Introduction

Shares in apparel and footwear company V.F. Corporation (NYSE:VFC) are undoubtedly not for the faint-hearted. VFC stock has fallen 86% since its exuberant all-time high of $100 reached before the outbreak of the pandemic in early 2020 and is now trading at levels last seen right after the Great Recession or before 2006.

As I pointed out in one of my earlier articles, when VFC stock was still trading well above $60 per share, I never really understood the valuation premium. Of course, VF has solid brands and is quite diversified for an apparel company, but given that debt was largely the only thing growing at VFC over the years, caution was warranted. The lockdowns during the pandemic and the subsequent supply chain issues acted as a fire accelerant, so to speak, creating a cash flow vacuum that made VFC’s already high debt levels seem increasingly difficult to manage. Add to that the acquisition of Supreme at an irresponsibly high multiple in 2020 and later the $876 million payment related to a tax dispute concerning the Timberland acquisition in 2011, and it’s easy to understand why the company had to cut its dividend after nearly 50 years of uninterrupted growth. In fact, VFC has cut its dividend twice – first by more than 40% in February 2023 and half a year later by another 70% to $0.36 annually.

In my article entitled “Don’t Take The Reduced Dividend For Granted”, I turned cautiously optimistic about VFC stock as a turnaround investment. Since then, VFC has lost 36% of its value. This is characteristic of a deep value, high-risk/high-reward investment that requires a lot of patience and continuous monitoring. The stock is now approaching its October 2023 low of $13 against the backdrop of a very strong broader market. Granted, the market’s performance is skewed by some heavyweights, but it’s still alarming when a stock does nothing but continue to fall.

So in this update, I take a fresh look at VF Corp’s business to see if the situation is still manageable or if the challenges have become overwhelming. After all, The North Face – the only bright spot at VFC for some time – has also disappointed recently. I will be paying particular attention to deleveraging, especially considering that rating agency Moody’s downgraded V.F. Corp.’s senior unsecured rating to Baa3, the lowest investment grade rating, in November 2023 and maintained the negative outlook.

VFC’s Third Quarter Of Fiscal 2024 – Extremely Poor, But A Small Bright Spot

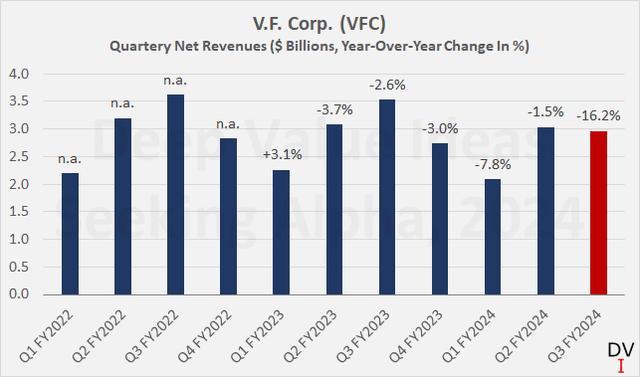

There is no denying the fact that VFC’s holiday quarter was a particularly bad one. Net revenue for the third quarter of FY2024 was down 16% year-over-year, compared to -2% in the previous quarter (Figure 1). However, it should be noted that the second quarter benefited from the timing of deliveries, so some of the sharp declines in Q3 should be considered a one-off – as the impact of the cybersecurity incident that occurred in December 2023. Nonetheless, it’s pretty obvious that VFC is struggling at every turn – its Americas segment continues to perform poorly (down 24% year-over-year), as does Vans, which is down a whopping 28% year-over-year. Vans has clearly fallen out of favor, and it will take a lot to get the iconic brand back on track. In this context, however, it should be noted that part of the abysmal performance in Q3 is due to the restructuring of the brand. While CEO Darrell’s tone during the Q3 FY2024 earnings call was definitely serious (and rightfully so!), it’s also worth highlighting that he’s optimistic about the initiatives that have been and continue to be implemented to restore Vans’ brand strength.

Figure 1: V.F. Corp. (VFC): Quarterly net revenues and year-over-year change in percent (own work, based on company filings)

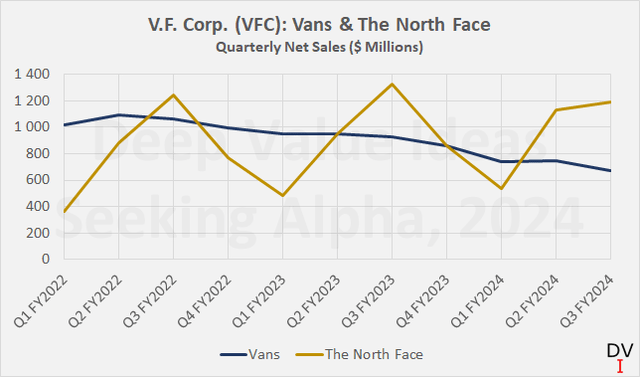

However, The North Face (TNF) was also disappointed with a 10% decline in quarterly net sales compared to the previous year. Part of TNF’s poor performance last quarter was due to the warm weather, and the brand returned to growth in January and February. It may seem like a lame excuse by management to attribute part of TNF’s performance to the weather, but there is no denying the brand’s pronounced seasonality (Figure 2). Adding the past three quarters together, TNF still posted net sales growth (+4% year-over-year), but this is a small consolation against the backdrop of a consolidated decline of 9% (or 10% at constant exchange rates).

Figure 2: V.F. Corp. (VFC): Quarterly net sales of Vans and The North Face (own work, based on company filings)

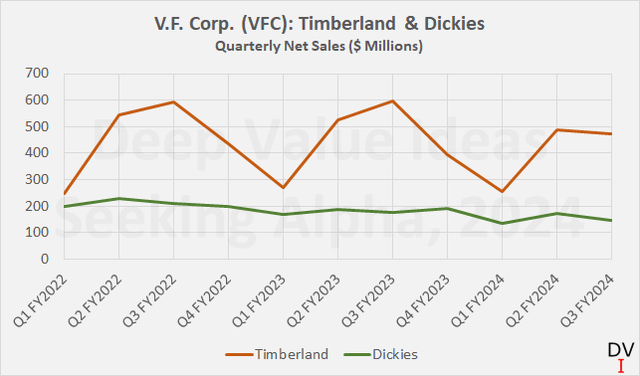

I’m inclined to say that VFC’s other major brands – Timberland and Dickies – performed as expected (read: poorly), with quarterly net sales declines of 22% and 17%, respectively (Figure 3). The company recognized $195 million and $62 million in goodwill impairment charges for Timberland and Dickies, respectively, in the third quarter, suggesting that the cash generation potential of the brands is lower than previously estimated. Of course, companies must regularly test their cash-generating units (CGUs) for impairment, and the recent charge could just be the result of a required recurring test – but I still find the timing noteworthy (more on that later).

Figure 3: V.F. Corp. (VFC): Quarterly net sales of Timberland and Dickies (own work, based on company filings)

VFC is clearly in a very weak position – a brand portfolio that is struggling in several areas and an over-leveraged balance sheet. But before we look at the current state of the financials and whether deleveraging is realistic – or whether V.F. Corp. is on the verge of losing its investment grade rating – let’s take a look at expenses and cash flow.

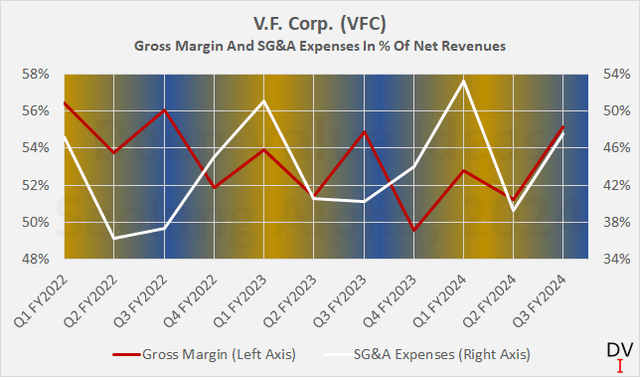

Like the company’s revenue, cost of goods sold and selling, general and administrative (SG&A) expenses are cyclical. VF Corp increases its SG&A expenses in the second and especially the third quarter of the fiscal year in preparation for the holiday season. Relatively speaking, however, the first quarter of the fiscal year is the weakest, as post-season discounts must be given (clearing inventory), and SG&A expenses are still higher than average due to discount promotions, for example (Figure 4). More important to highlight, however, is the fact that VFC’s gross margin has been trending downward over the last three years, reaching its lowest point of just under 50% in the fourth quarter of FY2023. Of course, this was largely due to the necessary discounting following the significant inventory build-up in previous quarters (supply chain issues), but to some extent, this was likely also due to pricing power-related issues. In this context, I found it reassuring that VFC’s gross margin recently recovered to its long-term average of 55%.

However, relative SG&A, costs rose sharply instead of remaining largely unchanged year-over-year as in previous years. However, two aspects must be taken into account here: Firstly, it was the weak sales performance in the third quarter that led to the jump in relative SG&A costs – in absolute terms, they were around $50 million lower compared to the third quarter of FY2023. Secondly, it will take a while for the expected permanent cost savings to become visible, especially in light of the ongoing investments in the restructuring of Vans and the corporate structure. Significant savings are to be expected. In this context, it is very telling that VFC’s previous management has deemed it necessary to maintain an aviation program that is now expected to generate between $50 million and $100 million (as highlighted by soon-to-be former CFO Puckett in the Q3 FY2024 conference call). There should indeed be some “low-hanging fruit” ready to be picked.

Figure 4: V.F. Corp. (VFC): Quarterly gross margin and relative SG&A expenses; blue and yellow colors indicate colder and warmer periods, respectively (own work, based on company filings)

For FY 2024, which ends shortly, VFC expects a free cash flow (FCF) of $600 million. Considering that former CEO Rendle presented an overly ambitious FCF roadmap at the 2022 Investor Day (see my discussion here), this is of course a disappointing number, but I wouldn’t say it’s unexpected.

However, investors should note that VFC is still benefiting from its inventory overhang and this is likely to continue for at least another quarter. At the end of Q3 FY2024, the company reported inventories of $2.15 billion, which is $444 million less than a year ago, but $861 million more than at the end of Q3 FY2022. Investors should be wary of transferring the excess inventories – around $800 million to $1.0 billion – to FCF on a one-for-one basis. We all know how dynamic the apparel and footwear industry is, so I think a conservative $250 million contribution to FCF is more appropriate until inventory levels return to normal. Other working capital accounts do not show significant potential for boosting FCF in the short term. In fact, accounts receivable and accounts payable are down 16% and up 8% year-over-year, respectively, suggesting that VFC is currently freeing up cash. In the longer term, of course, the company is expected to return to sustainable internal FCF growth and ideally maintain an efficient cash conversion cycle (e.g., through a lower inventory retention period and a higher days payables outstanding).

Management hasn’t been too clear on how FCF is calculated internally, but I don’t believe the aforementioned sales of tangible assets (aviation business and a few properties) are included in the $600 million guidance, in part because the transactions are not necessarily expected to close anytime soon, according to Puckett, but in the next two or three quarters. Depending on whether and how the operating business recovers in fiscal 2025 (Puckett noted that VFC’s wholesalers remain cautious), I would not necessarily expect a material improvement in underlying FCF, but rather a continuation of the inventory rightsizing and likely a further reduction in receivables.

Now let’s take a look at how these figures, as well as the sale of brand assets that management has recently become more vocal about, compare to VFC’s debt burden.

Can VF Corp Manage Its Debt Going Forward?

At the end of the third quarter of fiscal 2024, VFC had $6.2 billion in gross debt outstanding, excluding operating lease liabilities of $1.1 billion. That’s just over $200 million less than a year ago, which raises the question of why the debt reduction isn’t happening faster, even though the company has cut its dividend twice in 2023 and had previously indicated good prospects for a successful appeal of the US tax court’s ruling in favor of the IRS (Internal Revenue Service) regarding disputed taxes related to the 2011 Timberland acquisition. Management recognized the payment of $876 million made in October 2022 plus accrued interest as an asset (see p. 15, Q1 FY2024 10-Q).

First, it should be noted that VFC was not able to recover the alleged tax asset. Since the decision of the U.S. Court of Appeals for the First Circuit upheld the Tax Court’s decision in favor of the IRS (decision on September 8, 2023), the company had to write off the now $921 million (disputed taxes plus accrued interest) that could have been otherwise used to reduce debt.

Secondly, and this should of course be seen in a more positive light, VFC is hoarding cash, which is certainly not a bad idea in view of the upcoming maturities. At the end of the third quarter, the company had $988 million in cash and cash equivalents, $417 million more than a year ago. At the same time, it’s worth noting that VFC had $437 million in outstanding borrowings under its U.S. commercial paper program, which I expect the company has since reduced, presumably primarily due to the higher interest rate.

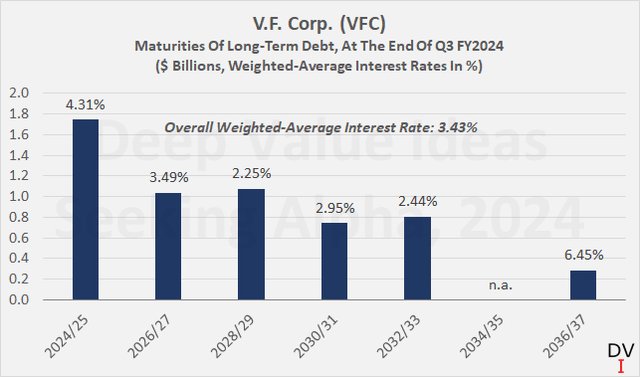

Concerning debt maturities (Figure 5), VFC has repaid its 0.625% euro-denominated senior notes at maturity in September 2023 (€850 million, $907 million), of course partly through borrowings under its commercial paper program. The next maturities are in December 2024 (delayed draw term loan) and April 2025 (2.4% senior notes). In total, they amount to around $1.75 billion, which will mature quite soon and which management expects to be repaid at maturity, despite knowing that it will probably only generate around $600 million in free cash flow in FY2025.

Figure 5: V.F. Corp. (VFC): Maturities of long-term debt at the end of Q3 FY2024 (own work, based on company filings)

As a skeptical investor, I am now inclined to say that the company will simply use its solid liquidity, which consists to a significant extent of commercial paper, and pay that back as the FCF gradually rolls in. This would of course have a negative impact on the otherwise very solid weighted-average interest rate of 3.4% that the company is currently paying on its long-term debt. However, considering that management recently announced a “strategic portfolio review” (this was even part of the headline of the Q3 FY2024 press release), it is actually more likely that the deleveraging will be significantly supported by asset sales.

Those of you who have read my previous articles on VFC know that it has been quite a while since management first hinted at selling its backpack business (i.e., JanSport, Eastpak, Kipling). The fact that there hasn’t been a definitive deal announced since the first rumors in December 2022 tells me that management is struggling to realize an acceptable price for the business. Apparently JanSport alone – certainly one of the better-known brands – could fetch at least $500 million dollars (rumors from December 2022).

VFC does not provide sufficiently granular detail on brand performance to estimate the size of each of these smaller brands. However, knowing that the backpack business is part of the Active reportable segment alongside Vans, Supreme, and Napapijri, we can estimate its annual sales. The entire segment generated net sales of $4.9 billion in FY2023, of which $3.7 billion is attributable to Vans. Management does not disclose Supreme’s contribution (fancy a guess which way the wind is blowing?), but knowing that it likely contributed $500 million to net sales in fiscal 2022, I would expect its contribution to be no more than $600 million in fiscal 2023 (and that’s probably already very optimistic). That leaves $622 million for the backpacks and Napapijri business. Assuming the latter is a fairly small brand leaves $500 million or $550 million for the backpack business. Therefore, I think $500 million for JanSport alone is excessive.

Considering the rather high interest rates, this is definitely not the ideal environment for leveraged acquisitions, so I honestly expect VFC to fetch no more than $600 million (a price-to-sales multiple of 1) for its entire backpack business. Ignoring consulting fees (VFC has already spent $3 million in FY2024, p. 4, Q3 FY2024 press release) and especially transaction-related costs, that leaves $1.15 billion of debt that needs to be addressed. I wouldn’t over-interpret VFC’s cash buffer in this context, primarily because of the $437 million in outstanding loans under the commercial paper program, but let’s subtract another $150 million from the total. If FCF is $600 million in FY2025, that leaves $460 million for debt reduction (the quarterly dividend of $0.09 equates to $140 million annually). So in my view, VFC needs to sell additional assets to be able to fully repay the 2.4% 2025 notes.

In this context, the impairment charges relating to the Timberland and Dickies CGUs caught my eye, but of course, it is well possible that I am over-interpreting and that they are simply the result of the planned regular impairment tests. In my view, however, it is possible that the growth and therefore cash flow forecasts for Timberland and Dickies, which were made in preparation for potential asset sales, simply turned out to be unrealistic, and management, therefore, had to recognize a corresponding impairment of goodwill.

The theory that Timberland and Dickies could be for sale is contradicted by the fact that their global brand presidents were replaced in December 2023 and April 2023, respectively. At the same time, it is worth noting that Marissa Pardini (a former TNF executive) was appointed Chief Product and Merchandising Officer of Vans in December 2022. However, it was only recently announced that she will be stepping down after just over a year in the role. Of course, it can be argued that Ms. Pardini was appointed CPMO of Vans (same as the brand president of Dickies) before Bracken Darrell became CEO of VF Corporation, so the remaining executive position (brand president of Timberland) should not necessarily be viewed as similarly short-lived.

Of course, it cannot be ascertained that VFC will sell Dickies in addition to the backpack business, but I consider it realistic. In my view, Timberland will stay with the parent, largely because it is a better fit for the company than Dickies and has stronger potential for synergies. Obviously, I would welcome the sale of Dickies and the associated reduction in overhead. The Timberland PRO segment, which is the only other component of VFC’s Work segment, could be consolidated with the rest of Timberland in the Outdoor segment. With sales of $647 million in the last twelve months, I wouldn’t expect more than $650 million in gross proceeds from the Dickies sale, but that amount should be enough to close the gap on the way to repaying the upcoming maturities. However, I wouldn’t mind the sale of other, smaller brands such as Napapijri, Smartwool, Icebreaker, or Altra, provided of course they have disproportionate overhead and are not worthy of revamping. Suffice it to say, it’s unrealistic to expect the sale of any of VFC’s top brands, including Supreme.

Considering debt paydown, and assuming a successful sale of the backpacks business and Dickies or the backpacks business and some other small brands, I don’t think it’s unrealistic for VFC to start fiscal 2026 with net debt of $4.7 billion or less, reflecting repayment of the delayed draw term loan and the 2.4% 2025 notes, and a slightly lower cash balance. That would be good news, of course, but it’s important to remember that with annual free cash flow of $750 million – a reasonably conservative estimate for fiscal 2026 – VFC’s leverage is still well over six times FCF. It remains to be seen whether the company will be able to achieve the debt target noted by Moody’s in its above-mentioned report – a debt/EBITDA ratio of 3.7x by the end of the fiscal 2025 financial year. I would not take the Baa3 investment grade rating for granted at present.

At the same time, and to end this paragraph on a positive note, VFC’s projected interest coverage ratio is very acceptable at 7x fiscal 2026 pre-interest FCF due to the favorable weighted-average interest rate and the fact that the short-term maturities have comparatively higher interest rates (right-skewed maturity profile, recall Figure 5).

Conclusion

The third quarter of fiscal 2024 was an extremely poor one for the struggling apparel and footwear company V.F. Corporation. Some of the weak performance was to be expected or at least partly due to external factors. The gross margin recovery was the only aspect that could be highlighted as a positive, but to be fair it should be noted that the new CEO is in the process of turning the operations and management around and that comes with significant near-term costs and one-offs.

But there is no denying that things are not going well for the company, which is faced with a high level of debt and a clearly unbalanced maturity profile. In order to manage the upcoming maturities of its long-term debt ($1.75 billion over the next 13 months) and to avoid refinancing at unfavorable interest rates, VFC is now more or less forced to sell assets.

However, with interest rates still comparatively high and the appetite for leveraged acquisitions likely dampened as a result, VF Corp. finds itself in a situation that can politely be described as suboptimal. Management has apparently been trying to sell its backpack business for more than a year, so it was likely unable to achieve the expected valuation multiple. However, considering that the last earnings release highlighted the “strategic portfolio review“, it’s reasonable to assume that a definitive transaction will be announced soon. That said, I think further asset sales will be necessary to fully address the upcoming maturities. Free cash flow alone, even after the two dividend cuts (avoiding $650 million in discretionary spending), will only be able to cover a small portion of the maturities.

In my view, Dickies could be for sale in addition to the backpack business, but I do not expect more than $650 million in gross proceeds from the workwear brand. However, this or the sale of some other small brands (Napapijri, Smartwool, Icebreaker, and Altra) should be enough to raise the necessary cash to repay the debt due at the end of 2024 and in spring 2025. The reduction in overhead and reduced complexity should also benefit VFC’s profitability, which fundamentally has a lot of potential (gross margin of 55% or more). At the same time, I do not believe that VFC’s level of diversification will be materially impacted by the sale of Dickies and/or some of its smaller brands.

Although this update may come across as overly negative, I would like to emphasize that I am confident that Bracken Darrell can turn things around. I think the new CEO is pulling the right levers, but an appointment a year later would probably have been too late. The involvement of an activist investor is also good news, as I explained in my last article. Engaged Capital LLC owned 5.3 million shares at the end of 2023, making it its third largest position in dollar terms at the time. The company previously increased its stake by a modest 145,000 shares during the fourth quarter of 2023.

Finally, I would like to touch on the recent insider transactions. My regular readers and followers know that I take a rather conservative stance on insider buying, mainly because of the risk of falling prey to window-dressing transactions. Spending a few $100,000 on company stock sounds impressive, but it depends entirely on the compensation of the insider as to whether that is meaningful skin in the game.

With that in mind, it seems worth noting that the still fairly new CEO Darrell bought around 65,000 shares for just over $1 million in early February 2024, increasing his holding by 83% to approximately 144,000 shares. His base salary is $1.3 million per year, with an additional bonus opportunity based on actual performance, as well as a long-term incentive opportunity. With that in mind, I think Darrell’s stock purchase is indeed meaningful. For what it’s worth, Chairman Carucci has purchased just over $1 million worth of stock as well (40,000 shares in August 2023, 20,000 shares in February 2024). Finally, other board members have spent $800,000 on VFC stock since Darrell took the helm last July.

Overall, I’m obviously not super-optimistic about VFC, as it remains a risky turnaround with many question marks, but the deleveraging plan strikes me as realistic, and I like the idea of a more focused company with significantly reduced overhead. I think there’s a fair chance that the new CEO will be successful, and there’s no denying that VFC’s main brands (Vans, TNF, Timberland, and Supreme) are solid and have a lot of untapped (or in the case of Timberland and especially Vans, disregarded) potential. I maintain my “buy” rating but have not added to my position recently as I intend to keep it as one of the smallest positions (<0.5%) in my portfolio.

Thank you very much for reading my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well. As always, please consider this article only as a first step in your due diligence.

Read the full article here