believe a swift turnaround is improbable. Persistent inflation and the broader economic slump are likely to continue casting shadows over the company’s performance. As the Chinese market recuperates and USANA’s sales team resumes fieldwork, there would be a period of settling and stabilization. Thus, I am not forecasting an immediate and vigorous recovery, a sentiment echoed in the earnings projections by analysts collated by Seeking Alpha. The consensus anticipates USANA to post a profit of $0.70 per share, a 30% drop from Q2-2022, and revenues of $231.14 million, a decrease of 12.45% from the previous year.

Seeking Alpha

Firstly, the impact of price increases on USANA’s earnings will be a significant indicator to monitor. The company hiked prices for its products across most markets at the end of the first quarter. This annual tradition typically prompts a surge in buying activity as active customers stock up at lower prices before the increase comes into effect, which we observed in the first quarter. However, I think this scenario demands heightened attention this time for two reasons.

The positive bump from the surge in customer purchases reached an unusually high level at $13 million in Q1-2023. This trend may retract in the second quarter, negatively affecting the company’s performance. Additionally, the actual increase applied by the company was steeper than its usual adjustments. USANA typically adjusts prices by 1% to 2%, but this year it enacted a weighted average increase of 4%. This above-normal increment was attributed to the strain from high costs of raw materials and supply chain disruptions. I suspect this above-average price hike could impact the company’s sales across various markets, particularly in a climate where consumers are already grappling with inflation. Such an environment might present challenges for the company in struggling markets like the Americas and Europe, which reported a sales decline of 10.7% in the first quarter.

Secondly, investors should anticipate further insights into USANA’s global expansion ambitions, which could influence the company’s long-term trajectory. It’s worth recollecting that the company previously revealed its preparations to penetrate a new market this year, which I thought could start contributing to growth from 2024 onwards. At the time of my previous article, the company hadn’t disclosed the identity of this new market. However, it later revealed its strategic intention to expand in India.

International expansion forms one of the cornerstones of USANA’s strategy, but it has been half a decade since the company last ventured into a new market-a period that includes the upheavals caused by the COVID-19 pandemic. Now, with COVID-19 in the rearview mirror, it seems USANA is returning to its foundational strategies-a positive development indeed. The company plans to officially commence operations in India around September. I am optimistic about this move, and I believe the Indian market could offer substantial opportunities, especially given the country’s projected rapid economic growth outpacing even China. While I don’t anticipate immediate sales impact, I foresee improvements from 2024 as the company scales up operations and builds its sales force. I look forward to more insights about the Indian venture during USANA’s post-earnings conference call.

Thirdly, and perhaps most crucially, signs of recovery in China will be a significant aspect to watch. As noted earlier, the company’s operations in its largest market were severely impacted due to COVID-induced lockdowns and economic conditions. However, the reopening of China has sparked some optimism for the company. In the second quarter, USANA resumed live meetings to rejuvenate its sales force and revive sales. For the first time in about three years, it held a significant event-the China National Sales Meeting in Macau, attended by 10,000 associates. The company has plans for additional minor events throughout the year, which should begin to positively affect its performance in China.

In the first quarter, USANA’s sales and active customer count in China decreased by 7% and 5%, respectively, on a YoY basis. Still, these declines were less severe compared to the company-wide averages. For the second quarter, I anticipate the company to report an improvement in both its sales numbers in China (particularly on a constant currency basis) and active customer count, especially in the wake of the large sales event. There might be signs of stabilization leading to potential growth, especially in the second half of the year.

Conclusion

In summary, it’s probable that USANA will report a further decline in both revenues and earnings, echoing the ongoing challenges the company faces. However, amidst this hardship, glimmers of hope are visible. The influence of the recent price increase, revelations regarding the foray into the Indian market, and early signs of resurgence in China present a cautious optimism for future progress. As the company navigates these turbulent times, these positive indicators could chart the course for recovery and future growth.

Read the full article here